The Foundation first said in December it would invest in meme coin as part of a digital culture drive.

Avalanche Unleashes Durango Upgrade, AVAX Price Rockets 8% With ‘Teleporter’ Debut

Blockchain platform Avalanche (AVAX) has announced the launch of the Durango upgrade and introduced Teleporter, a tool designed to improve communication within the protocol’s ecosystem.

Simplified Cross-Chain Messaging?

Teleporter, built on Avalanche Warp Messaging (AWM), the platform’s native messaging protocol, serves as a “developer-friendly interface” that reportedly simplifies the process of sending and receiving cross-chain Ethereum Virtual Machine (EVM) messages.

According to the announcement, by leveraging Teleporter, Avalanche blockchains will be able to share various types of information, including tokens, non-fungible tokens (NFTs), and oracle price feed data.

This “coordinated” communication will reportedly promote fluid EVM interoperability, enabling developers to create cross-subnet applications that provide “full functionality” and a “seamless user experience.” The Avalanche announcement goes on to say:

Since the beginning, Avalanche was developed to be a sprawling network of lightning-fast custom app chains. Subnets launched in Spring 2022, sparking an initial cohort of custom app chains that has grown to dozens, with many more coming across all major blockchain verticals. Since then, breakthroughs and highly anticipated releases like AWM (Subnet interoperability), HyperSDK (VM optimization), and Firewood (throughput) have vastly improved the potential capabilities of Subnets, and now Teleporter allows EVM Subnets to pass messages unhindered, natively linking the growing universe of Subnets.

The protocol also highlights that developers can now build cross-chain swaps and create gaming environments where one subnet can unlock features in another. Institutions will reportedly be able to use Circle’s USDC as a subnet’s native gas token, which Avalanche sees as an avenue for “financial innovation.”

Avalanche Durango Upgrade

The introduction of Teleporter coincided with the successful activation of the Durango upgrade on Avalanche’s Mainnet on March 6. Durango implemented several community-proposed Avalanche Community Proposals (ACPs), including ACP-30, which activated AWM, forming the foundation for Teleporter’s functionality.

Patrick O’Grady, VP of Platform Engineering at Ava Labs, expressed excitement about the Durango Upgrade, stating that Subnets can now natively communicate with the C-Chain using AWM.

O’Grady further emphasized that Teleporter provides an EVM-compatible interface, enabling Solidity developers to trigger contract invocations across any Avalanche Subnet.

On the other hand, Emin Gün Sirer, founder and CEO of Ava Labs, highlighted the role of Avalanche Warp Messaging and Teleporter in “revolutionizing” communication within Avalanche blockchains. Sirer emphasized that these “lightweight primitives” enhance user and developer experiences while solidifying Avalanche’s position as an “interoperability leader.”

Ultimately, with the release of Teleporter, Avalanche states that it is taking a step toward realizing its vision of a connected network of chains, providing increased interoperability and enabling developers to easily build cross-chain applications.

The native token of the Avalanche network, AVAX, has experienced a significant surge of 8% in the past 24 hours, reaching a trading price of $44.18. This increase follows its consistent upward trend, with a remarkable year-to-date growth of over 173%.

Featured image from Shutterstock, chart from TradingView.com

Dogecoin Rallies 50% To Beat Out Avalanche, BONK Overtakes PEPE

With altcoins finally catching up to Bitcoin, meme coins such as Dogecoin, BONK, and PEPE have been in the spotlight. This outperformance from these meme coins has pushed their standing in the crypto market further, putting them ahead of large competitors.

Dogecoin Rallies 50% To Reclaim 9th Spot From Avalanche

While Dogecoin did start out the week on a slow note, it picked up the pace on Wednesday after Bitcoin’s price rose to $64,000. This rally saw the DOGE price go from $0.09 to over $0.1 in a matter of hours, before the wipeout that sent Bitcoin below $60,000.

Once the market recovered, Dogecoin began to move up once again, and by Thursday, its price touched above $0.13. This is the highest that the price has been since 2022 and it gave its market cap enough boost to not only re-enter the top 10 cryptocurrencies by market cap. But also to reclaim the 9th spot from Avalanche.

Dogecoin’s price has risen 50% in the last week and pushed its market cap above $18.1 billion. Avalanche had been occupying the 9th spot on this list after rising from $10 to $40 in the last few months. However, its market cap of $16.64 billion falls behind DOGE, putting it in 10th place on the list.

It is interesting to note that a week ago, Dogecoin had completely fallen out of the top 10 cryptocurrencies after Tron’s TRX saw its market cap rise. This will end up being short-lived as TRX has fallen out of the top 10 and now sits at 11th position with a market cap of $12.6 billion.

BONK Beats Out PEPE

In addition to Dogecoin, BONK, another meme coin, has also seen impressive growth during the time. According to data from Coinmarketcap, the BONK price has risen 30% in the last day to cross the $0.00002 threshold.

This outperformance comes in light of a notable surge in the daily trading volume of the meme coin. Its volume saw a 135% increase in the last day to reach $955 million. This rapid rise in volume suggests a rapid increase in investor interest in the coin, leading to its gains.

BONK’s market rose to $1.81 billion as a result of this, which put it ahead of PEPE with a $1.22 billion market cap. BONK now holds the spot for the third-largest meme coin in the space behind Dogecoin and Shiba Inu.

However, on the weekly chart, PEPE is outperforming BONK with 148% gains compared to BONK’s 74% gains. Following behind PEPE is dogwifhat (WIF) which rose 142.6% in the last week to reach an $820 million market cap.

Ark and 21Shares to Disclose Spot Bitcoin ETF Reserves Via Chainlink Integration

Asset managers Ark Invest and 21Shares have taken a step towards more transparency of their ARK 21Shares Bitcoin ETF (ARKB) by integrating Chainlink’s proof of reserves to bring reserve data on the Avalanche mainnet, the companies announced Wednesday.

Avalanche C-Chain Experiences Block Production Halt, AVAX Price Responds

In a recent development, the Avalanche (AVAX) C-Chain encountered a significant disruption in block production, leading to a halt for over one hour. The interruption, which affected the primary network, was observed through the Avascan browser, with the last transaction recorded at block 42046853 (19:13 UTC+8).

Although other subnets experienced a slight delay, the primary network faced the most substantial impact.

Avalanche C-Chain Block Production Halt

Ava Labs, the team behind the Avalanche protocol, acknowledged the issue and promptly initiated an investigation. According to Kevin Sekniqi, co-founder of Avalanche, the disruption is believed to be related to a new inscription wave that was launched approximately an hour before the block production interruption.

Sekniqi expressed confidence that the incident was caused by an “esoteric bug” stemming from an untested edge case, emphasizing the need for a swift resolution.

The disruption is presumed to be associated with a mempool handling issue specifically tied to inscriptions, which encountered untested edge cases.

When questioned about the possibility of such untested scenarios arising, Sekniqi acknowledged that while ideally, there should be no untested edge cases, the vastness of the codebase and continuous updates make it challenging to anticipate every possible scenario.

The Avalanche co-founder further clarified that thorough testing is conducted on testnets, but the intricacies of the mainnet environment can introduce “unforeseen challenges.”

At present, no further official statement has been issued by the Avalanche protocol, awaiting additional reports and updates from the development team to gain further insights into the situation.

AVAX Price Dips

During the occurrence of the block production halt, the AVAX price, which serves as the native token of the Avalanche protocol, exhibited a negative reaction, further extending the ongoing decline observed since Thursday when the price was at $43.

As of now, the AVAX price has reached $36.13, indicating a decline of over 2% within the past 24 hours, accompanied by a substantial drop of 11.7% over the course of the previous seven days.

The subsequent actions taken by the Avalanche team in response to this situation, as well as the consequential effect on the AVAX price, are yet to be determined.

Featured image from Shutterstock, chart from TradingView.com

Avalanche Suffers Outage, Fails to Produce Block for Almost Two Hours

Layer-1 network Avalanche has failed to produce a block for more than an hour, Ava Labs co-founder Kevin Sekniqi said the issue “seems to be related to a new inscription wave.”

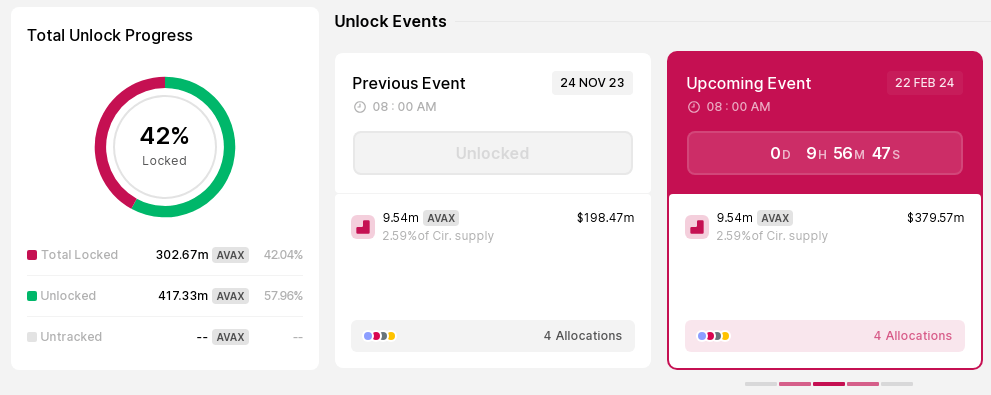

AVAX Slips, Adding Tension To $365 Million Avalanche Token Unlock Drama

The price of Avalanche’s AVAX token has dipped by 11% in the past week, bucking the bullish trend in the broader cryptocurrency market. This comes amidst a $365 million unlocking event that increased the token’s circulating supply by 2.6%. Experts suggest both short-term challenges and long-term opportunities for AVAX.

Unlocking Event Triggers AVAX Price Dip

Token.Unlocks data indicates that on Thursday, locked-up tokens valued at approximately $303 million will be released from vesting and put into circulation.

On February 15th, a significant unlocking event saw 9.5 million AVAX tokens, worth roughly $365 million, released from a vesting period. This influx of previously locked-up tokens coincided with a price decline for AVAX, which fell from $40.32 to its current price or nearly $37.

This aligns with historical trends, as a 2023 report by The Tie found that large unlocking events often lead to price drops within two weeks due to supply outpacing demand.

Analyst Opinions Diverge

Despite the recent dip, some analysts remain optimistic about AVAX’s future. The Tie’s report, while acknowledging the short-term price pressure, highlights the Avalanche network’s growing activity, fueled by popular NFT collections like Dreamheadz and Dokyoworld. The increased engagement within the NFT space is seen as a positive indicator for long-term adoption and potential price appreciation.

TSM’s @theblitzapp Subnet launched, where all premium subscriptions on the platform now flow on-chain, with more features to come later in Q1 https://t.co/dTb52vkFlw

— Avalanche

(@avax) February 5, 2024

Furthermore, analysts point to AVAX’s outperformance compared to specific peers like Celestia and Solana in recent days. This suggests some resilience in the face of the unlocking event and potential buying pressure despite the overall price dip. Some analysts even predict a possible climb to the $40 mark by the end of February, although this remains speculative.

Market Sentiment And Broader Trends

It’s important to remember that the cryptocurrency market is inherently volatile, and AVAX’s price will be influenced by various factors beyond the unlocking event.

The overall market sentiment, regulatory changes, and broader economic trends can all play a significant role. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions.

The recent unlocking event has undoubtedly impacted AVAX’s price in the short term. However, analysts remain divided on the token’s future trajectory. While some anticipate further price declines due to the increased supply, others highlight positive developments like the network’s growing NFT activity and potential for a rebound.

Featured image from Pixabay, chart from TradingView

Avalanche’s AVAX Underperforms Ahead of $365M Token Unlock

Avalanche’s AVAX was one of the few crypto assets that dipped in price over the past week as the token will undergo a $365 million unlocking event scheduled this week.

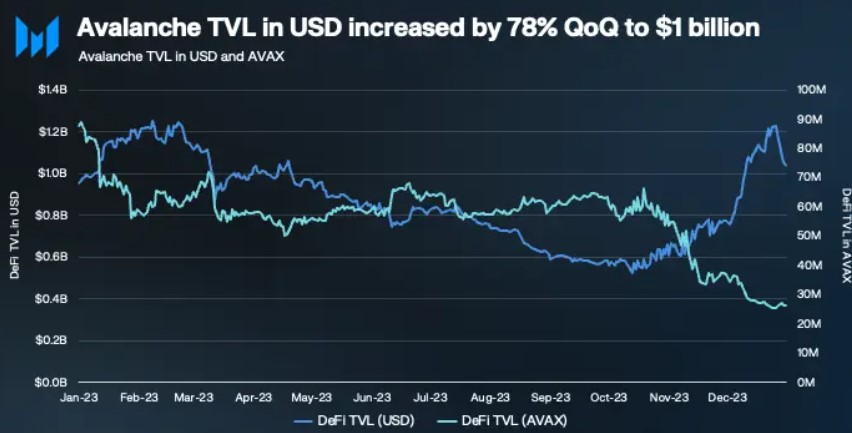

AVAX Rides The Crypto Avalanche To Success: Market Cap Skyrockets By 344%

Avalanche (AVAX), the blockchain platform known for its scalability and infrastructure, made significant strides in the fourth quarter (Q4) of 2023. According to a report by Messari, AVAX emerged as one of the best-performing tokens, driving the protocol to record notable gains in key metrics.

Record-Breaking Milestones For Avalanche

The report shows that AVAX experienced a notable increase in its market cap, which climbed 344% quarter-over-quarter (QoQ) and 326% year-over-year (YoY), reaching $14.4 billion at the end of the year. This large increase propelled AVAX’s market cap rank among all tokens from 20 to 9, up 11 spots (currently 10th behind Cardano (ADA).

One of the driving factors behind Avalanche’s significant revenue growth was the surge in inscriptions, particularly Avascriptions (ACS-20 tokens).

These on-chain call data transactions saw a significant boost, resulting in a substantial increase in revenue. From November to December, Avalanche witnessed a surge in revenue, with a 2,874% increase measured in USD, from $1.9 million to $56.5 million.

The surge in revenue was accompanied by a significant increase in daily transactions, which jumped 450% QoQ to 1.5 million. The emergence of Avascriptions also drove the majority of these transactions.

Avalanche’s C-Chain experienced a record-breaking 6.3 million transactions, with nearly 6.1 million being inscriptions. This marks the highest number of transactions ever recorded in a single day for Avalanche.

While C-Chain saw a 50% QoQ decrease in daily active addresses, this was primarily due to decreased activity on LayerZero – a bridge between different blockchains. However, the report highlights that Avalanche saw a significant increase in active validators, growing 20% QoQ from 1,374 to 1,651 validators.

According to Messari, this growth in validators, coupled with an 11% QoQ increase in AVAX stakes, indicates a promising long-term appetite for AVAX in the coming year.

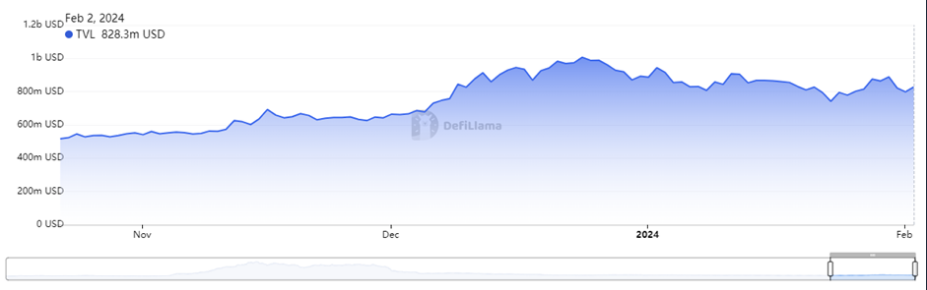

Avalanche’s TVL Surges 78%

Avalanche’s Total Value Locked (TVL) denominated in USD experienced a substantial 78% QoQ increase, reaching $1.03 billion by the end of Q4 2023. This positioned Avalanche as the 7th chain by TVL, denominated in USD.

However, TVL-denominated in AVAX decreased by 71% QoQ, primarily due to AVAX price appreciation driving the increase in USD-denominated TVL.

The report also sheds light on the performance of various protocols on Avalanche. AAVE, the largest protocol by TVL, witnessed a 60% QoQ growth, while Benqi and Trader Joe demonstrated strong gains of 205% and 131% QoQ, respectively. Together, these three protocols accounted for 79% of Avalanche’s TVL, showcasing their dominance in the ecosystem.

Smaller-sized protocols, such as Pangolin and GMX, also showcased impressive growth, while Balancer, aided by Benqi’s sAVAX liquidity pool, attracted significant TVL on Avalanche. Additionally, Q4 witnessed a surge in average daily DEX volumes, rising by 245% QoQ.

Analysis of the 1-day chart reveals that Avalanche’s token trading pair AVAX/USD experienced significant growth during Q4, breaking free from a prolonged period of sideways price action.

However, following a notable uptrend that propelled the token to reach $50, its highest level in 20 months, on December 24, AVAX underwent a sharp correction, plunging to the $27 price level.

The cryptocurrency has rebounded in response to Bitcoin’s (BTC) rally and the prevailing bullish sentiment in the market. Over the past fourteen days, AVAX has witnessed a 13% price increase, currently reclaiming the $40 zone.

Featured image from Shutterstock, chart from TradingView.com

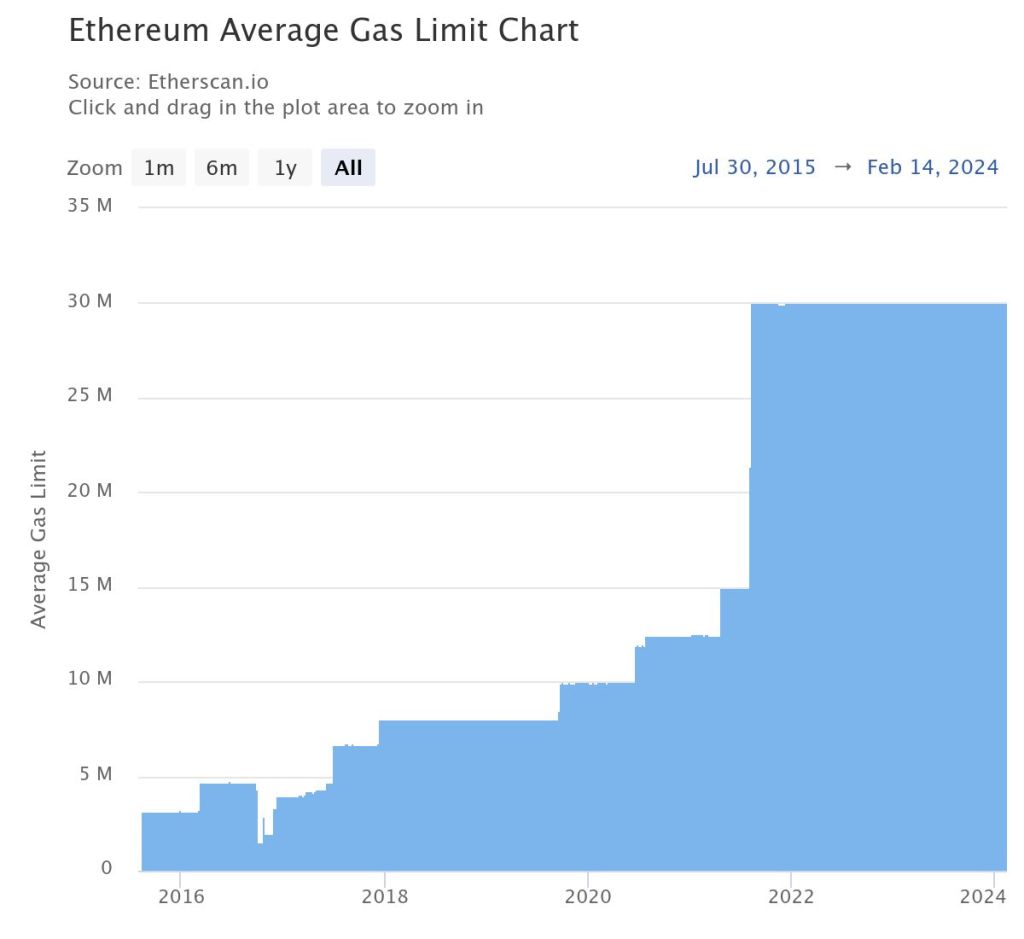

Developer Explains Why Meme Coins Are Shifting Base From Ethereum

Foobar, a code builder, criticizes Ethereum, accusing its developers of neglecting crucial improvements. Because of this shift, projects, including meme coin issuers, are adopting alternative protocols, including layer-2s and modern blockchains like Solana, which boast more features, mostly higher scalability.

Ethereum Developers Are Blocking Mainnet Updates

Taking to X, the developer claims that there have been no major mainnet improvements chiefly because such upgrades are being blocked by core and client developers. Specifically, Foobar cites the long-standing delays for features like Trie State Storage Optimizations (TSTORE) and Externally Owned Account (EOA) batch transactions. The developer also noted the lack of block gas limit increase since 2021.

The developer adds that the absence of main net updates and opcode improvements leading to the implementation of these proposals could be why decentralized apps (apps) launching on Ethereum are “bleeding tremendous value” due to high fees and limitations.

TSTORE and EOA batch transactions are proposals that, if they see the light of day, could see Ethereum scale better. Specifically, proposers of TSTORE forwarded a solution to address storage bloat to improve performance. On the other hand, EOA will enable the bundling of transactions from the same sender, reducing gas fees.

Meanwhile, Etherscan data shows that the block gas limit has been capped at around 30 million since August 9, 2021. Subsequently, Ethereum throughput remains low, and gas fees are higher, considering the high on-chain activity.

The failure of clients to integrate these proposals, the developer continues, makes Ethereum unusable for “any interesting app requiring moderate complexity.” Subsequently, many projects are migrating to layer-2s like Base, Arbitrum, Optimism, or entirely different blockchains like Solana and Avalanche due to limitations on the Ethereum mainnet.

Meme Coins Find Home In Solana And Others

As of mid-February 2024, more meme coin developers, reading from the popularity of emerging projects, are deploying from high throughput and low-fee platforms like Solana, Avalanche, and even Base. Meme coins like Bonk, Honk, and even the successful Bald on Base are examples.

Meanwhile, meme coin projects on Ethereum, like Pepe Coin (PEPE), appear to be losing market share as Shiba Inu, for example, launched Shibarium to offer its users lower transaction fees.

Foobar thinks the lack of improvements on the Ethereum mainnet is why Uniswap v4 has yet to launch. The new iteration of Uniswap, a popular decentralized exchange (DEX) powering Ethereum token swapping, is yet to release its latest version.

Based on existing documentation, v4 will include new features and functionalities, including Hooks. Supporters claim this tool will make the DEX more flexible, drawing more users once it goes live.

Citi Bank Tests Tokenization of Private Equity Funds on Avalanche

The firm tested a variety of use cases through Avalanche’s subnet with a focus on private markets.

Avalanche Rumbles: AVAX Eyes To Reclaim $50 As Upgrade Fuels Optimism On Testnet

In the dynamic realm of cryptocurrencies, Avalanche (AVAX) is causing a stir, riding the waves of a recovery rally that commenced last month. As the broader spectrum of alternative coins experiences a resurgence, AVAX stands at the forefront, ready to extend its ascent, with whispers in the market hinting at a potential surge towards the coveted $50 mark.

Avalanche Booms: Durango Upgrade Ushers Growth

Presently, the AVAX price confidently stands above the 50% retracement level at $39.91, signaling a robust support level within the market range spanning from $28.00 to $49. Technical indicators add to the positive sentiment, with the Simple Moving Averages (SMA) gracefully trending upwards. This suggests that the path of least resistance favors continued price appreciation, creating an optimistic atmosphere among market observers.

This is a big opportunity for Avalanche builders and validators to learn all the ins and outs of Durango

Going live right here on X or on YouTube this Wed. at 12pm ET

https://t.co/811uVwOIg9

— Avalanche

(@avax) February 12, 2024

The buzz surrounding AVAX reaches a crescendo as the eagerly anticipated AVAX Durango upgrade gears up for implementation on the 13th of February. The community’s anticipation has been steadily building since the pre-release of the upgrade’s code on February 2.

This upgrade brings forth a suite of exciting features, including the Avalanche Warp Messaging (AWM) functionality. The AWM is poised to revolutionize communication capabilities on-chain and across chains, promising a more interconnected and resilient network. This enhancement is set to facilitate seamless interoperability of protocols on the ever-evolving Avalanche platform.

Market analysts, fueled by the palpable excitement, predict that the mounting buying pressure could propel a substantial 20% surge, potentially propelling AVAX to $49.95, effectively filling the current market range.

In a more bullish scenario, the gains might extend to $54.92, marking levels not witnessed since the bloom of May 2022 and showcasing an impressive 35% climb from current valuation.

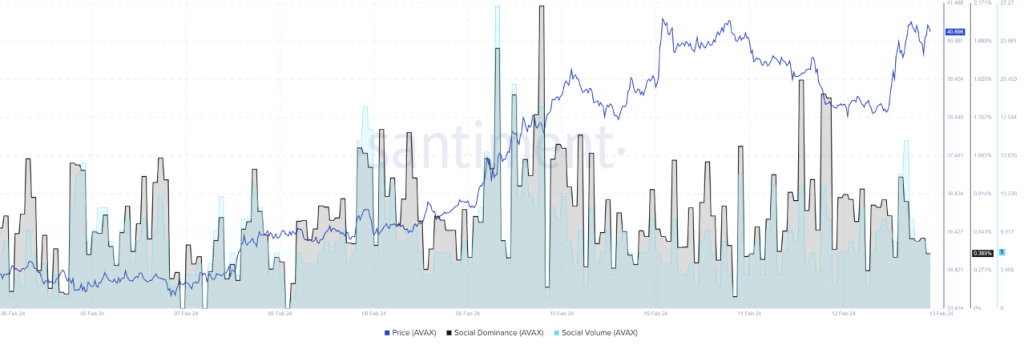

AVAX: On-Chain Metrics Signal Sustained Growth

Examining the coin’s on-chain metrics, an additional layer of support for this positive outlook can be seen. Both social dominance and social volume metrics for AVAX have gracefully eased, painting a picture of serenity in the market. This tranquility often lays the foundation for sustained price growth, steering clear of premature topping out fueled by heightened volatility from mainstream attention.

As the imminent AVAX Durango upgrade takes center stage, traders and investors are on the edge of their seats, eagerly awaiting the potential surge that might unfold. With technical indicators, on-chain metrics, and market sentiment aligning favorably for AVAX, the cryptocurrency seems poised to continue its upward trajectory, potentially scaling new heights in the unfolding weeks.

Featured image from Pixabay, chart from TradingView

AVAX Price Closes In On $40 With Latest 10% Surge

The Avalanche token has been in a positive form recently, with the AVAX price turning in a good performance over the past week. This latest price boost makes a run to the $40 level more or less inevitable for the altcoin.

However, investors are curious to see how long this rally will last, especially with the unlocking of a substantial amount of AVAX tokens on the horizon.

AVAX Price Overview

As of this writing, the AVAX price is slightly above $39, reflecting a nearly 8% jump in the last 24 hours. This recent increase only underscores how well the cryptocurrency has been performing in recent weeks.

According to data from CoinGecko, the value of the Avalanche token has increased by approximately 10% in the past week. After sinking to a low of $28 in late January, AVAX’s price has recovered quite well in the new month, surging by more than 17% since February started.

With the latest price growth, Avalanche looks set to reclaim $40, a level it occurred between December 2023 and early January 2024. The token, however, lost this level due to the downturn that hit the entire crypto market following the Bitcoin spot ETF approval.

With $40 already in sight, the question is whether AVAX can sustain a rally above this mark in the long term. While price indicators like the Relative Strength Index (RSI) are not showing any signs of trend reversal, upcoming events suggest that the Avalanche token might need to overcome some degree of bearish pressure in the coming days.

Avalanche To Unlock About $370 Million Worth Of Tokens

According to on-chain data, Avalanche will unlock 9.54 million tokens (worth about $372 million) on February 22. This figure represents about 2.6% of AVAX’s total supply and will be disbursed in four tranches.

Breaking it down, 2.25 million AVAX is expected to go to strategic partners, 1.67 million coins to the foundation, 4.5 million tokens to the Avalanche team, and 1.13 million AVAX are set to be released in a little over a week.

It is common for crypto projects to execute token unlocks, which may have a corresponding impact on the value of the unlocked token (AVAX, in this case). This effect is because this substantial amount of token, once unlocked, may become available for trading on the open market.

If these newly unlocked tokens are dumped on the open market, this can place some bearish pressure on the burgeoning price of AVAX. This selling pressure could halt the recent growth of the Avalanche token.

Avalanche To Unleash 9.5 Million Tokens, Traders Brace For Impact

Avalanche, the blockchain platform poised for a major event in the month of love, is gearing up for a significant development. As February unfolds, the cryptocurrency market is anticipating the release of nearly $900 million worth of vested tokens from a diverse array of projects. This imminent influx into the market has sparked a wave of concerns among investors who are closely watching the unfolding scenario.

Projects involved in this token release include Avalanche (AVAX), Aptos (APT), The Sandbox (SAND), Optimism (OP), and SUI. Avalanche is strategically targeting strategic partners, team members, and an airdrop to maintain a balance between long-term commitment and potential short-term sell-offs.

Avalanche Braces For Major Token Release

Scheduled for release on February 22, Avalanche is set to unleash 9.5 million tokens valued at approximately $320 million. Similarly, Aptos is gearing up to release 24.8 million tokens worth around $233 million on February 11. The distribution strategy for Aptos aims to ensure market stability while fostering community involvement.

The impending release of these vested tokens has put the crypto community on high alert. Investors and analysts are closely monitoring the developments with a mix of excitement and caution. While anticipation surrounds the token releases, there is also a sense of vigilance as market participants evaluate how the surge in supply might impact project valuations and overall stability.

Navigating A Potential Correction Phase: AVAX Price Analysis

Avalanche (AVAX) has recently caught the attention of the market with an impressive price performance, boasting a remarkable 470% increase after breaking through its bear market descending trendline on November 1.

Recent analyses suggest that AVAX is currently facing resistance at a descending trendline from the December high, which could lead to a price rejection and subsequent decrease.

If this correction signifies the commencement of a lasting bull phase for Avalanche, support levels around $20, aligning with the 0.5 to 0.618 Fibonacci retracement levels, may come into play. Following this correction phase, AVAX could potentially embark on a new uptrend, surpassing its all-time high.

Meanwhile, AVAX has grown exponentially in the last year, and according to DeFiLlama data, it is now the sixth-largest DeFi chain. An artificial intelligence (AI) based price prediction model has predicted that the AVAX token’s price would soar by more than 500% from its present levels, reaching over $200 by the beginning of 2025.

Previous AVAX Unlock And Its Impact On The Market

It’s crucial to note that AVAX’s previous token unlock on November 23 did not cause significant price fluctuations. However, in the anticipation leading up to the unlock, the price experienced a 16% fall from nearly $23 on November 20 to $19 at the tokens’ release.

This historical precedent underscores the importance of closely monitoring market dynamics during token release events. Market participants should exercise caution and carefully consider the potential impact of these developments on their investment strategies.

Featured image from Adobe Stock, chart from TradingView

Avalanche Foundation Puts Rules on Plans to Buy Meme Coins

Solana, Avalanche Tokens Slide as Bitcoin Traders Target Eye Support at $38K

Over half of the profits accumulated by short-term bitcoin holders have been wiped out, Bitfinex analysts said in a Tuesday note.

How To Buy, Sell And Trade Tokens On The Avalanche Network

The Avalanche (AVAX) network has gained prominence as a leading blockchain platform, providing users with a robust infrastructure for token transactions. It is a Layer 1 blockchain protocol that provides a high-performance platform for decentralized applications (dApps) and smart contracts.

Avalanche strives to provide users with a fast, secure, and scalable ecosystem for token transactions. It is a blockchain platform that aims to address the blockchain trilemma of scalability, security, and decentralization, thanks to its unique Proof of Stake (PoS) mechanism. Avalanche is commonly regarded as a viable alternative to Ethereum.

Avalanche serves as a leading light in the Web3 ecosystem by innovating a secure network that doesn’t compromise scalability or decentralization. The network possesses a remarkable characteristic in the form of its consensus protocol, referred to as Snow.

This protocol employs an innovative method known as “Snow consensus”, which enables the network to achieve nearly instantaneous transaction finality. Utilizing the “Snow consensus” method enables the network to achieve rapid confirmation times and efficient throughput by collectively validating transactions through a network of validators, overcoming the limitations of the blockchain trilemma. By addressing the challenges posed by the blockchain trilemma, Avalanche is actively working towards providing robust security and stability to the dynamic advancements in Web3.

This prominent network provides developers and investors with an advantageous blend of cost-effectiveness, high transaction speeds, dependability, and the scalability necessary for widespread acceptance. Avalanche’s commitment to sustainability and environmental consciousness further enhances its appeal. Consequently, it comes as no surprise that Avalanche has emerged as a prominent force in the Web3 ecosystem, commanding a significant presence.

How does Avalanche Work?

Avalanche’s platform sets itself apart from other blockchain projects through three fundamental design aspects: its distinctive integration of subnets, consensus mechanism and utilization of multiple built-in blockchains.

Subnetworks (subnets)

One capability that makes Avalanche innovative is Subnets, a game-changing technology that empowers developers to create projects on networks that they can design to fit their needs. Subnets are deeply customizable and inherit speed and security from Avalanche’s Primary Network.

Subnetworks, composed of groups of nodes, play a crucial role in achieving consensus on the chains within Avalanche’s platform. Each subnetwork is responsible for validating a specific set of blockchains. Additionally, all validators within a subnetwork must also validate Avalanche’s Primary Network.

It is also important to note that the Avalanche blockchain can reportedly process 4,500 transactions per second (depending on the subnet), a significant improvement over Ethereum’s less than 20. Avalanche’s native token is AVAX, which is used to secure the network and pay transaction fees.

Avalanche Consensus

Avalanche Consensus is a novel protocol that builds upon Proof of Stake (PoS) to achieve agreement among nodes in a blockchain network. When a user initiates a transaction, it is received by a validator node that randomly selects a subset of validators to check for consensus.

Through repeated sampling and communication, validators reach an agreement. Validator rewards are based on Proof of Uptime and Proof of Correctness, which consider staked tokens and adherence to software rules. Avalanche’s consensus resembles an avalanche, where a single transaction grows through repeated sampling and agreement.

Built-in Blockchains

Avalanche is built using three different blockchains in order to address the limitations of the blockchain trilemma. Digital assets can be moved across each of these chains to accomplish different functions within the ecosystem.

- i. The Exchange Chain (X-Chain) is the default blockchain on which assets are created and exchanged. This includes Avalanche’s native token, AVAX.

- ii. The Contract Chain (C-Chain) allows for the creation and execution of smart contracts. Because it is based on the Ethereum Virtual Machine, Avalanche’s smart contracts can take advantage of cross-chain interoperability.

- iii. The Platform Chain (P-Chain) coordinates validators and enables the creation and management of subnets.

Unique Features of Avalanche Network

The Avalanche ecosystem has experienced consistent growth, drawing the attention of a considerable number of projects, developers, and users. This expanding ecosystem fosters a dynamic and diverse trading environment, granting traders the opportunity to access an extensive range of assets and trading prospects. Participating in trading activities on the Avalanche network provides a multitude of significant advantages derived from the platform’s exceptional and unmatched features and capabilities. These include:

Enhanced Liquidity

The liquidity on the Avalanche network is strengthened as it continues to attract an expanding user base and an ever-growing assortment of projects. This heightened liquidity is important to traders, as it guarantees the presence of ample buyers and sellers within the market. Consequently, this diminishes slippage and fosters price stability, empowering traders to execute trades at their desired prices with minimal adverse effects.

Cross-chain Interoperability

Avalanche facilitates cross-chain interoperability through its support for the Ethereum Virtual Machine (EVM), enabling smooth interaction and compatibility with assets and decentralized applications (dApps), built on the Ethereum network.

This cross-chain interoperability broadens the horizons of trading opportunities, granting traders access to a wider selection of assets and the ability to leverage the liquidity present in other blockchain networks.

Security

Security is a top priority for the Avalanche network, and it implements robust Byzantine fault tolerance (BFT) mechanisms. These measures safeguard the network against malicious attacks and guarantee the integrity of transactions.

As a result, users can confidently participate in token transactions and interact with dApps on the Avalanche network, knowing that their security remains uncompromised.

Ecosystem Expansion

The expanding market depth on Avalanche empowers traders to broaden their asset selection, granting them access to a more extensive array of trading options. As adoption gains momentum, an increasing number of projects and tokens are introduced on the platform, enriching the diversity of available assets.

This diverse assortment of assets facilitates portfolio diversification and facilitates the exploration of various investment opportunities, accommodating a wide range of trading strategies and individual preferences. Avalanche works with a wide variety of Ethereum DApps and infrastructure projects, including Trader Joe and UniSwap.

How To Get Started On The Avalanche Network

In order to engage in token transactions on the Avalanche (AVAX) network, users are advised to acquire a Metamask wallet. Metamask is a widely utilized browser extension wallet that facilitates interactions with blockchain networks such as Ethereum. It can be easily accessed and installed as an extension on popular web browsers like Google Chrome.

To add your Metamask Wallet to your browser as an extension, simply click on the ‘Add to Chrome’ icon located in the top right corner, as depicted below:

After you have installed and set up MetaMask, you can use it to manage your cryptocurrency wallets, interact with decentralized applications (DApps), and safely perform transactions on supported blockchains directly from your browser.

Remember to write down your seed phrase on paper and keep it in a secure place. Avoid storing it online or on your device.

Afterwards, you can add the Avalanche (AVAX) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Avalanche (AVAX) Network

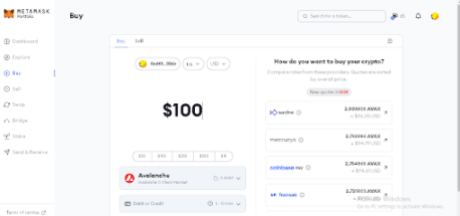

In order to execute trades on the Avalanche Network, users will need to fund their wallet with AVAX tokens. AVAX is the native cryptocurrency for the Avalanche Network, and it functions as the primary medium of exchange for transactions, gas fees and liquidity provision on the platform. Hence, users should ensure a sufficient amount of AVAX tokens in their wallet to cover the cost of trading on the Avalanche network.

Users have the option to purchase AVAX on centralized exchanges like Binance. Once you have obtained AVAX, you can copy your wallet address from Metamask and proceed to send the AVAX tokens from Binance to your Metamask wallet.

You can also buy AVAX directly from your Metamask wallet. Click on the buy/sell button within Metamask to open the interface. Here, you can put how much AVAX token you intend to buy in terms of dollar amounts, pick your payment method, and then click “Buy”.

Kindly note that if you wish to buy cryptocurrencies directly within Metamask, you will need to provide information such as your country and state of residence. Rest assured, the process is quick and uncomplicated, typically taking just a minute to complete.

The arrival of your AVAX tokens in your wallet should take no more than a few minutes. Once they are successfully deposited, you are ready to commence trading tokens on the Avalanche network.

Now, it’s time to visit Trader Joe, and embark on your trading journey.

How To Trade Tokens On The Avalanche Network Using TraderJoe

Trader Joe is a decentralized exchange (DEX) on the Avalanche network. It allows users to trade tokens directly from their wallets using liquidity pools. Trader Joe prioritizes user control, security, and privacy while providing a user-friendly trading experience.

Make sure to be on the right Trader Joe website so as to protect your assets from malicious activities. The first step on the website is clicking on the “Connect Wallet” option at the top right corner, as shown in the image below:

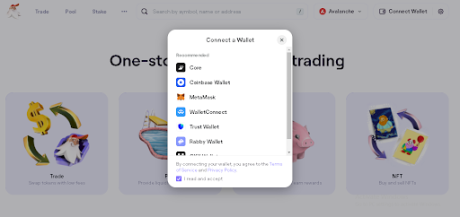

Connect to the preferred wallet option (Metamask) as presented in the image below:

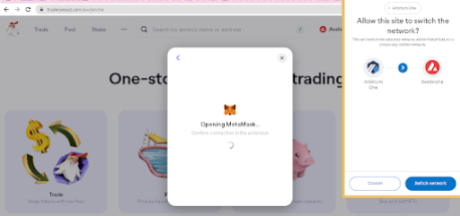

Once connected, switch Metamask to AVAX (no need to switch if you’re already on the AVAX network):

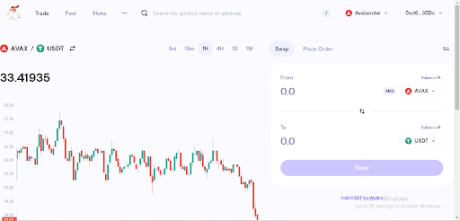

After connecting MetaMask to the Avalanche network, go to Trader Joe, and then you can start trading on the Avalanche (AVAX) network using Trader Joe.

Once you reach the Trader Joe interface, you can proceed by choosing your desired tokens. Since Trader Joe follows a token-to-token trading model, simply click on the “select token” button to pick the trading pair you wish to trade against. Users can search tokens by name, symbol or contact address:

Buying and Selling Tokens With The Metamask Wallet

Users of the Avalanche (AVAX) Network have the option to purchase and sell tokens directly through the Metamask extension wallet, which is already connected to the Avalanche network.

To proceed, ensure that you are connected to the Avalanche network and possess AVAX tokens for swapping and paying transaction fees. Next, locate the “Swap” button, illustrated below, and click on it. This action will redirect you to the Swap interface within Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on Trader Joe. Input the amount of AVAX you want to swap, confirm that you have the correct token, and then click “Swap.”

Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

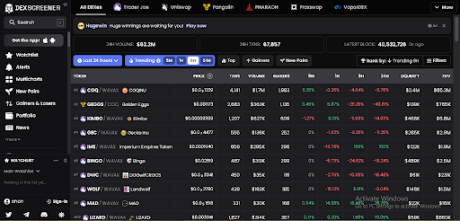

Tracking Token Prices on The Avalanche Network

Utilizing on-chain tools such as Dexscreener, users of the Avalanche network can access extensive market insights for specific tokens. These insights encompass crucial data like price information and contract details, equipping users with reliable and up-to-date information. By leveraging these insights, users can make informed trading decisions and engage in the market with confidence.

Dexscreener also allows Avalanche users can stay updated on token metrics and market dynamics, thereby improving their trading strategies and enhancing their overall trading experience. It provides valuable information such as price data, market cap, token supply, contract details, etc, that empowers users to make more informed decisions and navigate the market properly.

Dexscreener provides a range of beneficial features specifically designed for users on the Avalanche network. One standout feature is its advanced charting functionality, which offers real-time and historical price data for a diverse selection of tokens.

Through these charts, users can access valuable information about price trends, trading volumes, and other essential metrics. This empowers them to identify optimal entry and exit points for their trades with accuracy and certainty.

Conclusion

In conclusion, the Avalanche network provides a robust ecosystem for decentralized finance (DeFi) and token trading. With its fast transaction speeds, low fees, and high scalability, Avalanche offers an efficient and user-friendly platform for buying, selling, and trading tokens.

The network supports various decentralized exchanges, such as Trader Joe, and provides on-chain tools like Dexscreener to empower users with market insights. It is important for users to stay informed, exercise caution, and adapt to the evolving landscape of the Avalanche network to make the most of its features and opportunities.

A Bullish Beginning? $151 Million Poured Into Crypto Funds In 2024’s First Week

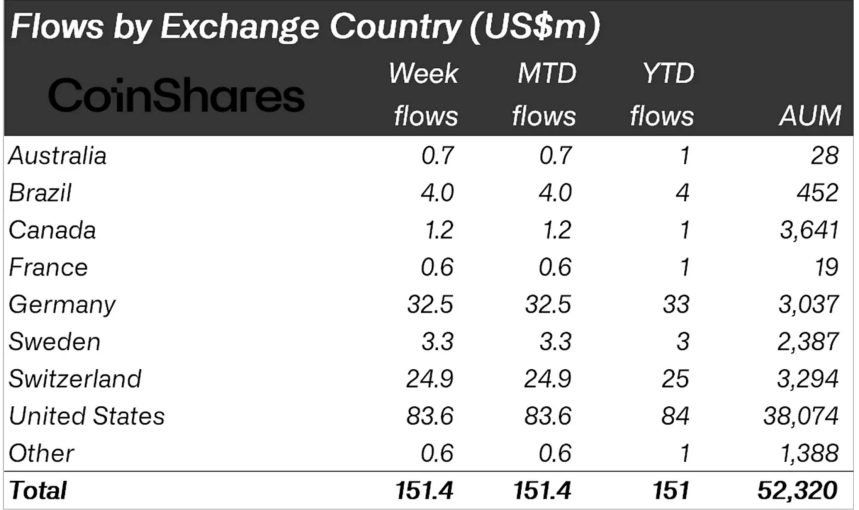

The first week of 2024 marked a notable milestone in crypto asset investments. Investment products in this particular sector witnessed inflows amounting to $151 million, according to a recent report from CoinShares.

Crypto Asset Funds Sees Surge In Inflows

This $151 million surge in inflow, as highlighted by James Butterfill, Head of Research at CoinShares, is particularly noteworthy in light of the Grayscale vs. US Securities and Exchange Commission (SEC) lawsuit, with these inflows contributing to a total of $2.3 billion since the case began in October 2022.

This amount accounts for 4.4% of the firm’s total managed assets. Even without a spot exchange-traded fund (ETF) launch in the US, Butterfill revealed that American exchanges contributed to over half of these inflows, at 55%. German and Swiss exchanges followed, contributing 21% and 17% of the inflows, respectively.

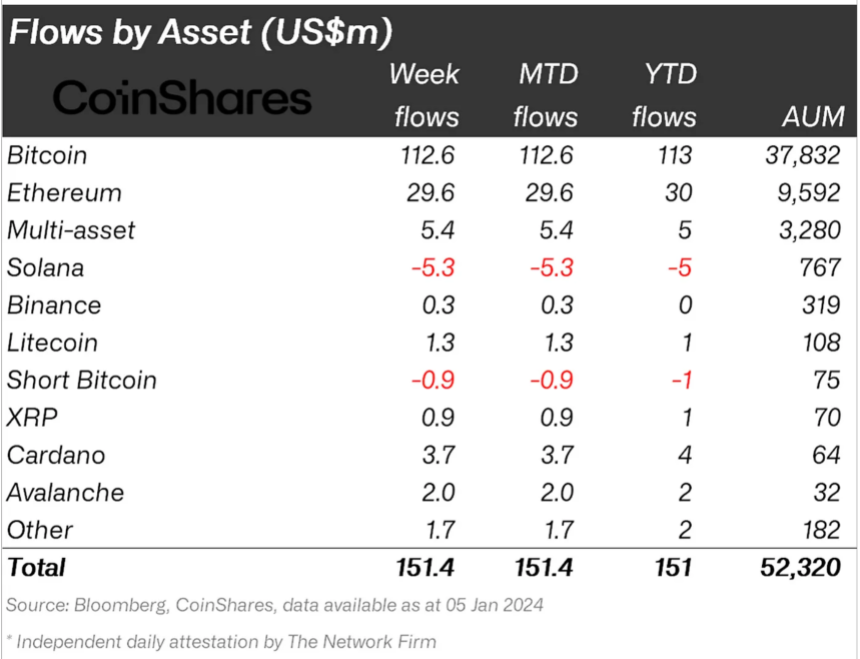

Bitcoin emerged as the leader in investment inflows, amassing $113 million. This substantial sum equates to 3.2% of the total assets under management (AuM) in the last nine weeks.

James Butterfill pointed out an interesting trend that challenges the anticipation of the US SEC approval of a spot Bitcoin ETF being a “buy the rumor, sell the news” event. Butterfill noted in the report:

If many truly believed that launch of the [spot] ETF in the US would a “buy the rumour, sell the news” event, we surely would expect to see inflows into short-bitcoin ETPs, instead, outflows over the last 9 weeks have amounted to US$7m.

Notably, this is because “buy the rumor, sell the news” implies that investors buy assets ahead of an anticipated event (like the spot ETF launch) and sell them when the actual event occurs, often leading to a price decline.

However, the observation here by Butterfill is quite the opposite. Instead of seeing inflows (more investment) into short-Bitcoin exchange-traded products (ETPs) (which benefit from a decline in Bitcoin’s price), there have been outflows amounting to $7 million over the last nine weeks.

This indicates that investors might not expect a significant price drop following the spot Bitcoin ETF launch in the US, contradicting the “buy the rumor, sell the news” expectation.

Ethereum And Altcoins: A Mixed Bag Of Sentiments

Ethereum’s performance in the crypto asset investment space has also been noteworthy. The second-largest crypto by market cap saw inflows of $29 million, with the last nine weeks bringing in $215 million. This influx indicates a significant shift in investor sentiment towards Ethereum.

While Solana, on the other hand, faced outflows amounting to $5.3 million, Cardano, Avalanche, and Litecoin witnessed inflows. Cardano saw $3.7 million, Avalanche $2 million, and Litecoin $1.4 million in inflows. The blockchain equity sector also started the year on a strong note, recording inflows of $24 million in the past week.

Despite Bitcoin’s dominance in inflows, the flagship crypto has recently experienced a net outflow of $32.8 million, with short Bitcoin investment products also seeing a minor outflow last month.

However, Bitcoin’s recent $113 million inflow has shown the asset’s move to rebound. Even in price performance, Bitcoin has increased by 5.2% over the past week and appears to be continuing its upward trajectory by 1.1% in the first 24 hours, with its trading price nearing the $45,000 mark.

Contrastingly, Ethereum, after a 2% decline over the past week, is showing signs of recovery, increasing by nearly 1% in the past day. Other altcoins such as Solana, Cardano, Avalanche, and Litecoin have been less fortunate, experiencing significant losses, with Avalanche and Cardano being the top losers, down by 27.3% and 17% in the past week.

Litecoin and Solana, though also in the red, have seen slightly lesser declines. Solana is down by 10% over the past week and 1.6% in the past 24 hours, while Litecoin mirrors this trend, down by 10.8% over the week and 0.4% in the last day.

Featured image from iStock, Chart from TradingView

3 Under The Radar Altcoins Expected To Hit $100 Before The Bitcoin Halving

With the Bitcoin halving expected to happen today, crypto enthusiasts are already starting to take positions in various altcoins. Among these, there are a number of coins that have shown a lot of promise when it comes to reaching the $100 price mark and this report takes a look at three.

MoonRiver (MOVR) Tops Lists Of Altcoins To Reach $100

The MoonRiver (MOVR) token has been one that has flown under the radar for quite a while now. This has to do with the fact that the price of the altcoin fell from its all-time high of $485 to as low as $5 earlier in 2023. However, this has not eradicated the bullish narrative for the asset.

So far, as the crypto market has recovered, the MOVR token has seen one of the most significant rallies. In the days leading up to Christmas, the price would go from around $6 to as high as $44 in a couple of days, notching 700% gains during this time.

Since then, the price has since retraced and fallen around 50%. But with the price still holding above $20, it shows a lot of promise for the coin. Given its low supply of around 11 million coins and a tendency to rise quickly in a short time, MoonRiver is one of the coins poised to break the $100 mark.

Litecoin (LTC) Slow Movement Coming To An End

The Litecoin price rallied tremendously in 2023 leading up to its halving and was among some of the best-performing altcoins. However, once the halving was completed, the LTC price would crumble and fall into a slow and steady decline. However, this has changed as the coin’s price has begun to pick up steam once again.

With the Bitcoin reversal, the Litecoin price is on the up once again, briefly crossing $75 in the early house of Tuesday. The altcoin, which is often referred to as the digital silver, could be poised to see firmer rallies, especially as the Bitcoin halving draws closer, which is often a catalyst for the bull market. If this continues, then LTC could easily cross $100.

Avalanche (AVAX) Sees An Awakening

Just like Solana (SOL), the Avalanche network has undergone an awakening that has brought investors back to the chain. As a result, the AVAX price has rallied, going from its 2023 low of around $9 to as high as $47 in December 2023.

As the new year rolled around, the Avalanche network has continued to enjoy attention from crypto investors and this has helped it maintain its bullish momentum. Just like MoonRiver (MOVR) and Litceoin (LTC), Avalanche (AVAX) is another token expected to cross the $100 mark.

Avalanche To Support Meme Coins; AVAX To The Moon?

The Avalanche Foundation is expanding its support of meme coins. This move could further boost the popularity of Avalanche, a low-fee and high-throughput blockchain, and even support its native coin, AVAX.

Avalanche Foundation To Support Meme Coins

Taking to X on December 29, the foundation said it would continue its Culture Catalyst initiative to encourage meme coin activity, among others, including Real-World Assets (RWAs), non-fungible tokens (NFTs), and more. This campaign, they continue, aims to foster innovation and propel the adoption of blockchains by supporting the creation of “new forms of creativity, culture, and lifestyle.”

The Avalanche Foundation believes that meme coins have carved out a significant niche in crypto, representing the collective spirit and shared interests of diverse crypto communities. By recognizing and encouraging this culture, the foundation hopes to develop and expand the Avalanche ecosystem, attracting new users.

As they resume Culture Catalyst, the foundation will start by purchasing select Avalanche-based meme coins to create a collection. The selection process will be based on several critical criteria, including the number of holders, liquidity thresholds, project maturity, principles of a fair launch, and overall social sentiment.

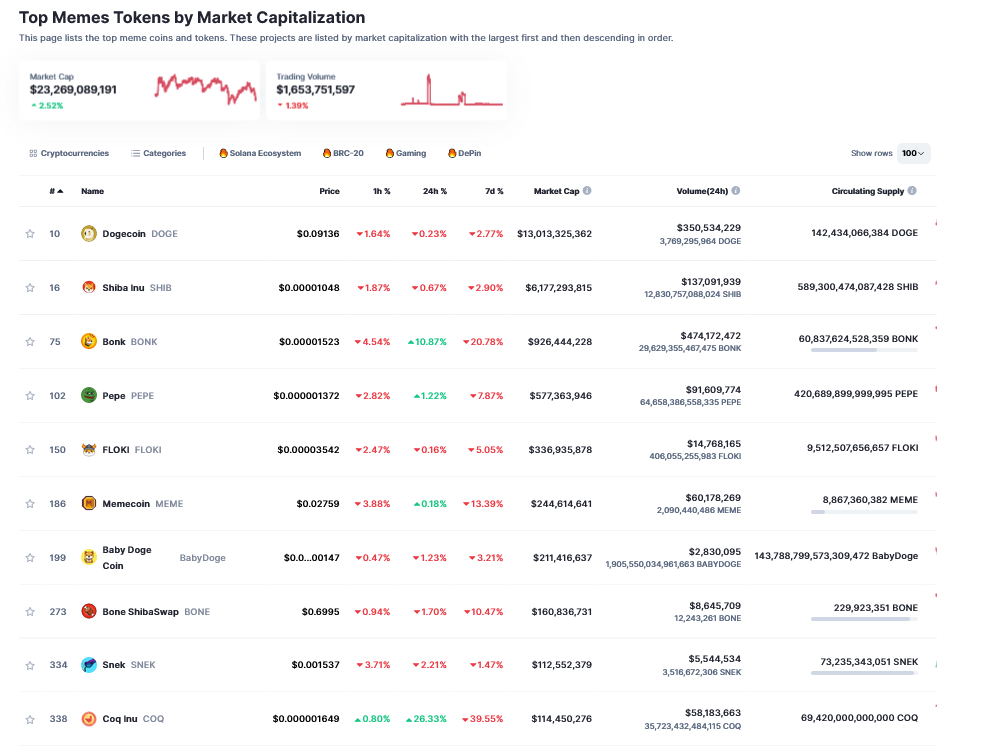

This move is a significant step for the Avalanche Foundation, as it indicates a growing recognition of the potential of meme coins to drive innovation and growth. It is because meme coins have become increasingly popular in recent years, often attracting large communities and generating significant trading volume. According to CoinMarketCap data on December 29, meme coins have a cumulative market cap of over $23 billion.

Will AVAX And COQ Extend Gains In 2024?

The foundation’s support for meme coins could further boost the popularity of Avalanche, as it will bring more attention to AVAX, a coin used for paying network fees. Thus far, AVAX remains in an uptrend, adding nearly 400% from October 2023 lows. Though there has been a cool-off, buyers have the upper hand. With rising demand triggered by more meme coins deploying on Avalanche, AVAX prices will likely float even higher.

One of the Avalanche-based meme coins, COQ, is among the top 10 most liquid. According to DEX Tools data, there are over 34,000 COQ holders when writing. As of December 29, Dogecoin (DOGE) is the largest and most valuable meme coin, with over $13.2 billion in market cap. However, the launch and subsequent stellar performance of COQ propelled it to command a market cap of $114 million.