The Arbitrum (ARB) network is a Layer 2 scaling solution for Ethereum that aims to address the scalability and high transaction fees. It is developed by Offchain Labs and utilizes a technology called Optimistic Rollups to achieve its objectives.

Optimistic Rollups work by processing most transactions off-chain and then periodically submitting a summary of those transactions to the Ethereum mainnet. This approach reduces the transaction costs significantly and increases the throughput of the network while maintaining the security guarantees of the Ethereum mainnet.

In other words, the optimistic rollup feature allows Ethereum smart contracts to scale by passing messages between smart contracts on the Ethereum main chain and those on the Arbitrum second layer chain. Much of the transaction processing is completed on the second layer, and the results of this are recorded on the main chain — drastically improving speed and efficiency.

One of the key features of the Arbitrum network is its compatibility with existing Ethereum smart contracts. Developers can deploy their contracts on the Arbitrum network with minimal modifications, allowing for easy migration of decentralized applications (dApps) from Ethereum to Arbitrum.

Also, the arrival of the Ethereum network introduced a groundbreaking transformation in the realm of blockchain technology, providing a platform for the creation of decentralized applications (dApps) and propelling the growth of decentralized finance (DeFi). Nevertheless, as Ethereum’s preeminence soared, it encountered hurdles related to scalability and exorbitant transaction fees.

This is where the Arbitrum network enters the picture as a Layer 2 scaling solution, poised to tackle these challenges while ensuring seamless integration with Ethereum’s ecosystem. In this article, we will explore the core features of the Arbitrum network and examine its immense potential in the Ethereum ecosystem.

Features Of Arbitrum Network

The promise of Scalability:

Scalability has long been a bottleneck for Ethereum, causing network congestion and skyrocketing transaction fees during times of high demand. Arbitrum tackles this challenge by implementing Optimistic Rollups, a technology that allows for most transactions to be processed off-chain. By aggregating multiple transactions into a single summary, ARB achieves significant scalability improvements, enabling faster confirmation times and a higher throughput. This scalability boost unlocks the potential for a more efficient and seamless user experience on the Ethereum network.

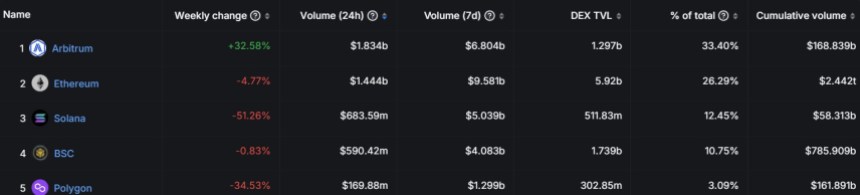

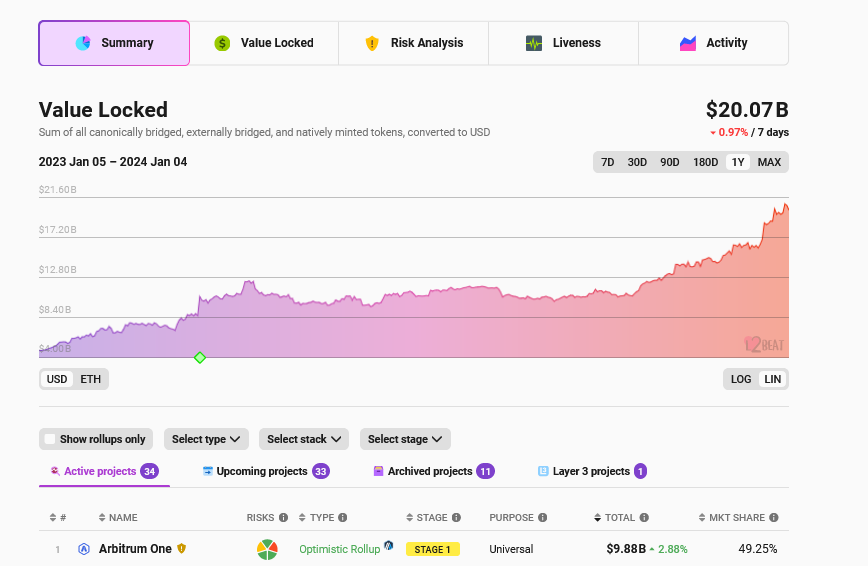

Ecosystem and Adoption:

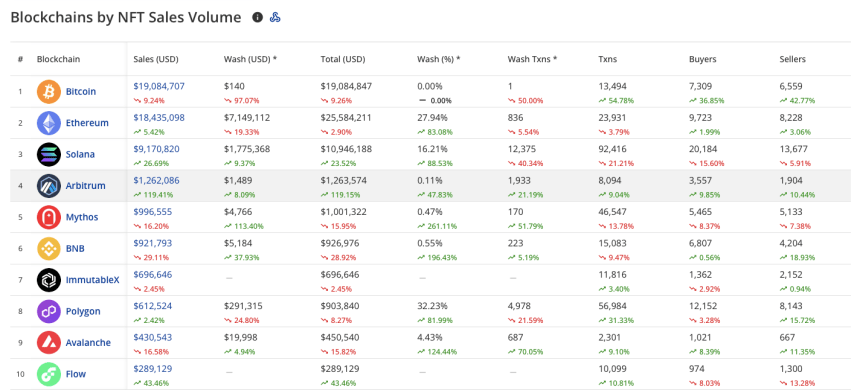

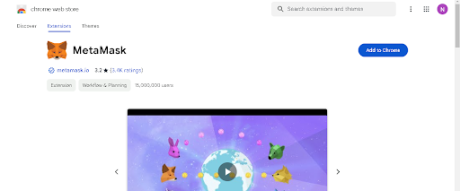

The Arbitrum network has garnered significant attention and interest within the Ethereum ecosystem. Several prominent projects and protocols have announced plans to deploy on Arbitrum or explore integrations. This growing ecosystem includes decentralized exchanges (DEXs), lending platforms, gaming applications, and more.

The increased adoption of Arbitrum provides users with a wider range of options for interacting with decentralized applications (DApps) and accessing various DeFi services.

Smart Contract Execution:

Arbitrum Network makes use of a technique called optimistic execution to process smart contracts. It assumes that most transactions are valid and executes them off-chain. This enables the network in providing fraud proofs, which allows anyone to challenge invalid transactions by submitting evidence to the Ethereum mainnet. This approach enables efficient and secure smart contract execution.

Decentralization and Security:

While Arbitrum relies on the Ethereum mainnet for final settlement and security, it maintains a high level of decentralization and security. By leveraging Ethereum’s robust consensus mechanism, Arbitrum benefits from the security guarantees of the Ethereum network. The periodic submission of transaction summaries to Ethereum ensures that any potential fraudulent activity can be detected and resolved.

Seamless User Experience:

Using the Arbitrum(ARB) network is designed to be seamless for users. They can continue using their existing Ethereum wallets, such as MetaMask, to interact with the Arbitrum network. This familiarity and compatibility make it easier for users to transition from Ethereum to Arbitrum and enjoy the benefits of improved scalability and reduced transaction fees without significant changes to their workflows.

What Makes Arbitrum Unique?

The Arbitrum (ARB) network is designed to provide an easy-to-use platform developers can use to launch highly efficient and scalable Ethereum-compatible smart contracts. It offers a range of exciting possibilities for developers and users alike. Some examples of what can be done on the network include:

High EVM compatibility

Arbitrum(ARB) is considered to be one of the most EVM-compatible rollups. It’s compatible with the EVM at the bytecode level, and any language that can compile to EVM works out of the box — such as Solidity and Vyper. This makes it easy to build on since developers do not need to get to grips with a new language before building on Arbitrum.

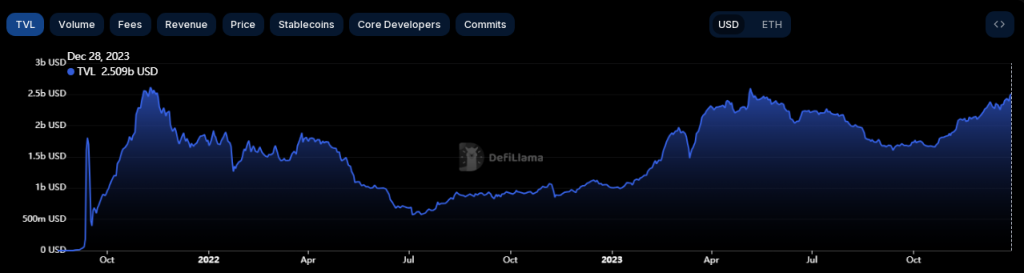

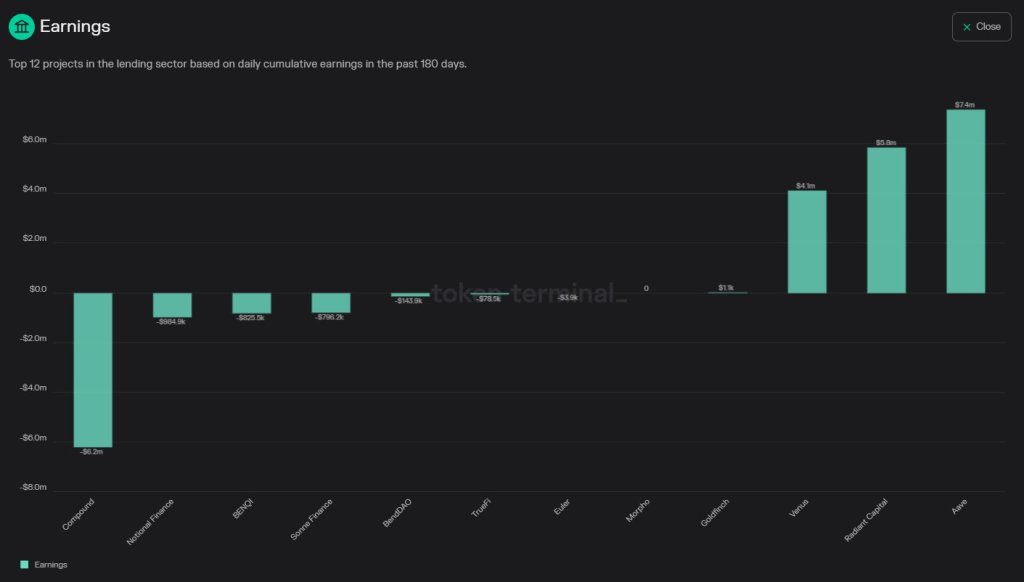

Decentralized Finance (DeFi) applications:

The Arbitrum (ARB) network can be used to build and run DeFi applications, such as decentralized exchanges (DEXs), lending and borrowing platforms, and stablecoin systems. These applications can benefit from the network’s fast transaction processing times and low gas fees, enabling efficient and affordable transactions.

Low transaction fees

As a Layer 2 scaling solution for Ethereum, Arbitrum isn’t just designed to boost Ethereum’s transactional throughput, it also minimizes transaction fees at the same time.

Thanks to its extremely efficient roll-up technology, Arbitrum is able to cut fees down to just a tiny fraction of what they are on Ethereum, while still providing sufficient incentives for validators.

Well-developed ecosystem

Arbitrum is already working with a wide variety of Ethereum DApps and infrastructure projects, including the likes of Uniswap.

Cross-Chain Interoperability

The Arbitrum (ARB) network can also be used to enable cross-chain interoperability between different blockchains. This could allow for the seamless transfer of assets and data between different blockchain ecosystems, enabling greater interoperability and connectivity across the entire blockchain space.

The Arbitrum network’s fast transaction processing times, low fees, and security and decentralization features make it a compelling choice for a wide range of use cases.

How To Get Started on The Arbitrum Network

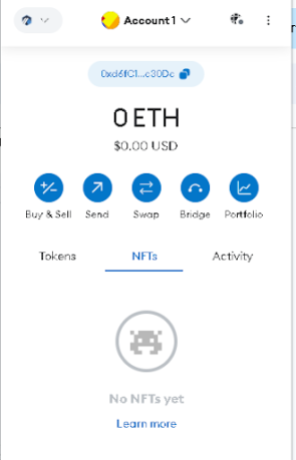

To buy and sell tokens on the Arbitrum (ARB) network, you must first get a metamask wallet. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum. It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the ‘Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it in a safe place. Do not store it online or on your device).

Next, add the ARB network to your Metamask wallet by following the instructions provided on the Metamask website here.

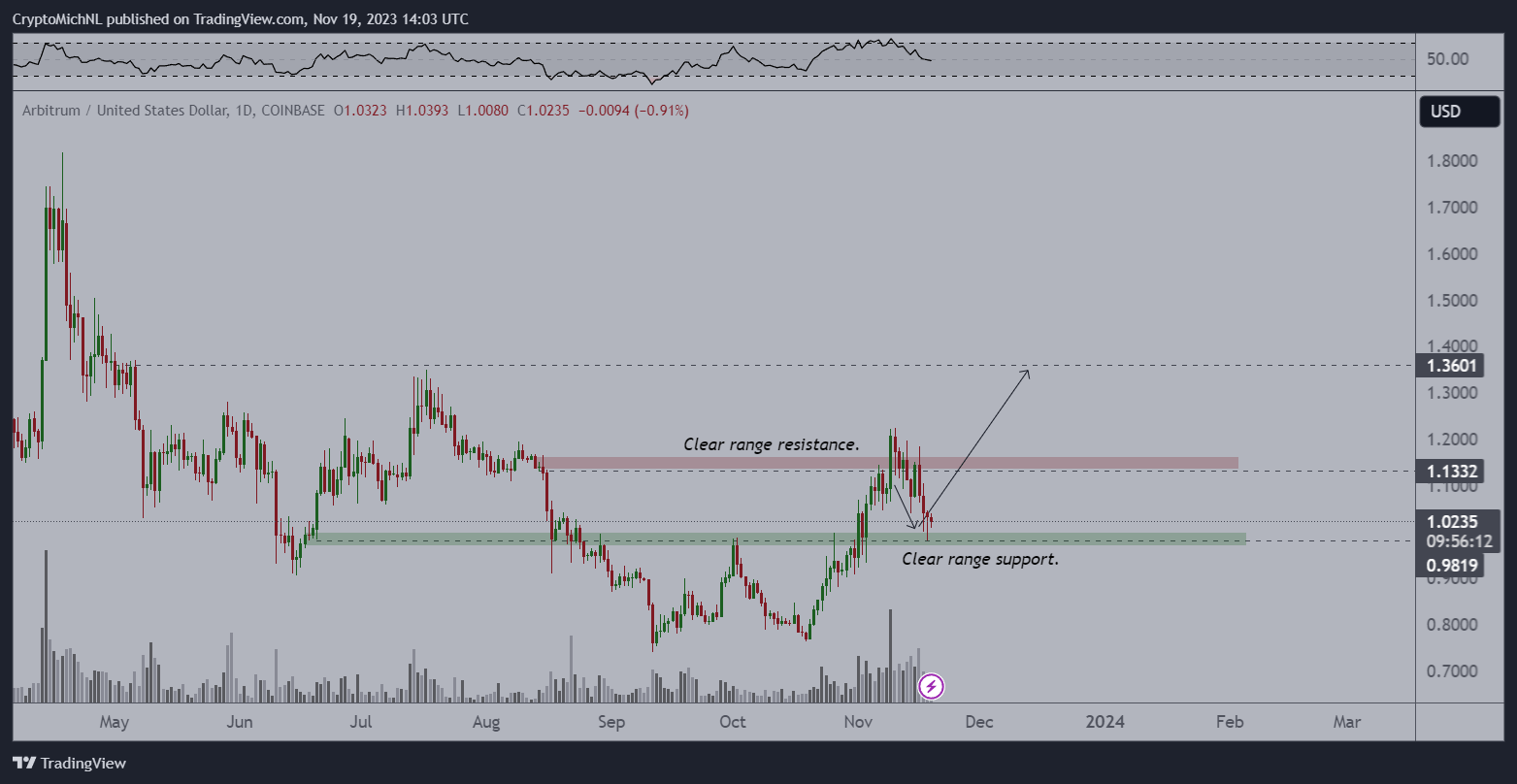

Trading On the Arbitrum (ARB) Network

In order to execute trades on the ARB network, you will need to fund your wallet with Ethereum (ETH) so as to enable you to cover gas fees even though the majority of the trading activity takes place on the Arbitrum layer 2 solution. This is because the Arbitrum network periodically submits transaction summaries and proofs to the Ethereum mainnet, which requires paying Ethereum gas fees.

You can buy ETH on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the ETH from Binance to your Metamask wallet.

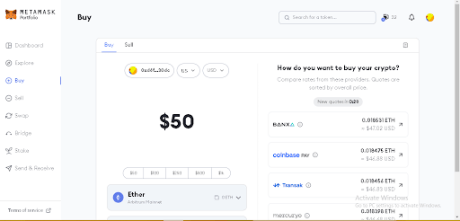

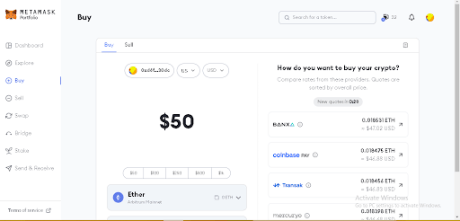

You can also purchase ETH directly within the Metamask wallet using traditional payment methods such as credit or debit cards, etc.

Just click on the “Buy/Sell” button within Metamask to open the interface. Here, you can put how much ETH (or any other token) you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your ETH to arrive in your wallet. Once the ETH arrives, you are all set to begin trading tokens on the ARB network. So, head over to UniSwap to get started on your trading journey.

How To Trade Tokens On The ARB Network Using UniSwap

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly from their wallets without the need for intermediaries or traditional order books. Uniswap offers users a simple and straightforward way to buy and sell a wide variety of tokens.

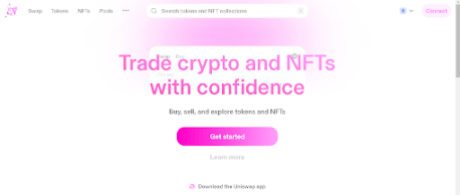

Endeavour to be on the right Uniswap website to protect your wallet from any fraudulent activity. The first step is clicking on the “launch app” button at the top right corner, as shown in the image below:

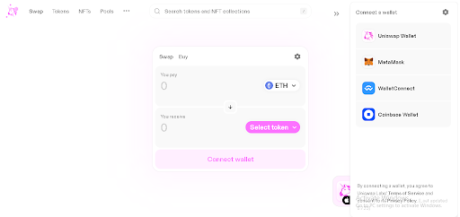

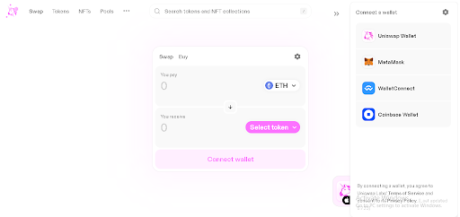

The next step is clicking on the connect wallet option on UniSwap at the top right corner, as shown in the image below:

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

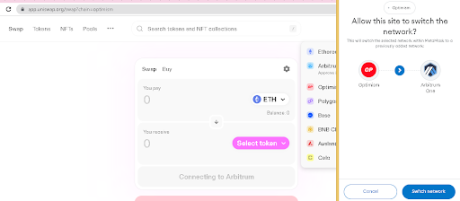

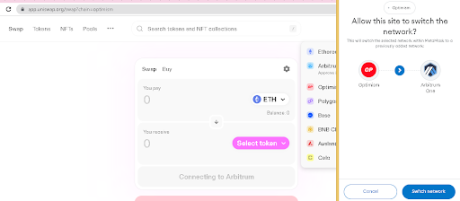

Once connected, switch Metamask to the ARB network. (If you’re already on the ARB network, you do not need to switch):

After connecting MetaMask to the ARB network, go to UniSwap, and then you can start trading on the ARB network using UniSwap.

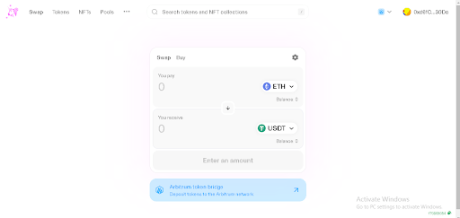

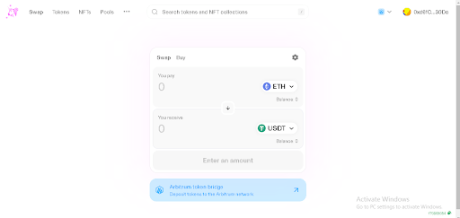

The next step is to select your preferred tokens on the UniSwap interface and since Uniswap operates on a token to token trading model, click on the “select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using ETH, select ETH – USDT, enter the amount, then click on “swap” or “trade now” and confirm the transaction in your Metamask wallet. You can view the tokens in your wallet’s asset list.

Buying and Selling Tokens with the Metamask Wallet

ARB Network users can also buy and sell tokens using the Metamask extension wallet already connected to the ARB network.

To do this, make sure you’re connected to the ARB network and have ETH to swap and pay for gas fees. Then, navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on UniSwap. Input the amount of ETH you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

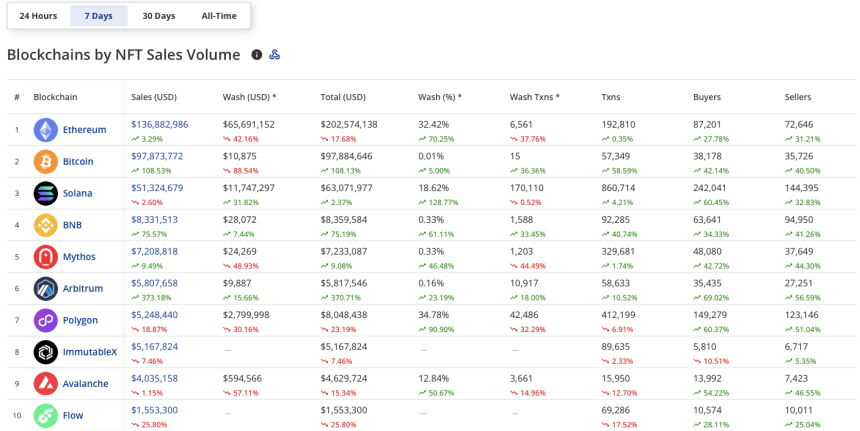

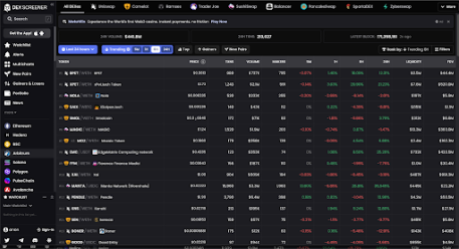

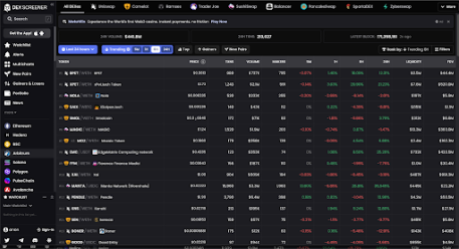

Tracking Token Prices on The Arbitrum Network

Users of the Arbitrum (ARB) network can take advantage of on-chain tools like Dexscreener to gain access to comprehensive market insights for specific tokens. These insights include price data and contract information, empowering users to make well-informed trading decisions based on reliable and up-to-date information.

With Dexscreener on the Arbitrum network, users can stay informed about token metrics and market dynamics, enhancing their trading strategies and overall trading experience.

Dexscreener offers a variety of advantageous features tailored to users on the Arbitrum network. Among these features, an exceptional one is the charting functionality, which delivers both real-time and historical price data for a wide range of tokens.

By utilizing these charts, users gain valuable insights into price trends, trading volumes, and other pertinent metrics. This enables them to pinpoint potential entry or exit points for their trades with precision and confidence.

Take a look at the example below:

Conclusion

In conclusion, the Arbitrum network offers a compelling ecosystem for buying, selling, and trading tokens, providing several notable advantages over other platforms. With its seamless integration of on-chain tools like Dexscreener, users gain access to detailed market insights, real-time price data, and historical charts, enabling them to make informed trading decisions with confidence.

Additionally, Arbitrum’s scalability and low transaction fees enhance the overall trading experience, ensuring quicker and more cost-effective transactions. By leveraging the power of the Arbitrum network, traders can enjoy a secure, efficient, and feature-rich environment that empowers them to navigate the world of token trading with ease.

two wallets which potentially belong to

two wallets which potentially belong to  wallet 0x1dc firstly sent 3

wallet 0x1dc firstly sent 3  (@Catakor)

(@Catakor)