Avalanche (AVAX) has had a relatively quiet second half of 2023 regarding price performance and ecosystem advancements. However, the token experienced a mesmerized turnaround towards the end of October, which has seen its value rise almost vertically in the past few weeks.

Avalanche’s positive run coincides with an optimistic climate in the general crypto market, as investors appear to be more interested in various digital assets. While Bitcoin, the premier cryptocurrency, continues to hold its own above the $37,000 mark, most altcoins seem ready to take advantage of changing market sentiment.

Avalanche Displays Strength With 31% Rally – Price Overview

The Avalanche price reached a yearly low of $8.78 in late September, forming the bottom for a trend reversal. The cryptocurrency’s price has been on a bullish run since then while looking to reclaim the highs achieved at the beginning of 2023.

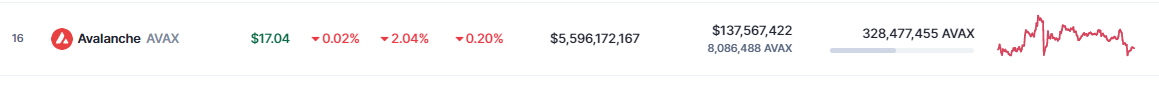

As of this writing, the AVAX token is valued at $18.58, reflecting a massive 31% price increase in the past 24 hours. Meanwhile, the price of the altcoin has swelled by more than 48% in the weekly timeframe.

A broader look at the Avalanche price chart further highlights the token’s strength and attractiveness over the past few weeks. According to CoinGecko data, the value of AVAX has more than doubled in the past month.

Avalanche’s positive price action – in such a short timeframe – further emphasizes the favorable sentiment currently brewing in the general crypto market. Investors have also seen other altcoins, like Solana, Ethereum, and Chainlink, go on an upward trajectory in the past weeks.

Based on data from CoinMarketCap, AVAX has witnessed more than an 85% increase in its daily trading volume. Meanwhile, the token’s current market cap of roughly $6.68 billion reflects a 31% jump in the past day.

Can AVAX Maintain Bullish Momentum To $22?

Many investors would be watching to see how far the Avalanche token can keep up with its red-hot momentum. And this makes sense, considering that the cryptocurrency was one of the best performers in the last bull market, rallying to a peak of $145.

In the short term, price action data suggests AVAX might be able to break above the psychological $20 level without much resistance. Nevertheless, investors should watch out for the $22 threshold, as it has proven to be a significant resistance zone in the past.

If Avalanche manages to breach and close above the $22 price mark, the token’s price could experience a parabolic run to $60. On the flip side, if the resistance level holds strong, the AVAX price could fall to find support at around $15.

Attention

Attention

(@Artemis__xyz)

(@Artemis__xyz)

(@Flowslikeosmo)

(@Flowslikeosmo)