The announcement stated that the program is the largest ever announced in the crypto space.

Cryptocurrency Financial News

The announcement stated that the program is the largest ever announced in the crypto space.

Roughly $12.7 million worth of tokenized Bitcoin has been stolen from the BSC-based cross-chain composability platform pNetwork.

Solana, with its fast-growing ecosystem, has found a position at the forefront within the crypto space. By hitting $314 million in its private token sales, Solana crept the headlines in early June. Polychain and Andreessen Horowitz pioneered the Solana token sales.

This funding impacted greatly in developing the fast-growing ecosystem of Solana. This pushes it as one of the top competitors to Ethereum, the blockchain with the widest usage.

Before now, the Ethereum blockchain has high demand from crypto users and investors. Unfortunately, this results in network congestion and exorbitant transaction fees.

The congestion propelled the great opportunities for sidechains and Layer 2 solutions. Also, Layer 1 networks can take from the loopholes and create scalable decentralized apps beyond Ethereum. Solana falls under such Layer 1 networks.

Related Reading | Coinbase States Infrastructure Bill Could Impact 60 Million American Crypto Owners

Founded in 2017, the project team realized over $25 million through its private and public ICO token sales. March 2020 brought the release of the main net beta.

The project is reputable for its 400ms block time and 50,000 throughput for transactions per second. This performance is higher than Bitcoin and Ethereum’s current version by several thousands of times. Though both of these formers platforms rely on Proof-of-Work consensus.

Solana has a theoretical capacity of 700,000 transactions per second through its focus on scale for more adoption, as contained in its whitepaper.

The technological design of Solana accounts for its high performance in scalability. The blockchain can process transactions horizontally in parallel using its sea-level runtime. Thus, the blockchain has continuous scalability with validator GPU improvements, thereby maintaining low fees.

The CEO of Solana Labs, Anatoly Yakovenko, reveals that the network’s scalability level is proportionally linked to hardware computation. This accounts for its execution of tens of thousands of transactions of smart contracts in parallel.

Also, the network uses several GPU cores to validators. The major network down part is that running a specialized hardware validator can cost thousands of dollars.

Solana Performance Trend

Solana satisfies its aim of having a distributed system for transaction scalability in proportion to its bandwidth.

The network achieves its aim through the use of some features like the consensus algorithm Tower BFT. Other outstanding enabling features are the Proof-of-History and Proof-of-History-Optimized versions of BFT.

The network currently boasts over 900 validators. Though Ethereum remains the most Defi smart contract blockchain, Solana has made a name than other Layer 1 chains. It’s more decentralized than Binance Smart Chain, Polkadot, Fantom, and Cosmos.

Solana has maintained a bullish momentum and it seems to be on an upward direction | Source: SOLUSD on TradingView.com

Several new protocols are building on the Solana blockchain to leverage its fast and low transaction fees. This has propelled more rise of more dApps in the Defi ecosystem.

The ecosystem now has more decentralized exchanges, yield aggregators, automated market makers, and stablecoin swap platforms.

Related Reading | SushiSwap Narrowly Escaped A $350 Million DeFi Hack, Here’s How

Others include NFT marketplaces: wallets, gaming platforms, and derivatives. The Chain also has projects based on infrastructures such as block explorers, oracles, launchpads, and data analytics tools.

When it comes to its operability, unlike Ethereum, SOL has no support for Solidity programming language. So, it’s not EVM compatible, and this puts a gap in its competition with Ethereum.

However, the Solana network utilizes Rust as its programming language. Fortunately, Rust is becoming one of the preferred languages in the most developing communities in the Defi ecosystem.

Furthermore, Neon Labs plans on providing SOL with EVM compatibility by porting Solidity smart contracts on the network.

Featured image from Pixabay, chart from TradingView.com

Tranchess is live on the Binance SmartChain with a Bitcoin tracking token and yield farming options for investors.

Binance is set to match bug bounties paid by Immunefi to white hat hackers that discover vulnerabilities in Binance Smart Chain projects.

DeFi protocol Impossible Finance is building a multi-chain incubator to expand out from BSC.

CZ claims Binance didn’t really make Binance Smart Chain, Beijing to distribute $6.2 million in free digital yuan, and miners speak out about clean energy mining

Another day, another BSC DeFi protocol gets hacked.

Binance beefs up blockchain analytics amid a surge in DeFi exploits.

One blockchain security firm says its audit of the SafeMoon smart contract has unearthed a potential $20 million vulnerability within the viral meme coin.

PancakeBunny is the latest Binance Smart Chain-native DeFi protocol to suffer a vicious exploit, with more than $200 million being drained from the platform.

Ethereum (ETH) based yield aggregator Rari Capital was attacked this weekend by a group of bad actors. As a result, 2,600 in this cryptocurrency were stolen from the Rari Capital Ethereum Pool, as a post-mortem report released by core contributors confirmed.

The attack took place at around 1:48 PM UTC, May 8th, with a series of transactions that lasted for almost an hour. Rari Capital’s product deposits ETH into Alpha Homoras’ ibETH interest-bearing token as part of their strategy.

The protocol’s pool contract operates with the ibETH.totalETH()/ibETH.totalSupply(), used to calculate the exchange rate for the ibETH/ETH pair. A separate report from Alpha Finance Labs claims that this operation can “lead to incorrect assumption”. Rari Capital report stated the following:

According to Alpha Finance, `ibETH.totalETH()` is manipulatable inside the `ibETH.work` function, and a user of `ibETH.work` can call any contract it wants to inside `ibETH.work`, including the Rari Capital Ethereum Pool deposit and withdrawal functions.

On Ethereum, the attack began when the bad actors took a flash loan from protocol dYdX for around 59,000 in this cryptocurrency. The funds were into Rari’s Ethereum based pool with the correct conversion rate for the aforementioned trading pair.

Then, the attackers used the function “work” which enabled them to trigger their offensive by encoding an “evil” fToken contract. This allowed the hackers to artificially inflate their ibETH/ETH rate.

At 2:29 PM +UTC, the possible root of the exploits was discovered. At 2:34 PM +UTC, actions on Alpha Homora were paused. The losses represented around 60% of all users fund in this Ethereum-based Pool. However, only Rari’s funds were lost, as Alpha Finance’s report claims. Rari Capital said:

At the end of `ibETH.work`, the value of `ibETH.totalETH()` returns to its true value, leading the Rari Capital Ethereum Pool’s balances to values lower than they were before the attack as a result of the attacker withdrawing more than they deposited while their balance was artificially inflated.

Researcher Igor Igamberdiev revealed that the exploit was far more complex than usual. According to a separate report made by Igamberdiev, the attack on Rari Capital is the first cross-chain exploit in the crypto space.

The researcher believes that the hackers first took funds from a Binance Smart Chain yield aggregator called Value DeFi. This protocol suffers multiple attacks on its products, VSafe and VSwap, and the bad actors looted 5,346 BNB which immediately were converted into 1,000 ETH.

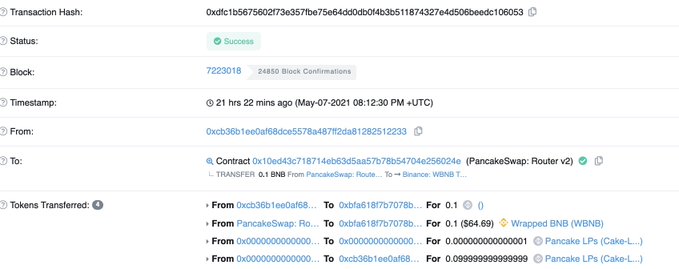

On Binance Smart Chain, the hackers also created a fake token which was pool into exchange PancakeSwap. This allowed them to interact with protocol Alpaca Finance. Igamberdiev stated:

Interact with Alpaca Finance, where when calling approve() for a fake token, a payload is called, which allows an attacker to use VSafe through Codex farm to get vSafeWBNB. Convert vSafeWBNB to WBNB. All WBNB transferred to Ethereum through Anyswap.

To fight these types of attacks in the future, Rari Capital took additional security steps, such as place their protocol integration under review, check all invariants for potential malfunctions, and others. However, Igamberdiev concluded the following:

The interoperability between DeFi protocols is becoming more complex, which opens up new vectors of attacks. This attack was similar in difficulty to the Pickle Evil Jar and will become even more frequent in the future.

Ethereum trades at $3,918 with a 2.1% profit in the daily chart and a 31.9% profit in the weekly chart.

Built on top of Binance Smart Chain, CryptoTycoon (CTT) is a monopoly game based on Binance Coin (BNB), Binance USDC (BUSD), and stablecoin Tether (USDT). With it, users can play to construct in-game buildings by rolling the dice. The game operates with a deflationary and dividend model, according to an official post.

The team behind the game recently announced the successful completion of their seed round of fundraising. Per their announcement, they have received support from 16 institutions from “different regions and backgrounds”.

In total, Binance Smart Chain’s partner was supported by HappyBlock, CryptoDiffer, R8 Capital, A195 Capital, 4SV, AKG Venture, PrimeBlock Ventures, Amplio Capital (BitMart Labs), T3E (MW partners), Infinity Labs, CatcherVC, BenMo Labs, BEST, Horizon Capital, Ternary Capital, and 7Star Capital. The team added:

In addition, we have recently received supports from many BSC community building participants, who provided a lot of valuable suggestions to CryptoTycoon and participated in CryptoTycoon’s seed round fundraising in a private form.

The project will focus on “market building and user experience” for their next phase of development. They are currently taking feedback from the community. So far, they have divided their roadmap into two stages an initial stage and an early stage.

The former has been composed of game design, smart contract coding, legitimate subject and legal matters, participation from their American and European market partners, smart contract audit, official website (v0.1) launch, and other items related to community operations and media. Most of the first items have already been completed.

In their early stage, they will have a close beta of their game, a CTT release, an official website launch on their v0.5 launch, liquidity provider staking mining, game interactive contract audit, planning for their second iteration of the game, and much more.

CryptoTycoon’s native token CTT will have a burned mechanism, as two of the most important assets in the Binance Smart Chain ecosystem, BNB, and PancakeSwap’s CAKE.

BNB trades at $619 with a 5.7% profit in the daily chart. In the weekly and monthly chart, BNB has a 20.4% and 99.9% profit, respectively.

Bitcoin is struggling to sustain above the $53,000 support for the past 3 days. As the king cryptocurrency price slumped, Ethereum picked up its pace, surging to a new all-time high of $2,800.

It appears that the European Investment Bank’s launch of a “digital bond” sale using the Ethereum network, has boosted Ethereum’s price. The EIB is issuing a two-year digital bond worth 100 million euros ($120.8 million), led by Goldman Sachs, Santander, and Societe Generale.

Furthermore, JP Morgan published a research note last week claiming that due to improved liquidity and increased network activity, Ether should continue to outperform Bitcoin.

According to fixed-income analyst Joshua Younger:

“Bitcoin is more of a crypto commodity than currency and competes with gold as a store of value, whereas Ether is the backbone of the crypto-native economy and therefore functions more as a medium of exchange. To the extent owning a share of this potential activity is more valuable.”

Throughout 2021, Ethereum longs dominated, reaching a high of 130 percent greater than shorts, while Bitcoin traders were typically more modest. The market pattern reversal on April 29 comes as the ratio of BTC longs to shorts is 45 percent higher. Meanwhile, Ethereum traders are just 6% net long, indicating skepticism about the recent rally.

When Wall Street banks start covering alt coins like $ETH, you know we are going to be in alt season soon. pic.twitter.com/oZisZcMhQ5

— Eugene Ng 🌊 (@Eug_Ng) April 28, 2021

Given that the long-to-short ratio is relatively flat, the status of OKEx traders in Ethereum should not be interpreted as bearish. The monthly trend in April, on the other hand, shows that Bitcoin traders are becoming more positive.

The expiration of BTC and Ethereum options on Friday should not be overlooked by traders. The $3.9 billion Bitcoin expiry poses a threat to bulls if the price falls below $50,000, as the neutral-to-bearish put options will gain a $700 million advantage.

Bulls currently dominate Ethereum’s more modest $930 million options expiry, and even if Ether’s price declines to $2,600, the $115 million gap in call options open interest appears to be guaranteed.

Related article | Ethereum Seems Unstoppable, Here’s How ETH Could Extend Rally

Following the plunge of valuation on Apr 18, BTC prices have been gyrating at tight ranges above $50k but capped below $60k. Traders and investors are opting to stay away, adopting a wait-and-see approach.

Meanwhile, altcoins, spearheaded by the resurgent Ethereum and Binance (BNB), have defied gravity and expectations, soaring higher to new all-time highs.

In particular, Ethereum is primed by several solid fundamentals, including the coin’s prospects after the activation of EIP-1559 and Eth2.

On the other hand, BNB is being pumped the expansion of DeFi and the relentless efforts by Binance to catalyze NFT activities on its Binance Smart Chain (BSC).

Furthermore, projects like Cardano and IOTA, both of which are known as Altcoins, are still refining their systems.

Cardano has been developing its system over the last few years, and in the Goguen level, it will soon activate smart contracting, bringing it closer to full functionality.

IOTA, on the other hand, is pursuing complete decentralization in order to power the future computer economy.

Related article | Bitcoin Dominance Dives To Lowest In Years, Altcoin Season Is Finally Here

Featured image from Pixabay, Charts from Tradingview.com

Uranium Finance joins the growing list of hacked projects on the Binance Smart Chain network.

Popular crypto YouTuber Lark Davis talked about Binance Smart Chain (BSC) many opportunities for investors. With its low fees and fast transactions, Davis believes this ecosystem provides the kind of experience that the people want.

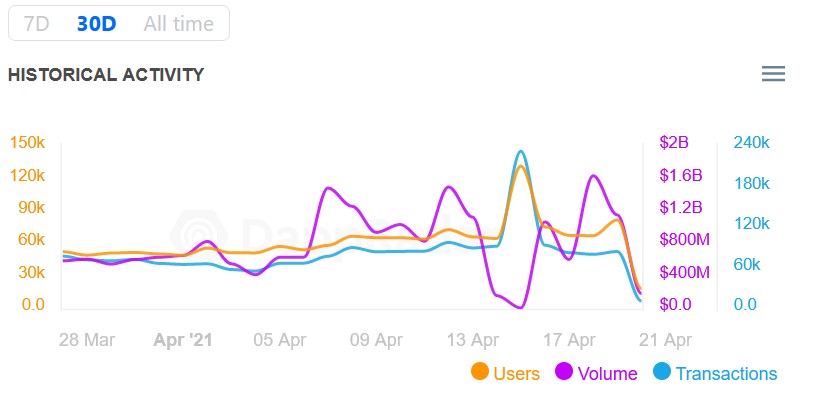

BSC flagship product PancakeSwap (CAKE) has given its competitor a run for their money and even managed to “eclipse Ethereum” in terms of transaction volume, according to Davis. The analyst cited data from DappRadar that claims BSC outperformed Ethereum on this metric, at least for a 24-hour period.

PancakeSwap experienced an all-time high number of users during the past week and registered some issues due to the high congestion. Davis said:

Binance Smart Chain hit a an all-time of 8.5 million transactions. I think it is pretty obvious what we are seeing right here. People want exposure, they want to get into DeFi. They want to get into crypto and use the different products.

The analyst reiterated Ethereum’s disadvantages and the high number of users that have been price out of the platform. When it comes to adoption, the “numbers speak for themselves”. PancakeSwap’s native token trading volume sits at $1.1 billion in the daily chart. Ethereum DEX Uniswap record a similar number but has been lagging behind its competitor. David added:

I suspect that we’re going to continue to see Pancakeswap moving up the charts and becoming a more and more prominent decentralized exchange. The users are there. The daily volume’s there. Just the market cap is a bit behind in comparison to Uniswap which only does half the daily volume right now.

This ecosystem is anything but static and will be making an entry into other crypto trends, like non-fungible tokens (NFT). For that, they will launch the BSC Station to allow users to do auctions for these assets to a “wide” audience. The platform will also integrate a BSC Swap feature along with the NFTs.

This development will be supported by Morningstar Ventures, NGC, BSCPad, x21, and many others. Its growth could positively impact PancakeSwap (CAKE), and the other projects on Davis’ list, Refinable (FINE), and Smoothy Finance (SMTY).

Refinable seeks to leverage the NFT’s nascent period. Davis believes this project could “get a good share of the market”. The platform is supported by Mr. Beast, a YouTuber with 60.4 million subscribers, in cooperation with Binance.

The platform’s native token FINE will give power to their holders, the NFTs creators trading on Refinable. For example, FINE holders can increase the royalties and distribution of an asset and participate in the governance model.

Davis’ second project, Smoothy Finance (SMTY) is also doing some “serious stuff”. Users can leverage their swap feature with 0 slippages to trade different dollar-pegged coins. Davis added:

(…) this is the infrastructure that actually allows DeFi to work in a smooth fashion for people. It allows it to be a good user experience where you’re not getting crushed on fees, you’re not getting crushed on slippage and so this kind of product actually allows users to have that nice user experience.

Binance native token BNB is trading at $500 moving sideways in the daily chart. In the weekly and monthly chart, BNB has a 3.1% loss and a 113% gain in respectively.

Ethereum is not getting flipped by Binance Smart Chain anytime sooner, shows on-chain indicators.

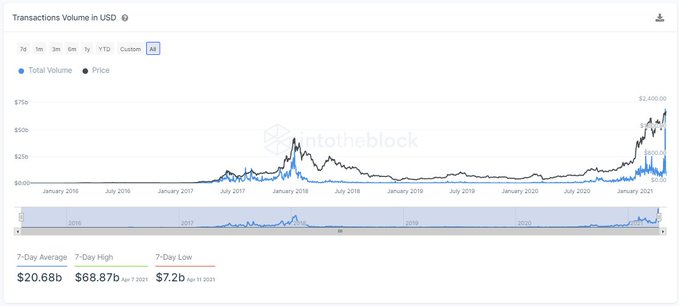

Blockchain analytics platform IntoTheBlock gathered data on Ethereum transactions with volumes greater than $100,000. The portal noted that the second-largest blockchain network processed $20.68 billion worth of transactions in the week ending April 11, leading to a record high volume transfer of $68.87 billion.

“These large transactions are representing over 77% of the daily on-chain volume,” it added.

Increasing volumes on a blockchain point to its growth as a public ledger. Meanwhile, transactions carrying a larger capital points to transfers between wealthy entities. They could be exchanges, wallet services, and even institutional investors.

The last few weeks have witnessed Ethereum walking out of the shadows of Bitcoin as an alternative cryptocurrency and creating a niche of its own among institutional entities. The biggest example among all was Visa’s first stablecoin transaction via USDC, a token built atop the Ethereum blockchain.

A report published by CoinShares also noted that ETH-based investment products attracted $4.2 billion worth of capital inflows in the first quarter. Meanwhile, Grayscale Investments, a New York-based crypto-focused investment firm, increased its Ethereum holdings from 2.94 million ETH at the start of this year to 3.17 million ETH this April 12.

Market sentiment analytics portal Santiment noted that increasing demand from “whales” — entities that hold a larger amount of cryptocurrency wealth — led to a supply crisis in Ethereum markets. Now, wealthy investors hold 68 percent of the total ETH supply in circulation. On the other hand, the number of Ethereum wallets holding anywhere between 10-10,000 ETH dropped to its lowest since September 2017.

Santiment also noted constant ETH inflows into the liquidity pools of decentralized finance projects. It also noted declines in the amount of Ethereum tokens sitting inside exchange wallets. It pointed at a brewing supply crisis in the Ethereum market while its prices achieve a new historic high above $2,000.

“Another aspect that contributed to Ethereum‘s all-time this weekend was the fact that average fees have dropped back to a 5-week low,” added Santiment. “With fees back to an average of $11.08, this is the lowest since March 5th, allowing for an increased ETH utility.”

Some bottleneck catalysts continue to pressure Ethereum lower, such as the Binance Smart Chain’s increasing control over the blockchain space. Its native token BNB surged towards $650 on Monday, up more than 1,100 percent on a year-to-date timeframe.

Meanwhile, Ethereum’s extremely positive correlation with Bitcoin continues to pose risks to its decline under the top cryptocurrency’s influence. Bitcoin’s uptrend has paused near $60,000 against the prospect of a stronger US dollar.

Photo by Nick Chong on Unsplash

With Binance Chain’s 11 validators hand-selecting Binance Smart Chain’s validators daily, analysts are warning of the protocol’s centralization.

Multiple teams, protocols and chains mean 1inch is growing fast

Despite many leading Ethereum-powered DeFi protocols posting a weekly loss, the success of Binance Smart Chain is pushing the TVL of decentralized finance into new highs.