ApeCoin (APE), the ERC-20 token governing the ApeCoin Decentralized Autonomous Organization (DAO), showed notable growth in the first quarter (Q1) of 2024.

Key metrics showed significant progress, driving APE’s market capitalization, token price, and trading volume quarter-over-quarter (QoQ), demonstrating consecutive quarters of growth.

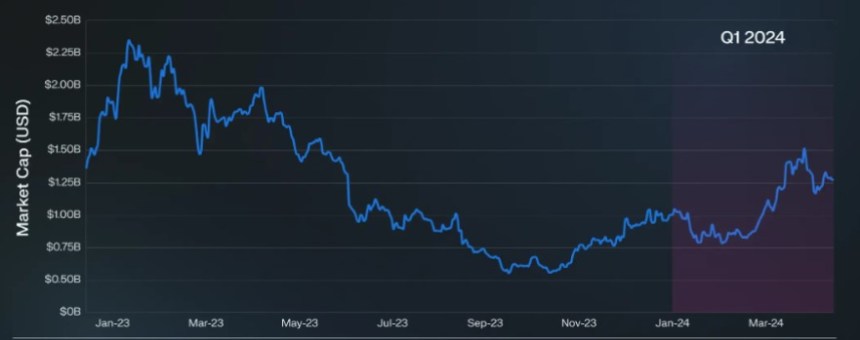

ApeCoin Regains Unicorn Status

As noted in a recent report by Messari, APE’s rebound was particularly noteworthy compared to the broader cryptocurrency market, which grew 53% quarter over quarter, and Bitcoin’s market cap, which grew 63% quarter over quarter.

After briefly dipping below $1 billion in Q2 2023, APE’s market cap regained unicorn status, ending Q1 2024 at $1.3 billion, representing 31% growth. According to the report, this market value increase was partly driven by a 21% QoQ rise in APE’s token price.

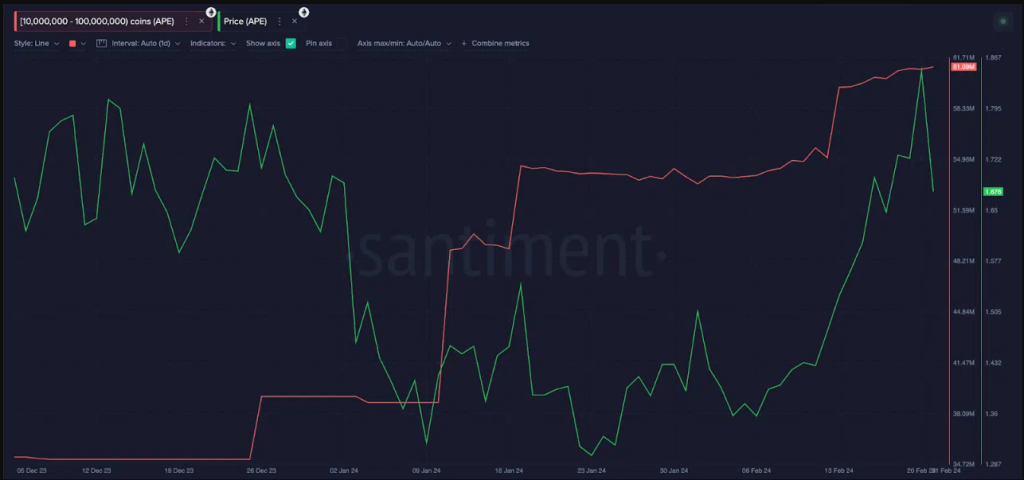

The report also highlighted the unlock of 46.8 million APE tokens from the circulating supply, contributing to the market cap growth. However, this unlocks, and the $16.5 million allocated to governance expenditures potentially created sell pressure on the asset throughout the quarter.

Another 46.8 million APE tokens were unlocked in Q1 2024, with 22 million APE going to the DAO Treasury and 24.8 million APE distributed to non-DAO entities. The DAO plans to issue or sell APE to fund approved proposals, while non-DAO entities are free to sell once their funds are unlocked.

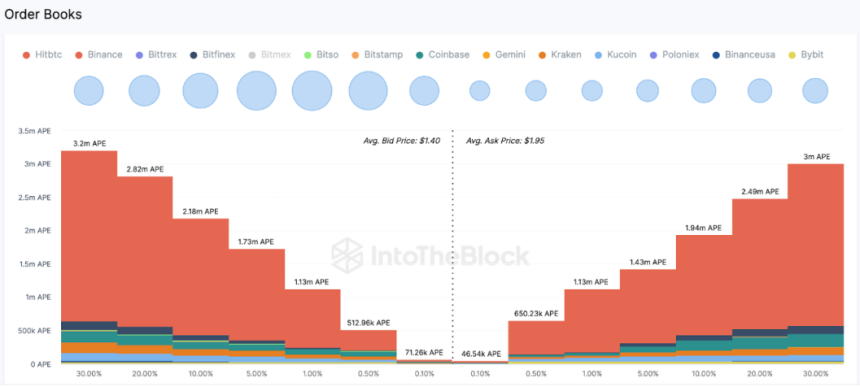

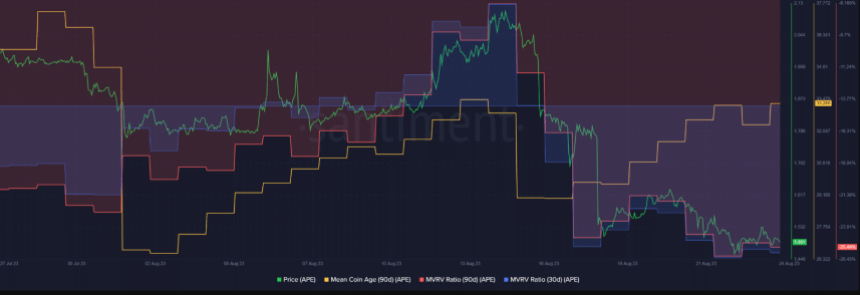

Despite the additional sell pressure resulting from unlocking and committing 8.3 million APE tokens, the price of APE still saw a substantial 21% QoQ increase. This surge in price indicated a higher volume of buy orders, exerting upward pressure on the asset.

The report also analyzed trading activity, highlighting the dominance of large-volume traders (whales and sharks), who accounted for 63% of the trade volume in Q1. The average decentralized exchange (DEX) swap size increased by 28% QoQ, reflecting the heightened activity among larger-volume traders.

Furthermore, the transfer volume of APE tokens grew by 12% QoQ, potentially driven by significant transactions following the approval of various governance proposals throughout the quarter.

APE’s Journey Forward

Looking ahead, APE’s utility is set to expand by implementing recently passed governance proposals. AIP-381 aims to build game-focused DAOs and vaults accessible exclusively to APE holders, allowing them to participate in governance and access specific ecosystem assets.

Additionally, the ApeChain proposal selected Horizen Labs to build a blockchain that utilizes APE as a gas token and potentially supports other asset-related applications.

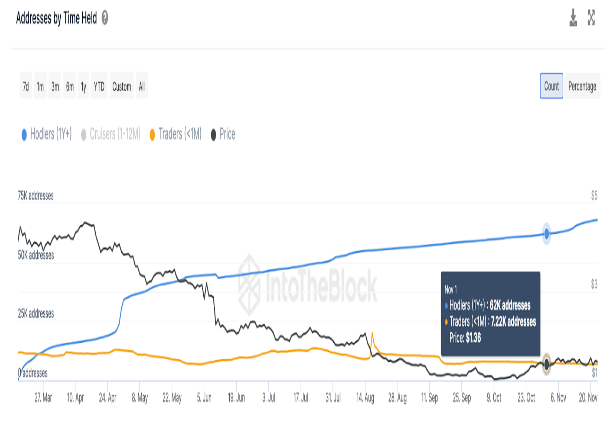

However, while APE continued to attract new holders, the growth rate of new APE holders did not accelerate despite two consecutive quarters of price increases, according to Messari.

To address this, ApeCoin DAO formed a branding partnership with a Formula One racing team, among other initiatives, to attract new holders in the future.

On the other hand, the ApeCoin DAO has been actively voting on new governance proposals, approving the building of ApeChain on the Arbitrum technology stack and expanding the utility of the APE token to GameFi DAOs and vaults.

The average votes per proposal increased by 19% QoQ, indicating growing community engagement. ApeCoin DAO plans to move the voting process on-chain more, promoting decentralization and participation in governance.

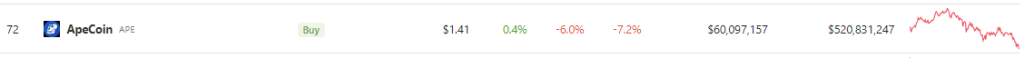

Despite the overall growth witnessed by APE in Q1, the token has recently experienced a significant downturn, aligning with the downward trend in the overall market. APE has suffered a notable decline of over 41% in the past month, leading to its current trading price of $1.148.

Featured image from Shutterstock, chart from TradingView.com