Bitcoin and altcoins could be en route to retest their recent strong support levels as bears try to extend the correction.

Cryptocurrency Financial News

Bitcoin and altcoins could be en route to retest their recent strong support levels as bears try to extend the correction.

Bitcoin and altcoins continue to be rocked by macroeconomic and geopolitical uncertainty, but data shows bulls continue to buy each dip.

The loans are currently live in Colorado and plan to extend to other states.

Generally, the cryptocurrency market is bearish at the moment, with coins like Avalanche (AVAX), Ethereum, Litecoin, XRP, Solana, and others all caught in this trend. Currently, the price of AVAX is on a strong bearish move below the 100-day Moving Average (MA) and could continue in that direction for a while before retracing.

Observing the chart from the 4-hour timeframe, AVAX has crossed below both the 100-day moving average and the trend line. This could mean that the price is on a downward trend. The MACD indicator on the 4-hour timeframe suggests a very strong bearish movement as the MACD histograms are trending below the MACD zero line.

Also, both the MACD line and MACD signal line are trending below the zero line. Given the formation of the MACD indicator, it shows that there is a possibility that the price will still move further downward.

Furthermore, the Relative Strength Index (RSI) also on the 4-hour timeframe suggests a bearish trend as the RSI signal line is trending around the oversold zone. Despite the potential of a retracement at this point, the price will drop more following this.

The alligator indicator is another powerful tool used to determine the trend of an asset. A look at the above image shows that both the alligator’s lip and teeth have crossed over the alligator’s jaw facing the downward direction. This formation suggests that the trend is bearish and that the price could witness a deeper decline.

Based on the price’s previous movement, there are two major resistance levels of $50 and $59.99 and a support level of $39.95. As Avalanche is on a negative trajectory, if prices manage to break below the support level of $39.95, it could trigger a move further toward the next low of $27.53.

On the other hand, if the price fails to break below its previous low, it might start an upward correction movement toward the resistance level of $50.80. However, if it manages to break past this level, AVAX might move even further toward the $59.99 resistance level.

As of the time of writing, the Avalanche was trading around $38, indicating a decline of 1.75% in the last 24 hours. Its market cap is down by over 16%, while its trading volume has increased significantly by nearly 250% in the past day.

AVAX, the native token of the Avalanche protocol, presented a mixed experience for investors in the month of March. The altcoin initially rose by over 64% to trade above $65 for the first time since May 2022 before declining by 18.44% in the last two weeks.

Unsurprisingly, AVAX’s price movement has drawn much attention from investors and market experts alike. Notably, a popular crypto analyst with the X handle Rekt Capital has advised against panic, stating the recent decline of the altcoin could prove to be rather beneficial for investors.

In a post on X on March 30, Rekt Capital shared that AVAX has suffered an overall decline since encountering the $65-$70 price zone in mid-March. However, the analyst has described this price drop as a “healthy dip,” which could result in the token returning to previously high levels.

Avalanche rallied to the $65-$70 area

And is now dipping towards the December 2023 highs (red)

This is a healthy dip to set AVAX up for the next uptrend back to the $65-$70 area again, over time#AVAX #Crypto #Avalanche https://t.co/o7s9sU4eIN pic.twitter.com/5QJG2e581Y

— Rekt Capital (@rektcapital) March 30, 2024

Currently, AVAX trades in the range of $52-$54, but Rekt Capital predicts the altcoin is heading to the region of $44-$49, which represents its highest price points recorded in December 2023. On entering this price zone, Rekt Capital expects the token to find support and embark on an uptrend back to the $65-$70 region.

However, in the presence of overwhelming bearish pressure, the analyst technical analysis revealed that AVAX could drop further to around $32.66, indicating a potential price decline of 39.62% and 49.9% from the coin’s current price and its peak price in March, respectively

At the time of writing, AVAX trades around $53.50 with no significant price movement in the last day, while recording a 0.51% decline over the past week based on data from CoinMarketCap. Meanwhile, the crypto asset’s trading volume is down by 16.62% and valued at $370.86 million.

However, AVAX has generally been one of best best-performing assets in the last six months boasting a market gain of 471.35% within this period. Notably, in December 2023, the altcoin rose by about 150% to move from $20.41 to a monthly high of $49.98.

Off the market, AVAX has also scored some positive strides. Most recently, the Avalanche network announced a collaboration with fellow blockchain Chainlink and the prestigious Australia and New Zealand Banking Group (ANZ) targeted at exploring the use of crypto assets in global financial settlement systems. The use of AVAX in such a project would largely amplify the token’s adoption, which would elicit a positive effect on its market price.

AVAX trading at $53.30 on the daily chart | Source: AVAXUSDT chart on Tradingview.com

Featured image from Zipmex, chart from Tradingview

The tokenization of real-world assets – or placing traditional assets onto blockchain rails – is a growing trend in crypto with global financial giants entering the space.

According to a recent announcement from blockchain platform Avalanche (AVAX), Australia and New Zealand Banking Group (ANZ) has partnered with Chainlink (LINK) Labs to explore the potential of on-chain digital assets for global movement and settlement.

Using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), the collaboration aims to connect the Avalanche and Ethereum (ETH) blockchains to enable uninterrupted delivery versus payment (DvP) settlement of tokenized assets across networks in multiple currencies.

ANZ, a provider of banking products and services to millions of customers in nearly 30 markets, has reportedly taken an unusual approach to exploring the world of on-chain digital assets.

By leveraging Chainlink’s CCIP, ANZ is validating how customers can access, trade, and settle tokenized assets across multiple networks and currencies using Delivery vs. Payment. This approach aims to improve settlement efficiency and risk management for digital assets that fall under the classification of “securities” and their transactions.

According to Avalanche, Chainlink’s CCIP has been “crucial” in abstracting the complexities of moving tokenized assets across various blockchains, ensuring “atomic” cross-chain Delivery vs. Payment settlement.

Notably, within the collaboration, ANZ simulated a transaction where a customer used ANZ’s Digital Asset Services (DAS) portal to purchase tokenized ANZ-issued New Zealand dollar stablecoins (NZ$DC) on Avalanche.

Subsequently, the customer purchased tokenized Australian nature-based assets issued as non-fungible tokens (NFTs), denominated in tokenized ANZ-issued Australian dollar stablecoins (A$DC), on Ethereum.

Furthermore, ANZ facilitated the FX conversion between the two currencies, while CCIP provided the necessary infrastructure to transfer tokens and data between Ethereum and Avalanche.

Monday’s announcement also revealed that ANZ used its Avalanche Evergreen Subnet for the project, leveraging its Ethereum Virtual Machine (EVM) compatibility, permissioning, and custom gas token features.

The Evergreen Subnet allowed ANZ to explore new use cases and business models using customizable networks like Avalanche.

ANZ’s collaboration with Chainlink and Avalanche showcases how traditional financial institutions embrace blockchain technology to enhance capital markets.

Ultimately, Avalanche revealed that the initial results of the test transactions were promising, and the initiative could change how the financial services industry approaches tokenized assets.

The next steps include deploying the solution on blockchain mainnets and extending the workflows to include communication between different blockchain networks for different use cases.

AVAX Nears 22-Month High

At the time of writing, Avalanche’s token AVAX has been on a steady uptrend, resulting in a remarkable increase of over 60% in the last 30 days. Currently, the token is trading at $58.31, just below its 22-month high of $65 set on Monday the 18th.

Within the last 24 hours, AVAX experienced a 9% increase after the announcement of the collaboration with Chainlink and ANZ Group. This surge allowed the token to break through the $55 resistance level. However, the $60 level is expected to be another obstacle that could lead to a consolidation period between $55 and $60 should the bullish momentum fade.

Further demonstrating the interest in AVAX, the token’s trading volume in the last 24 hours reached $1,135,122,192, indicating a significant increase of 127.20% compared to the previous day.

Featured image from Shutterstock, chart from TradingView.com

The rally was broad-based, with SOL and AVAX advancing nearly 10% over the past 24 hours.

Avalanche (AVAX), the 10th-ranked cryptocurrency, has been on a tear in the past week, not only emerging as the top performer among major digital assets but also reaching its highest price point in nearly two years.

According to CoinMarketCap data, AVAX surged by an impressive 20%, surpassing its previous peak in May 2022 and reaching a price of $60 at the time of writing. This remarkable rally has ignited a wave of bullish sentiment within the crypto community.

Analysts are pointing to a confluence of on-chain activity and market signals that paint a bullish picture for AVAX. NewsBTC’s analysis revealed a key factor: 84% of AVAX holders are currently sitting on profits, signifying a wave of positive sentiment within the investor community. This profitable position fosters a more optimistic environment, potentially attracting new buyers to the market.

Digging deeper into on-chain data, market observers at NewsBTC noticed a significant rise in large buy orders on the Avalanche network. This trend suggests that institutional investors or whales might be accumulating AVAX, potentially fueling the upward price movement.

The bullish momentum isn’t confined to on-chain activity. The spot market is also exhibiting strong demand for AVAX. Coinalyze data indicates a steady rise in the token’s Cumulative Volume Delta (CVD) since March 17th. CVD is a metric that gauges the difference between buying and selling volumes, and its current uptick suggests a clear dominance of buying pressure in the spot market.

The derivatives market is echoing the optimism as well. Open Interest (OI) in AVAX futures contracts has been on an upward trajectory, reflecting a growing interest from investors looking to leverage the potential price increase.

It’s important to note that OI doesn’t necessarily indicate a long-biased market (where more traders are betting on a price rise), but rather highlights increased participation from both buyers and sellers.

However, the rising price alongside surging OI suggests that buyers are currently more aggressive, potentially leading to a breakout above resistance levels.

With this bullish tailwind propelling AVAX forward, analysts are cautiously optimistic about its future trajectory. Some market observers are of the opinion that AVAX has the potential to reach $70 soon.

However, they acknowledge the presence of a psychological hurdle at $70, where the price might encounter some resistance before continuing its climb. If the bulls can overcome this obstacle and achieve a decisive breakout, the bullish target of $75 might be within reach.

Looking at the potential downside risks, the article warns of a possible rejection at $70, which could trigger a price correction back down to $63. The report also emphasizes that the predicted upswing might not be a linear path, with potential price fluctuations along the way.

Avalanche (AVAX) is experiencing a period of strong momentum, buoyed by positive on-chain data, a surge in investor interest, and a bullish market sentiment. While some resistance levels and potential price corrections are to be expected, the overall outlook for AVAX appears promising in the near future.

Featured image from Pexels, chart from TradingView

The Foundation first said in December it would invest in meme coin as part of a digital culture drive.

Blockchain platform Avalanche (AVAX) has announced the launch of the Durango upgrade and introduced Teleporter, a tool designed to improve communication within the protocol’s ecosystem.

Teleporter, built on Avalanche Warp Messaging (AWM), the platform’s native messaging protocol, serves as a “developer-friendly interface” that reportedly simplifies the process of sending and receiving cross-chain Ethereum Virtual Machine (EVM) messages.

According to the announcement, by leveraging Teleporter, Avalanche blockchains will be able to share various types of information, including tokens, non-fungible tokens (NFTs), and oracle price feed data.

This “coordinated” communication will reportedly promote fluid EVM interoperability, enabling developers to create cross-subnet applications that provide “full functionality” and a “seamless user experience.” The Avalanche announcement goes on to say:

Since the beginning, Avalanche was developed to be a sprawling network of lightning-fast custom app chains. Subnets launched in Spring 2022, sparking an initial cohort of custom app chains that has grown to dozens, with many more coming across all major blockchain verticals. Since then, breakthroughs and highly anticipated releases like AWM (Subnet interoperability), HyperSDK (VM optimization), and Firewood (throughput) have vastly improved the potential capabilities of Subnets, and now Teleporter allows EVM Subnets to pass messages unhindered, natively linking the growing universe of Subnets.

The protocol also highlights that developers can now build cross-chain swaps and create gaming environments where one subnet can unlock features in another. Institutions will reportedly be able to use Circle’s USDC as a subnet’s native gas token, which Avalanche sees as an avenue for “financial innovation.”

The introduction of Teleporter coincided with the successful activation of the Durango upgrade on Avalanche’s Mainnet on March 6. Durango implemented several community-proposed Avalanche Community Proposals (ACPs), including ACP-30, which activated AWM, forming the foundation for Teleporter’s functionality.

Patrick O’Grady, VP of Platform Engineering at Ava Labs, expressed excitement about the Durango Upgrade, stating that Subnets can now natively communicate with the C-Chain using AWM.

O’Grady further emphasized that Teleporter provides an EVM-compatible interface, enabling Solidity developers to trigger contract invocations across any Avalanche Subnet.

On the other hand, Emin Gün Sirer, founder and CEO of Ava Labs, highlighted the role of Avalanche Warp Messaging and Teleporter in “revolutionizing” communication within Avalanche blockchains. Sirer emphasized that these “lightweight primitives” enhance user and developer experiences while solidifying Avalanche’s position as an “interoperability leader.”

Ultimately, with the release of Teleporter, Avalanche states that it is taking a step toward realizing its vision of a connected network of chains, providing increased interoperability and enabling developers to easily build cross-chain applications.

The native token of the Avalanche network, AVAX, has experienced a significant surge of 8% in the past 24 hours, reaching a trading price of $44.18. This increase follows its consistent upward trend, with a remarkable year-to-date growth of over 173%.

Featured image from Shutterstock, chart from TradingView.com

With altcoins finally catching up to Bitcoin, meme coins such as Dogecoin, BONK, and PEPE have been in the spotlight. This outperformance from these meme coins has pushed their standing in the crypto market further, putting them ahead of large competitors.

While Dogecoin did start out the week on a slow note, it picked up the pace on Wednesday after Bitcoin’s price rose to $64,000. This rally saw the DOGE price go from $0.09 to over $0.1 in a matter of hours, before the wipeout that sent Bitcoin below $60,000.

Once the market recovered, Dogecoin began to move up once again, and by Thursday, its price touched above $0.13. This is the highest that the price has been since 2022 and it gave its market cap enough boost to not only re-enter the top 10 cryptocurrencies by market cap. But also to reclaim the 9th spot from Avalanche.

Dogecoin’s price has risen 50% in the last week and pushed its market cap above $18.1 billion. Avalanche had been occupying the 9th spot on this list after rising from $10 to $40 in the last few months. However, its market cap of $16.64 billion falls behind DOGE, putting it in 10th place on the list.

It is interesting to note that a week ago, Dogecoin had completely fallen out of the top 10 cryptocurrencies after Tron’s TRX saw its market cap rise. This will end up being short-lived as TRX has fallen out of the top 10 and now sits at 11th position with a market cap of $12.6 billion.

In addition to Dogecoin, BONK, another meme coin, has also seen impressive growth during the time. According to data from Coinmarketcap, the BONK price has risen 30% in the last day to cross the $0.00002 threshold.

This outperformance comes in light of a notable surge in the daily trading volume of the meme coin. Its volume saw a 135% increase in the last day to reach $955 million. This rapid rise in volume suggests a rapid increase in investor interest in the coin, leading to its gains.

BONK’s market rose to $1.81 billion as a result of this, which put it ahead of PEPE with a $1.22 billion market cap. BONK now holds the spot for the third-largest meme coin in the space behind Dogecoin and Shiba Inu.

However, on the weekly chart, PEPE is outperforming BONK with 148% gains compared to BONK’s 74% gains. Following behind PEPE is dogwifhat (WIF) which rose 142.6% in the last week to reach an $820 million market cap.

Asset managers Ark Invest and 21Shares have taken a step towards more transparency of their ARK 21Shares Bitcoin ETF (ARKB) by integrating Chainlink’s proof of reserves to bring reserve data on the Avalanche mainnet, the companies announced Wednesday.

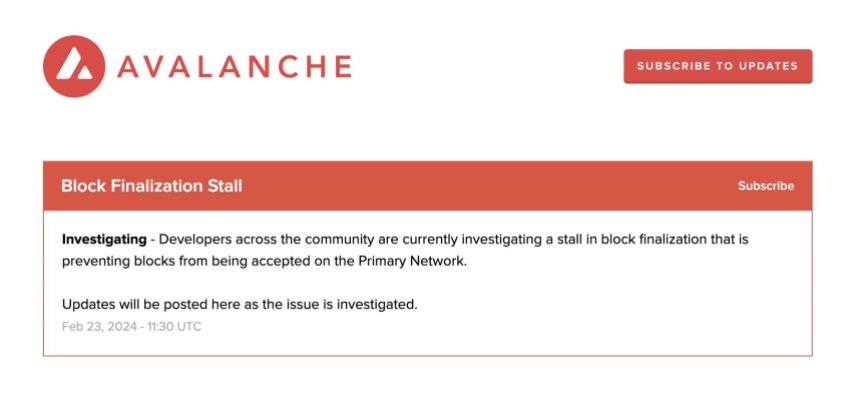

In a recent development, the Avalanche (AVAX) C-Chain encountered a significant disruption in block production, leading to a halt for over one hour. The interruption, which affected the primary network, was observed through the Avascan browser, with the last transaction recorded at block 42046853 (19:13 UTC+8).

Although other subnets experienced a slight delay, the primary network faced the most substantial impact.

Ava Labs, the team behind the Avalanche protocol, acknowledged the issue and promptly initiated an investigation. According to Kevin Sekniqi, co-founder of Avalanche, the disruption is believed to be related to a new inscription wave that was launched approximately an hour before the block production interruption.

Sekniqi expressed confidence that the incident was caused by an “esoteric bug” stemming from an untested edge case, emphasizing the need for a swift resolution.

The disruption is presumed to be associated with a mempool handling issue specifically tied to inscriptions, which encountered untested edge cases.

When questioned about the possibility of such untested scenarios arising, Sekniqi acknowledged that while ideally, there should be no untested edge cases, the vastness of the codebase and continuous updates make it challenging to anticipate every possible scenario.

The Avalanche co-founder further clarified that thorough testing is conducted on testnets, but the intricacies of the mainnet environment can introduce “unforeseen challenges.”

At present, no further official statement has been issued by the Avalanche protocol, awaiting additional reports and updates from the development team to gain further insights into the situation.

During the occurrence of the block production halt, the AVAX price, which serves as the native token of the Avalanche protocol, exhibited a negative reaction, further extending the ongoing decline observed since Thursday when the price was at $43.

As of now, the AVAX price has reached $36.13, indicating a decline of over 2% within the past 24 hours, accompanied by a substantial drop of 11.7% over the course of the previous seven days.

The subsequent actions taken by the Avalanche team in response to this situation, as well as the consequential effect on the AVAX price, are yet to be determined.

Featured image from Shutterstock, chart from TradingView.com

Layer-1 network Avalanche has failed to produce a block for more than an hour, Ava Labs co-founder Kevin Sekniqi said the issue “seems to be related to a new inscription wave.”

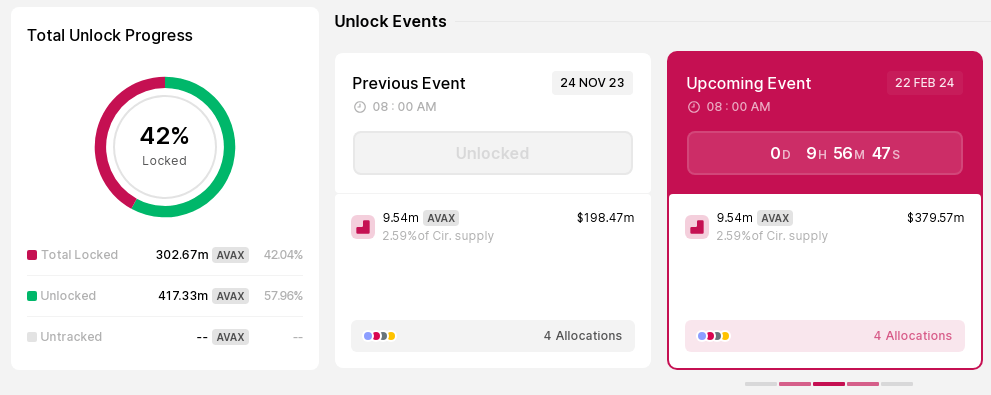

The price of Avalanche’s AVAX token has dipped by 11% in the past week, bucking the bullish trend in the broader cryptocurrency market. This comes amidst a $365 million unlocking event that increased the token’s circulating supply by 2.6%. Experts suggest both short-term challenges and long-term opportunities for AVAX.

Token.Unlocks data indicates that on Thursday, locked-up tokens valued at approximately $303 million will be released from vesting and put into circulation.

On February 15th, a significant unlocking event saw 9.5 million AVAX tokens, worth roughly $365 million, released from a vesting period. This influx of previously locked-up tokens coincided with a price decline for AVAX, which fell from $40.32 to its current price or nearly $37.

This aligns with historical trends, as a 2023 report by The Tie found that large unlocking events often lead to price drops within two weeks due to supply outpacing demand.

Despite the recent dip, some analysts remain optimistic about AVAX’s future. The Tie’s report, while acknowledging the short-term price pressure, highlights the Avalanche network’s growing activity, fueled by popular NFT collections like Dreamheadz and Dokyoworld. The increased engagement within the NFT space is seen as a positive indicator for long-term adoption and potential price appreciation.

TSM’s @theblitzapp Subnet launched, where all premium subscriptions on the platform now flow on-chain, with more features to come later in Q1 https://t.co/dTb52vkFlw

— Avalanche

(@avax) February 5, 2024

Furthermore, analysts point to AVAX’s outperformance compared to specific peers like Celestia and Solana in recent days. This suggests some resilience in the face of the unlocking event and potential buying pressure despite the overall price dip. Some analysts even predict a possible climb to the $40 mark by the end of February, although this remains speculative.

Market Sentiment And Broader Trends

It’s important to remember that the cryptocurrency market is inherently volatile, and AVAX’s price will be influenced by various factors beyond the unlocking event.

The overall market sentiment, regulatory changes, and broader economic trends can all play a significant role. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions.

The recent unlocking event has undoubtedly impacted AVAX’s price in the short term. However, analysts remain divided on the token’s future trajectory. While some anticipate further price declines due to the increased supply, others highlight positive developments like the network’s growing NFT activity and potential for a rebound.

Featured image from Pixabay, chart from TradingView

Avalanche’s AVAX was one of the few crypto assets that dipped in price over the past week as the token will undergo a $365 million unlocking event scheduled this week.

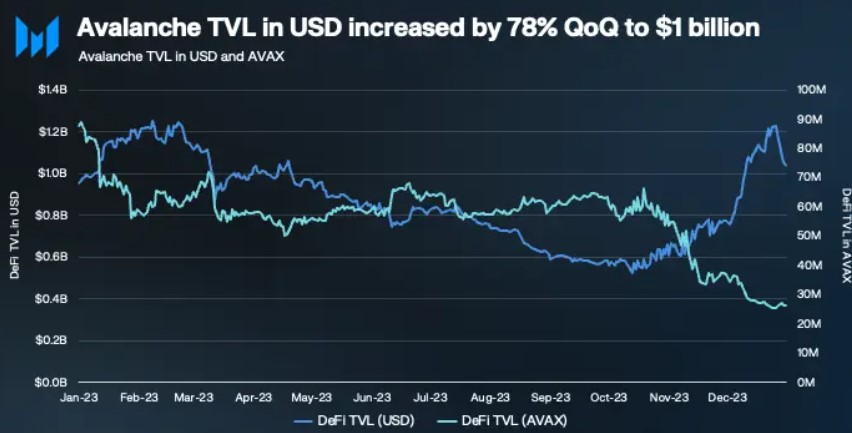

Avalanche (AVAX), the blockchain platform known for its scalability and infrastructure, made significant strides in the fourth quarter (Q4) of 2023. According to a report by Messari, AVAX emerged as one of the best-performing tokens, driving the protocol to record notable gains in key metrics.

The report shows that AVAX experienced a notable increase in its market cap, which climbed 344% quarter-over-quarter (QoQ) and 326% year-over-year (YoY), reaching $14.4 billion at the end of the year. This large increase propelled AVAX’s market cap rank among all tokens from 20 to 9, up 11 spots (currently 10th behind Cardano (ADA).

One of the driving factors behind Avalanche’s significant revenue growth was the surge in inscriptions, particularly Avascriptions (ACS-20 tokens).

These on-chain call data transactions saw a significant boost, resulting in a substantial increase in revenue. From November to December, Avalanche witnessed a surge in revenue, with a 2,874% increase measured in USD, from $1.9 million to $56.5 million.

The surge in revenue was accompanied by a significant increase in daily transactions, which jumped 450% QoQ to 1.5 million. The emergence of Avascriptions also drove the majority of these transactions.

Avalanche’s C-Chain experienced a record-breaking 6.3 million transactions, with nearly 6.1 million being inscriptions. This marks the highest number of transactions ever recorded in a single day for Avalanche.

While C-Chain saw a 50% QoQ decrease in daily active addresses, this was primarily due to decreased activity on LayerZero – a bridge between different blockchains. However, the report highlights that Avalanche saw a significant increase in active validators, growing 20% QoQ from 1,374 to 1,651 validators.

According to Messari, this growth in validators, coupled with an 11% QoQ increase in AVAX stakes, indicates a promising long-term appetite for AVAX in the coming year.

Avalanche’s Total Value Locked (TVL) denominated in USD experienced a substantial 78% QoQ increase, reaching $1.03 billion by the end of Q4 2023. This positioned Avalanche as the 7th chain by TVL, denominated in USD.

However, TVL-denominated in AVAX decreased by 71% QoQ, primarily due to AVAX price appreciation driving the increase in USD-denominated TVL.

The report also sheds light on the performance of various protocols on Avalanche. AAVE, the largest protocol by TVL, witnessed a 60% QoQ growth, while Benqi and Trader Joe demonstrated strong gains of 205% and 131% QoQ, respectively. Together, these three protocols accounted for 79% of Avalanche’s TVL, showcasing their dominance in the ecosystem.

Smaller-sized protocols, such as Pangolin and GMX, also showcased impressive growth, while Balancer, aided by Benqi’s sAVAX liquidity pool, attracted significant TVL on Avalanche. Additionally, Q4 witnessed a surge in average daily DEX volumes, rising by 245% QoQ.

Analysis of the 1-day chart reveals that Avalanche’s token trading pair AVAX/USD experienced significant growth during Q4, breaking free from a prolonged period of sideways price action.

However, following a notable uptrend that propelled the token to reach $50, its highest level in 20 months, on December 24, AVAX underwent a sharp correction, plunging to the $27 price level.

The cryptocurrency has rebounded in response to Bitcoin’s (BTC) rally and the prevailing bullish sentiment in the market. Over the past fourteen days, AVAX has witnessed a 13% price increase, currently reclaiming the $40 zone.

Featured image from Shutterstock, chart from TradingView.com

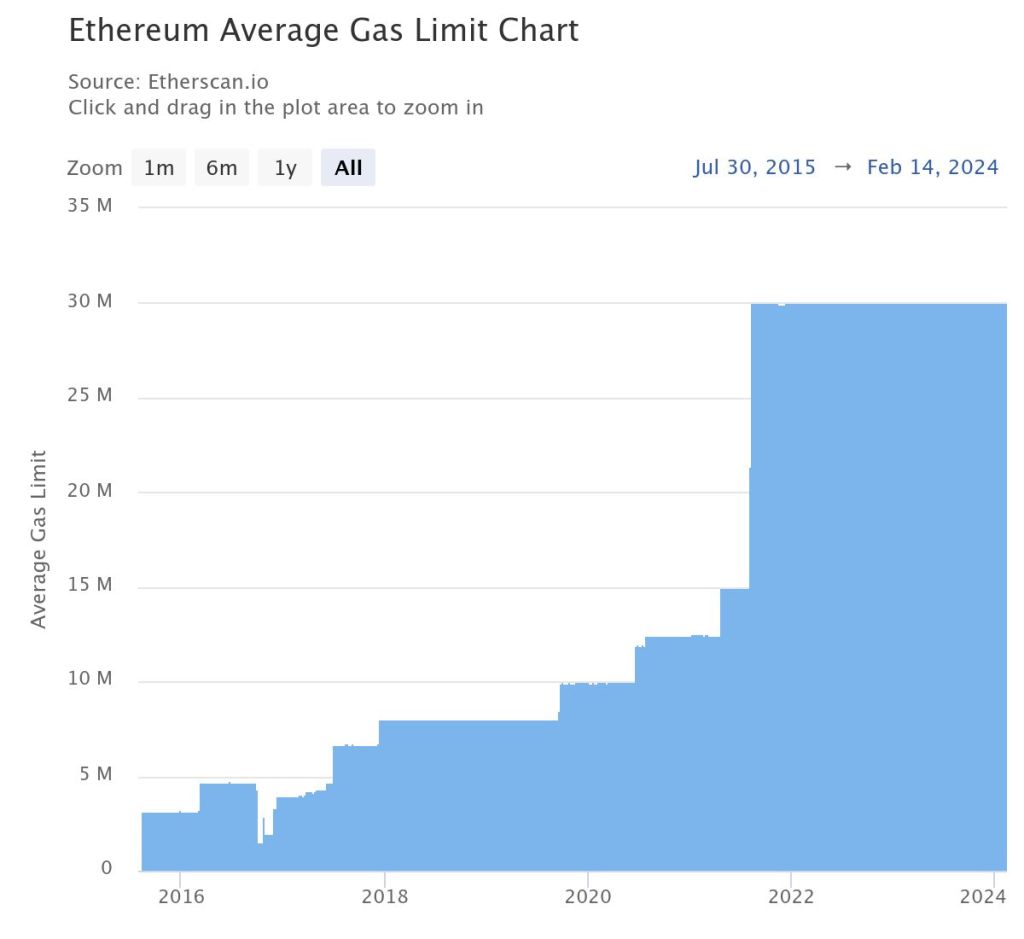

Foobar, a code builder, criticizes Ethereum, accusing its developers of neglecting crucial improvements. Because of this shift, projects, including meme coin issuers, are adopting alternative protocols, including layer-2s and modern blockchains like Solana, which boast more features, mostly higher scalability.

Taking to X, the developer claims that there have been no major mainnet improvements chiefly because such upgrades are being blocked by core and client developers. Specifically, Foobar cites the long-standing delays for features like Trie State Storage Optimizations (TSTORE) and Externally Owned Account (EOA) batch transactions. The developer also noted the lack of block gas limit increase since 2021.

The developer adds that the absence of main net updates and opcode improvements leading to the implementation of these proposals could be why decentralized apps (apps) launching on Ethereum are “bleeding tremendous value” due to high fees and limitations.

TSTORE and EOA batch transactions are proposals that, if they see the light of day, could see Ethereum scale better. Specifically, proposers of TSTORE forwarded a solution to address storage bloat to improve performance. On the other hand, EOA will enable the bundling of transactions from the same sender, reducing gas fees.

Meanwhile, Etherscan data shows that the block gas limit has been capped at around 30 million since August 9, 2021. Subsequently, Ethereum throughput remains low, and gas fees are higher, considering the high on-chain activity.

The failure of clients to integrate these proposals, the developer continues, makes Ethereum unusable for “any interesting app requiring moderate complexity.” Subsequently, many projects are migrating to layer-2s like Base, Arbitrum, Optimism, or entirely different blockchains like Solana and Avalanche due to limitations on the Ethereum mainnet.

As of mid-February 2024, more meme coin developers, reading from the popularity of emerging projects, are deploying from high throughput and low-fee platforms like Solana, Avalanche, and even Base. Meme coins like Bonk, Honk, and even the successful Bald on Base are examples.

Meanwhile, meme coin projects on Ethereum, like Pepe Coin (PEPE), appear to be losing market share as Shiba Inu, for example, launched Shibarium to offer its users lower transaction fees.

Foobar thinks the lack of improvements on the Ethereum mainnet is why Uniswap v4 has yet to launch. The new iteration of Uniswap, a popular decentralized exchange (DEX) powering Ethereum token swapping, is yet to release its latest version.

Based on existing documentation, v4 will include new features and functionalities, including Hooks. Supporters claim this tool will make the DEX more flexible, drawing more users once it goes live.

The firm tested a variety of use cases through Avalanche’s subnet with a focus on private markets.