Looking Deeper: Can ATOM Sustain Its 13% Surge Beyond The Network Buzz?

ATOM has ascended to the summit of network activity within the inter-Blockchain ecosystem. However, upon closer inspection, the narrative surrounding Cosmos unveils a more nuanced story. Despite the accolade of being at the forefront of blockchain network activity, a discerning analysis reveals a dip in actual user engagement and transaction volumes.

Surprisingly, against the backdrop of these statistics, Cosmos has witnessed a remarkable 13% surge in its token price over the past week, prompting a deeper inquiry into the factors propelling its momentum.

Digging Deeper: Beyond Buzzwords

Although Cosmos received accolades for its network activity, the narrative quickly unravels when scrutinizing actual user statistics. Daily Active Addresses and Transactions for ATOM, tracked by Artemis, experienced a noticeable decline, painting a different picture than the headline numbers suggest. Similarly, fees and revenue for the Cosmos network dipped during this period, further dampening the celebratory mood.

Despite the declining activity metrics, ATOM’s price defied the trend, showcasing a 6% gain over the last 24 hours, data from Coingecko shows. This disconnect highlights the influence of factors beyond user engagement, including the broader market bullishness and potentially, speculation fueled by a spike in ATOM’s MVRV ratio, a profitability indicator.

The Power Of Partnerships And Policy: Catalysts For Growth

While the overall market sentiment played a role, key developments within the Cosmos ecosystem also contributed to ATOM’s ascent. The recent merger between Osmosis and UX Chain solidified their foothold within the Cosmos landscape, bolstering cross-chain DeFi capabilities.

Additionally, the Cosmos Hub’s governance decision to reduce ATOM’s inflation rate from 14% to 10% addressed concerns surrounding stability and security, potentially attracting further investment.

Despite the recent rally, ATOM’s technical indicators paint a somewhat cautious picture. The daily chart presents a bearish MACD signal, and the Chaikin Money Flow’s sideways movement suggests a potential extension of the current price consolidation.

The Road Ahead: A Balancing Act

Cosmos faces the challenge of bridging the gap between headline-grabbing network activity metrics and actual user engagement. The recent decline in transactions and addresses raises questions about long-term sustainability. Nevertheless, the ecosystem’s strategic partnerships, focus on DeFi integration, and proactive governance decisions provide promising counterpoints.

As the new year approaches, ATOM’s trajectory will likely hinge on its ability to address user-centric metrics while leveraging its strategic alliances and proactive governance. Whether it can translate its headline dominance into sustained user engagement and price growth remains to be seen.

As Cosmos (ATOM) revels in its recent ascent to the peak of network activity within the inter-blockchain ecosystem, the question looms: can this momentum be sustained beyond the current buzz? The enigma surrounding Cosmos deepens as its 13% surge in value defies conventional metrics, prompting a cautious examination of the factors at play.

Featured image from Shutterstock

Cosmos (ATOM) Wyckoff Analysis (May 2022 – Dec 2023)

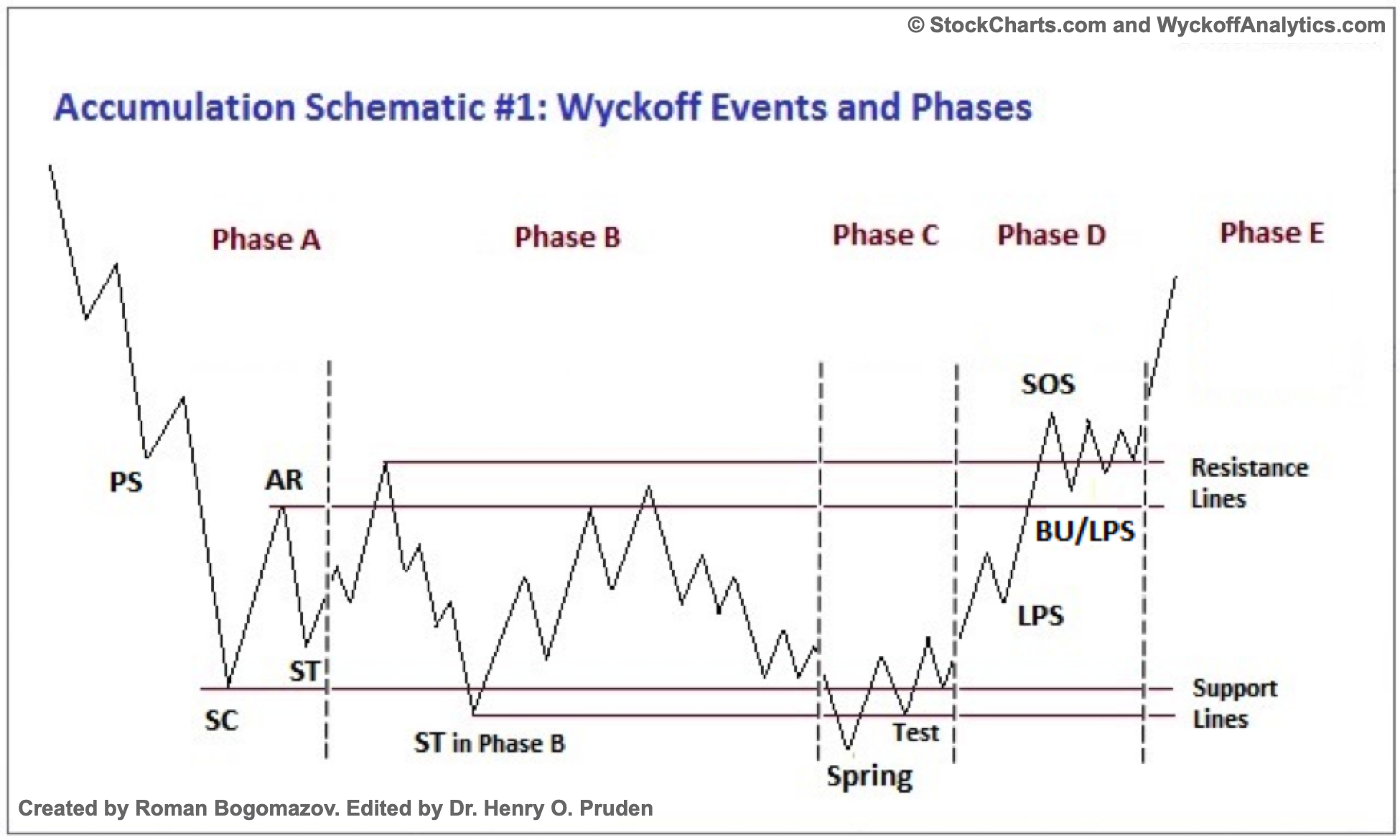

Wyckoff Analysis (WA) aims to understand why prices of stocks and other market items move due to supply and demand dynamics. It typically is applied to any freely traded market where larger or institutional traders operate (commodities, bonds, currencies, etc.). In this article we will apply WA to the cryptocurrency Cosmos ($ATOM) to make a forecast for approximate future events.

Link to the raw image: https://www.tradingview.com/x/r8asKWOI

Cosmos $ATOM is currently in Phase D of a Wyckoff Accumulation Schematic #1. Note the volume spike near where I placed the SC and Spring. In Wyckoff Analysis these typically must align even if the overall form isn’t perfect. The only slight anomaly is that the ST dips sharply below the SC breaking the ICE (not labeled). There are Advanced Schematics that you can find online that accommodate many of these anomalous formations.

Phase D is where demand greatly overcomes supply leading the rallies on higher (or noticeably increasing) volume. When an LPS occurs that is typically a favorable (even optimal) place for a long position. It recently finished a Reaccumulation, to which it’s rallying sharply. Below are the typical schematics for both Wyckoff Accumulation Schematic #1 and a Reaccumulation for reference.

Cosmos Price Targets

The basic target (per the schematic) is the top of the trading range. In this case it’s at $18, but $15 is a preliminary target it must concretely clear first. Doing some more work using the Horizontal Count method with PnF charts yields different results. My settings are currently a $0.25 box size and a three box reversal on a High-Low lookback.

When using the Horizontal Count method Extended Congestions need to be accounted for differently. The main thing is finding the relevant column in and out to create the Congestion Box. In our case that’s from 13 to 20 December 2023 spanning 7 bars. Since this is a Reaccumulation “breakout” we will need to add the value from the formula the Horizontal Count uses.

7 x $0.25 x 3 = $5.25

The relevant low to add this to is $10.25 so the PnF target is $15.5.

Glossary

All quotes are from the first link in Supplemental Reading.

Preliminary Support (PS) – “where substantial buying begins to provide pronounced support after a prolonged down-move”

Selling Climax (SC) – “the point at which widening spread and selling pressure usually climaxes and heavy or panicky selling by the public is being absorbed by larger professional interests at or near a bottom”

Automatic Rally (AR) – “occurs because intense selling pressure has greatly diminished”

Secondary Test (ST) – when “price revisits the area of the SC to test the supply/demand balance at these levels”

Spring – “allow the stock’s dominant players to make a definitive test of available supply before a markup campaign unfolds”

Test – where larger traders “test the market for supply throughout a TR”

Sign of Strength (SoS) – “a price advance on increasing spread and relatively higher volume”

Last Point of Support (LPS) – “a pullback to support that was formerly resistance, on diminished spread and volume”

Back Up (BU) – “a common structural element preceding a more substantial price mark-up, and can take on a variety of forms, including a simple pullback or a new TR at a higher level”

Supplemental Reading

“The Wyckoff Method: A Tutorial” by Bogomazov & Lipsett

“Reaccumulation Review” by Bruce Fraser (2018)

“Jumping the Creek: A Review” by Bruce Fraser (2018)

“Distribution Review” by Bruce Fraser (2018)

“Introduction to Point & Figure Charts” from StockCharts

“P&F Price Objectives: Horizontal Counts” from StockCharts

“The Wyckoff Methodology in Depth” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Structures, Volume Profile and Order Flow” by Rubén Villahermosa (2021)

Cosmos (ATOM) Elliott Wave Summary (2019 – 2023)

Cosmos ($ATOM) is the coin that powers the entire Cosmos ecosystem. It consists of a variety of projects from different spheres such as finance, decentralized exchanges (DEX), and cloud computing. The earliest price data I can find for $ATOM is from Kraken, starting in April 2019. Using this price data, the remainder of the article represents my best efforts to apply Elliott Wave Theory (EWT) to isolate its placement in market structures. I will assume that you have some knowledge of EWT to understand the terms, but I have also included a small glossary at the bottom for reference.

EWT Summary

A link to the raw image since it might be hard to see all the details: https://www.tradingview.com/x/jIKwljmV.

Cycle Wave 0 – Mar 2020 – $1.1151

Primary Wave 1 – $2.4794

Primary Wave 2 – $1.8482 (38.2% LFR)

Primary Wave 3 – $32.2433 (3.618 LFE)

Primary Wave 4 – $7.872 (50% LFR)

Primary Wave 5 – $44.7383 (1.236 LFE)

Cycle Wave 1 – Sep 2021 – $44.7383

Primary Wave A – $20.2221 (Contracting, Leading Diagonal)

Primary Wave B – $33.2641 (Contracting Triangle)

Primary Wave C – $5.5409 (Impulse)

Cycle Wave 2 – Jun 2022 – $5.5409 (50% LFR)

Primary Wave 1 – ONGOING

Primary Wave 2 – TBA

Primary Wave 3 – TBA

Primary Wave 4 – TBA

Primary Wave 5 – TBA

Cycle Wave 3 – ONGOING

Exploring Further

EWT uses ratios to create price targets. The main target being the 1.618 LFE, however there are the minimum, lower, and much higher LFE’s to watch out for. For $ATOM we first need to find the beta multiple to scale the targets off of. This is accomplished by taking Wave 1 and dividing it by Wave 0. In this case for the Cycle Wave Degree it’s approximately 40.12. Then we raise this multiple to various numbers defined by EWT to create a table of targets. In order below are the LFE Price Targets:

0.618 – $54.26

1 – $222.3

1.236 – $531.3

1.618 – $2,176.84

Therefore, if we expect $ATOM to be a Diagonal then $54.26 – $222.3 is the preferred price box.

If we are looking for the typical price box then it’s: $531.3 – $2,176.84.

However, due to the nature of the next estimated bull run only the Intermediate Degree Wave 3 of the Cycle Wave 3 should play out. The next bull run is estimated by many traders and institutions to peak around late 2024 to early 2026. Benner Cycle Theory also puts a market peak around 2026. You can see the full layout for Benner’s Cycle Theory here. As such, the Intermediate Wave 1 and 2 are: $17.2656 and $6.17. The beta multiple for the Intermediate Degree is approximately 3.116. Then as we did for the Cycle Wave Degree the relevant typical price box is: $25.14 – $38.81. The higher price boxes are all above the ATH for $ATOM. The current price action for $ATOM is overwhelmingly bullish, so the higher price boxes are definitely a possibility.

A link to the raw image since it might be hard to see all the details: https://www.tradingview.com/x/FQhUSWST.

Conclusion

Given the next bull run peak for crypto is likely late 2024 to early 2026 the relevant LFEs to use for $ATOM are at the Intermediate Wave Degree . The typical price targets for the Intermediate Degree Wave 3 are $25.14 – $38.81. The price as I write is $11.3 so the next peak is a rough 2 to 3.5x from here. If the Wave 3 is heavily extended and possibly goes to the 2.618 or 3.618 LFE then a new ATH is possible. That would mean a minimum of a 4x from here to the next peak. The Primary Wave 1 of Cycle Wave 3 is likely due in late 2026 to 2030 using Fibonacci Time Ratios.

Glossary

Elliott Wave Theory (EWT)

“A theory in technical analysis that attributes wave-like price patterns, identified at various scales, to trader psychology and investor sentiment.”

Source: “Elliott Wave Theory: What It Is and How to Use It” by James Chen (2023)

Logarithmic Fibonacci Retracement (LFR)

A measured correction at certain Fibonacci ratios on a semi-log scale.

Logarithmic Fibonacci Extensions (LFE)

A measured rally at certain Fibonacci ratios on a semi-log scale.

Supplemental Reading

“Elliott Wave Principle – Key To Market Behavior” by Frost & Prechter (2022)

“Visual Guide to Elliott Wave Trading” by Gorman & Kennedy (2013)

“How to Calculate Logarithmic Retracements and Extensions” by C. D. Chester (2023)

Top Altcoins Poised To Make Waves This Week: Crypto Analyst

Miles Deutscher, a crypto analyst, recently shared insights on altcoins that are catching his attention for the upcoming week. In a post on X, he starts by noting the market’s recent cool-off, suggesting this phase is creating new opportunities for savvy investors. Deutscher also emphasizes the importance of staying informed and ready to capitalize on these shifts.

Top Altcoins To Watch This Week

Injective (INJ)

According to Deutscher, Injective (INJ) is experiencing a lull in hype, but this should not undermine its strong performance throughout the year. He believes that if the bullish momentum continues, INJ could reach its local highs in the $19’s. “Monitoring closely, as it runs hard when it runs,” Deutscher states, highlighting the potential for rapid gains.

At press time, INJ was trading at $15.88 after being rejected at the 0.618 Fibonacci retracement level of $17.13.

Pyth Network (PYTH)

Deutscher points out that PYTH is in an interesting position with attributes favored by the market: it’s a new, shiny coin with a low float and perpetual contracts. However, competition from other Solana tokens, like Jupiter and JITO, may temporarily divert attention. For those already holding PYTH, Deutscher advises to hold but not to add more unless the price drops.

SuperFarm (SUPER)

SUPER is part of the trending gaming narrative and has been gaining attention from significant creators and influencers. Despite its volatile funding, Deutscher sees potential for a FOMO-driven price increase. “It could be one of those ‘it’s already up too much, I’m not buying’ plays,” he speculates, suggesting that late buyers might drive the price even higher.

Cosmos (ATOM)

The recent approval of the ATOM Halving proposal is a significant development for Cosmos. This change will halve the maximum inflation rate from 20% to 10%, potentially impacting ATOM’s price action (PA). Deutscher is watching this closely for signs of a developing trend.

dYdX (DYDX)

The unlocking of $524 million worth of DYDX on November 28th is a crucial event, especially since these tokens will be released on the DYDX chain, not supported by centralized exchanges (CEXs). Deutscher anticipates a complex interplay of market psychology around this event. “Watching to see if the head and shoulders pattern continues to play out,” he comments, suggesting possible price movements following the unlock.

Solana (SOL) And BONK

SOL’s struggle to break past $58 is noted by Deutscher, placing it in a “no trade zone” for now. However, a breakthrough could lead to significant gains. BONK, a Solana-based meme coin, is also on his radar due to its higher volatility and correlation with Solana’s movements.

Vertex (VRTX)

Finally, Deutscher highlights the significant volume increase on Vertex, surpassing DYDX and Uniswap. Despite suspicions of wash trading due to low open interest (OI) compared to volume, he sees potential in Vertex and perceives a resurgence in the popularity of perpetual decentralized exchanges (DEXs).

Cosmos Co-Founder’s Controversial Proposal Triggers 11% Plunge In ATOM

In a bold move, Cosmos co-founder Jae Kwon has called for a significant shift in the blockchain’s direction following the controversial passing of NWV #848. This proposal was approved by the community’s voting mechanism, earning around 40% of the votes, and it was aimed at changing the blockchain’s native token inflation rate.

Kwon, expressing his dissent, is now advocating for a coordinated “split” in the Cosmos ecosystem, a proposal that could reshape the blockchain’s future. This development comes in response to what Kwon perceives as “deviating from the network’s core principles.”

“AtomOne” Split, Cosmos Co-Founder Urges Community Engagement

Kwon’s proposal, termed “AtomOne,” is not just a divergence but an exodus from the current state of Cosmos, encouraging community members who voted ‘No’ to join this new venture. The plan is still in its infancy and laid out in a GitHub repository, where Kwon invites community ideas and participation in shaping this new direction.

He emphasizes a collaborative approach, urging the community to discuss and contribute to the formation of AtomOne.

The essence of AtomOne lies in integrating $ATOM with $ATMO/$ATOM1, aiming to prevent a “complete collapse of ATOM by mass selling.” Kwon suggests that instead of abandoning ATOM altogether, there should be a way for it to coexist with the new fork.

Cosmos Community Faces a Crossroads: Exodus And Innovation

Kwon’s vision for AtomOne involves forking the current “cosmoshub4” but with its development path and teams, aiming for a more decentralized structure than the current Gaia. This new entity is open to all who opposed the recent vote, signaling a departure from the traditional paths of blockchain governance.

Kwon highlights the power of the minority in blockchain ecosystems and the ability to self-organize and create antifragile structures.

His message is clear: those who do not align with sound logic are destined to fail, and the future belongs to those who dare to exodus and build a better civilization. Kwon assures that this move isn’t about abandoning the original Cosmos hub but saving it and redefining its role.

People are completely confused about the nature of blockchains what power the NO/NWV voters have altogether inside and outside the hub. The reality is that we exist, our principles and goals are aligned because they come from logic and we are about to demonstrate antifragility. The reality is that you cannot take control of a chain even with over 50% consensus, even 67%, because the minority can always self-organize even without your help. And the reality is that those who don’t make decisions based on sound logic always end up failing in the end.

As the community gears up for this potential split, Kwon’s call for a departure to AtomOne reflects a pivotal moment in Cosmos’ history and a testament to blockchain governance’s dynamic and evolving nature. A conversation that will continue for “generations.”

As a result of the split proposal, ATOM has seen a spike in volatility, recording an 11% loss over the past few days. However, speculation is that the split will involve an airdrop poised to attract positive attention for the token.

Cover image from Unsplash, chart from Tradingview

Cosmos Founder Calls For Chain Split, ATOM Down 3%

Cosmos’ founder Jae Kwon urged his followers to split the chain into two following a decision by the community to approve a reduction in ATOM’s inflation to 10% from 14%.

Cosmos (ATOM) Shows Price Recovery In Response To New Update Reveal

Over the past few days, Cosmos Hub (ATOM) has demonstrated remarkable strength and resilience in its price fluctuations, despite significant downturns across the broader cryptocurrency markets due to shifts in trader sentiment. For three consecutive days, ATOM bulls have managed to bounce back and maintain the native token’s price, despite Bitcoin’s bearish momentum that has caused most altcoins to plummet.

Cosmos’ (ATOM) renewed strength and price stamina in the crypto markets may be linked to the fresh updates announced by the team behind the project.

Adoption Grows For Cosmos Replicated Security Model

In an exciting update, the Cosmos team announced yesterday that its first Replicated Security Model went live and has gained adoption by a top smart contract and consumer chain platform.

1/ The first #Cosmos native shared security model just got adoption

@Neutron_org is the first Consumer Chain to leverage @cosmoshub Replicated Security.

Replicated Security brings a new era of utility for #ATOM

Appchains can now launch with the economic security of #ATOM pic.twitter.com/sMp6mXhjPC

— Cosmos – Internet of Blockchains

(@cosmos) May 11, 2023

Before this, the team had made it known in February that the launch of the Replicated security model was close and presented an opportunity for delegators and validators to earn multiple tokens from upcoming consumer chains by staking the native token ATOM.

The Cosmos Replicated security model, a new and secure innovation, provides security to smart contracts and consumer chain platforms. The team announced and introduced Neutron as the first ever consumer chain and smart contracts platform to adopt and leverage its new and innovative Replicated security model.

In leveraging Cosmos’ Replicated security model, smart contracts and consumer chains platforms like Neutron no longer worry about platform security but can now focus on other application areas and services, according to the official announcement.

As seen in an official tweet where the team made the announcement, it was also stated that the Replicated security model brings forth a new dawn and era of utility as dApps can now launch with ATOM’s native security.

This fundamental news by the Cosmos team could be the backing behind ATOM’s recent show of strength and price resilience despite the bearish market outlook observed in several cryptocurrencies.

Daily Chart Analysis For ATOM

Cosmos (ATOM) trades at $11.04, a 2.02% increase from its 24-hour low at $10.55, as seen from Coingecko data trading reports. The market capitalization of ATOM is also seen to increase by 1.10%.

On the daily timeframe, bulls pushed ATOM’s price above the key resistance at $10.90 and moved further to an $11.27 high before retracing.

The previous resistance turned support level on the daily price chart is a good area for bulls to build momentum and push ATOM’s price to the upside. Although the 50 and 200 Exponential Moving Averages (EMA) are an immediate resistance level, bulls must contend with them to confirm further upside movements.

To the downside, a break above the newfound support at $10.90 will signal further bearish movements for the asset.

Just Bitcoin or diversify? 5 cryptocurrencies to watch in the next few days

If Bitcoin price breaks above $30,000, several altcoins such as SOL, ATOM, ICP and HBAR are well-positioned for a rally of their own.

Cosmos (ATOM) Rallies With Over 10% Gain As Indicator Shows Not In Safe Zone

- ATOM’s price shows strength as price bounces off from a weekly low of $8.5 giving bulls some relief.

- ATOM’s price continues to look bearish as more sentiment for the market lingers, with things looking uncertain for most traders and investors.

- ATOM’s price rallies high on the daily timeframe as the price moves toward the 50 Exponential Moving Averages (EMA) price, looking less likely to break higher.

The price action displayed by Cosmos (ATOM) recently hasn’t been motivating after prices declined from a region of $27 to a weekly low of $8.5. With many looking for a major dump in Bitcoin (BTC) price, the price of Bitcoin (BTC) bounced from $15,500 as price rallied to a high of $16,500, leaving bears on the sidelines as the price of Comos (ATOM) gains some relief bounces to hold strong above key support. The price action displayed by Cosmos (ATOM) and many altcoins recently have been problematic as many altcoins battle for survival. The Domino effect of the FTX saga and other huge investors involved has left the market at a standstill as the market is yet to make a major move after previous weeks. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart

Most crypto traders and investors have had a rough few days, with many concerned about where the market is headed after so much turbulence in the crypto space. Many altcoins have struggled to show strength, losing key support in a bid to survive.

The current market uncertainty has caused traders and investors to be hesitant to purchase altcoins, as there is no guarantee that they will rise in value any time soon.

The price of ATOM on the weekly chart has struggled despite the market uncertainty that has affected major crypto projects that have continued to build in this bear market, and more FUD (fear of uncertainty and doubt) persists. ATOM saw its price traded in a region of $17 on the weekly chart, but the price was rejected as ATOM’s price declined to a region of $8.5, bouncing off this region to trade at $9.5 with a small relief from the market.

Weekly resistance for the price of ATOM – $10.

Weekly support for the price of ATOM – $8.5.

Price Analysis Of ATOM On The Daily (1D) Chart

The price of ATOM remains considerably weak in the daily timeframe as the price trades above $8.5 support after the price was rejected from a high of $17.

ATOM’s price trades at $9.8 below its 50 and 200 EMA, acting as resistance for the price of ATOM. The price of $11.5 and $13.8 corresponds to the prices at these levels, acting as resistance.

If the price of ATOM breaks and holds above $11.5, we could see more rallies for the ATOM price to a region of $13; a break below a region of $8.5 would send the price back to a region of $5.

Daily resistance for the ATOM price – $11.5.

Daily support for the ATOM price – $8.5-$6.

Featured Image From zipmex, Charts From Tradingview

Cosmos (ATOM) Trades Below $13 As Bulls Give Up; Here Are Levels Bulls Will Buy

- ATOM’s price loses its demand zone of $13 as the price trades to a low region of $10 and could experience more sell-off.

- ATOM’s price continues to look weak after a bearish downtrend with the market’s current state, as things look uncertain for most traders and investors.

- ATOM’s price trades below the daily 50 Exponential Moving Average (EMA) as bulls eye levels to buy in.

In the last two days, the crypto market has seen some drastic shift in sentiment, with Cosmos (ATOM) and the price of other altcoins battling for survival after the news that Binance would not be taking over FTX after conducting due diligence. Previous weeks saw the price of Cosmos (ATOM) perform well, rallying from a low of $13 to a high of $15. Most altcoins trend higher as many produced gains of over 200%, with many hoping for more recovery bounce. Still, these expectations were cut short by the uncertainty surrounding the crypto market, leading to much fear about where the market is headed. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart

The past few days have been filled with so much turbulence in the crypto space as many altcoins have struggled to show strength after losing their key support holding off price decline.

The current uncertainty surrounding the market has resulted in reluctance on the part of traders and investors to make altcoin purchases, as there is no assurance if they would be heading up any time soon.

The price of ATOM, despite showing some great strength in recent weeks, ATOM has been left hanging in the air as the current state of the market has led to the price dropping to its weekly low of $10 after a long while.

The price of ATOM saw its price decline to a weekly low of $9.5 before bouncing off this region, showing some great strength to a region of $10 as the price aims to break higher.

Weekly resistance for the price of ATOM – $11.5.

Weekly support for the price of ATOM – $6.5.

Price Analysis Of ATOM On The Daily (1D) Chart

The price of ATOM remains weak in the daily timeframe as the price trades below the key support region of $11.5, with bulls eyeing lower regions to buy in on the price of ATOM.

The region of $8.5-$5.5 has been a key demand zone for the price of ATOM on both weekly and daily timeframes, considering how strong this project has been with good community backing.

Daily resistance for the ATOM price – $12.

Daily support for the ATOM price – $8-$5.

Featured Image From zipmex, Charts From Tradingview

Cosmos (ATOM) Trades Below $13 As Bulls Give Up; Here Are Levels Bulls Will Buy

- ATOM’s price loses its demand zone of $13 as the price trades to a low region of $10 and could experience more sell-off.

- ATOM’s price continues to look weak after a bearish downtrend with the market’s current state, as things look uncertain for most traders and investors.

- ATOM’s price trades below the daily 50 Exponential Moving Average (EMA) as bulls eye levels to buy in.

In the last two days, the crypto market has seen some drastic shift in sentiment, with Cosmos (ATOM) and the price of other altcoins battling for survival after the news that Binance would not be taking over FTX after conducting due diligence. Previous weeks saw the price of Cosmos (ATOM) perform well, rallying from a low of $13 to a high of $15. Most altcoins trend higher as many produced gains of over 200%, with many hoping for more recovery bounce. Still, these expectations were cut short by the uncertainty surrounding the crypto market, leading to much fear about where the market is headed. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart

The past few days have been filled with so much turbulence in the crypto space as many altcoins have struggled to show strength after losing their key support holding off price decline.

The current uncertainty surrounding the market has resulted in reluctance on the part of traders and investors to make altcoin purchases, as there is no assurance if they would be heading up any time soon.

The price of ATOM, despite showing some great strength in recent weeks, ATOM has been left hanging in the air as the current state of the market has led to the price dropping to its weekly low of $10 after a long while.

The price of ATOM saw its price decline to a weekly low of $9.5 before bouncing off this region, showing some great strength to a region of $10 as the price aims to break higher.

Weekly resistance for the price of ATOM – $11.5.

Weekly support for the price of ATOM – $6.5.

Price Analysis Of ATOM On The Daily (1D) Chart

The price of ATOM remains weak in the daily timeframe as the price trades below the key support region of $11.5, with bulls eyeing lower regions to buy in on the price of ATOM.

The region of $8.5-$5.5 has been a key demand zone for the price of ATOM on both weekly and daily timeframes, considering how strong this project has been with good community backing.

Daily resistance for the ATOM price – $12.

Daily support for the ATOM price – $8-$5.

Featured Image From zipmex, Charts From Tradingview

Cosmos Recaptures $14 As Price Grows; Will Bulls Push To A High Of $17?

- ATOM’s price shows strength as it bounces from a downtrend range price rallied to a high of $14 with eyes set on $17.

- ATOM could rally more as the price creates more bullish bias by breaking out of a downtrend descending triangle with eyes set on rallying higher.

- ATOM’s price remains strong on the daily timeframe above the 50 Exponential Moving Average (EMA) as the price aims for more rallies.

The price action displayed by Cosmos (ATOM) has been tremendous as the price resisted the bears rallying from a region of $12.7 to a high of $14, reclaiming a vital support area it has built in the past few weeks. The crypto market is looking increasingly welcoming as many altcoins continue producing over 50% gains. The likes of DOGE have seen some great runs recently, rallying from a low of $0.055 to a high of $0.15, with many others as Cosmos (ATOM) continues to lead the charge for more price recoveries. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart

Cosmos (ATOM) has struggled to regain its bullish momentum in recent times; despite the uncertainty that has befallen the crypto space, the price of ATOM has enjoyed a measure of relief after showing so much strength on the weekly low, rallying from a low of $12.7 to a high of $14 and recapturing this region as it forms key support for more potential to rise higher.

The past weeks have been nothing short of a boring and difficult moment for the crypto market as this affected the price of most altcoins negatively, forcing them to lose their support zone, with others battling it to stay afloat of their price.

After its weekly close of above $13.5, ATOM’s price looked stronger as the price of ATOM geared up for more upside price moves.; the price has faced a minor rejection to break higher to a region of $17.

Weekly resistance for the price of ATOM – $17.

Weekly support for the price of ATOM – $13.5.

Price Analysis Of ATOM On The Daily (1D) Chart

In the daily timeframe, the price of ATOM continued to look strong as the price broke out of its descending triangle, with good volume rallying to a high of $14 and forming good support around $13.5 below its current value of $14.1. Still, the price of ATOM faces a little rejection; the price of ATOM needs to break and hold above $14.5 for the price to become more bullish once more.

The price of ATOM faces a resistance to break and hold above 200 EMA, which corresponds to $14.5. A break and close above this region could send the price of ATOM to a region of $17 and possibly a retest of $20 region acting as a supply zone.

Daily resistance for the ATOM price – $14.5.

Daily support for the ATOM price – $13.5.

Featured Image From Blockchain News, Charts From Tradingview

Cosmos In A Downtrend Since Last 2 Months – Investors Shying Away From ATOM?

Cosmos (ATOM) started this year with a bang by attaining its all-time high (ATH) on January 17 when it traded for $44.45.

But just like other cryptocurrencies, it failed to sustain that level and was relentlessly pummeled by the volatile crypto market.

- Cosmos has been down by 16.8% over the last month

- ATOM is forecasted to fall below $7 a month from now

- Cosmos remains in extended bearish momentum nine months after attaining its ATH

Nine months later, Cosmos lost more than 70% of its ATH and is currently trading at $11.86 according to tracking from Coingecko at the time of this writing.

In just two weeks, the asset went down by 10.3%. On a month to date basis, the 23rd largest cryptocurrency in terms of market capitalization declined by almost 17%.

It failed to break free from its downward trend that has been going on since the latter part of September.

Technical Indicators Not Looking Rosy For Cosmos

Hopes for a bullish run for the asset this time might be met with disappointment as its analysis points are leaning towards extension of the current bearish momentum.

Source: TradingView

While the Relative Strength Index (RSI) of Cosmos stayed above 40, it is still below the 50 neutral score. While not strongly, it will still pull the digital coin in a downward trend.

In September, ATOM’s On-Balance Volume (OBV) swayed between two levels of resistance and support. In this case, a surge cannot be ruled out but the same can also be said about a sharp price dump.

The crypto’s current price action is suggesting that over the next few days sellers will dominate. As a result forecasts see Cosmos declining even more in the days to come.

According to prediction from Coincodex, the next five days will see ATOM go down all the way to $10.72.

The situation doesn’t get better from there as the 30-day prediction hints a steep fall that will pull Cosmos to $6.72.

ATOMic Interest Already Fading?

Cosmos had a good start for October in terms of development activity, tallying strong numbers from early to mid part of the month.

But developers seem to have stalled as activity metrics started to dwindle towards the end of the month. Moreover, social dominance for the protocol remained low, peaking at 0.72%.

Even when Cosmos rallied in September, from $11.7 to $16.7, it failed to surpass the current almost insignificant value of its social dominance.

By all indications, it seems interest for the crypto asset is starting to fade. This is seen to impact trading price severely, as ATOM will probably soon hit $10.53 or worse, $9.

ATOM total market cap at $3.3 billion on the daily chart | Featured image from Jeremy Thomas/Unsplash, Chart: TradingView.com

Disclaimer: The analysis represents the author’s personal views and should not be construed as investment advice.

Cosmos Clings To $12 As Price Struggles, Will This Region Act As Strong Support?

- ATOM’s price shows strength as price breaks bounced off from $12 with good volume with eyes set to reclaim $13.

- ATOM breaks out of a downtrend as the price resumes a bullish structure.

- The price of ATOM continues to trade above 50 Exponential Moving Average (EMA) in the four-hourly timeframe.

The price movements of Bitcoin (BTC) have hurt most altcoins, with Cosmos (ATOM) finding its price at key support as bulls defend this region with blood and sweat. The recent Consumer Price Index news had a significant impact on the crypto market, as the price of BTC fell to a low of $18,200 before rebounding to $19,300, with many altcoins struggling to keep up, but Comos (ATOM) proved resilient. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart.

Despite experiencing some great price movement in recent weeks due to so many traders and investors becoming interested in the various projects built on the Cosmos ecosystem, this, in a way, serves as a huge catalyst for such price movement.

After the price of ATOM dropped to a weekly low of $6, the price rallied from this low to a high of $17, where the price faced resistance to breaking above this region to a height of $20.

The price of ATOM faced a rejection to a low of $11.5, where the price bounced and rallied to a high of $12, reclaiming this region as it has been a key support for ATOM prices.

ATOM’s next weekly candle closed bearish, but the new week’s candle opened with bullish signs as the price of ATOM could be set for a rally to a region of $13, where the price will face resistance to break higher.

Weekly resistance for the price of ATOM – $13.

Weekly support for the price of ATOM – $12.

Price Analysis Of ATOM On The Daily (1D) Chart

Daily ATOM Price Chart | Source: ATOMUSDT On Tradingview.com

In the daily timeframe, the price of ATOM continues to trade below key resistance despite breaking out from its downtrend after the price got rejected from a high of $17.

The price of ATOM has shown strength, as the price broke out from a descending triangle as the price tries to break above 50 EMA at $12.75, acting as resistance for ATOM price. If the price of ATOM reclaims 50 EMA, we could see more price action to a region of $13-$14.

The Relative Strength Index (RSI) for ATOM price on the daily timeframe looks good after rallying from a region of oversold, which indicates good buy volume for ATOM

Daily resistance for the ATOM price – $13.

Daily support for the ATOM price – $12.2.

Featured Image From BitcoinKE, Charts From Tradingview

Cosmos Detects Major System Weak Point – Will ATOM Price Be In Trouble?

Cosmos is now making sure their system won’t share the same fate as the BNB Chain that was drained of $100 million worth of tokens in a hacker attack last week.

On October 13th, Ethan Buchman, co-founder of the Cosmos inter-blockchain communication (IBC) ecosystem, revealed a major security weak point that affects all Cosmos chains that utilize IBC, regardless of the version of IBC they employ.

The Inter-Blockchain Communication protocol allows users to seamlessly switch from one Cosmos blockchain to another.

42-IBC Connected Blockchains At Risk

Currently, there are 42 blockchains that are IBC-enabled. Among these are Cosmos Hub, Osmosis, Cronos and Evmos.

OKX Chain, Luna Classic and Thorchain are some of the major blockchains which have integrated IBC before. Luckily for them, the functionality was either already deactivated or was never fully enabled to begin with.

Buchman’s disclosure during the Cosmos Hub Forum is not to be taken lightly especially that all affected networks combine for a total market capitalization of $8.18 billion.

Meanwhile, the Cosmos co-founder said the problem has been dealt with through a patch that will be deployed on all blockchains currently at risk.

Developers and validators were given private access to the patch before the announcement of the security threat was made.

A third of a blockchain’s voting power must be patched in order for it to be safe from the said vulnerability.

ATOM Price Takes A Hit

The news about the potential threat took its toll on ATOM, the cryptocurrency of Cosmos, as the asset is experiencing a price drop.

At press time, according to tracking from Coingecko, ATOM is trading at $11.58 and has been down by 4.4% over the last 24 hours. Its price correction furthered its decline over the past seven days as the crypto is -10%.

Although it is forecasted to jump all the way to $13.31 over the next five days, the general sentiment toward the asset remains bearish according to Coincodex.

In fact, the online crypto data provider said 25 of the 28 technical analysis indicators for ATOM gave bearish signals.

As for the Fear and Greed Index, the crypto tallied a score of 24 which translated to Extreme Fear. Moreover, Coincodex said now is a bad time to buy the asset.

It’s understandable that the digital currency would react negatively to the development announced by Cosmos.

It’s now a waiting game to see if the mentioned solution for the detected threat will allay fears and negativity that pushed ATOM to another bearish rally.

ATOM total market cap at $3.31 billion on the daily chart | Featured image from Zipmex, Chart: TradingView.com

Disclaimer: The analysis represents the author’s personal views and should not be construed as investment advice.

Cosmos (ATOM) Invalidates Uptrend; Where Is The Next Area Of Interest For Price?

- ATOM price struggles on high timeframes to trend higher despite showing bullish sentiment in recent times.

- ATOM trades below uptrend support as the price looks bearish with the current market state.

- The price of ATOM eyes key support as price trades below 50 and 200-day EMA.

The price of Cosmos (ATOM) struggles to discover its bullish trend as the price breaks below uptrend support against tether (USDT). The previous weeks saw the crypto market cap looking good as prices of Bitcoin (BTC) and other crypto assets, including Cosmos (ATOM), showed so much strength as price rallied from a low of $6 to a high of $17. (Data from Binance)

Cosmos (ATOM) Price Analysis On The Weekly Chart.

Despite showing some great price movement in recent weeks with so many traders and investors becoming interested in the different projects being built on the Cosmos ecosystem, this, in a way, is a huge catalyst for such price movement.

After the price of ATOM dropped to a weekly low of $6, the price rallied from this low to a high of $17, where the price faced resistance to breaking above this region to a height of $20.

The price of ATOM faced a rejection to a low of $12.5, where the price bounced and rallied to a high of $13.5 but could not move higher as the price continued to range.

ATOM’s next weekly support is at $12.1, with the price eyeing a retest of that region; if ATOM fails to hold this region, we could see the price going lower as there is no strong weekly support close to this region.

Weekly resistance for the price of ATOM – $17.

Weekly support for the price of ATOM – $12.1.

Price Analysis Of ATOM On The Daily (1D) Chart

Daily ATOM Price Chart | Source: ATOMUSDT On Tradingview.com

In the daily timeframe, the price of ATOM continues to trade below key resistance formed by the uptrend line as the price broke below this trendline, helping ATOM to maintain its bullish structure for the past days it had trended.

The price of ATOM has shown strength, as the price has held on not going below key support, as this could lead to more sell orders for ATOM holders.

Daily resistance for the ATOM price – $13.8.

Daily support for the ATOM price – $12.1-$10.4.

Onchain Analysis Of ATOM

ATOM Onchain Analysis | Source: On Messari.io

The ATOM price from the on-chain analysis looks more decent despite a fall of over 70%. ATOM produced a reasonable return on investment (ROI) of 64% over the past three months compared to other crypto assets that have struggled for the past months.

Featured Image From zipmex, Charts From Tradingview and Messari

Cosmos (ATOM) Leads Gains Among Top Coins

Despite being down 2.74% as of writing, Cosmos (ATOM) still leads gains among top coins in the past week. The internet of blockchains has had its fair share of roses and thorns during the week. However, data from CoinMarketCap shows that ATOM has enjoyed several peaks and is still trading in the green.

The blockchain has also experienced high trading volume within the past 24 hours, up 14.93%. It has also held its end against top coins like Wrapped Bitcoin, Cronos, and Ethereum Classic, considering the 7-Day trading activity.

Related Reading: XRP Price Hits Target Of $0.5, But Can It Break This Key Resistance?

Lower Timeframe Structure Remains Bullish Despite ATOM Stall

The ATOM price has produced a sequence of higher lows during the last week. Crucially, it established a short-term uptrend by breaking above the prior lower highs at $12.54 and $12.84. Higher time frame charts saw this as more of a bounce. Plus, it was met with strong resistance around the $13.4 level.

As the price approaches the white ascending trendline, it may find some support there. A session closing below $13 would once again render the lower-timeframe structure bearish. This may cause prices to fall back to the $12.35-$12.4 support area. However, if ATOM can break out over $13.4, it might signal a significant upward trend. Such a rise can potentially drive ATOM over the $14.8 resistance zone that has been in place since late September.

As of this writing, the RSI reading was 46. Even though it has dropped below the neutral 50 levels, there is no sign of bearish momentum. The OBV was flat as well. This indicated that neither the purchasers nor the vendors were in a position of power. It also suggested that a bullish breakthrough was less likely to occur.

ATOM’s price is currently hovering below $13. | SourceL ATOMUSD price chart from TradingView.com

ATOM Records Higher Total Staked Value, Thanks to DeFi

The DeFi sector on Cosmos has been booming in recent weeks. After publishing the “Cosmos Hub Roadmap 2.0,” Cosmos received great interest from investors. In addition, the native token ATOM saw growth in terms of total value locked (TVL), development engagement, and the number of holders in the third quarter of 2022.

According to a tweet recently posted by the Cosmos Daily, the DeFi industry is one of the fastest-growing parts of the Cosmos ecosystem. The TVL of popular protocols like the Kava Network skyrocketed in the previous month to 291.2 million. Osmosis zone and THORChain, two other protocols, garnered $209 million and $105.85 million, respectively.

Related Reading: Bitcoin Volatility Index Suggests Large Price Move Arriving Soon

Still, on on-chain analytics, there was a steady increase in the number of cryptocurrency investors who held ATOM throughout the year. Despite this, there was no significant increase in the number of transactions or the volume. We also saw top DeFi platforms like dYdX move from Ethereum to Cosmos within the past week. One could say that many investors are in for the long ride, especially given dYdX’s big move and the blockchain’s plans outlined in its updated roadmap.

Featured image from Pixabay and chart from TradingView.com

New Cosmos whitepaper repurposes ATOM token and refines vision

The news comes a couple of weeks after research firm Delphi Labs announced it would shift the focus of its research and development efforts toward the Cosmos ecosystem.

ATOM Maintains “Market’s Biggest Mover” Tag, Sustains 4-Month High

Cosmos’ native crypto continues its bullish run up to a 40% bullish gain while other cryptos ebb and flow; NEAR follows with a multi-week high.

The native coin of Cosmos protocol, ATOM continues to move upward, hitting new highs every day. At the time of writing, the crypto is trading at $14 after briefly hitting $16 earlier today. It had hit a 4-month high of $13.92 on Thursday amidst the broader crypto market bounce back.

That was after the Wednesday dip when ATOM price dropped to just below $12. Ever since the $6 dip in the middle of June, Cosmos token (ATOM) has been on an upward gliding triangle. Notably, ATOM has broken the Relative Strength Index (RSI) barrier and briefly hit $16.

Related Reading: TA: Bitcoin Price Trims Gains, Why $20K Is The Key To Fresh Increase

As of Thursday, crypto sites were still speculating if ATOM would hit the $15 mark as it continued to rise. Most of these sites opined that it would have to break its Relative Strength Index (RSI) barrier to achieve that. According to them, this hurdle would appear as a ceiling at 63.30.

However, ATOM cleared the barrier early this morning, trading at $16 before dropping to its current price, $14. This bullish run makes it a 40% gain ($10) within the space of 3 months.

Other Cryptos Rally in The Wake of Sell-odd On Wednesday

Additionally, this event comes alongside the wider market rallying from the ongoing massive crypto sell-off. The increasing strength of the dollar impacted crypto values negatively, causing a considerable market sell-off. This drove the price of tokens, like Ethereum Classic and Aave, to drop dangerously. ETC dipped by 12%, while Aave dropped by 7% on Tuesday. Another crypto Celsius fell by 11% as well.

However, by Wednesday afternoon, the affected coins were on the rise once again. In fact, Aave was trading at a higher position than before the dip. Analysts traced this recovery to a sharp drop in the US dollar Index around the same time.

ATOM’s price is currently trading above $14. | Source: ATOMUSD price chart from TradingView.com

NEAR Protocol Is Not Left Out In The Bullish Run

Another remarkable protocol amid these market movements is the NEAR network which reached a multi-week high coinciding with ATOM’s surge. Still, the NEAR token didn’t break its own hurdle remaining in the same $5 range. The token is currently trading at $4.55, according to data from Tradingview.

Related Reading: Bitcoin Takes A Blow After It Falls Below $22,000, Any Chances For A Bull Run

Nonetheless, COSMOS’ ATOM remains the “Biggest Mover” on the market at the moment. Amidst market volatility, the token continues to make significant headway. While other cryptos struggle with volatility from the rising US dollar index, the crypto has hit a 4-month high. As a result, ATOM has earned applause from numerous crypto sites.

Featured image from Pixabay and chart from TradingView.com