Turning the tide in the altcoin race, Sei Network’s SEI token has experienced an extraordinary 50% surge in the last 24 hours, outperforming the top 100 cryptocurrencies. This surge has pushed the token’s current trading price to $0.3638.

Attracting Global Attention?

According to CoinGecko data, Sei Network’s blockchain, explicitly built for trading, has optimized every layer of its stack to provide infrastructure for trading apps of all types.

Sei claims to outperform other Layer 1 blockchain, such as Solana and Aptos, by offering a native order-matching engine in Layer 1. This engine enables exchange apps built on top to scale more efficiently than ever.

One of the standout features of the protocol is its speed, with a lower bound time to the finality of 300ms, making it the fastest chain in existence. This speed is achieved by implementing the Twin Turbo consensus, consisting of intelligent block propagation and optimistic block processing. According to CoinGecko, these innovations reduce the time required to achieve consensus securely and reliably.

Moreover, Sei’s market-based parallelization sets it apart by offering a specialized kind of parallelization that differs from other leading blockchains. Additionally, Sei implements order batching to prevent frontrunning, enhancing the fairness and efficiency of its trading ecosystem.

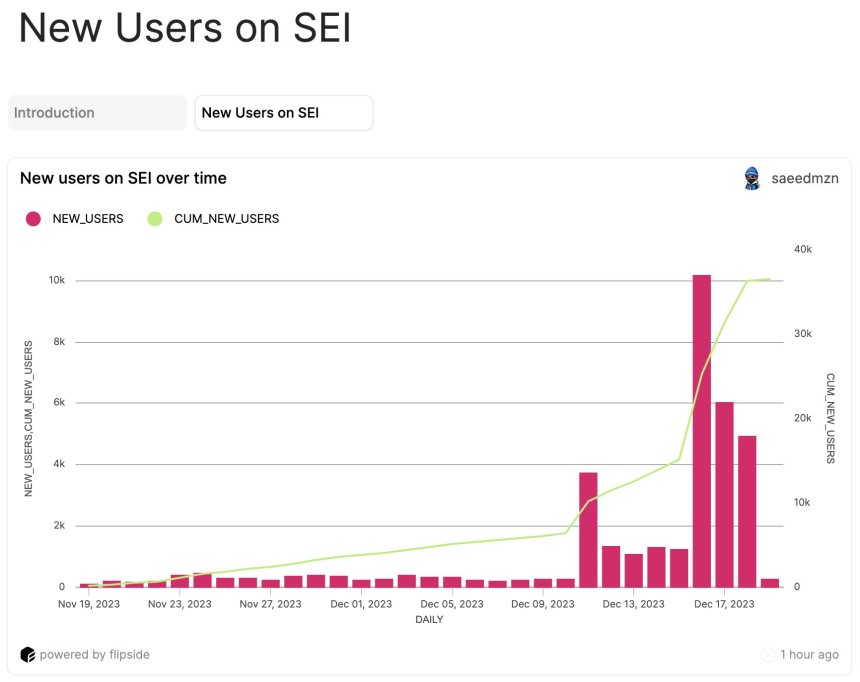

On the other hand, the Sei blockchain, launched on August 16, has amassed a market cap exceeding $380 million and a 24-hour trading volume surpassing $1 billion. Notably, the blockchain has witnessed a surge in new user registrations, with over 40,000 new users joining in the past two days.

This influx of new users has further propelled the token’s market cap and trading volume, underscoring the growing interest in the Sei blockchain.

Sei v2 Proposes Seamless EVM Integration

Sei Labs co-founder Jayendra Jog recently unveiled the first “parallelized” Ethereum Virtual Machine (EVM), combining the aspects of Solana and Ethereum. According to Jayendra, this “hyper-optimized” execution layer leverages the tooling and mindshare surrounding the EVM, addressing a major pain point for developers.

As announced, Sei v2 introduces EVM support by integrating go-ethereum and enabling seamless deployment of contracts from other EVM chains. This compatibility allows developers to leverage existing Ethereum-based tooling and resources without additional effort.

Furthermore, optimistic parallelization eliminates the need for developers to define dependencies explicitly, enabling the chain to handle parallelization autonomously. This enhancement reduces developer friction and guarantees maximum parallelization of transactions whenever possible.

Sei Labs’ co-founder stated that Sei v2 boasts orders of magnitude greater throughput with Sei’s speed than Ethereum’s Layer 1 or Layer 2 solutions.

The protocol’s upper bound of 12.5k transactions per second (TPS) is supported by early load tests, which have already observed over 5k TPS. Sei v2 will launch on a public testnet in the first quarter 2024.

As Sei Network continues to garner attention from developers and traders alike, the future looks promising for this open-source Layer 1 blockchain.

Featured image from Shutterstock, chart from TradingView.com