Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Cryptocurrency Financial News

Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

In a notable collaboration, Aptos Labs, the developer of the Aptos (APT) Layer-1 (L1) blockchain, announced a partnership with tech giants Microsoft, Brevan Howard, and South Korean telecommunications company SK Telecom for a new decentralized finance (DeFi) platform.

The announcement, made on Thursday, revealed that Aptos Labs is launching Aptos Ascend, which will leverage the technologies of cloud computing platform Microsoft Azure, Azure OpenAI service, and SK Telecom while benefiting from the expertise of Brevan Howard and Boston Consulting Group (BCG) to provide digital currency and asset management services to its user base.

This partnership effort aims to set new benchmarks for secure and scalable financial solutions built on the Aptos blockchain, specifically through the launch of Aptos Ascend.

Aptos Ascend introduces advanced Digital Asset Controls designed to provide precision and adaptability in asset management.

Key features include customizable tokens tailored to specific financial requirements, access control limited to approved transactions and participants, and increased confidentiality through Zero-Knowledge Proofs (ZKP) that ensure compliant transaction details remain secure.

Furthermore, Aptos Ascend’s Network Controls empower financial institutions to upgrade their infrastructure and address future financial challenges.

This is achieved through customizable solutions that allow adaptation of network settings to meet regulatory requirements, implementation of multi-signature protocols for improved security, and maintenance of transparency through comprehensive audit trails.

Mo Shaikh, Co-founder and CEO of Aptos Labs, believes the project will “unlock the on-chain potential that financial institutions have been eagerly awaiting.”

Shaikh emphasized that this collaboration signifies the beginning of a ‘financial revolution” and expressed excitement about the future pioneers who will leverage the capabilities of the Aptos Ascend suite.

In August 2023, Aptos Labs had already announced their utilization of Microsoft’s infrastructure to deploy new offerings that combine artificial intelligence (AI) and blockchain technology.

Among these offerings was Aptos Assistant, a chatbot that provides increased user experiences. Shaikh highlighted the convergence of AI and blockchain as “transformative forces” that shape the internet and society and emphasized the shared vision of Aptos Labs and Microsoft to make this technology accessible to a wider audience.

APT Breaks Month-Long Downtrend

Following the collaboration and the introduction of the new platform, APT has experienced a significant breakthrough in its month-long downtrend, which amounted to a decline of over 40%. The unlock event of a substantial portion of APT tokens primarily drove this decline.

Before the unlock event on April 12, APT had already witnessed a price drop of nearly 16%. In this event, $141 million worth of tokens were distributed, with $100 million allocated to investors, $38 million among community members, and $16 million earmarked for the ecosystem development foundation. The released APT tokens account for 6% of the current circulating supply.

Currently, APT is trading at $9.54, recording a surge of 6% concurrent with the collaboration unveiling. Moreover, according to data from CoinGecko, the token’s trading volume has experienced a remarkable increase, reaching $238 million, reflecting a 46% surge compared to the trading volume on Wednesday.

Featured image from Shutterstock, chart from TradingView.com

The aim is to offer banks and large institutions a gateway to decentralized finance on Aptos.

Nearly 25 million of locked-up APT tokens will be released Friday including to early investors, TokenUnlocks data shows.

Layer 1 (L1) blockchain platform Aptos has experienced a significant surge in key metrics, accompanied by a 12% price rally of its native token APT within the past 24 hours. On Tuesday, the token’s price approached its all-time high (ATH) level of $19,92, reaching above $19.

Despite the recent price correction across the broader cryptocurrency market, Aptos’ APT token has been on an impressive uptrend since early March. Over the past 30 days, the token has surged by more than 94%, showcasing its strong performance.

Aptos has also gained recognition in crypto, climbing to the 23rd position among the largest cryptocurrencies by market capitalization. Currently valued at $7.3 billion, the token has experienced a substantial increase from the $4 billion recorded at the beginning of the month.

The trading volume of Aptos (APT) has seen a significant surge, reaching $542,531,437 in the last 24 hours, a notable 90.70% increase from the previous day, according to CoinGecko data.

Analyzing the daily APT/USD chart, no significant resistance levels are observed, indicating that reaching the $20 milestone may be within reach, which would mark a new all-time high for the token.

The sustainability of the bullish momentum and the ability of investors to hold on to their gains will play a key role in determining the coin’s future performance. Nevertheless, a possible retest of the next support level at $17.36 cannot be ruled out in the event of profit-taking and selling pressure.

If the $17.36 support level fails to hold, the next significant support level for APT is at $16.31. However, it is important to note that APT’s bullish structure remains intact as long as the $12.14 support level remains unbroken, suggesting that the bulls currently have the upper hand as long as a sharp 30% decline does not occur.

Coupled with the increase in the price of its native token, Aptos has seen significant growth in key metrics over the past 30 days. According to Token Terminal data, token holders have grown significantly, increasing by 3.4% to 11.79 million individuals over the past 30 days.

In terms of fees generated, Aptos has seen a notable uptick. Over the past 30 days, fees generated were $209.16 thousand, representing a growth rate of 87.8%. Annualized fees reached $2.54 million, a slight increase of 0.2%.

In a longer time frame, the Aptos token’s trading volume has experienced significant expansion, reaching $10.82 billion over the past 30 days, indicating a significant increase of 178.2%.

Featured image from Shutterstock, chart from TradingView.com

Sui, the layer 1 blockchain built by a group of former Meta (META) employees, has experienced a cascade of inflows this month in a spike that has seen it overtake Cardano, Near and Aptos in terms of total value locked (TVL).

February 2024 is a pivotal month, with nearly $1 billion in altcoins set to unlock. This phenomenon, crucial for investors and newcomers alike, signifies the release of previously restricted altcoins into the market, influencing supply and demand dynamics.

Alex Wacy, a renowned decentralized finance (DeFi) research specialist, has highlighted this significant event, emphasizing its impact on some of the notable altcoins among this February unlock.

February’s token unlocks encompass a diverse range of projects. Key players such as Aptos (APT), Immutable (IMX), Sui (SUI), Sei Network (SEI), and Oasis Network (ROSE) are at the forefront of this movement.

Aptos is set for a substantial release on February 12, with roughly $230 million worth of tokens poised for circulation. Despite previous unlocks, APT’s price has remained relatively stable.

Similarly, IMX and SUI are preparing for significant unlocks on February 23 and February 3, respectively. IMX’s unlock is valued at around $70 million, while SUI’s, worth $100 million, is particularly noteworthy as it marks its inaugural annual unlock.

SEI and ROSE are also partaking in February’s unlock, with SEI releasing $85 million worth of tokens on February 15 and ROSE’s $19 million unlock scheduled for February 18. These events come when both projects have shown modest gains in the market.

Large token unlocks in February

:

• $DYDX – $91M February 1

• $SUI – $100M February 3

• $NYM – $14M February 3

• $GMT – $28M February 9

• $CGPT – $9M February 10

• $APT – $230M February 12

• $SEI – $85M February 15

• $MANTA – $51M February 18

• $ROSE – $19M February… pic.twitter.com/aK2dT2Phkk— AlΞx Wacy

(@wacy_time1) January 31, 2024

Amid the anticipation of these altcoins unlock, SUI, IMX, and Aptos have experienced notable surges in their values, increasing by 27.3%, 10.6%, and 9.7%, respectively, over the past week. However, the last 24 hours have seen varied movements, with SUI facing a 6.4% decline, Aptos slightly up by 0.7%, and IMX reducing by a mere 0.1%.

SEI and ROSE, on the other hand, have witnessed less dramatic shifts. SEI saw a 6.4% increase over the week, while ROSE gained 5.4%. However, their 24-hour performance has diverged, with SEI dropping nearly 10% and ROSE decreasing by a marginal 0.2%.

These market performances reflect the broader crypto market trajectory, which has recently seen a 1.7% decline in the overall market cap, now at $1.72 trillion.

This decline is led by crypto giants Bitcoin and Ethereum, which have experienced a 1.7% and 1.8% decline in their market caps over the past 24 hours. To put this into perspective, Bitcoin’s overall market cap has dropped approximately $15 billion in the past day, falling from $856 billion yesterday to $841 billion today.

Similarly, Ethereum’s market cap has decreased by nearly $6 billion over the same period, moving from $282 billion yesterday to $276 billion today.

Featured image from Unsplash, Chart from TradingView

The SUI blockchain has been ramping up since the year 2024 began, and a natural consequence of this rapid growth is that it has now surpassed some major players in the decentralized finance (DeFi) space. This has put it ahead of heavy hitters such as Bitcoin and Aptos as SUI begins to leave its mark on the market.

The total value locked (TVL) on the SUI network has completely exploded in the last year. The total value locked on the blockchain was sitting at less than $12 million in the middle of 2024. But now, less than a month into the year 2024, the TVL has already crossed the $360 million mark.

While this figure is still far off from the likes of Ethereum and BSC which continue to dominate the DeFi TVL, it puts it ahead of some heavy hitters in the game. For example, the Bitcoin TVL is currently sitting at $298.8 million, which means SUI TVL is much higher than that of Bitcoin.

Then again, another network which is currently lagging behind SUI is the Aptos TVL. The Aptos blockchain, which was launched to much fanfare back in 2022, is sitting at a TVL of $133 million. This means that SUI’s TVL is more than 2x higher than that of Aptos.

Other DeFi networks which SUI has surged ahead of include the likes of Kava at a TVL of $251 million, Near at a TVL of $94 million, and Metis at a TVL of $124 million. With its TVL figures, SUI is now the 13th-largest DeFi network.

After a long stretch of poor performance, the DeFi market looks to be making its comeback in 2024. As DeFiLlama data shows, after the market peaked at a TVL of almost $245 billion in 2022, it dropped more than 50%, spending the majority of 2023 trailing below $70 billion.

However, as crypto market sentiment has improved, so has the DeFi TVL. The TVL has grown from its October 2023 lows of $47 billion to more than $72 billion so far in 2024. This is as a result of the likes of SUI gaining more adoption and their token prices also increasing.

As expected, Ethereum dominates the majority of this TVL, currently sitting at $43.743 billion. The Tron and BSC networks are the second and third-largest, with TVLs of $8.14 billion and $5.41 billion, respectively.

With hundreds of millions at stake, Avery Ching, co-founder of one of the year’s most-talked-about new projects, has much to prove.

The crypto market is set to experience significant token unlocks in November, with projects such as Aptos (APT), Avalanche (AVAX), and Hashflow (HFT) leading the way.

These unlocks are anticipated to release more than $320 million worth of tokens, contributing to the overall $450 million set to enter circulating supplies in the crypto market this month.

It is worth noting that such substantial releases could have immediate and long-term effects on both the price and availability of these digital assets.

Token unlocks are events where previously locked tokens become available for trading, often increasing a project’s circulating supply. These events are critical moments for projects, as they can signal maturation and a new phase of market dynamics.

Aptos, a Layer 1 blockchain created by former Meta executives, is expected to have the most significant token unlock by value, releasing 24.8 million APT tokens, currently representing about $165.6 million at today’s price.

Aptos’s upcoming unlock on November 12 is not just substantial in value but also notable for its distribution, with core contributors, investors, the community, and the Aptos Foundation all set to receive portions of the release.

Meanwhile, Avalanche, another Layer 1 blockchain, is preparing for its considerable token unlock later in the month on November 24, which will see 9.54 million AVAX tokens (valued at approximately $99.3 million at today’s price) released, marking 2.7% of its circulating supply.

Hashflow, a multi-chain decentralized exchange, is slated to have the largest token release by circulating supply percentage. It is poised to unlock 160.38 million HFT tokens, approximately 73.9% of its circulating supply, on November 7, injecting roughly $42 million into the market.

The distribution of these tokens will span early investors, ecosystem development, the core team, and community rewards, adding another layer to the economic activities of the project.

Other projects like Optimism (OP), ApeCoin (APE), and Sui (SUI) are also scheduled for significant token unlocks this November. However, they pale in comparison to the top three in terms of value. Optimism is set to unlock 24.16 million OP tokens worth $32.4 million.

Apecoin (APE) is poised for an unlock of 15.60 million APE tokens worth $19.5 million, and SUI is to unlock 34.62 million tokens valued at $14.6 million at today’s market prices.

Each unlock carries potential implications for the broader crypto market, as they may affect liquidity, trading volume, and investor sentiment. Furthermore, out of these six tokens above set to unlock this month, Aptos and Avalanche are the top gainers.

Currently, both assets are up 38% and 22%, respectively, in the past 14 days. APT trades at $6.82, down by 2% over the past 24 hours, while AVAX trades at $11.02, down by 2.7% over the same period, at the time of writing.

Featured image from Unspkash, Chart from TradingView

ETH rallied alongside Bitcoin as new spot ETF news emerged, and the altcoin could benefit from the failure of its layer-1 competitors.

BTC price advances toward $35,000, potentially opening the door for ETH, APT, QNT and RUNE to move higher.

Since the second week of October, there was a noticeable surge in demand for Aptos’ native cryptocurrency APT. This increased interest led to a robust phase of Total Value Locked (TVL) growth.

Ultimately, this surge in demand for APT resulted in Aptos achieving its highest-ever TVL value of $74 million during the trading session on Thursday, October 26th.

This surge in TVL is a crucial metric for decentralized finance (DeFi) platforms, showcasing the total value of assets, tokens, or cryptocurrencies locked within the platform’s smart contracts.

Aptos TVL. Source: DefiLlama

The increase in demand for Aptos’ native cryptocurrency, APT, further demonstrates growing investor confidence and interest in the platform’s utility, potentially indicating an expanded user base or enhanced use case scenarios within the Aptos ecosystem.

At the time of writing, APT was trading at $6.69, up 4.5% in the last 24 hours, and etching a notable 31.5% increase in the last seven days, according to figures by crypto market tracker Coingecko.

This rally can be partially due to Aptos’ distinct position as a proof-of-stake blockchain that uses a cutting-edge smart contract programming language, to facilitate quicker and less expensive transactions on its network.

For this reason, a lot of cryptocurrency fans frequently associate Aptos with certain decentralized Web3 applications, with a focus on the domain of non-fungible tokens (NFTs).

1/

Aptos Community, we’re celebrating #AptosOne in style! Introducing Graffio: a unique canvas where YOUR art shapes a special commemorative NFT.

Dive in and be a part of Aptos history!

pic.twitter.com/pKAaQtwhi3

— Aptos (@Aptos_Network) October 18, 2023

AptosOne recently launched Graffio, an NFT-based art display platform. This tool simplifies NFT art creation, with standout features including waived gas fees for social media logins and the creation of an exclusive Graffio wallet.

The announcement led to a surge in Aptos (APT) price from $4.88 to $6.03 between October 20 and 23, a nearly 24% increase, prompting experts to predict a bullish trend continuing to $7.20 around end of next month.

Its current value of $6.69 reflects a notable climb of 36% since mid-October, demonstrating a robust upward trend. The increase in price underscores the promising prospects for the future of Aptos and its indigenous digital currency, APT.

As Aptos achieves its all-time high in Total Value Locked (TVL), the soaring trajectory of APT’s price and the platform’s advancements in NFT technology have sparked significant optimism.

The recent market surge and robust momentum hint at the potential for sustained growth and increased interest in APT. Despite concerns looming over a possible market retraction, the record-breaking TVL and the remarkable rise in APT’s value prompt a hopeful outlook, suggesting that Aptos and its native token may be well-positioned to weather potential market fluctuations and maintain their upward trajectory in the near future.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Aptos suffered a five-hour outage, coincidentally in the same week that the network launched this time last year.

SUI, the native token of the blockchain that was built by former Meta (META) employees, has tumbled by 5% on Tuesday after the community raised concerns over whether the team had been selling staking rewards on Binance.

Exchange has resumed operations, but many are left wondering how such an issue will be prevented.

The collective 20 million APT to be unlocked then equates to 112% of the average daily trading volume over the prior 30 days, according to The Tie.

Sushi, the decentralized exchange (DEX) that has $350 million in locked value, has expanded its services to a layer-1 blockchain Aptos.

September is gearing up to be a pivotal month in the crypto space, with a series of substantial token unlocks for Solana, ApeCoin, Worldcoin, Optimism, dYdX and Aptos on the horizon. Popular crypto voices, @TheDeFinvestor and @wacy_time1, have taken to Twitter to provide insights, speculations, and analyses on these impending events. Here’s a consolidated look at their perspectives.

Set to witness one of the most significant unlocks this month, APE will release $54.8 million, which represents 11% of its circulating supply, on Sept. 17. Both influencers highlighted the magnitude of this event. @TheDeFinvestor pointed out that most of the unlocked tokens would go to insiders, specifically launch contributors. Drawing from history, the last time a large amount of APE tokens entered circulation, the price experienced a sharp dip.

@wacy_time1 mentioned the potential risks of shorting APE, especially given its current position. Since the beginning of the year, the APE is in a steep downtrend which saw price decline by 80%.

WLD is set for a daily unlock of $3.38 million. @TheDeFinvestor emphasized that in a year, the circulating supply of WLD would be three times its current amount.The token’s value has reportedly decreased by almost 50% since its launch. Despite this downtrend, both influencers cautioned against shorting it due to its large VC backers and potential price manipulations.

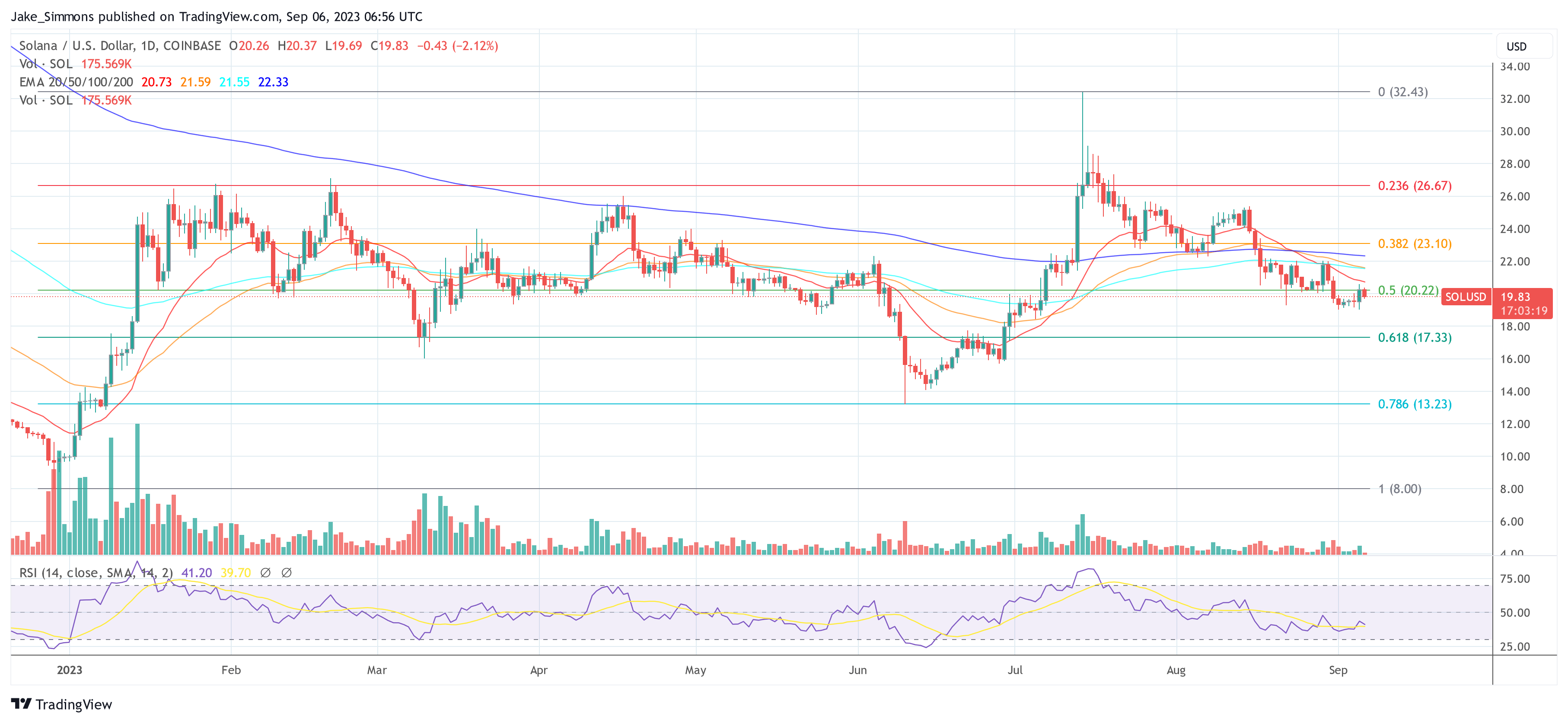

Solana is set for an unlock of $10.3 million from staking on September 7. @wacy_time1 provided an analysis suggesting that a majority of the 2756 stakers receiving 531,574 SOL might not immediately sell. The influencer believes that any price drop could be an accumulation opportunity, emphasizing the potential of Solana.

Remarkably, just yesterday, Solana announced that payments giant Visa is scaling their USDC settlement pilot to include the Solana blockchain, enabling enterprise-grade throughput at virtually no cost for Visa issuers and merchant acquirers on Solana. The SOL price reacted with a 5% surge but couldn’t take out the 50% Fibonacci retracement level on the 1-day. As long as this mark is not surpassed on a daily closing basis, further upside potential seems ruled out.

OP will unlock $32.3M, or 3.03% of its circulating supply, on Sept. 30. These tokens are designated for core contributors and investors. @TheDeFinvestor mentioned that these groups are typically the ones most likely to sell. However, @wacy_time1 expressed a more optimistic view, suggesting that the price might not react negatively. The influencer emphasized the potential of Optimism following the success of Coinbase’s Base and hinted at accumulation opportunities if any negative price reaction occurs.

On Sept. 26, $13.7 million, about 3.8% of the dYdX circulating supply, will be unlocked. These tokens are allocated to the community treasury, liquidity provider rewards, and trading rewards. @TheDeFinvestor highlighted the mid-long term selling pressure these unlocks might introduce, while @wacy_time1 did not express significant concerns regarding this token’s unlock.

A standard linear unlock of $25 million is scheduled for APT on September 12. @wacy_time1 shared that he doesn’t anticipate a significant price reaction and might consider buying APT for speculative purposes if it drops below $3.

In light of these impending unlocks, the crypto community is advised to stay informed and exercise caution. The events of September are poised to offer both challenges and opportunities for crypto investors.

This week, Coinbase launched its new Base blockchain while DeGods NFTs are way up after the project announced its upcoming Season III series. Plus, Microsoft and Aptos are teaming up to launch new blockchain AI tools.