Amid the renewed strength recently displayed by Bitcoin, Michael Van De Poppe, a recognized cryptocurrency analyst and trader has offered an intriguing prediction for BTC, highlighting that the crypto asset is likely to reach the $300,000 threshold in this bull cycle.

Bitcoin Price Targetted At Unprecedented Heights This Cycle

Over the past month, the price of Bitcoin has been consolidating and hasn’t been able to sustain its rise beyond its new peak of $73,000. However, things could soon be changing, as Michael Van De Poppe expects the coin to surge immensely in the short term.

His forecast coincides with anticipation around the upcoming Bitcoin Halving expected to take place in less than 12 days, fueling optimism within the crypto community.

According to the expert, the largest cryptocurrency asset by market cap is still experiencing significant resistance. Nonetheless, if Bitcoin manages to break out of this zone, the coin could witness a progression towards new all-time highs in the coming months.

Given that BTC achieved the $70,000 price level ahead of the halving event, Poppe believes that it is likely to surge to unprecedented levels, particularly topping out at $300,000 in this bull run.

The post read:

Bitcoin still facing crucial resistance. If this breaks, then we will be seeing a continuation towards new all-time highs. Bitcoin at $70,000 pre-halving. Likely $300,000 this cycle.

Poppe underscored that the price of Bitcoin returned to $70,000 level over the weekend. As a result, he has pointed out bullish indicators that are presently occurring in the crypto landscape.

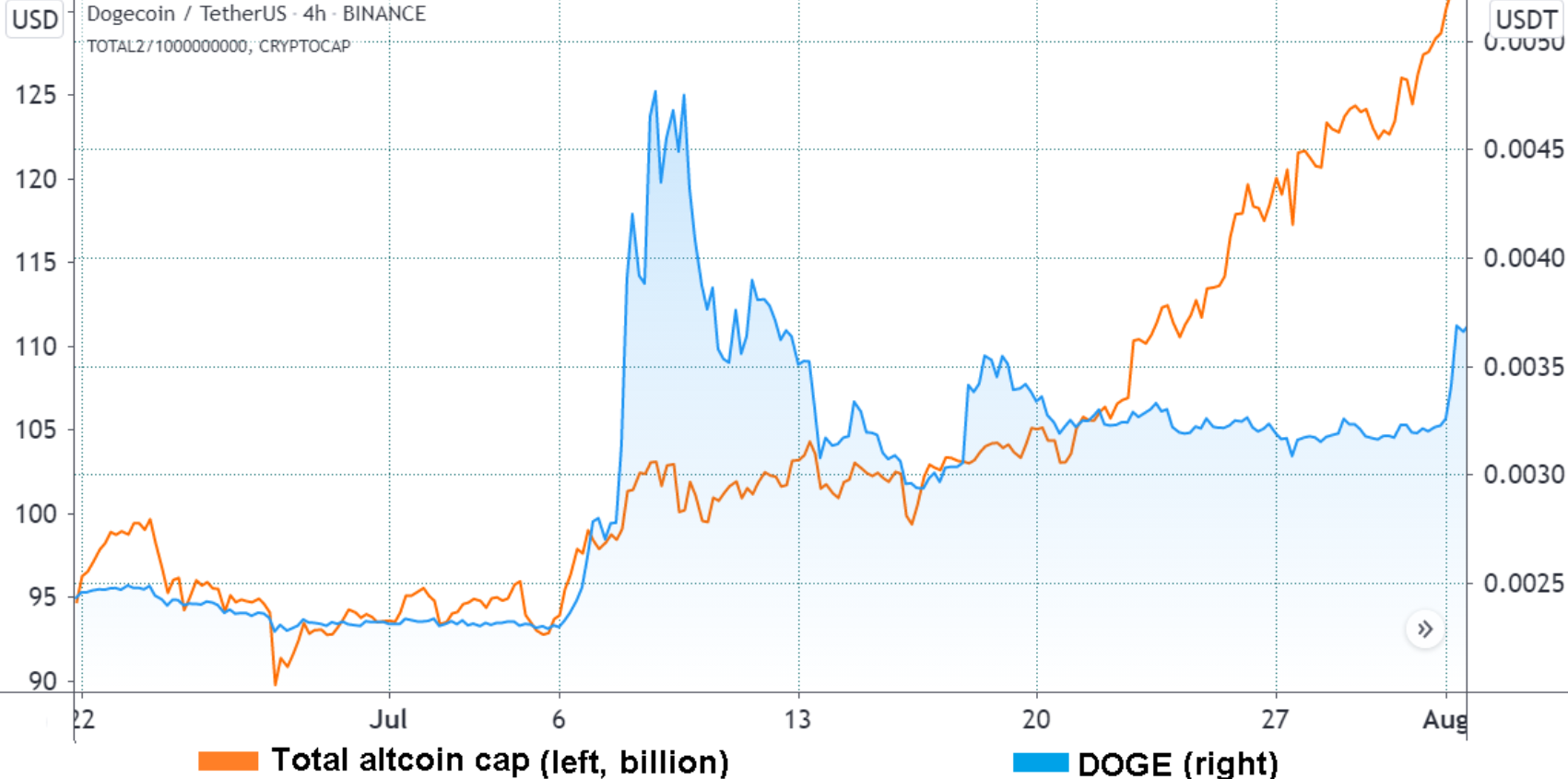

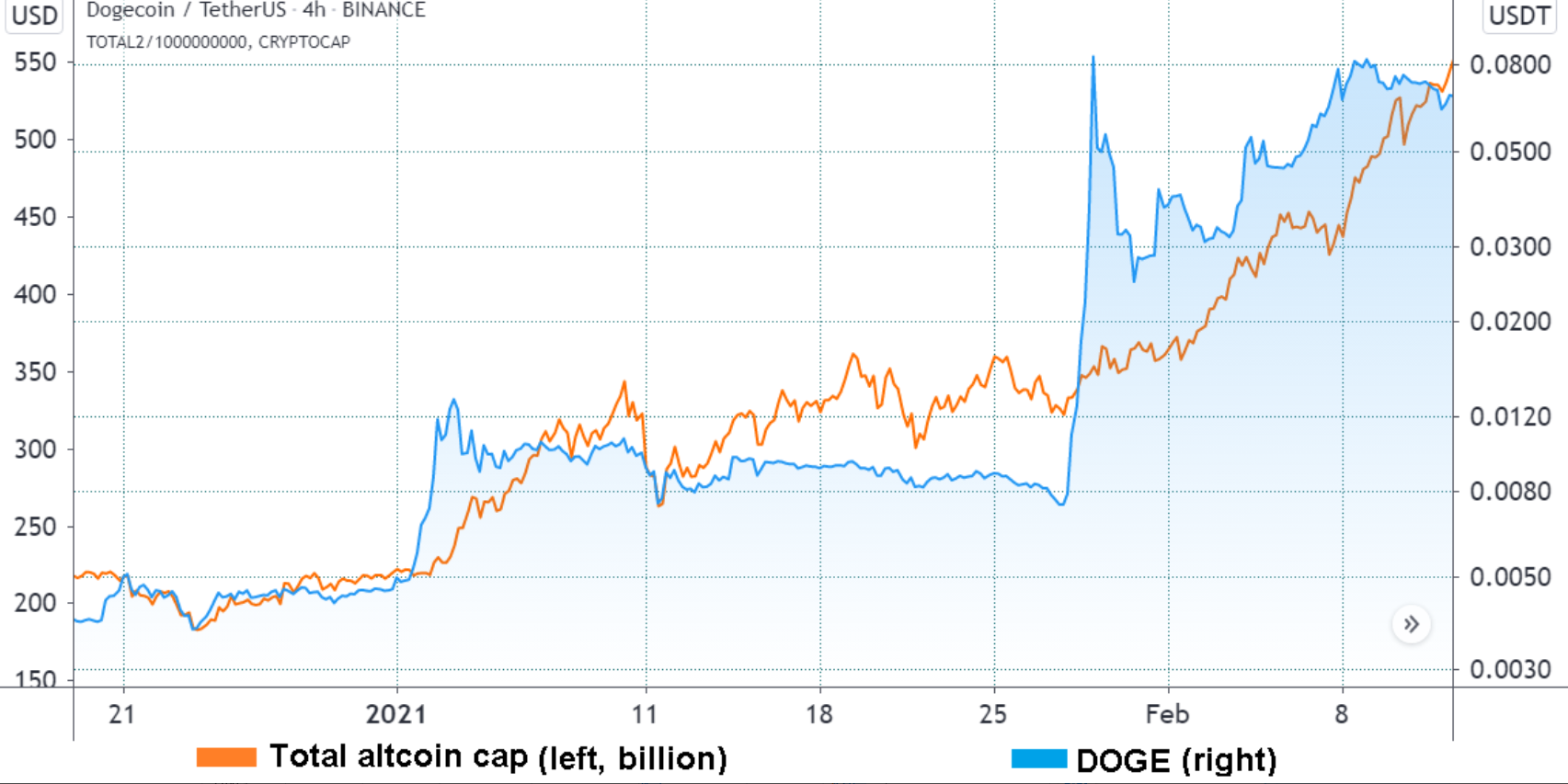

The analyst also noted that the strength of the cryptocurrency markets has now exceeded our perceptions, and dips in altcoins represent opportunities for good entries. In addition, BTC’s price action demonstrates the potential to reach a new all-time high pre-halving, and the shift in favor of altcoins is on the horizon.

Altcoin Season Set To Kick Off In Weeks

Poppe is super bullish toward an ‘altcoin season’. However, it is important to note that altcoins’ value has frequently coincided with shifts in Bitcoin’s supremacy. But even though Bitcoin’s dominance is still at its peak prior to the halving, Poppe thinks these coins still have a lot of momentum.

He advocates that a new altcoin season will undoubtedly begin in the upcoming weeks. “We always have one, we have seen Meme coins, Solana (SOL) ecosystem, and AI,” he stated.

The expert’s statement suggests that the Solana ecosystem, AI projects, and meme coins in recent months have led the altcoin market. Thus, Michael Van De Poppe has contended that in the impending alt season, crypto initiatives that prioritize the tokenization of Real-World Assets (RWA), the Ethereum (ETH) ecosystem, and the Decentralized Physical Infrastructure Network (DePIN) are likely to be next, paving the way for alts this cycle.

At the time of writing, the altcoin’s overall market excluding Bitcoin and Ethereum was valued at $753.47 billion. This indicates a 2% increase in the market cap in the past 24 hours.

The same applied measure rule would take ETH to the neckline of the "Eve" | Source:

The same applied measure rule would take ETH to the neckline of the "Eve" | Source: