With the Bitcoin halving expected to happen today, crypto enthusiasts are already starting to take positions in various altcoins. Among these, there are a number of coins that have shown a lot of promise when it comes to reaching the $100 price mark and this report takes a look at three.

MoonRiver (MOVR) Tops Lists Of Altcoins To Reach $100

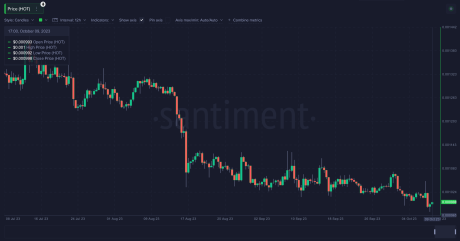

The MoonRiver (MOVR) token has been one that has flown under the radar for quite a while now. This has to do with the fact that the price of the altcoin fell from its all-time high of $485 to as low as $5 earlier in 2023. However, this has not eradicated the bullish narrative for the asset.

So far, as the crypto market has recovered, the MOVR token has seen one of the most significant rallies. In the days leading up to Christmas, the price would go from around $6 to as high as $44 in a couple of days, notching 700% gains during this time.

Since then, the price has since retraced and fallen around 50%. But with the price still holding above $20, it shows a lot of promise for the coin. Given its low supply of around 11 million coins and a tendency to rise quickly in a short time, MoonRiver is one of the coins poised to break the $100 mark.

Litecoin (LTC) Slow Movement Coming To An End

The Litecoin price rallied tremendously in 2023 leading up to its halving and was among some of the best-performing altcoins. However, once the halving was completed, the LTC price would crumble and fall into a slow and steady decline. However, this has changed as the coin’s price has begun to pick up steam once again.

With the Bitcoin reversal, the Litecoin price is on the up once again, briefly crossing $75 in the early house of Tuesday. The altcoin, which is often referred to as the digital silver, could be poised to see firmer rallies, especially as the Bitcoin halving draws closer, which is often a catalyst for the bull market. If this continues, then LTC could easily cross $100.

Avalanche (AVAX) Sees An Awakening

Just like Solana (SOL), the Avalanche network has undergone an awakening that has brought investors back to the chain. As a result, the AVAX price has rallied, going from its 2023 low of around $9 to as high as $47 in December 2023.

As the new year rolled around, the Avalanche network has continued to enjoy attention from crypto investors and this has helped it maintain its bullish momentum. Just like MoonRiver (MOVR) and Litceoin (LTC), Avalanche (AVAX) is another token expected to cross the $100 mark.

(@Flowslikeosmo)

(@Flowslikeosmo)