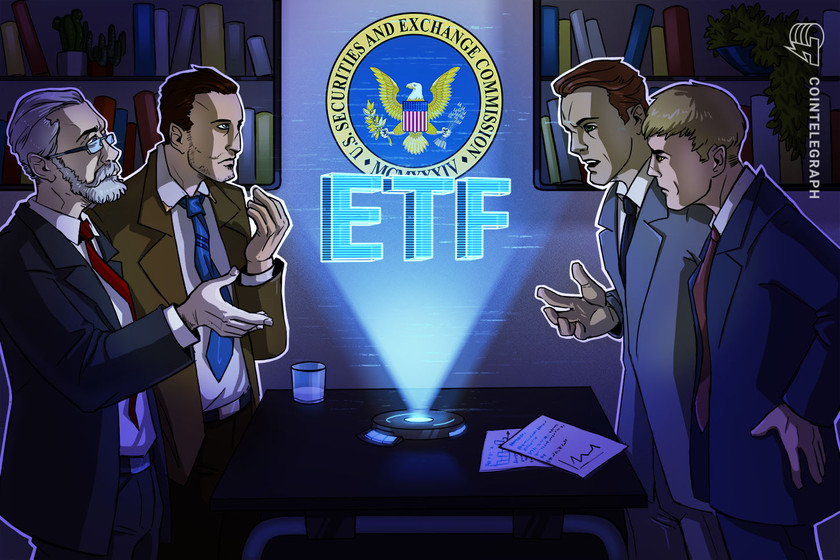

As BTC has gained over 100% this year, most observers tied its recent strength to a looming approval of a spot BTC ETF. But its increasingly constrained supply, underinvested market participants and bitcoin’s rejuvenated shine as a safe haven from spiraling debt levels, banking crises and geopolitical turmoil may also have played a role.

Arbitrum Sale On Binance: How This Investment Firm Lost $465,000 In An ARB Trade

Recent transactions by Arca, a prominent investment firm, involving Arbitrum native token ARB, have again put them under the spotlight. According to on-chain tracking platform Lookonchain, the firm has suffered a substantial loss nearing half a million recently.

Arca’s Arbitrum Shipment to Binance

Lookonchain reported earlier today that Arca transferred roughly 1.49 million ARB tokens to Binance. With a value of around $1.21 million, this transaction indicates a possible liquidation of Arca’s holdings in Arbitrum (ARB).

If this were the case, according to Lookonchain, it would translate into a significant loss of $465,000 for the investment firm. Notably, as significant as it seems, the ARB token transaction isn’t an isolated case of Arca’s investments not panning out as anticipated. Loononchain noted: “Arca’s investment this year appears to be terrible.”

An analytical dive into the firm’s past decisions has shown similar patterns. For instance, Arca’s foray into GMX and DYDX left them with losses of $231,000 and $304,000, respectively. Their stakes in DPX and SYN further compounded their negative streak, resulting in losses of $142,000 and $107,000.

Arca (@arca) deposited 1.49M $ARB ($1.21M) to #Binance at a price of $0.815 5 hours ago and is expected to lose $465K.

Arca’s investment this year appears to be terrible.

Lost $213K on $GMX, $304K on $DYDX, $142K on $DPX, $107K on $SYN;

Only made a profit of $294K on $RDNT. pic.twitter.com/qPSuZc4MSA

— Lookonchain (@lookonchain) October 12, 2023

Silver Linings Amid Investment Storms

However, it’s crucial to note that not all is gloomy for Arca. Investment is as much about strategy as it is about timing, and while the firm has faced setbacks, they’ve also had its share of victories.

An example is their investment in RDNT, which proved profitable, netting them a profit of $294,000, according to the on-chain tracking platform.

Furthermore, Arca is not alone in its recent losses with Arbitrum. The ARB token has seen a decline of nearly 10% over the past week and 1.2% in just the last day, ensnaring numerous traders in its bearish trajectory.

Data from Coinglass indicates that Arbitrum has witnessed total liquidations amounting to approximately $376,160 in the past 24 hours alone. A significant portion of these liquidations were long positions, valued at $282,120, compared to short positions at a mere $93,840.

This data suggests that many traders were optimistic about ARB’s potential to follow a bullish trend. However, starkly contrasting their expectations, they faced significant losses.

When writing, the ARB token is trading at $0.72, marking a significant drop of roughly 90% from its all-time high of $8.67 recorded just seven months ago in March.

Featured image from iStock, Chart from TradingView

Arca’s Jeff Dorman: Market’s Fixation on Bitcoin ETF is Because 2023 is Boring

Arca’s Chief Investment Officer says there hasn’t been much to sink your teeth into as a digital asset investor this year.

Embattled Aragon Mulled Sale of Crypto Project, Leaked Screenshot Shows

One of the biggest crypto projects building tools to support decentralized governance is trying to get out of its own governance pickle.

Crypto Hedge Fund Arca Has Trimmed 30% of Its Staff

Crypto asset manager Arca has cut 30% of its staff amid a continuing bear market and regulatory uncertainty, the company said Monday.

Heavyweight Hedge Fund Arca Joins Activist Fight Against DAO Builder Aragon

The crypto investment fund sent a letter demanding Aragon conduct buybacks of its ANT token.

Ethereum’s Shanghai Upgrade Will Not Crash Ether Price, Analysts Say

Many investors fear that ETH’s price may tumble as the Shanghai upgrade will allow withdrawals for some $29 billion of previously locked ETH. Crypto analysts CoinDesk interviewed are saying that concerns are overblown and the selling pressure will be limited.

Crypto Hedge Fund Arca VP of Portfolio Management Leaves

Hassan Bassiri’s exit comes months after the firm shuttered its Digital Yield Fund, citing market volatility.

Arca Firm CEO Believes Crypto Winter Has Reached The End, How True Is That?

In 2018, the cryptocurrency world experienced a crypto winter that saw the value of assets fall below 70-95% of their original value. This period lasted from January 2018 to December 2020.

Currently, the crypto market is experiencing another chilly winter with its devastating effects felt on the top market player – Bitcoin.

Despite the adoption and market dominance enjoyed by BTC: it still felt the crippling power of the bearish market cycle. Various predictions and speculations by experts relying on past market cycles are all over the place.

With the last crypto winter lasting almost three years: investors and traders are puzzled about the length of this current bearish market trend.

The crypto world is affected by the devastating effects of global players on the political scene. The Russia – Ukraine conflict has increased the pressure on cryptocurrency globally.

Igor Zakharov, CEO of DBX digital ecosystem: notes that high inflation has spiked interest rates in the United States. The U.S is the biggest promoter of crypto and a dominant force.

Shift Of BTC Holdings By Whales And Big players

Data obtained from Coinbase Pro shows that the big institutional players have transferred large amounts of their BTC holdings. The BTC volume pegged at 48,000 BTC is worth roughly $940 million.

These bitcoin assets; were removed from long-term holding positions with a time frame of three to five years. Surprisingly, the smaller and medium addresses have increased their BTC holdings: according to Santiment.

From recent data, BTC addresses with holdings in the range of 0.1 to 10 BTC now hold a record-breaking 15.9% of BTC’s total circulating supply.

BTC price has been in constant flux. With its recent price struggles around the $20,000 range noted. It has left experts puzzled about the actual length of the crypto winter.

Bitcoin price outlook remains strong l BTCUSDT on Tradingview.com

Light At The End For Crypto

But amid the uncertainty, Rayne Steinberg, CEO of digital assets investment firm Arca, is quite optimistic. He expressed his thoughts that the market is generally closer to the end of this dark period. However, he pointed out that macroeconomic factors made it difficult to go into specifics.

With macroeconomic factors like inflation taking center stage worldwide, Steinberg opted to water down false hopes but encouraged optimism.

Due to Bitcoin’s current connection with S&P 500, BTC price has taken a beating since the general market drawdown. This bitcoin sync with the equity market might favor the bears.

Some experts’ predictions had the price of bitcoin nosediving by as much as 20% as its relationship with the S&P 500 continues. Relatively other altcoins are also experiencing the chilling effects of the dip.

Uncertainty has now taken root in the crypto world. Forecasts and past price data are speculative as the big players gear up to weather the storm.

Featured Image From Pixabay, Charts From Tradingview

SEC delays decisions on Bitwise and Grayscale’s Bitcoin ETFs

The SEC now expects to decide whether to approve or disapprove Bitwise and Grayscale’s Bitcoin exchange-traded offerings in early February.

Arca Labs partners with Securitize on regulated, tokenized financial products

As part of its partnership with Arca Labs, Securitize will help launch tokenized financial products for the firm, starting with Arca’s registered tokenized treasury fund.

Digital Asset Manager Arca Raises $10M

Asset management firm Arca has announced Wednesday the closure of a $10 million Series A round of funding led by RRE Ventures. Read more: Arca Labs Launches Ethereum-Based SEC-Registered Fund

Arca to Gnosis: Show Us a Turnaround Plan or Give Investors’ Money Back

In addition to wads of cash and the aura of respectability, institutions are bringing Wall Street’s activist investing strategies to crypto markets.

605 Days Later: How ArCoins Got the SEC Go-Ahead as an Ethereum-Traded Treasuries Fund

A look inside Arca and TokenSoft’s 605-day crusade to register the first Ethereum blockchain-native ‘40 Act Fund.

Arca’s Flagship Crypto Hedge Fund is Up 77% in 2020

Arca’s Digital Assets Fund is beating the S&P, crypto indices and bitcoin’s price.

Arca Labs Launches Ethereum-Based SEC-Registered Fund

After nearly 20 months of back-and-forth, the Los Angeles money manager finally cleared what appears to be the first regulated fund represented by digital shares.

Tokenized US T-Bond Fund Seeks Foothold in $17T Market

The crypto industry is taking aim at one of Wall Street’s oldest redoubts: investing in the $17 trillion market for U.S. Treasury bonds.

WATCH: Where Is the Crypto Market Headed Next Week?

CoinDesk’s Brad Keoun talks to Arca’s investment head about recent bitcoin price activity.