In a recent interview on the future of Bitcoin, Anthony Scaramucci, the founder and managing partner of Skybridge Capital, has made a compelling prediction that the Bitcoin price could potentially reach $200,000 following its forthcoming halving event. This forecast comes at a time of considerable volatility within the crypto markets, exacerbated by recent geopolitical tensions and broader economic uncertainty.

Bitcoin Poised To Hit $200,000

During the interview, Scaramucci provided insights into the forces he believes will drive Bitcoin’s price in the coming months. “Well, I mean, look, you could get shocks like wars and you could get, you know, God forbid a terrorist calamity or something like that that could take Bitcoin down 10 or 15%,” he explained. Despite potential short-term setbacks, Scaramucci emphasized the underlying demand dynamics bolstering Bitcoin’s price, particularly highlighting the influence of new financial products like ETFs and the growing interest from institutional investors.

He elaborated on his bullish outlook, linking it to the anticipated Bitcoin halving, an event that historically impacts the supply side of Bitcoin economics by reducing the reward for mining new blocks, thereby constraining supply. “But long term with the halving coming this week, I think this thing trades to $170,000, possibly to $200,000,” Scaramucci asserted.

The discussion also veered into the broader implications of Bitcoin’s integration into traditional financial products, such as ETFs. Scaramucci argued that these instruments play a critical role in broadening Bitcoin’s investor base.

He dismissed concerns over the potential for ETFs to lead to centralization of Bitcoin ownership. “In terms of adoption vis-a-vis the ETF, you look out your four-year time horizon. […] It will still be less than 10 % of the overall ownership of Bitcoin. So this whole notion that the ETFs are gonna overly centralize Bitcoin, I don’t buy it. I think what the ETFs are, though, is they’re a great conduit for people that are used to buying them.”

BTC Is Still In The Web 1.0 Era

Scaramucci compared Bitcoin’s trajectory to the early internet era, particularly drawing parallels with significant tech stocks like Amazon during the dot-com bubble. “In 1999, Amazon was an emerging stock on an emerging technology, and it was quite volatile. And you lost 20 to 50 % eight times on Amazon. You lost 80%. Yeah, that one time in March of 2020, it went down 80%. But if you held Amazon over that period of time, $10,000 is worth a little over $14 million today.”

He also addressed concerns about Bitcoin’s practical uses, contrasting its current utility with more traditional assets like gold, which also do not offer direct cash flow. Scaramucci highlighted innovative financial practices within the crypto ecosystem that provide returns similar to traditional cash flow, such as yield-generating accounts and borrowing agreements available through platforms like Galaxy Digital.

Regarding potential market downturns akin to the dot-com bust, Scaramucci acknowledged the risks but remained optimistic about Bitcoin’s resilience and long-term value proposition. “I think if we go through a dot-com bust in the broader market in the next year or two, I think you’ll have a price shock in Bitcoin consistent with a dot-com bust. However, if you’re willing to hold that asset, which we are over a rolling four-year period of time, no one has ever lost money in Bitcoin,” he noted, underscoring the importance of a long-term investment horizon.

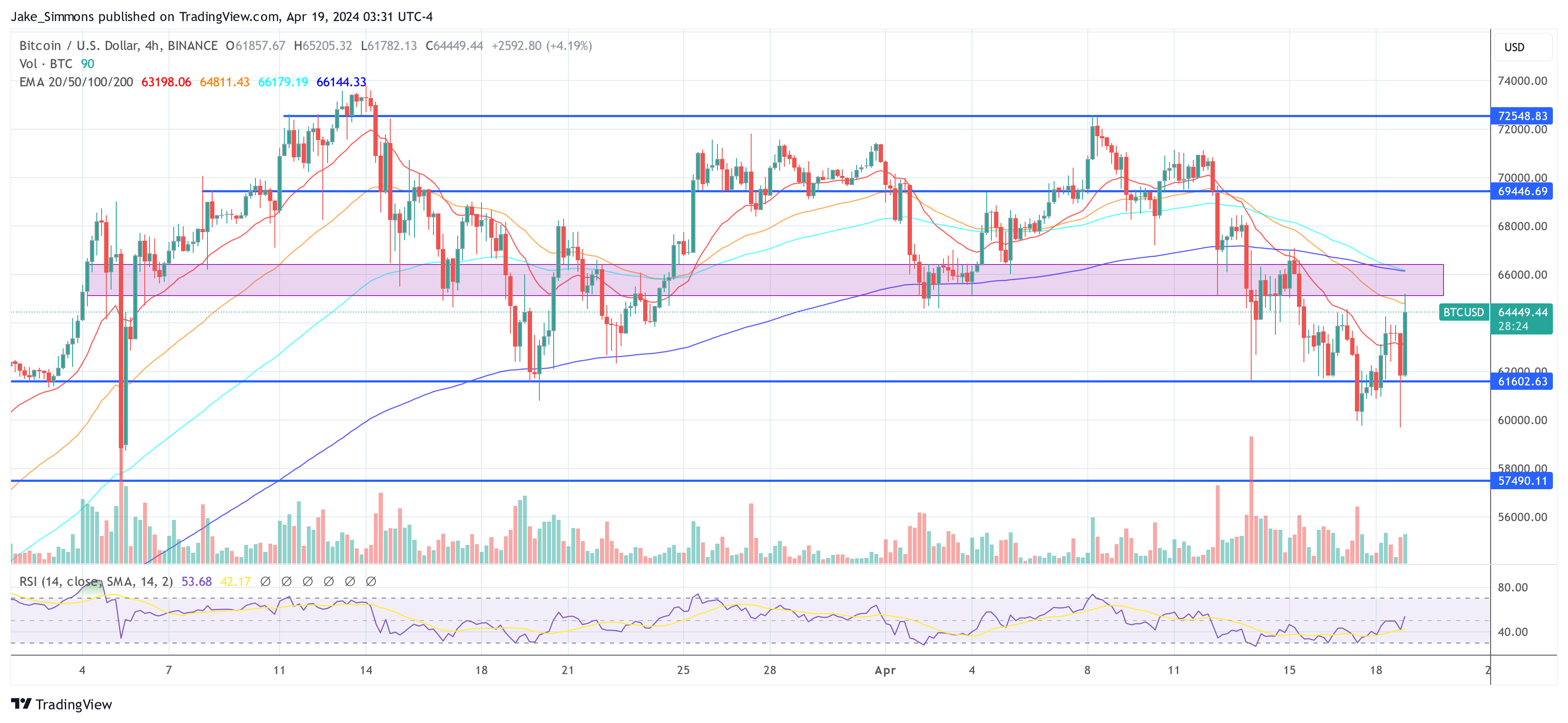

At press time, the BTC price rallied back above $64,000.