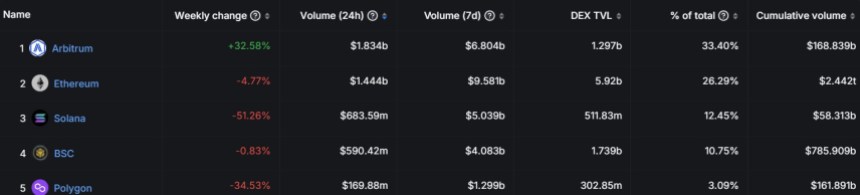

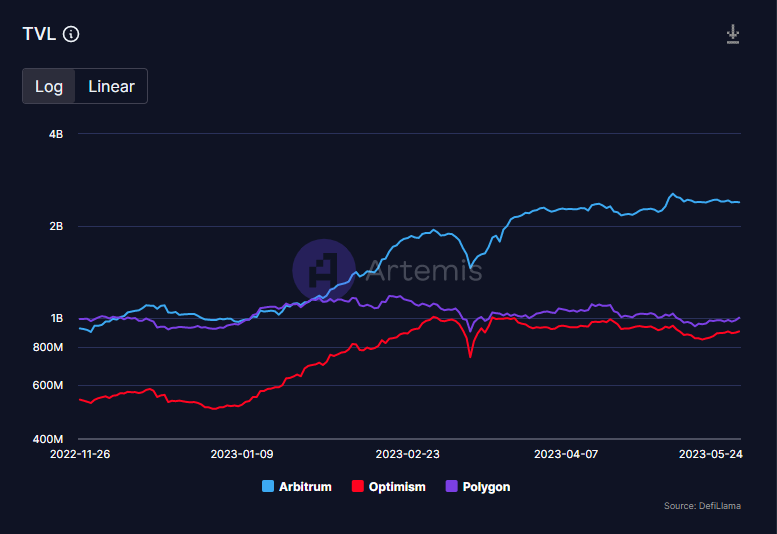

On Saturday, March 16, the Layer 2 protocol Arbitrum (ARB) unlocked 1.1 billion ARB tokens as part of its 2024 roadmap. This event led to a significant decline in the native token’s value, with losses of up to 18% reported over the past week.

In the past 24 hours, more whales have been sending ARB tokens to exchanges for selling, indicating a potential further drop in the protocol’s prices. This token unlocking marks the beginning of a four-year phased process, releasing a specific number of tokens every four weeks until 2027.

11 Whales Dump $58 Million Worth Of ARB Tokens

Following the massive unlocking of ARB tokens, analysis firm Lookonchain revealed that 11 whales deposited 34 million ARB tokens (equivalent to $58 million) into exchanges.

Additionally, on-chain data provider “The Data Nerd” noted that trading firm Wintermute has been continuously depositing ARB tokens for the past 48 hours, potentially for selling purposes.

The data provider notes that digital asset trading firm Wintermute now holds only 7.22 million ARB tokens worth $12.35 million, indicating that they have already deposited or sold $18.12 million worth of ARB over the past few days.

The ARB token has been on a 29% downtrend since reaching its all-time high (ATH) of $2.39 on June 12, 2024. Following the unlock event, ARB traded as high as $1.96 but dipped to $1.61 within 48 hours.

The token has managed to reclaim the $1.68 level despite being in the red zone over the past 24 hours if the price drops further, ARB’s potential support walls are identified at $1.56, $1.46, and potentially as low as $1.32.

Arbitrum Post-Unlock Journey

NewsBTC reported that there has been only one previous unlock event for ARB tokens. On the first day after the unlock, ARB experienced a 3% increase, indicating positive market sentiment and initial demand.

However, the token’s price gradually declined, reaching a low of -21% approximately 21 days after the unlock event. Interestingly, around the 25-day mark, the price began significantly recovering, surging by 19% above the unlock-day level.

These patterns suggest that while Arbitrum may face initial downward pressure post-unlock, there is potential for recovery and positive price movement in the following weeks.

The future trajectory of ARB’s price action remains uncertain despite experiencing a 15% drop from its first unlock day. Drawing from the past unlock event, if historical patterns hold, there may be a further 6% decrease, aligning with the previous 21% drop observed 25 days after the first Arbitrum unlock event.

This hypothetical scenario would place Arbitrum at $1.57, indicating a favorable mid-term uptrend structure.

However, it is crucial to note that past patterns do not guarantee identical outcomes in current price trading. Nevertheless, analyzing historical data can provide valuable insights and help understand and assess potential price movements.

Featured image from Shutterstock, chart from TradingView.com