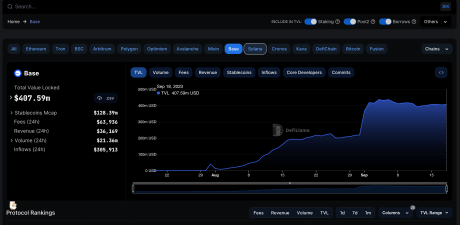

The foundational infrastructure of the Base Network brings about yet another Ethereum Layer 2 network, distinguished by its scalability and empowerment through the notable association with Coinbase. Coinbase is recognized globally as one of the most trusted cryptocurrency exchanges and companies, Coinbase effectively manages a diverse portfolio of crypto assets, solidifying its status as a cornerstone within the digital currency realm.

Positioned as a pivotal solution to address the persistent challenge of high transaction costs within the Ethereum network, the Base Chain stands quite firmly to revolutionize transaction fees, delivering a cost-effective alternative within the secure Ethereum environment. The assurance of a safe and reliable ecosystem is heightened by the affiliation with Coinbase, an industry titan renowned for its unwavering commitment and 10-year-long track record of great service.

Reasons To Trust The Base Chain

The current centralized phase of the Coinbase company, with its owners and Devs known to the public, establishes a solid foundation for users to place their trust in the Base chain. With over a decade of extensive experience in the cryptocurrency space, Coinbase has consistently demonstrated its expertise by developing and launching numerous successful crypto products.

This wealth of experience instills confidence in the Base Chain as it navigates its initial stages of centralization, with a strategic vision to progressively evolve into a decentralized entity over time.

For those embarking on their journey within the Base Chain ecosystem, it is imperative to keep certain key considerations in mind. Firstly, the association with Coinbase serves as a testament to the network’s reliability and credibility. Additionally, users can anticipate ongoing enhancements and decentralization initiatives as the Base Chain matures, aligning with the broader ethos of blockchain technology.

In summary, the Base Network, fortified by its affiliation with Coinbase, emerges as a promising Ethereum Layer 2 solution, poised to alleviate the burden of high transaction costs while providing a secure and gradually decentralized environment.

Key Features To Note About Base Chain

Expanding on the diverse utilities and functionalities within the Base Ecosystem

How To Buy, Sell, And Trade On The Base Network

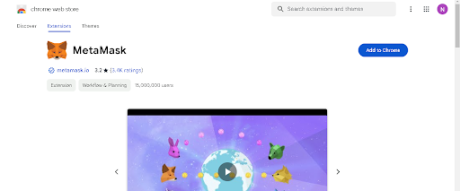

Select an EVM-Compatible Wallet

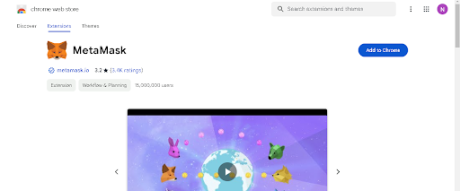

To be able to make any transactions on the Base network, you need to have an EVM-Compatible Wallet. Click here to see a list of wallet options you can select from but I would recommend you use MetaMask, it is one of the most popular Ethereum Virtual Machine (EVM)-compatible wallets and also one of the most used wallets for Base Network transactions.

If you are using a PC, install the Metamask wallet extension by clicking on “Add to Chrome” to add the extension to your Chrome browser, as shown below:

Once installed, open your MetaMask, set up your account, and make sure to keep your secret phrase very safe, I would advise that you write it down on a shit of paper, away from the internet where it can’t be hacked.

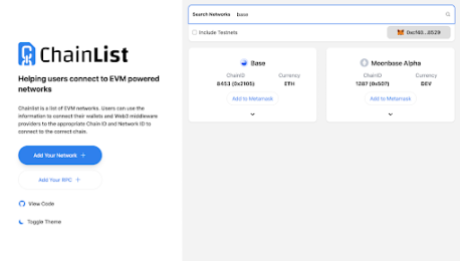

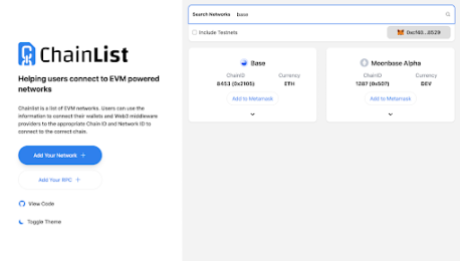

Add The BASE Network To Your MetaMask

To add the Base Network to your MetaMask, search for Chainlist on your browser, open it, connect your MetaMask wallet, search for Base, and add it to MetaMask by clicking on “Add to Metamask”, click on “Approve” and lastly click on “Switch Network” on your Metamask.

Acquire Base ETH

To make any transaction on the Base Network, you need Base ETH. Get your Base ETH from these cryptocurrency exchanges such as Binance, OKX, or KuCoin. Buy ETH on these platforms, go to the withdraw section, making sure to choose the BASE network as your transfer Network, which automatically converts your ETH to Base ETH as it gets to the ETH wallet destination.

Related Reading: How To Buy, Sell, and Trade Tokens On The Arbitrum Network

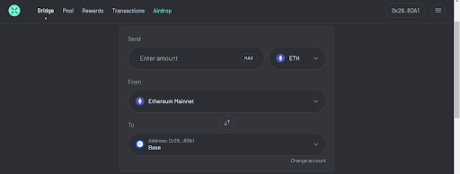

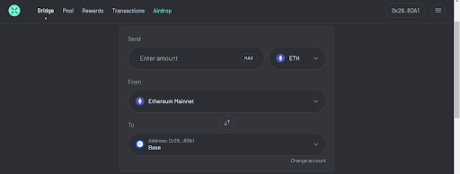

Alternatively, if you already have native ETH in your Metamask wallet, you can use the BASE bridge to bridge from the Ethereum Mainnet to the Base Network.

Bridging to Base Network ETH From Other Ethereum Layer 2s

If you wish to bridge your ETH to Base ETH from other Ethereum Layer 2 solutions, I would recommend secondary bridging platforms featured on the BASE Bridge platform. These platforms facilitate a smooth transition to the Base Network from various Ethereum Layer 2 environments, as shown below.

Example Of Bridging to Base ETH From Other Ethereum Layer 2s

ACROSS PROTOCOL is the first secondary bridging platform featured on the BASE Bridge platform as shown above, all you need to do is connect your Metamask wallet and select the amount of ETH you want to bridge to Base ETH and Bridge.

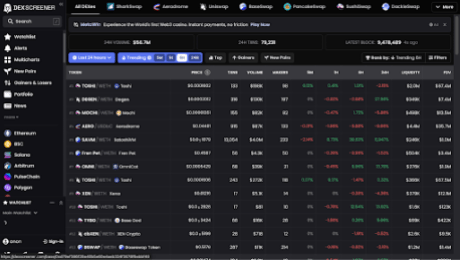

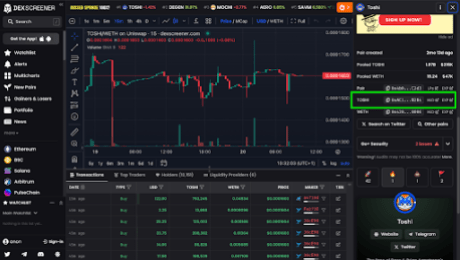

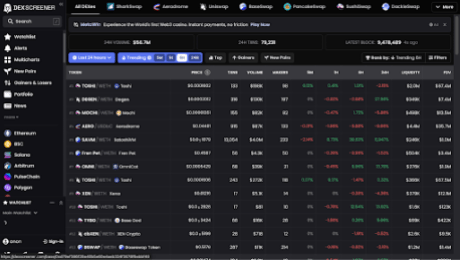

After Acquiring your Base ETH, you need to do your research and know which token you want to buy on the Base Network on Coingecko before heading over to Dexscreener to check for the token, Dexscreener serves as a valuable tool for checking available tokens on the EVM chain, including the Base Network.

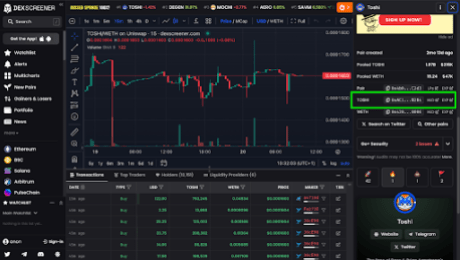

By selecting the Base network on Dexscreener, you can access a comprehensive chart of available Base tokens. Note that not all tokens are supported on every DeFi DEX, search for the token you would like to trade and select it. After selecting, look out for the Green Box section selected in the image to identify which DeFi platforms support the token you wish to trade.

Obtaining Token Contract Address

Scroll down on the Dexscreener to find the token contract address or go back to Coingecko and copy the contract address. This address is crucial when trading on DeFi platforms.

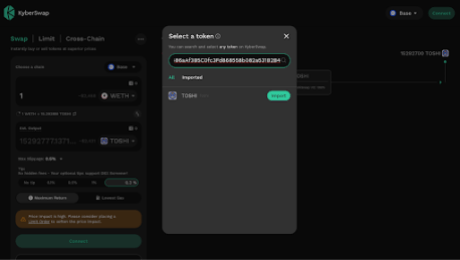

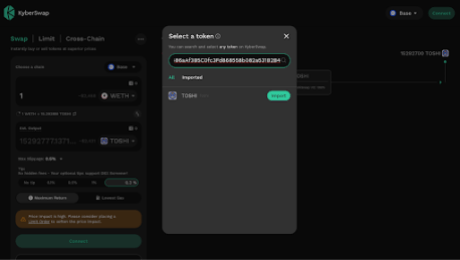

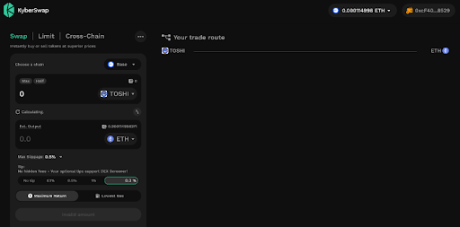

Copy the contract address, and when you enter it in the swap section of a DeFi platform like Uniswap, it will reveal the token. If the token is not available on Uniswap, the Dexscreener will redirect you to another supported DeFi where you can trade the token like KyberSwap.

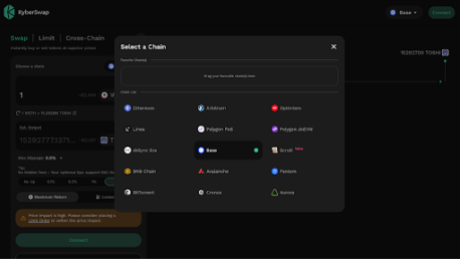

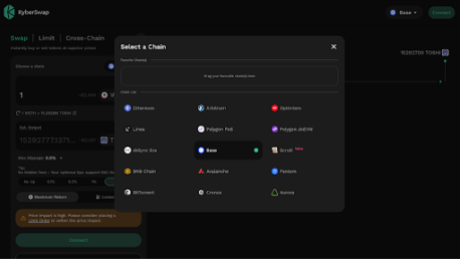

Connect your wallet to KyberSwap, click on the denominator token, and paste the contract address of the Base token in the search box. Before initiating any trade on DeFi, confirm that the network on the DeFi is on, in this case, the Base Network, ensuring the token’s availability on the Base Network. If it’s not initially on the Base Network, go to “Select a chain”, and select the Base network to ensure compatibility.

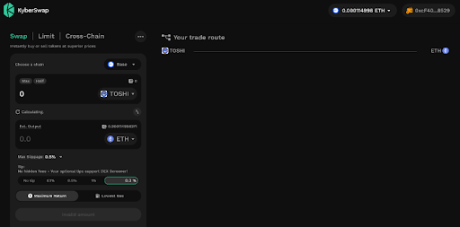

Choose the desired pair of Base tokens and ETH (or other base pairs), specify the amount you want to swap, and execute the trade.

Related Reading: How To Buy, Sell, And Trade Tokens On The BSC Network

Reverse Trading For Base Network ETH

If you wish to trade from a BASE token to Base ETH, simply reverse the order. Place the Base token at the top and the ETH at the bottom, then proceed with the swap. This allows you to exchange your Base token for ETH within the Base Network.

By following these steps, you can confidently navigate the trading process on the Base Network, leveraging the features of DeFi platforms and Dexscreener to make informed decisions and execute trades seamlessly.

Conclusion

The Base Network is another Ethereum Layer 2 network which is also affiliated with Coinbase, which is one of the most trusted cryptocurrency exchanges and companies in the crypto space with over 100 million users and processing $80 billion worth of crypto assets. Base Network has a lot of features which I have pointed out in the article already, although the Base Network does not have its Native token yet, it is still trusted and reliable due to its affiliation with Coinbase.