Magnate Finance, a DeFi lending protocol on the Ethereum layer-2 network Base, is reported to have conducted a rug pull, robbing its users of $6.4 million worth of assets. This event represents the latest troubling incident on the Base network in merely a month of its official mainnet launch.

3 Rug Pulls, $16.7 Million Lost – Who’s Responsible?

On Friday, August 25, blockchain security intelligence Peckshield confirmed Magnate Finance’s rug pull, stating that the project developers manipulated the provider of the price oracle, allowing them to withdraw all assets of the platform.

Peckshield also provided more information on the scammers’ movement, stating that they had transferred $1.34 worth of DAI to a new address while also bridging $1 million of the loot to the BNB chain.

The majority of the stolen funds have been transferred to other Ethereum layer 2 solutions such as Optimism and Arbitrum. Meanwhile, the $1.3 million DAI and an additional 295 ETH, valued at around $486,000, remain on the Base Network.

Magnate Finance on #BASE has rug pulled for $6.4M.

The deployer is also linked to the past rug pulls:

Solfire's $4.8M rug on Jan 23, 2022

Kokomo Finance's $5.5M rug on Mar 27, 2023

That makes a total profit of $16.7M for the scammers. https://t.co/jl7rhRnt7C pic.twitter.com/SfL3dk4wW0

— Beosin Alert (@BeosinAlert) August 25, 2023

Interestingly, a few hours before the Magnate Finance rug pull occurred, an X user and on-chain investigator, ZachXBT, posted a community alert stating the possibility of such an event.

ZachXBT’s suspicion was based on the fact that the deployer address of Magnate Finance received some funds from the Solifire’s $4.8 million rug pull that occurred in January 2022.

In addition, the deployer address of Magnate Finance is also linked to the Kokomo Finance $5.5 million exit scam in March 2023. In total, the developers of the Base DeFi lending protocol have been involved in three rug pulls that have resulted in the loss of $16.7 million of user funds.

At the time of writing, Magnate Finance has deleted its Telegram group, as well as disabled its official website. In addition, the project’s X account has also been deactivated, wiping all of its online and social media presence in what has been a “classic rug pull.”

Another Setback For Base?

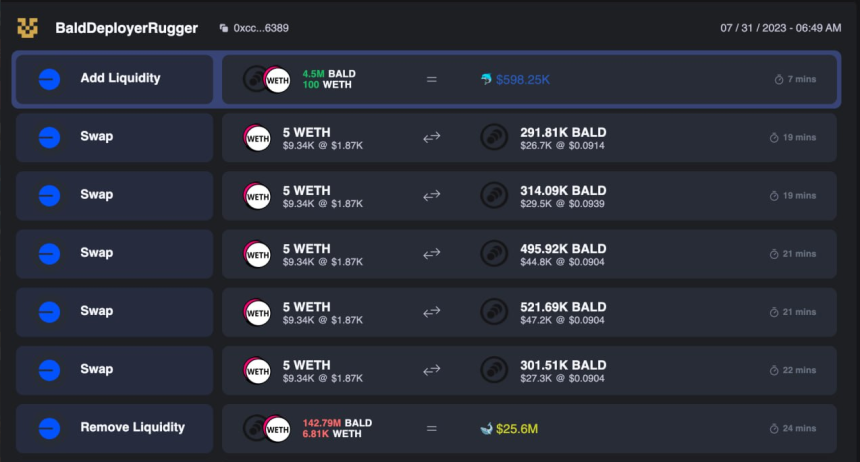

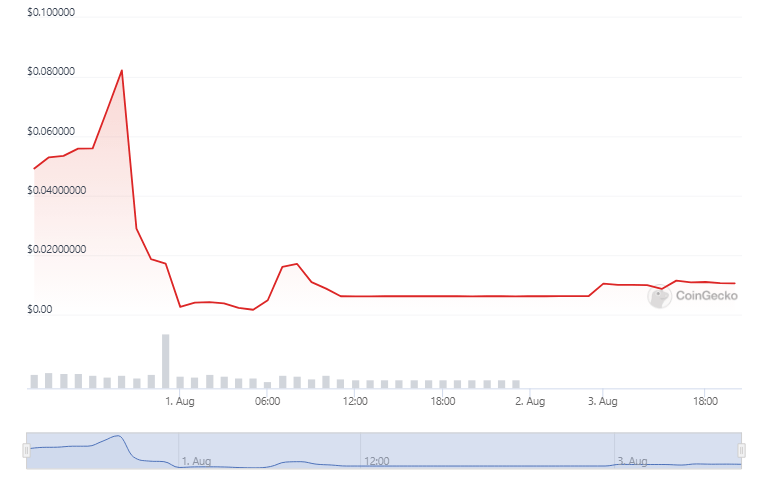

The early days of the Base Network in the crypto space have been anything but smooth sailing. Prior to the network’s public launch on August 9, BALD, a memecoin project on the Coinbase native network, was exposed as a rug pull after developers withdrew $25.6 million of the project’s liquidity.

Since then, there have been more negative occurrences within the Base ecosystem, with the Rocketswap DEX losing over $450,000 via “brute force hack,” while 342 ETH, valued at $626,000, has also been stolen from LeetSwap, another Base-native DEX.

However, it is worth stating that the Base Network has also recorded some positives in its short time of operation. According to data from L2Beat data, Base ranks as the fourth most active layer two solution with a daily transaction per second value of 7.73.

In addition, where the general total DeFi ecosystem has taken a dive below the $40 billion mark, Base has shown much resilience. Using data from DefiiLama, the project’s TVL gained by 11.02% in the last week and is now valued at $185.81 million.