Blockchain platform Avalanche (AVAX) has announced the launch of the Durango upgrade and introduced Teleporter, a tool designed to improve communication within the protocol’s ecosystem.

Simplified Cross-Chain Messaging?

Teleporter, built on Avalanche Warp Messaging (AWM), the platform’s native messaging protocol, serves as a “developer-friendly interface” that reportedly simplifies the process of sending and receiving cross-chain Ethereum Virtual Machine (EVM) messages.

According to the announcement, by leveraging Teleporter, Avalanche blockchains will be able to share various types of information, including tokens, non-fungible tokens (NFTs), and oracle price feed data.

This “coordinated” communication will reportedly promote fluid EVM interoperability, enabling developers to create cross-subnet applications that provide “full functionality” and a “seamless user experience.” The Avalanche announcement goes on to say:

Since the beginning, Avalanche was developed to be a sprawling network of lightning-fast custom app chains. Subnets launched in Spring 2022, sparking an initial cohort of custom app chains that has grown to dozens, with many more coming across all major blockchain verticals. Since then, breakthroughs and highly anticipated releases like AWM (Subnet interoperability), HyperSDK (VM optimization), and Firewood (throughput) have vastly improved the potential capabilities of Subnets, and now Teleporter allows EVM Subnets to pass messages unhindered, natively linking the growing universe of Subnets.

The protocol also highlights that developers can now build cross-chain swaps and create gaming environments where one subnet can unlock features in another. Institutions will reportedly be able to use Circle’s USDC as a subnet’s native gas token, which Avalanche sees as an avenue for “financial innovation.”

Avalanche Durango Upgrade

The introduction of Teleporter coincided with the successful activation of the Durango upgrade on Avalanche’s Mainnet on March 6. Durango implemented several community-proposed Avalanche Community Proposals (ACPs), including ACP-30, which activated AWM, forming the foundation for Teleporter’s functionality.

Patrick O’Grady, VP of Platform Engineering at Ava Labs, expressed excitement about the Durango Upgrade, stating that Subnets can now natively communicate with the C-Chain using AWM.

O’Grady further emphasized that Teleporter provides an EVM-compatible interface, enabling Solidity developers to trigger contract invocations across any Avalanche Subnet.

On the other hand, Emin Gün Sirer, founder and CEO of Ava Labs, highlighted the role of Avalanche Warp Messaging and Teleporter in “revolutionizing” communication within Avalanche blockchains. Sirer emphasized that these “lightweight primitives” enhance user and developer experiences while solidifying Avalanche’s position as an “interoperability leader.”

Ultimately, with the release of Teleporter, Avalanche states that it is taking a step toward realizing its vision of a connected network of chains, providing increased interoperability and enabling developers to easily build cross-chain applications.

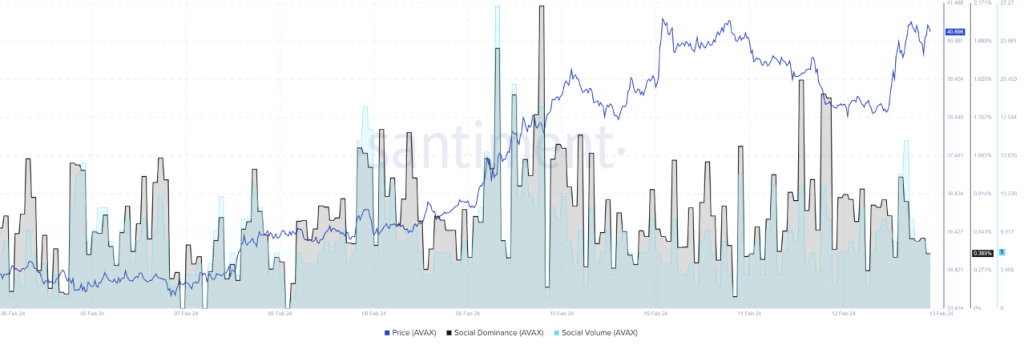

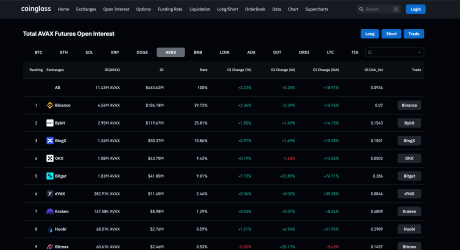

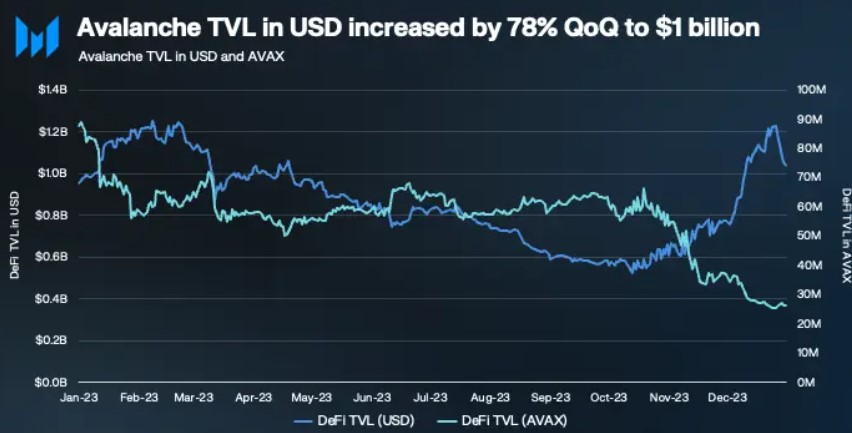

The native token of the Avalanche network, AVAX, has experienced a significant surge of 8% in the past 24 hours, reaching a trading price of $44.18. This increase follows its consistent upward trend, with a remarkable year-to-date growth of over 173%.

Featured image from Shutterstock, chart from TradingView.com

(@avax)

(@avax)