A new breed of meme coins have spawned on Solana this week with speculators hopping on a new wave of cartoonish coins focused around politicians and celebrities.

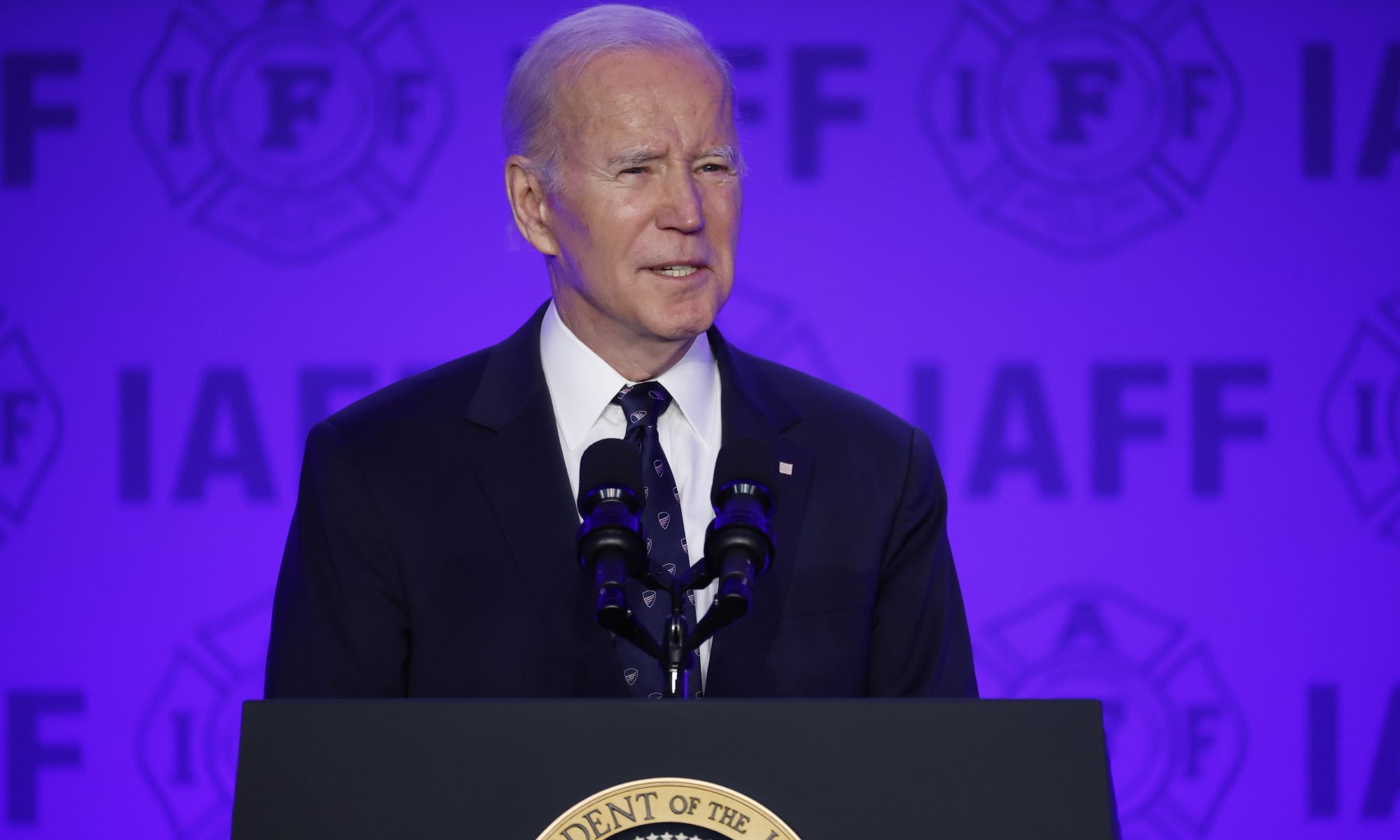

AI-Related Tokens Stumble After White House Executive Order

Issued Monday, President Biden’s executive order is aimed at potential threats posed by artificial intelligence, but critics of the White House action wonder if innovation could be stifled.

Ripple Labs chair slams Biden, Gensler for having ‘screwed up’ on crypto

Ripple Labs chair Chris Larsen commented on the recent cases involving Ripple, Grayscale, and the SEC, arguing it is time for Congress to take the lead on crypto policy.

7 presidential candidates have dropped clues about their crypto stance

There are currently many from the Democratic and Republican parties bidding for the job of president. Here’s what they’ve said about crypto.

Will This Political Deal In The US Save Bitcoin and Crypto?

Politicians in the United States will likely strike a deal and raise the government’s $31.4 trillion debt ceiling for two more years. Amid this debate, the price of Bitcoin is firm but lower, tracking below the psychological $30,000 level as bulls recover after posting sharp losses mid-this week.

The Debt Ceiling Debate

There are reports that there will be more discretionary spending on the military and veterans with the reduction of other sectors.

Moreover, there are unconfirmed reports that the Biden administration will likely not fund the Internal Revenue Service (IRS) to boost collection, as laid out earlier.

Instead, the immediate focus will be to hire more auditors and target wealthy citizens.

There are concerns that the Treasury Department and the United States government will default on their obligation as soon as the first half of June 2023.

Even though highly unlikely, as the Treasury Department has said it will liquidate $119 billion of debt on that day, the market is watching how discussions pan out.

Bitcoin is firming up after losses on May 24.

As a deal is reportedly struck and consensus reached, politicians would once again lift the debt ceiling, sending mixed signals to the economy.

Unlike in previous years when top cryptocurrencies were decoupled from the mainstream economy, things have changed as Bitcoin’s prominence rises.

Will Bitcoin Benefit?

BTC prices will likely rally if there is an instance of default brought about by politicians disagreeing on the way forward.

On the reverse side, a deal that addresses concerns brought by the negotiating parties could signal confidence in the economy despite more debt on the table.

This averts a crisis and keeps operations running, removing uncertainty and stabilizing the economy.

In that case, the USD could strengthen, possibly reversing gains by Bitcoin bulls in the last two trading days.

Still, the crypto community remains bullish on Bitcoin considering macroeconomic events and next year’s halving.

After months of steady interest rate hikes, the United States Federal Reserve could slow down rate increments in the next meeting in mid-June. Their action could support the commodities and securities markets.

At the same time, the expected supply shock following the halving of Bitcoin miner rewards could make BTC scarcer, driving prices even higher.

Miners are special nodes tasked with confirming transactions and decentralizing the network.

If past price action can be used to predict future formations, BTC’s prospects look positive. Before the rally of 2020 to 2021, BTC prices bottomed up in 2018 and rose in 2019 before the halving event 2020.

The same pattern may be repeated through to 2024 when Bitcoin halving occurs.

White House advisors renew push for 30% digital mining energy tax

The May 2 blog post by the White House’s Council of Economic Advisers (CEA) has already attracted strong criticism from the community.

‘Crypto FUD’ — Industry outraged as White House report slams crypto

The report included 35 pages seemingly aimed at debunking the merits of crypto assets.

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank Collapses

The government on Sunday evening stepped in to guarantee no losses will be borne by the lenders’ depositors.

Bitcoin slips under $20K amid Biden budget, Silvergate collapse

The price of BTC briefly slipped under $20,000 on March 10, although at time of writing was hovering just above that level.

Biden budget proposes 30% tax on crypto mining electricity usage

The tax would be phased-in at 10% per year over three years and covers electricity generated from both on and off-grid sources.

Biden wants to double capital gains and clamp down on crypto wash sales: Reports

The Biden administration wants to apply the wash sale rule to digital assets.

United States CBDC would ‘crowd out’ crypto ecosystem: Ex-Biden advisor

Daleep Singh argues that crowding out cryptocurrencies by establishing a CBDC in the United States would protect the country’s national interests.

Long the Bitcoin bottom, or watch and wait? Bitcoin traders plan their next move

Bitcoin price dropped to $18,270, but derivatives traders didn’t flinch. Here is why.

Gloomy Crypto Future? Book Author Warns We’re In The Biggest Bubble In History

Famous “Rich Dad, Poor Dad” author Robert Kiyosaki has predicted a bleak future for the economy and the crypto market.

He says we live in the largest bubble in human history — with stocks, real estate, commodities, and oil all experiencing bubbles.

Kiyosaki added that hyperinflation and despair are on the table as well.

Crypto Prediction

The book author predicts that the US government will seize all cryptocurrencies when US President Joe Biden signs an executive order on cryptocurrency — which the President did, on Wednesday.

Bitcoin is out, he writes, and a “Fed crypto” will be launched following the signing of Biden’s EO.

Kiyosaki has warned of depression in the past, and this is no exception. As recently as December of last year, he cautioned that a major economic disaster was in the offing.

Related Article | Massive Amount Of ‘Sleeping’ Bitcoin Moved After More Than 11 Years In Hibernation

Decentralized cryptocurrencies such as bitcoin and ether cannot be frozen or seized inside the network itself.

“This is why he is so enthusiastic about bitcoin,” according to US Senator Ted Cruz.

Biden Signs Crypto EO

Biden’s crypto directive is aimed at creating a “national strategy for digital assets across six important goals.”

A government strategy to manage the dangers and utilize the potential advantages of digital assets is outlined in the executive order, among other key factors.

The presidential order asks the Treasury and other agencies to “review and produce policy recommendations” to “protect US consumers, investors, and companies.”

Related Article | Bitcoin On Course To Hit $100K Nine Months From Now, Bitbull CEO Predicts

Biden’s executive order also calls for a report on the future of money and payment systems by the secretary of the Treasury.

The second objective is to “maintain financial stability in the United States and across the world.”

Crypto total market cap at $1.736 trillion on the daily chart | Source: TradingView.com

The Treasury’s Role

Treasury Secretary Janet Yellen says the Treasury will expand upon the National Risk Assessments, which highlight crucial illicit financing concerns linked with digital assets under the presidential order.

As the fourth objective, the Department of Commerce is being directed to develop an adequate framework to “advance US leadership in technology and economic competitiveness to strengthen US leadership in the global financial system.”

A Danger To The Financial Market?

For his part, Cornell University economics professor Eswar Prasad discussed Biden’s EO on cryptocurrency regulation with CNBC.

Prasad has warned about the dangers of bitcoin to the stability of monetary and financial markets.

He said the goal behind the executive order is to “start thinking about the usefulness of these diverse assets and technologies and thus govern them.”

Meanwhile, Kiyosaki said he plans to “be an entrepreneur as a second option.”

“Stay out of the stock market, construct your assets, and utilize debt as $,” he said.

Featured image from Intelligence Squared, chart from TradingView.com

Yellen’s Positive Remarks About Biden’s Crypto EO Push Bitcoin Past $41,000

It only took an unintentionally flattering remark from a high-ranking US official to propel Bitcoin above the $41,000 level.

Bitcoin (BTC) advanced early on Wednesday, boosting the entire crypto market, as US Treasury Secretary Janet Yellen’s inadvertently disclosed remarks indicated that US President Joe Biden’s long-awaited crypto directive will take a constructive approach to regulating the digital asset sector.

The crypto order requires steps to foster innovation while managing industry risks. The secretary’s statement appeared in print a day early, reportedly because of a an error, and was promptly removed, but was retained on a web cache.

Bitcoin, which has been trading below $40,000 for the last seven days, rebounded more than 8% Wednesday, hitting $41,000 once more.

Related Article | Leading News Outlets In Ukraine Aim To Secure $1 Million By Selling NFTs

Crypto EO Detailed Report

According to Yellen, the US Treasury will collaborate with interagency partners to develop a detailed report on the future of money and related payment systems in accordance with Biden’s EO.

Since early January, Biden’s White House team of financial experts has been working on an executive order on digital assets, which an unnamed source said will help bring “coherence to what the US government is trying to accomplish in this arena.”

Bitcoin was trading around $38,135 at this time Tuesday, prior to Yellen’s comments. Nonetheless, BTC quickly recovered to surpass $41,500 shortly after the statement was delivered.

BTC total market cap at $795.45 billion on the daily chart | Source: TradingView.com

Yellen Remarks Lift Bitcoin, Other Cryptos

Notably, Bitcoin is not the only cryptocurrency that has experienced a rally. Evidently, Yellen’s partial disclosure favors all cryptos in the top ten global crypto rankings.

According to Coingecko data, Ethereum (ETH) has increased by more than 7% in the previous 24 hours and is presently selling at roughly $2,715 per coin.

Similarly, Binance Coin (BNB) is up 4.5%, while Cardano (ADA), Terra (LUNA), Ripple (XRP), Solana (SOL), and Avalanche (AVAX) are up 8.5%, 18.4%, 5.6%, and 3%, respectively.

“Based on Yellen’s words, the crypto EO is a welcome development that calls for a coordinated and comprehensive approach to digital asset regulation that promotes responsible innovation,” Cameron Winklevoss of Gemini Trust wrote on Twitter.

Related Article | Billionaire Investor Says Crypto Outlook Is ‘Very Bullish’ For Bitcoin

Mixed Reactions

Thus far, notable members of the industry have had a mixed reaction. Evan Van Ness, founder of Week In Ethereum, described the speech as a “nothingburger of a statement.”

However, Altered State Machine founder Aaron McDonald expressed a more somber reaction to the announcement.

McDonald stated in a tweet that Yellen’s remarks demonstrate her want to “ensure we keep the most potent weapon in our arsenal – the USD as global settlement.”

Traders anticipate that the Biden administration will enact stricter cryptocurrency laws as part of its efforts to prevent Russia from escaping the mountain of sanctions put on the country for its ongoing invasion on Ukraine.

However, Yellen’s favorable comments appear to indicate that the law will certainly benefit the new asset class.

Featured image from Decrypt, chart from TradingView.com

Why Hillary Clinton Warns Biden Administration To Regulate Crypto Market

During an MSNBC interview, Hillary Clinton continued to suggest hypothetical scenarios in which cryptocurrencies could destabilize the United States and called on the Biden administration to regulate them as she fears that state and nonstate actors manipulate the role of the U.S. dollar.

Related Reading | Inverse Signals: Why Bitcoin Weakness Is Attributed To Dollar Strength

Clinton warned people are only beginning to see the need to regulate the cryptocurrency markets and called to imagine “the combination of social media, the algorithms that drive social media, the amassing of even larger sums of money through the control of certain cryptocurrency chains,”

The former presidential candidate has already voiced her unamicable views around cryptocurrencies before, seeing them as a threat for the United States.

Likewise, for Clinton, the nations of China and Russia are manipulative obstacles for the country.

We are looking at not only states, such as China or Russia or others, manipulating technology of all kinds to their advantage, we are looking at nonstate actors, either in concert with states or on their own, destabilizing countries, destabilizing the dollar as the reserve currency.

Clinton thinks that the Biden administration needs to address many questions regarding the role of cryptocurrencies in the U.S. nation and its economy, but added they might not have much time to do so.

The Former Secretary of State hopes that the current administration will try to operate “exactly” in the way she thinks best based on what she has been “hearing from them”, meaning their views regulations match her hostility.

We certainly need new rules for the information age, because our current laws, our framework, it is just not adequate for what we are facing.

Is The U.S. Marching Towards More Crypto Hostility?

Last week, the Former Secretary of State made a similar warning during the Bloomberg New Economy Conference, where she stated that crypto represents a risk for the stability of the U.S. nation and currency (the U.S. dollar).

Clinton believes the “interesting and somewhat exotic effort” of crypto mining can undermine the role of the dollar and seemed to consider full-ban on cryptocurrencies similar to China’s:

It appears as though China is going to prevent outside technology payment systems, like the cryptocurrencies development, from playing a big role inside China. I think they recognize, giving their nationalism, perhaps earlier than other nations, that this could be a direct threat to sovereignty.

On the other side, Senator Pat Toomey had voiced back in September that the China ban was an advantage for the United States and tweeted his own opinion on the upside of innovation and economic liberty, which Hillary Clinton still fails to approach.

Beijing is so hostile to economic freedom they cannot even tolerate their people participating in what is arguably the most exciting innovation in finance in decades. Economic liberty leads to faster growth, and ultimately, a higher standard of living for all.

Furthermore, Jerome Powell has just been renominated as U.S. Federal Reserve Chair to face the accelerating inflation and other challenges the nation’s economy is facing. Powell has been warry around cryptocurrencies, but he has also stated he would not opt for a ban, but regulatory controls on stablecoins.

Related Reading | Bitcoin Heads Towards $35,000 as Biden Stimulus Hurts US Dollar

Crypto total market cap at $2.5 trillion in the daily chart | Source: TradingView.com

USDC issuer Circle supports proposal to regulate stablecoin issuers as banks

“There’s a real recognition that as these payment stablecoins grow, they could grow at internet scale relatively quickly,” Circle CEO said.

Opposition mounts to Biden’s OCC pick, fears she could ‘regulate crypto into oblivion’

Texas Senator Ted Cruz is among a number of politicians and bankers that are opposed to the nomination of Saule Omarova.