The savvy cryptocurrency trader is up over 15,000 fold on his initial $3,000 Pepe investment in just one month.

Cryptocurrency Financial News

The savvy cryptocurrency trader is up over 15,000 fold on his initial $3,000 Pepe investment in just one month.

Mirroring the 2021 cycle, the profits from GameStop could spill into altcoins, catalyzing the start of the 2024 altcoin season. Could history repeat itself?

The Ethereum network had its cheapest day in over six months, which could suggest altcoins could rally “sooner than many may expect.”

Analysts cite a classic trading pattern and growth in the altcoin total market capitalization index as proof of an upcoming altcoin season.

Bitcoin’s correction at the start of Q2 dragged down the Altcoins market, and a “gloomy” sentiment appears to surround investors despite Q1 2024 registering one of the best performances for the crypto market. As prices recover momentum, traders and analysts suggest a brighter future might be around the corner.

On Friday, some traders shared optimistic forecasts for altcoins. According to investor Crypto Jelle, the altcoin market cap chart “looks primed to go on a massive rally in the coming months.”

The investor highlights the similarities between the altcoin’s performance during the previous bull runs. Per the chart, after 2018’s all-time high (ATH) of $474.5 billion, the altcoin market consolidated under the resistance zone in “preparation” for the next bull run.

During the 2020-2021 bull market, altcoins’ market cap broke out and consolidated around a new support zone before continuing its upward trajectory to its last ATH of $1.7 trillion.

As the investor highlighted, altcoins’ performance looks like that of the previous bull run. They are seemingly consolidating after a breakout from the resistance zone. If history were to repeat itself, then altcoins could “remind everyone what they’re capable of.”

Another trader and analyst, Titan of Crypto, shared a similar prediction to Jelle’s. According to the analysts, he’s seen crypto community members believing that “there’ll never be another altseason.”

To those in doubt, the trader suggests they “zoom out” to get a broader perspective on where the market is in the cycle. Per his chart, which excludes Ether (ETH), altcoins are at the “2 bullish monthly candles followed by consolidation” phase.

The chart also suggests that the subsequent run-up could surpass the $1.13 trillion ATH and soar to a market cap of $3.25 trillion in the coming months. To the analyst, the “#Altseason2024 is inevitable.”

Across different platforms, the sentiment seems to lean towards “negative” despite the optimistic forecasts. Follis, content creator and founder of Chroma Trading shared his experience on X this Thursday.

According to the post, “sentiment at the moment is some of the worst” he’s seen during his years in the crypto community. Moreover, he considers “engagement is dead” as “everyone is quiet” across X, Discord, and Twitch.

Sentiment at the moment is some of the worst I've seen in my 3y in crypto

Twitter, twitch, discord – everyone is quiet, engagement is dead$BTC only -6% from ath but lots of alts down -40% or more. No real bid to be found for a month or more, except on random rotations &…

— フ ォ リ ス (@follis_) April 11, 2024

The post opened a discussion as to what could be the reason. Follis suggested a combination of “over-leveraged top longers” and “traders who expected price to go up indefinitely.”

Another user weighed in, suggesting traders lost significant money buying high and selling low on Solana and Base memecoins.

Top crypto trader Ansem joined the discussion, disagreeing with the “depressing” take on the current market. The trader pointed out that BTC was at $70,000 and ETH at $3,500 at the time of his post. These prices represent a 129.8% and 82.5% increase in the past year.

Similarly, he highlighted the performance of SOL compared to the bear market bottom and the remarkable performance of memecoins in the past six months. Many users agreed that drawdowns are usual during market cycles and ultimately suggested looking at the bigger picture.

After a prolonged period of weakness for a year and a half against the Bitcoin price, the Ethereum price is currently showing strength again and could be set for an explosive move, according to several renowned analysts.

In an analysis of the ETH/BTC trading pair, renowned financial expert Raoul Pal has brought to light a compelling dual-chart pattern. The formation of both a “mega wedge” and an inner descending channel is setting the stage for what might be a significant breakout for Ethereum when priced in Bitcoin. Pal stated:

The ETH/BTC chart is an absolute stunner…and ready for the next big move, the break of the mega wedge…let’s see how it pans out….

The “mega wedge” pattern, discernible on the weekly ETH/BTC chart, showcases a contraction of price movement between two converging trend lines over an extended time frame. The upper trend line, acting as a dynamic resistance, has repeatedly pushed back ascending price attempts. Conversely, the lower trend line has provided a sturdy support base.

Within the boundaries of this one and a half year wedge, a more immediate descending channel has taken shape. This channel, characterized by a downward trajectory with price action making lower highs and lower lows, indicates a bearish sentiment within the overarching consolidation phase of the mega wedge.

However, Ethereum’s current positioning, slightly above the upper boundary of this descending channel, implies that a breakout could be on the cards (if confirmed). As of press time, Ethereum was trading at an equivalent value of over $3,059, which translates to roughly 0.06037 BTC.

The intersection of these two patterns, particularly if the breakout from the descending channel is confirmed, could be a harbinger of increased volatility and a potential trend reversal for ETH against BTC. A potential retest of the channel could catalyze a rally towards the mega wedge’s upper trend line, challenging the longer-term resistance. A successful breakout from the mega wedge could then ensue, signaling a massive bullish phase for Ethereum against Bitcoin.

Remarkably, Raoul Pal is not the only seasoned analyst observing this major trend. Christopher Inks, founder of Texas West Capital stated via X:

The monthly ETH/ BTC chart looks crazy bullish off the lows. Bullish SFP, volume expansion at the lows, rally into descending resistance. An impulsive break out above that descending resistance will have me looking for price to target the top of the range and, likely, new ATHs.

Renowned analyst Will Clemente has also weighed in on the unfolding situation with his expert commentary, echoing the significance of the patterns observed by Raoul Pal. Clemente accentuates the breaking of a multi-year downtrend on the weekly chart, a technical milestone that carries substantial weight for market sentiment.

Clemente’s analysis further deepens the plot by highlighting several key factors currently at play in the Ethereum ecosystem. First, Ethereum’s price action has revisited and swept the lows of May 2022, a move often associated with shaking out weak hands before a potential trend reversal.

Second, the recent talk of “Ethereum obituaries” on social media timelines suggests a sentiment extreme, often seen at major turning points. Moreover, there is currently a new narrative for ETH shaping, the emergence of “restaking”.

Probably the strongest catalyst for the ETH price in the coming months could be the potential approval of an spot Ethereum ETF in the United States. Similar to the Bitcoin ETF euphoria, Clemente speculates that the approval has not yet been priced in.

Lastly, Uniswap’s governance proposal to switch on fees could redirect significant value to token holders, potentially adding further bullish momentum to ETH’s valuation. Clemente caps his commentary with a forecast that resonates with the sentiments of many observers: “ETH & ETH shitcoin rotation is probably upon us.”

At press time, ETH traded at $3,059.

Here’s what the “Altseason Indicator” from the on-chain analytics firm Glassnode says regarding if an Altcoin season is currently going on or not.

In its latest weekly report, Glassnode has discussed what the Altcoin season status for the cryptocurrency market has looked like recently. To check whether the “altseason” is on, the analytics firm has devised its Altseason Indicator.

This metric judges if the investors are in a risk-on mode based on how capital rotations are occurring in the sector. There are two conditions the indicator checks for.

First, the Altseason Indicator looks at the capital netflows involving the three major asset classes in the sector: Bitcoin (BTC), Ethereum (ETH), and stablecoins.

For the former two assets, netflows are gauged using their “realized caps.” The realized cap is a capitalization model that calculates any asset’s total valuation by assuming that the real value of any token in circulation is the price at which it was last moved rather than the current spot price.

The last transfer for any coin was likely the last point at which it changed hands, so the price at the time of that transaction would be its current cost basis. As such, the realized cap sums up the cost basis of every holder in the sector.

Put another way, the realized cap measures the actual amount of capital the investors have put into the asset. Thus, changes in the metric would reflect the amount of capital flowing into or out of the asset.

For the stablecoins, net flows can be judged based on the supply or market cap alone, as the stables’ value remains tied to $1 at every point, so the magnitude of the market cap and realizes cap would be equal (both of these would also equal the supply, except for the unit).

For the Altcoin Season to be active, all three asset classes should have positive netflows. This is because capital generally enters the cryptocurrency sector through these coins and only then rotates into altcoins as investors’ appetite for risk rises.

The other condition the Altseason Indicator checks for is the momentum in the altcoin market cap itself. In particular, the metric confirms whether or not the altcoin market cap is currently over its 30-day simple moving average (SMA).

The chart shows that the Altseason Indicator first started flashing the risk-on signal in October of last year. However, the signal turned off when the market cooled off following the launch of the Bitcoin spot ETFs.

After staying off for 22 days this month, though, the Altseason Indicator seems to have been saying that the Altcoin season is back on.

At the time of writing, Bitcoin is trading around the $50,900 level, down 1% in the past week.

Altcoins, or alternative cryptocurrencies, have become a buzzword in the digital currency landscape, offering a world beyond Bitcoin (BTC). This guide explores the essence of altcoins, answering the pivotal question: What are altcoins? From the historical rise of altcoins to the exciting phenomenon of altcoin season, we delve into the intricacies that define this dynamic market.

Altcoins, short for “alternative coins,” encompass a diverse range of cryptocurrencies that have emerged following the success of Bitcoin. They are not simply imitations of Bitcoin but represent a broad spectrum of digital currencies with unique attributes, purposes, and technological innovations.

Characteristics Of Altcoins

Each altcoin is distinguished by its unique blockchain technology and consensus mechanism. For instance, Ethereum, one of the most prominent altcoins, utilizes a Proof-of-Stake (PoS) consensus mechanism, which is less energy-intensive compared to Bitcoin’s Proof-of-Work (PoW) system.

XRP operates on a consensus protocol known as the Ripple Protocol Consensus Algorithm, designed for high-speed and energy-efficient transactions. Cardano employs the Ouroboros PoS algorithm, acclaimed for its security and scalability. These varying consensus mechanisms reflect the diverse goals and technological advancements of altcoins, ranging from enhancing transaction efficiency to ensuring greater security and sustainability.

Altcoins also vary significantly in their market capitalization, liquidity, community support, and real-world applications. For example, Litecoin, often referred to as the silver to Bitcoin’s gold, offers faster transaction confirmation times, making it suitable for smaller, everyday transactions. Meanwhile, Binance Coin (BNB) is intricately linked to the Binance exchange ecosystem, providing utility within that specific platform.

Differences Between Altcoins And Bitcoin

One of the stark contrasts between Bitcoin and many altcoins is their development and governance structure. Bitcoin, created by the pseudonymous Satoshi Nakamoto, who has since left the project in December 2010, operates in a decentralized and open-source manner without a central authority.

In contrast, many altcoins have identifiable founding teams or organizations overseeing their development. For example, Ethereum is backed by the Ethereum Foundation, Solana is developed by Solana Labs, and Cardano is spearheaded by IOG (Input Output Global).

Another key difference lies in their transaction speeds and capabilities. Bitcoin, primarily designed as a digital store of value and medium of exchange, processes transactions approximately every 10 minutes. In contrast, altcoins like Ripple’s XRP have a much-shorter block time and can process transactions in seconds, making it a preferred choice for cross-border money transfers. Ethereum, with its smart contract functionality, enables a wide range of decentralized applications (dapps) beyond simple monetary transactions.

Furthermore, while Bitcoin’s maximum supply is capped at 21 million coins, altcoins have varied approaches to supply. For example, Ethereum initially had no cap. With the introduction of EIP-1559, Ethereum developers have introduced a mechanism that burns a portion of the supply with each transaction, potentially making its supply deflationary over time. XRP – like many other altcoins – was premined and has a capped total supply of 100 billion XRP.

The history of altcoins is a captivating narrative of innovation, market dynamics, and the continuous pursuit of refining digital currency technology. Since the inception of Bitcoin, the first decentralized cryptocurrency, there has been a surge in the creation of alternative cryptocurrencies, each seeking to address perceived limitations of Bitcoin or to introduce new features and use cases.

The First Altcoins Gaining Traction

The journey of altcoins began soon after the establishment of Bitcoin, with the creation of Namecoin in April 2011. Namecoin aimed to decentralize domain-name registration, making internet censorship more difficult.

Following Namecoin, Litecoin was launched in October 2011, envisioned as the “silver” to Bitcoin’s “gold.” Litecoin offered faster transaction confirmation times and a different hashing algorithm (Scrypt).

Following these, another notable early altcoin included Peercoin, introduced in 2012, which was the first to implement a Proof-of-Stake/Proof-of-Work hybrid system. Another significant early player was XRP which was created in 2012. The XRP Ledger was launched in June 2012 by the founders of Ripple Labs, including Chris Larsen and Jed McCaleb. Shortly after that, Dogecoin was launched in December 2013, initially created as a light-hearted take on cryptocurrency.

Remarkably, not all early altcoins sustained their momentum. Many, like Feathercoin and Terracoin, which gained attention initially, saw their influence wane over the years. These coins, while innovative in their time, couldn’t keep up with the rapidly evolving cryptocurrency market or build a lasting community and development ecosystem.

Evolution Of The Altcoin Market

The altcoin market has evolved significantly over the years, expanding beyond simple variations of Bitcoin’s technology. The introduction of Ethereum in 2015 was a watershed moment. Ethereum’s innovation was not just in creating a new cryptocurrency but in introducing a platform for decentralized applications (dApps) through smart contracts.

This breakthrough opened the doors for a new era of blockchain technology, where altcoins could serve various purposes beyond mere currency, from powering decentralized finance (DeFi) to non-fungible tokens (NFTs). The market saw an influx of diverse altcoins based on Ethereum, each catering to specific niches and use cases.

Key Milestones In Altcoin History

Several key milestones mark the history of altcoins. The Initial Coin Offering (ICO) boom in 2017 was one such significant event. ICOs became a popular method for new cryptocurrency projects to raise funds, leading to the launch of thousands of new altcoins. However, this period also saw increased regulatory scrutiny and instances of fraud, leading to a more cautious market approach.

Another major development was the rise of DeFi in 2020, where altcoins played a central role in enabling decentralized lending, borrowing, and trading, independent of traditional financial institutions. This era also witnessed the surge in popularity of NFTs, with altcoins like Ethereum being at the forefront of this new digital asset class. These milestones highlight the dynamic nature of the altcoin market, continuously shaped by technological advancements and shifting market sentiments.

As the crypto market continues to evolve, a number of altcoins have risen to prominence, each offering unique advantages and innovations. This section highlights some of the top altcoins that have captured the market’s attention due to their technological advancements, community support, and potential for future growth.

Overview of Top Altcoins

These are just a few examples of the numerous altcoins in the market, each contributing to the diverse landscape of cryptocurrency in their unique ways.

Features That Make Altcoins Stand Out

Altcoins distinguish themselves through various features that cater to specific needs and use cases:

Altcoin season or “altseason” is a term that describes a period in the crypto market when altcoins significantly outperform Bitcoin. It’s a phase where investors’ appetite for riskier assets grows, and capital flows from Bitcoin into altcoins, often resulting in substantial price surges for these alternative coins. Understanding when an altcoin season is on the horizon can be crucial for cryptocurrency traders and investors looking to capitalize on market trends.

Indicators Of An Upcoming Altcoin Season

A key indicator of an impending altcoin season can be the Bitcoin Dominance (BTC.D) chart, which tracks the percentage of the total cryptocurrency market capitalization contributed by Bitcoin. Technical analysts scrutinize this chart for signs of decreasing dominance, which may suggest that altcoins are starting to take up a larger share of the market.

Support and resistance levels on this chart can indicate potential shifts in market dynamics. For instance, a sustained fall below a major support level could signal the beginning of altcoin season.

Remarkably, the market often moves in cycles which can be broken down into four distinct phases, as illustrated in the image provided by crypto analyst Ted (@tedtalksmacro):

Purchasing altcoins can seem daunting for newcomers to the cryptocurrency space, but by following a clear step-by-step process, it can be straightforward and secure. Here’s a simplified guide to help you through the process:

Research: Before anything else, conduct thorough research to determine which altcoins align with your investment goals and risk tolerance.

You can purchase altcoins on a variety of platforms, each offering its own set of features, fees, and security measures. Here are some of the most common places where you can buy altcoins:

When choosing where to buy altcoins, consider factors such as security, fees, the variety of available altcoins, and the user experience of the platform. Always ensure that the platform you choose complies with the regulatory standards in your jurisdiction.

The question of whether altcoins are a good investment depends on various factors, including market conditions, the specific altcoin’s potential for growth, and the investor’s risk tolerance and investment strategy.

Pros Of Investing In Altcoins:

Cons Of Investing In Altcoins:

The altcoin market is a diverse ecosystem with a wide range of projects boasting various levels of innovation, utility, and community support. Similar to the early days of the internet which led to the Dot-Com bubble, the cryptocurrency space is experiencing its own form of natural selection where not all projects will survive in the long term.

The Reality Of Altcoin Longevity:

Survival Of The Fittest:

Market Dynamics And Speculation:

In conclusion, while the altcoin market as a whole shows signs of thriving, with continuous innovation and increasing integration into the broader financial system, it’s clear that not every altcoin will survive the test of time. Investors should be discerning, focusing on projects with solid fundamentals, active development, and real-world utility to identify those with the potential to succeed in the long term.

What Are Altcoins?

Altcoins, short for “alternative coins,” are cryptocurrencies other than Bitcoin.

Who Is Altcoin Daily?

Twin brothers Aaron and Austin Arnold founded Altcoin Daily, a prominent cryptocurrency YouTube channel. With over 1.34 million followers, it covers daily updates on Bitcoin, altcoins, NFTs, and more.

What Is Altcoin Alert?

Altcoin Alert refers to a software and service that tracks and analyzes sentiment on a large scale in the cryptocurrency market. It predicts coin prices based on extensive data.

How Many Altcoins Are There?

The number of altcoins constantly changes with the creation of new ones and the obsolescence of others. As of the last known count, there are ten thousands of altcoins, each with its own value proposition and community, but also a lot of scam projects.

Are Altcoins Worth Investing In?

Altcoins can be worth investing in, but they carry their own sets of risks and potential rewards. Their worth as an investment will depend on individual risk tolerance, market research, and investment goals.

Can You Short Altcoins?

Yes, it is possible to short altcoins on many cryptocurrency exchanges. In short selling, an investor borrows a cryptocurrency and sells it on the market, anticipating a decrease in its price.

How Do Altcoins Work?

Altcoins work using blockchain technology, which is a decentralized ledger that records all transactions across a network of computers. Many alternative cryptocurrencies have different features and operate on various consensus mechanisms, such as Proof of Work, Proof of Stake, or others.

How Are Altcoins Created?

Creating altcoins often involves forking from an existing blockchain or developing a new blockchain and its underlying technology from scratch. The process includes designing the coin’s protocol, creating its blockchain, and launching it for public use.

What Is An Altcoin?

An altcoin is any cryptocurrency other than Bitcoin. The term “altcoin” encompasses a broad range of cryptocurrencies with various functions and underlying technologies.

Market observers are closely eyeing the tussle between Bitcoin and its altcoin counterparts. Bitcoin’s dominance, a critical indicator of its market influence relative to the entire crypto market, has reached a pivotal crossroads. This juncture holds the potential to determine whether this year’s trend of Bitcoin outperforming altcoins will persist or if the heralded “altcoin season” is on the horizon.

Bitcoin Dominance (BTC.D) stands as a percentage value that calculates Bitcoin’s market capitalization against the entire global crypto market capitalization. This metric has garnered substantial attention due to its role in reflecting shifts in market sentiment.

Since May 2021, Bitcoin dominance has oscillated within a range of 39% to 49%. However, early June this year marked a breakout from this range, with BTC.D briefly surging above 52% before retracing toward the 49% level in recent weeks. A successful retest of this level could trigger new bullish momentum for BTC against altcoins. On the flipside, a drop below this level could trigger a longer-term drop towards 39%, the range-low which would trigger the start of a new altcoin season.

Daan de Rover, a prominent Crypto YouTuber, emphasizes the importance of understanding the broader market cycle before predicting an “altcoin season.” He argues that the current phase, being the pre-halving stage of the Bitcoin cycle, might not be the optimal time for altcoin investments.

De Rover highlights that a minor retracement in Bitcoin dominance shouldn’t overshadow the overarching upward trajectory, advising that the right time for significant altcoin investments usually occurs after Bitcoin surpasses its all-time high. “We are currently in the pre-halving stage of the cycle, which is generally not the best time to buy altcoins. Bitcoin dominance might drop by 3%, but this is likely just a minor retracement in a larger upward move.” emphasized the crypto YouTuber.

Benjamin Cowen, the founder of ITC Crypto, sheds light on the shifting sentiment, stating, “In June, many said BTC dominance would never break 49% and that alt season was about to begin. Now those same people are dunking on BTC dominance because it had a pullback to 49%. The altcoin casino will remain open until all the money is gone,” indicating that the altcoin market’s potential is far from exhausted.

Michaël van de Poppe, the CEO and founder of MN Trading, delves into historical patterns to discern the optimal time for investing in altcoins. He suggests that the best opportunity emerges around 8-10 months before a Bitcoin halving, during a period of low market confidence. Van de Poppe indicates that the performance of altcoins often hinges on Bitcoin pairs, asserting that they show interest in the markets and initiate rallies when least anticipated.

Highlighting the cyclical nature of the market, van de Poppe references past instances when altcoin strength followed historical patterns despite market variables. He references examples like Ethereum’s cycle low in September ’19 and October ’15, occurring precisely 252 days before Bitcoin halvings, which heralded altcoin bull runs.

The next two or three weeks will probably decide who is right and whether Bitcoin will continue its dominance or if altcoins will make their move and become the favored asset. Investors should therefore watch BTC.D closely.

Data shows all the altcoin indexes have outperformed Bitcoin during the past month, with the small caps becoming the market leaders.

According to the latest weekly report from Arcane Research, all indexes record positive returns in the 27-31% range during the past month. The “altcoin indexes” here refer to groups of alts divided based on their market caps. The benefit of creating indexes of cryptos is that it makes it easy to assess the performances of the different segments of the market against each other this way.

There are three main altcoin indexes: the “small caps,” the “mid caps,” and the “large caps.” As is already apparent from their names, each of these covers coins of different sizes.

Now, here is a chart that shows how these three indexes have performed against each other, as well as versus Bitcoin, over the past month:

As shown in the above graph, both the altcoins and Bitcoin observed very little price action in the final third of December, as their returns were close to 0%. This trend started to change around a couple of weeks ago, however, as some bullish price action finally returned to the market after what was a full year of mostly bearish movement in 2022.

In the period since then, the entire market has seen a significant uplift, as all the market segments are in some major profits now. The winner during the past 30 days has been the small caps, who are currently sitting at 31% in the green.

An interesting thing to notice is that the small caps suffered the most at the end of 2022 as they capped the year being noticeably more underwater than the other indexes (as can be seen in the chart). This makes them turning it around and outperforming the rest of the market all the more impressive.

Investors of both the large caps and mid caps are in profits of 28% each right now, not too far from the small caps’ performance. Bitcoin has also seen very close positive returns of 27% over the past month, but clearly, the altcoins have managed to outdo the pioneer crypto during this period.

As for Ethereum’s performance in this same period, the asset with the second largest market cap in the sector has observed gains of more than 32% in the past month, meaning that on its own, it has performed better than the indexes.

The report notes that the main reason behind the outperformance by the alts is due to these indexes observing a deeper decline than Bitcoin during the period following the FTX debacle back in November of last year.

At the time of writing, Bitcoin is trading around $21,200, up 21% in the last week.

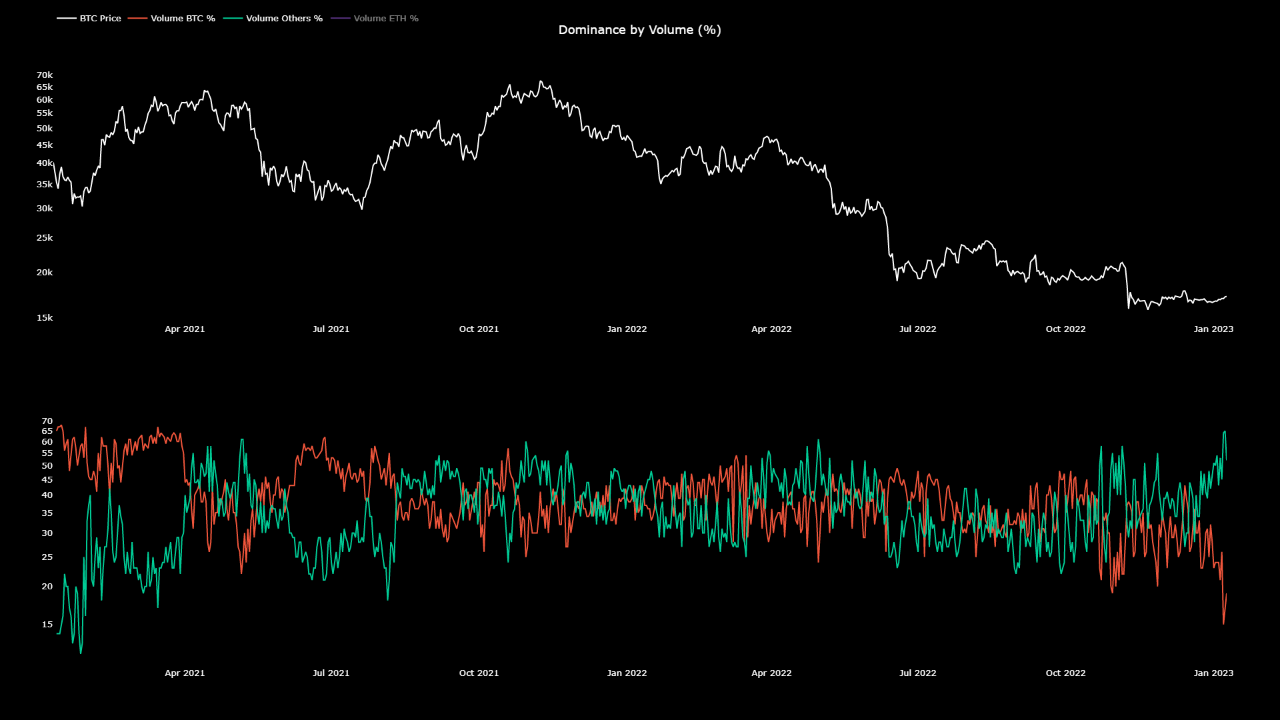

On-chain data shows that altcoin volume dominance is now at the highest level since January 2021, while Bitcoin’s is at its lowest.

As pointed out by an analyst in a CryptoQuant post, Bitcoin’s dominance is just at 16% now. The “dominance by volume” is an indicator that measures the percentage of the total crypto market trading volume that’s being contributed by a specific coin.

When the value of this metric goes up for any crypto, it means that particular crypto is observing a higher amount of activity relative to the rest of the market currently. This suggests that the coin is garnering more interest from investors right now. On the other hand, low values can imply that the crypto is losing mindshare at the moment as its volume percentage is going down.

Now, here is a chart that shows the trend in the dominance by volume for the entire altcoin sector combined (minus Ethereum), as well as for Bitcoin, over the past couple of years:

As shown in the above graph, Bitcoin’s dominance by volume has sharply decreased recently and has touched a value of just 16%. This is the lowest value BTC has observed during the last couple of years.

The altcoins (other than Ethereum), on the contrary, have observed their dominance shoot up in the last week or so, as the metric now has a value of 64%. This suggests that BTC has lost its market share to these alts recently.

The quant finds this trend “very concerning,” however. The reason behind that is the fact that whenever rallies have kicked off with altcoins being on top, they haven’t usually lasted for too long, and the prices have quickly come back down.

This can be very clearly seen in the chart. For example, the tops of both the bull rallies of 2021 (the ones in the first and second half of the year) took formation while the altcoins had a higher trading volume dominance than Bitcoin. The latest FTX crash also took place while alts were dominating the market.

It would appear that generally any sustainable and healthy price rallies have only started with the dominance of BTC being higher than these alts. One prominent example is that the July 2021 bottom, which kicked off the second-half bull run of 2021, took place with the Bitcoin volume percentage being higher than altcoins.

The entire market has been rallying in the last week, but if the historical pattern is anything to go by, this uplift may not last too long as the dominance of altcoins is at very high levels right now. This would spell trouble not only for Bitcoin but also for these alts themselves.

At the time of writing, Bitcoin is trading around $17,400, up 3% in the last week.

In this episode of NewsBTC’s daily technical analysis videos, we are analyzing Bitcoin dominance (BTC.D) and how the top cryptocurrency might perform in the near term against altcoins.

Take a look at the video below:

VIDEO: Bitcoin Dominance Versus Altcoins (BTC.D): October 20, 2022

In addition to the video highlights listed below the video, we also analyze BTC.D using the Ichimoku, Average Directional Index, LMACD, and other technical tools.

Bitcoin Outperforms Altcoins During Sideways Phase

On daily timeframes, BTC.D is taking a short pause, but is mostly still bullish according to price action and technical indicators. Dominance is above the Tenkan-sen and Kijun-sen on the Ichimoku, while flipped bullish on the LMACD. The Average Directional Index at the bottom shows that trend strength is weakening on daily timeframes and bulls have the upper hand

Bitcoin is has been outperforming altcoins | Source: ETHUSD on TradingView.com

Related Reading: Bitcoin Price Action Falls Flat | BTCUSD Analysis October 18, 2022

Why Altcoin Season Could Be Over For Some Time

On weekly timeframes using the same tools, we can see that dominance has only just turned bullish against altcoins, and the Average Directional Index is hinting that this trend could soon strengthen. On the Ichimoku, dominance is above the Tenkan-sen, but not the Kijun-sen, making it the next logical target.

Moving to monthly timeframes, Bitcoin dominance is also bullish against alts on the LMACD, and the ADX shows that altcoin season could be cooling off for some time. The Ichimoku isn’t very telling, but much like weekly timeframes, the Kijun-sen above could make for a possible next target.

But the trend could just be beginning | Source: ETHUSD on TradingView.com

Related Reading: A Bullish Week In Bitcoin On The Way? BTCUSD Analysis October 17, 2022

Can Alts Hold Onto 50% Of Crypto Dominance?

Additional trend line TA shows that BTC dominance possibly retested the neckline of a years old inverse head and shoulders pattern, which includes the early 2018 alt season peak that came shortly after Bitcoin topped in December 2017 at $20,000. Shockingly, Bitcoin is trading below that level some five years later.

If Bitcoin dominance does reverse hard against altcoins, the line in the sand to watch for is around 52% dominance. Above there would trigger the first ever monthly buy signal of Bitcoin against altcoins.

Will BTC recapture 50% of crypto market share? | Source: ETHUSD on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin has had a favorable year in 2021 but the altcoins have dominated the market. The advent of the alt seasons this year had seen multiple altcoins rally towards new highs even when market-mover bitcoin had remained stagnant at times. This move, coupled with the growth and adoption that rocked the crypto space this year, has proven that the altcoins dominated the market on a large scale.

Altcoins Rule 2021

So many new things came out of the altcoin industry this year and have found success at the same time. Basically, the year 2021 has been one long alt season when we look at the performance of some of these assets.

Related Reading | The Year In Review: An Emotional Rollercoaster For Crypto Investors

A lot of this growth has been driven by decentralized finance (DeFi), NFTs, and most recently, the metaverse gaining popularity among investors. These have brought to the forefront some interesting projects that have had their tokens rally because of it. Most of the time, they followed the growth of bitcoin. While at other times, these assets broke free and rallied on their own accord.

Altcoins market cap at $1.32 trillion | Source: Altcoins Total Market Cap on TradingView.com

This has led to bitcoin losing a significant portion of its market dominance to altcoins. Starting the year out at about 75% of total market dominance, it has now fallen to 38% where altcoins have continuously eaten into the pioneer cryptocurrency’s market share. Ethereum was, as always, leading this charge as it took the largest chunk of the market share.

Memecoins also found favor in the market this year. Coins like Dogecoin and Shiba Inu grew into the thousand and million percentile, as well as “ETH killers” also making a play in the market.

Mid-Caps Take The Lead

Altcoins always showed out in the indexes with triple-digit gains for the year. Bitcoin which had a tremendous run of it this year still recorded the lowest gains being the only index that returned double-digit gains. All other indexes, the small, mid, and large cap indexes enjoyed the majority of the gains.

Related Reading | Bullish Signal? Ethereum Market Dominance Sitting Above 20%

Bitcoin’s returns for the year only came out to 73%. While this is still vastly ahead of top investment vehicles like gold, the S&P, and NASDAQ, it still performed poorly in comparison to the other indexes.

Mid Cap Index records highest returns of 2021 | Source: Arcane Research

The Large Cap Index saw the second-lowest returns with 179%, but even it saw returns over 100% higher than that of bitcoin. The Small Cap Index made a splash with returns reaching as high as 485% for the year.

Finally, the Mid Cap Index came out as the winner for 2021 marking returns of 830%. This index consists mostly of Layer 1 tokens which had seen some of the most gains for the year, outperforming even ethereum despite its massive 485% returns for the year.

Featured image from Investment U, charts from Arcane Research and TradingView.com

It’s official, this was Binance Coin’s year. There are no two ways about it, BNB crushed it throughout 2021 and cemented itself as the third more popular coin in the world by market capitalization. Not a small feat, considering the phenomenal year that altcoins had. Several projects had their moment in the sun, capturing capital, headlines, and attention. No one got near Binance Coin, though.

Binance Coin’s stellar performance | Source: The Weekly Update

According to Arcane Research’s The Weekly Update:

“Bitcoin may have beaten the stock market in 2021, but it has been left in the dust by other cryptocurrencies. Binance Coin (BNB) is the best performer of the three biggest cryptocurrencies by market cap, with a 1344% gain. The Binance Smart Chain ecosystem has seen massive growth in 2021, taking some market share from Ethereum.”

That’s why they dubbed Binance Coin as “the winner of 2021,” and their point is well taken. However, there’s more to the story. Binance as a company was in hot water for a while there. And their own validators blasted the Binance Smart Chain, saying things like, “There doesn’t appear to be any reasonable testing process in place. Every update appears to make things worse.”

Let’s explore the Binance Coin ecosystem’s tumultuous year.

Big Projects Decided To Operate On The Binance Smart Chain

There’s no denying it. As The Weekly Update says, “Ethereum has lost its indisputable position as the “one and only” smart contract platform.” And Binance has a lot to do with that. A controversial project from the start, the Binance Smart Chain has been dubbed a centralized Ethereum clone. And the critics have a point. However, even though the Binance team did fork Ethereum’s code, they were always upfront with the direction of the project.

In BSC’s documentation, the team shamelessly claims that the “Binance Smart Chain uses a consensus model called Proof of Staked Authority (PoSA). (…) This consensus model can support a short block time and low fees, and it only requires 21 validators to run.” Contrast that with the 11.000 nodes that reportedly support the Ethereum ecosystem.

However, their plan worked and projects flocked to it:

“Binance Smart Chain was developed explicitly to solve Ethereum’s rising gas fees and offers faster, scalable, and cheaper transactions. In the past, several alternative blockchains have tried to become ‘Ethereum Killers’ but couldn’t succeed in capturing new project’s interest. However, Binance Smart Chain is hosting numerous blockchain, Defi, and crypto projects.”

Problems And Connection To The Binance Coin

However, as in Ethereum’s case, success came with scalability problems. A set of validators took to GitHub to raise concerns about the state of the network and how running a complete node’s cost has increased tremendously. “There is no code review, patches are simply committed, in most cases even without a proper description of what they do or what problem they try to solve,” the original poster said.

“I’ve rarely seen something handled so unprofessionally,” the OP accused. “I have many full nodes running there and now all of them are unable to sync. Each of these servers costs me $800 per month (previously only $200), then you told me that I need faster bandwidth and disk which means the cost will keep rising,” a commenter claimed.

What does this have to do with the Binance Coin? Everything. As the native currency of the Binance ecosystem, BNB’s success is tied to the success of the whole network. Binance is still doing amazing, but, can Binance Coin holders count on that to be the case in 2022?

BNB price chart for 12/29/2021 on Binance US | Source: BNB/USD on TradingView.com

Make No Mistake, Binance Coin Won 2021

It was an action-packed year, but Binance Coin rose to the test. Besides the validators uprising, the Binance team took care of these flash loan hacks and kept BNB’s price rising throughout the year. When CZ himself called for other entrepreneurs to create their own coins, NewsBTC was the voice of reason:

“Binance is not only the biggest exchange in the world; it also has the most activities, features, things to do. BNB powers all of that. How many coins support that huge of an ecosystem? How many coins have that many use cases? And yes, BNB provides its user with superpowers while in the Binance ecosystem and helps them save money. How many other coins can do something similar?”

Let’s not kid ourselves, the Binance Coin AKA BNB is a unicorn. A one-of-a-kind project that did many things right and rewarded the early believers with a phenomenal year. A 1344% increase in price is not something we see every day. Congratulations to Binance Coin for owning 2021.

Featured Image: Foundry on Pixabay | Charts by TradingView & The Weekly Update

Bitcoin price is only striking distance away from potentially setting a new all-time high, or only about a 15% move higher for the new record to be set. As the top-ranked cryptocurrency surprisingly weathers the macro turmoil as of late, altcoins have suffered dramatically and for the most part bled while BTC has been rising.

Alt investors are capitulating, and moving their capital into BTC as to not miss the coming last leg up. But what exactly does this mean for the ongoing altcoin season? Is it over? Or will there be another leg up like there could be in Bitcoin – a move that is becoming increasingly clear by the day?

Alt Season, Bitcoin Dominance, And The Theory Of Five Waves Down

Bitcoin and altcoins have a very unusual relationship, despite being assets of the same class. Top traders such as Nik Patel have spent years working to understand the strange, cyclical behavior between BTC and alts, and have found some success.

After such an explosive altcoin season, the market is convinced that the music has already stopped, asset prices have topped out, and have started to reallocate heavily into the strength of BTC.

Related Reading | How 90-Year Old Market Wizardry Predicted The Bitcoin Breakout

But much like Bitcoin’s recent pullback is close to proving to be little more than a massive bull market shakeout, due to the relationship between alts and BTC, this divergence between the two types of crypto assets could be a similar shakeout.

BTC dominance suggests another wave down. | Source: CRYPTOCAP-BTC.D on TradingView.com

Many analysts, such as Elliott Wave International’s Tony Carrion, subscribe to the idea that BTC is about to enter a wave five impulse against the dollar. That would suggest that BTC just completed a wave four, which in the end was a big bear trap. But what if alts are close to finishing a wave four against BTC, with another wave to follow? That’s exactly the picture BTC dominance tells.

Comparing the total altcoin market cap sans BTC against the king itself, shows that alts might shockingly be undervalued by comparison. A similar shakeout in momentum can be seen during the last cycle using the LMACD, pictured below.

Alts are lagging behind BTC in valuation comparatively. | Source: CRYPTOCAP-TOTAL2 on TradingView.com

Which Altcoin Will Survive Best Against BTC When Retail Returns?

Looking at the total crypto market cap and comparing it against Bitcoin price, there are some similarities between the two potential points highlighted by an ascending triangle. The bullish chart pattern if valid would result in a similar up move – taking the cycle to its climax in both Bitcoin and altcoins.

An ascending triangle fractal could launch alts to new highs. | Source: CRYPTOCAP-TOTAL on TradingView.com

With so many altcoins having already performed so well, capital very well could flow into other lagging coins, leading to underperformance in alts that have previously done well.

Related Reading | Astro Crypto: Summer Bitcoin Slump Could Bring Bountiful Fall Harvest

For example, during the last cycle, although both BTC and ETH went on to new highs, it was Litecoin and XRP that performed the best during the last leg up.

Both assets were well below the triangle consolidation during the last cycle, and once again have found themselves lagging severely behind. Is this time different? Not much has changed from cycle to cycle.

Underperforming altcoins could perform the best in the next wave | Source: CRYPTOCAP-TOTAL on TradingView.com

The direction of BTC dominance can be deceiving, as the direction of the chart is down when altcoins are doing well. The rest of the charts, which use the same assets in unique juxtapositions, make for a more compelling argument as to why altcoin season has barely even started yet. And the current divergence between BTC and alts is possible the same type of a shakeout that most of the market just fell for in the BTCUSD trading pair.

The psychology behind this expectation, is that the market has realized it was wrong about BTC, and is selling USD, alts, anything to get back into position. When Bitcoin gets back to new all-time highs and attracts more attention to the market, newcomers will go to alts and not BTC.

The higher the top-ranked cryptocurrency gets toward $100,000 and more, the less likely anyone but institutions or the extremely wealthy can afford it. Altcoins will be the next best bet – especially ones that have no sellers remaining such as those that have underperformed thus far.

This is the best alpha I can offer regarding the future of #Bitcoin price. I do not think we see a lower low, regardless of if we continue to correct. Bears will not get their win before bulls get $100K. All info pulled directly from the source: https://t.co/BhmNxjeE4I pic.twitter.com/WU6snm9aCu

— Tony "The Bull" Spilotro (@tonyspilotroBTC) September 23, 2021

Follow @TonySpilotroBTC on Twitter or via the TonyTradesBTC Telegram. Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin price is struggling to break through resistance at $50,000, and it could partially be altcoins to blame for the weakness. The most recent technical structure on the highest time frames suggests that not only could alts continue to gain against BTC dominance, altcoin season itself could last a while longer.

Bitcoin Dominance And Technical Analysis Using The Metric

Technical analysis is a subjective art. The practice has enough naysayers as is, but even those that subscribe to the study don’t always believe that all charts are created equally.

For example, there are several industry vets that do not believe BTC dominance – a metric that weighs Bitcoin against the rest of the crypto space in terms of market share – has value as part of crypto analysis.

Related Reading | Total Crypto Market Cap Reenters Monthly RSI Bull Zone

If Ethereum outperforms Bitcoin, for example, dominance might dip as a result. The magnitude of this is enhanced further due to the sheer volume of unique altcoins that exist today. Some even argue that the metric itself was once useful, but less so due to dominance not including the vast world of NFTs or the constant sea of new DeFi projects springing up.

For those that are believers, the recent altcoin season could have been predicted with some degree of accuracy. And if the metric continues to hold weight, altcoin season might have another few months left.

Could altcoins beat Bitcoin at its own game a while longer? | Source: CRYPTOCAP-BTC.D on TradingView.com

Why Altcoins Season Could Last Several Months Longer

BTC dominance has established a massive trading range between 70% and 38% dominance. While altcoin sentiment was at its worst compared to Bitcoin, the range failed to break to the upside, resulting in a swing to the lower boundary of the trading range.

BTC.D stopped short of touching the previous bottom, but is following a pattern from the last cycle that suggests not only will the lower boundary be touched, lows will be swept and perhaps a new range reached.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

Technicals also support a fall into the bear zone – or oversold levels – on the Relative Strength Index. The total crypto market cap has also reentered the bull zone on the RSI, all while Bitcoin struggles with resistance.

The LMACD is still fully red on the histogram and not nearly at the depths, lengths, or oversold levels as the last market cycle. All of the signals combined suggest that altcoins are likely to outperform Bitcoin for another few months.

A monthly candle close below the trading range highlighted in the chart above might be the exit signal that altcoin season is over, and putting any crypto capital back into BTC might become the more profitable venture again. Before it happens, there could be extreme volatility on the dominance chart in a battle that’s brewing between Bitcoin and altcoins.

Follow @TonySpilotroBTC on Twitter or via the TonyTradesBTC Telegram. Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin price is diving currently, shaking up the crypto market as a whole. In addition to the correction in the top cryptocurrency by market cap, altcoins have taken an even more severe beating.

With top alts like Ethereum and Litecoin are seeing an even further drop on BTC trading pairs, Bitcoin dominance has formed a bullish engulfing candle just as a key technical indicator reach overheated status. Here’s how that could put an abrupt end to the ongoing altcoin season.

Bitcoin is the first ever cryptocurrency that an entire industry was built from since, and anything that isn’t BTC is considered an altcoin. Ethereum is currently the king of that camp, and is outpacing Bitcoin in performance since its inception.

But due to first move advantage and just how dominant Bitcoin is, it represents more than 50% of the entire crypto market cap. The BTC dominance metric was created to measure the rest of the crypto market and its weight compared to all altcoins.

Related Reading | Following Bitcoin “Reset,” It’s “Off To The Races Again”

BTC dominance has dropped by 18% since end of 2020 highs, leaving a red streak behind. However, during today’s crypto market bloodbath, the metric began to make a comeback and has formed a bullish engulfing candle.

A bullish engulfing candle is a type of Japanese candlestick formation, that typically suggests a short term reversal is in the coming. It forms when after a sharp bearish move, sellers are overwhelmed by a sudden surge in bullish buying. It is then up to bulls to continue the reversal.

A bullish engulfing appears as daily RSI reached oversold conditions | Source: CRYPTOCAP-BTC.D on TradingView.com

Coinciding with the bullish engulfing candle pictured above, the daily Relative Strength Index fell sharply into oversold territory. If a reversal plays out in BTC dominance, whatever altcoin season that’s been going on recently, will be over.

Adding more credence to the theory of further reversal in the relationship between Bitcoin and altcoins, on weekly timeframes a hidden bullish divergence has formed, just as BTC.D touches down at the bottom Bollinger Band.

A bull div on the RSI has formed as dominance falls to Bollinger Band support | Source: CRYPTOCAP-BTC.D on TradingView.com

Divergences occur when price action moves opposite a technical indicator – in this case the Relative Strength Index again on weekly timeframes. Although daily has fallen into completely oversold levels, weekly either has more to go, or buyers are secretly showing up ready to stage a reversal.

Counter Point | Why Bitcoin Dominance Is No Longer Relevant To Crypto

If bulls can begin the comeback starting with a bullish engulfing today, and close out next week with a powerfully bullish move, a morning star doji pattern will be left on weekly charts, adding yet another signal that an extended reversal could result.

Any reversal in BTC.D, could either have Bitcoin leaving alts in its dust, or the coins crash far further than the top cryptocurrency does on its way back down. All that’s left to do, is wait and see.

Featured image from Deposit Photos, Charts from TradingView.com