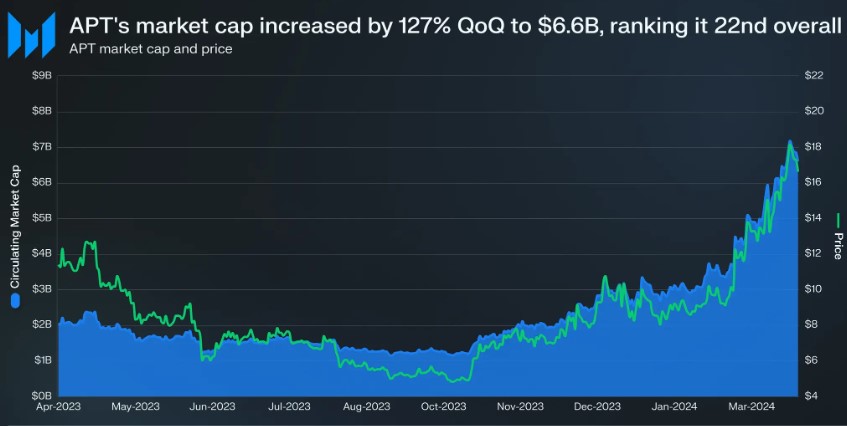

According to a report by Messari, Layer 1 (L1) blockchain Aptos experienced substantial gains in key metrics during the first quarter (Q1) of the year. The growth was driven by the surge in Bitcoin prices to new record highs and increased capital inflow in the market.

However, Aptos’ native token, APT, has struggled with price performance, recording modest gains compared to other top cryptocurrencies.

Aptos Network Activity Surges

The report highlighted that Aptos’ circulating market cap increased 127% quarter-on-quarter (QoQ) to $6.6 billion.

This growth outpaced other projects with similar market caps, improving market cap rank from 33 to 22. Despite this growth, APT’s price experienced a more modest increase of 76% QoQ.

Aptos revenue, which encompasses all fees collected by the protocol, grew by 37% to $475,000. However, when denominated in APT, the revenue decreased by 10%. All revenue generated by Aptos is burned, but these burned tokens have not significantly reduced inflation.

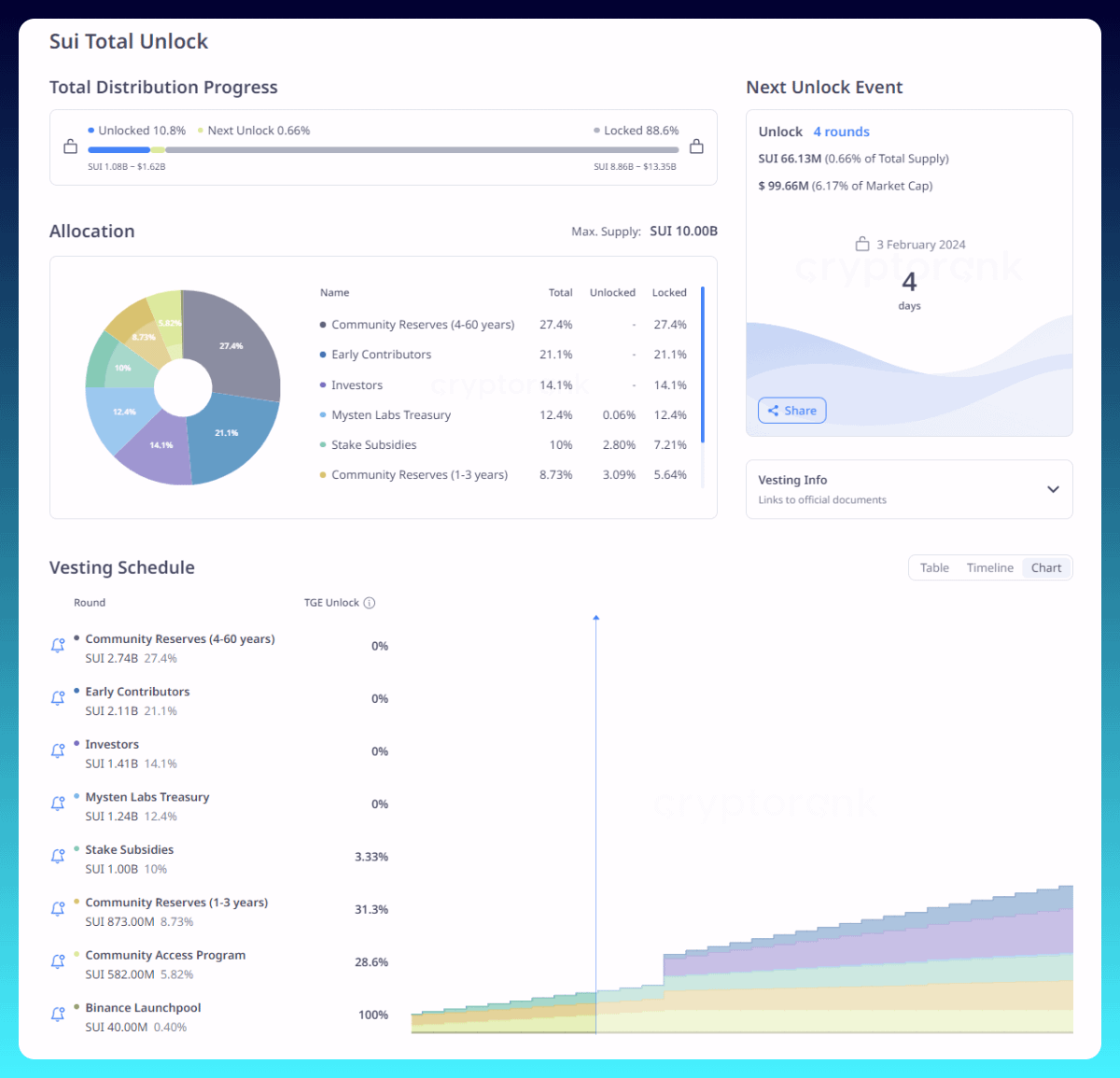

APT inflation started at a 7% annualized rate and is set to decrease by 1.5% each year until it reaches 3.5%. By mid-October, the inflation rate had reduced to just under 6.9%. Additionally, there was inflationary pressure from the genesis supply unlocks, with almost 31% of the genesis supply distributed by the end of Q1.

Looking at network activity, Aptos witnessed a significant increase in transactions and active addresses in Q1. Average daily transactions and addresses saw 66% and 97% QoQ growth rates, respectively.

Despite the increased transaction activity, the average transaction fee decreased by 45% QoQ to 0.0006 APT ($0.007). Furthermore, average daily new addresses grew by 91% QoQ to 44,000, and the weighted average one-month retention rate increased by 82% QoQ to 14%.

APT Staked Tokens Decrease 5%

Regarding staking, APT staked decreased by 5% to 861 million tokens. However, when denominated in USD, the staked market cap grew by 68% QoQ, surpassing $14 billion.

As seen in the chart above, Aptos also experienced growth in its decentralized finance (DeFi) total value locked (TVL), which increased by 376% QoQ to $573 million.

According to Messari, this increase was not solely due to APT price appreciation; TVL also grew by 170% QoQ in APT terms. Additionally, Aptos’s stablecoin market cap nearly doubled QoQ, reaching $97 million.

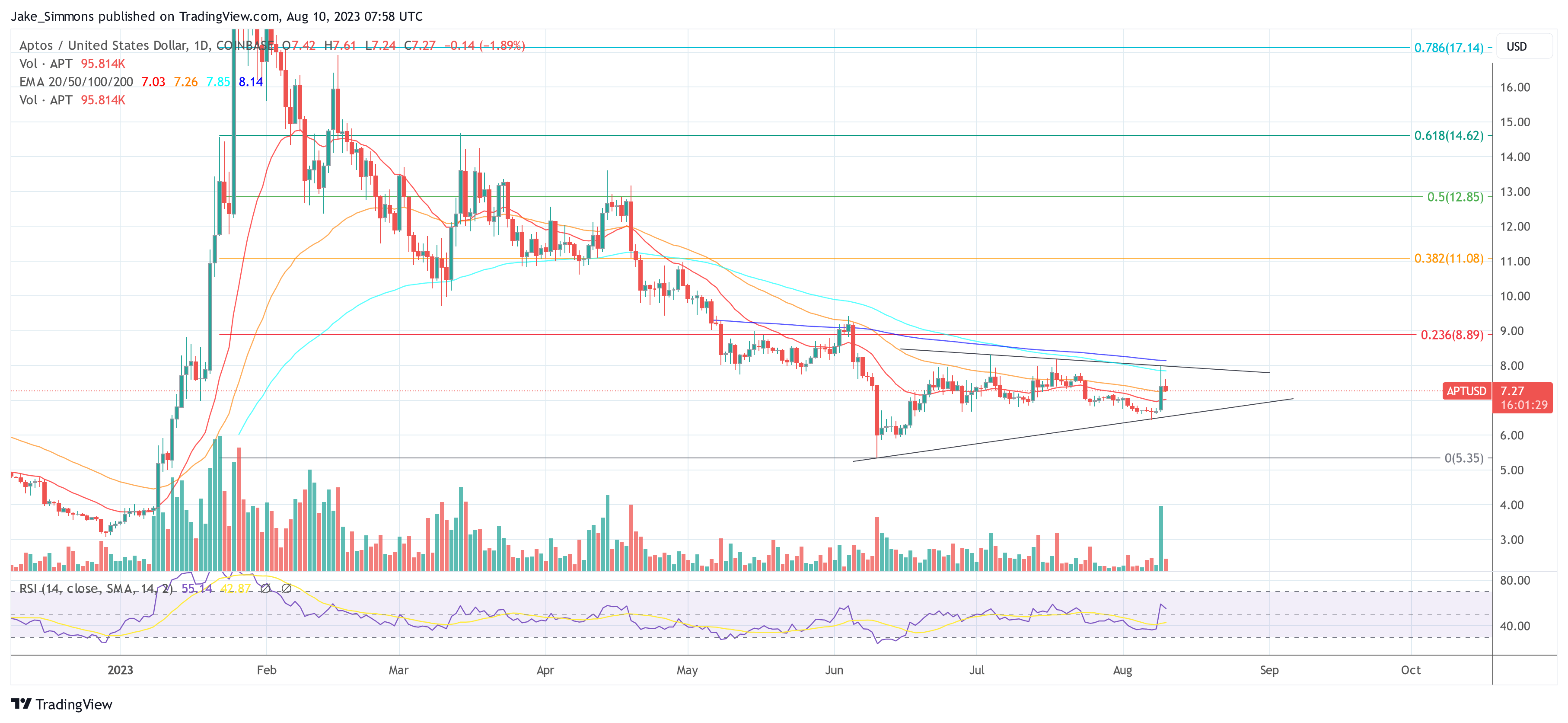

APT Struggles To Break $8.80 Resistance

Despite these positive developments, APT’s price performance has faced challenges. The native token has declined over 16% in the past month, resulting in a modest 2.7% surge year-to-date. This contrasts with the double or triple-digit gains seen by other top cryptocurrencies.

Currently trading at $8.46, APT has struggled to surpass its nearest resistance wall at $8.80, leading to a consolidation phase between $8.20 and $8.70 over the past month.

Featured image from Shutterstock, chart from TradingView.com

:

: (@wacy_time1)

(@wacy_time1)

Aptos Community, we’re celebrating

Aptos Community, we’re celebrating