The stablecoin issuer is currently facing a lawsuit from the SEC in which the financial regulator claimed BUSD was an unregistered security.

Cryptocurrency Financial News

The stablecoin issuer is currently facing a lawsuit from the SEC in which the financial regulator claimed BUSD was an unregistered security.

Tether’s USDT has seen its market capitalization rebound to nearly $70 billion as the SEC ordered Paxos to stop issuing BUSD, the third-largest stablecoin.

Remember how the U.S. Securities and Exchange Commission’s declaration of war against crypto staking was big news for like two days? This week we’re looking at the other big news from last week: Paxos and the Binance USD stablecoin it issues. The SEC has apparently alleged the sale of BUSD violates securities laws, and the New York Department of Financial Services has asked Paxos to cease issuing the token.

A slew of technical, fundamental and on-chain indicators hint at more pain for BNB’s price in February.

The company’s complaint to the New York regulator reportedly came before the SEC’s lawsuit against Paxos over BUSD and NYDFS ordering the firm to “cease minting” the stablecoin.

A New York regulator ordered Paxos to stop issuing BUSD, the third-largest stablecoin by market cap.

According to people familiar with the matter, the notice relates to Binance USD, which is being seen by the SEC as an unregistered security.

Persistent worries about Binance’s solvency, increased regulation of the crypto sector and questionable use cases are chipping away at BUSD’s market capitalization.

The stablecoin market, in general, is going through hard times, though the algorithmic coins suffered the most.

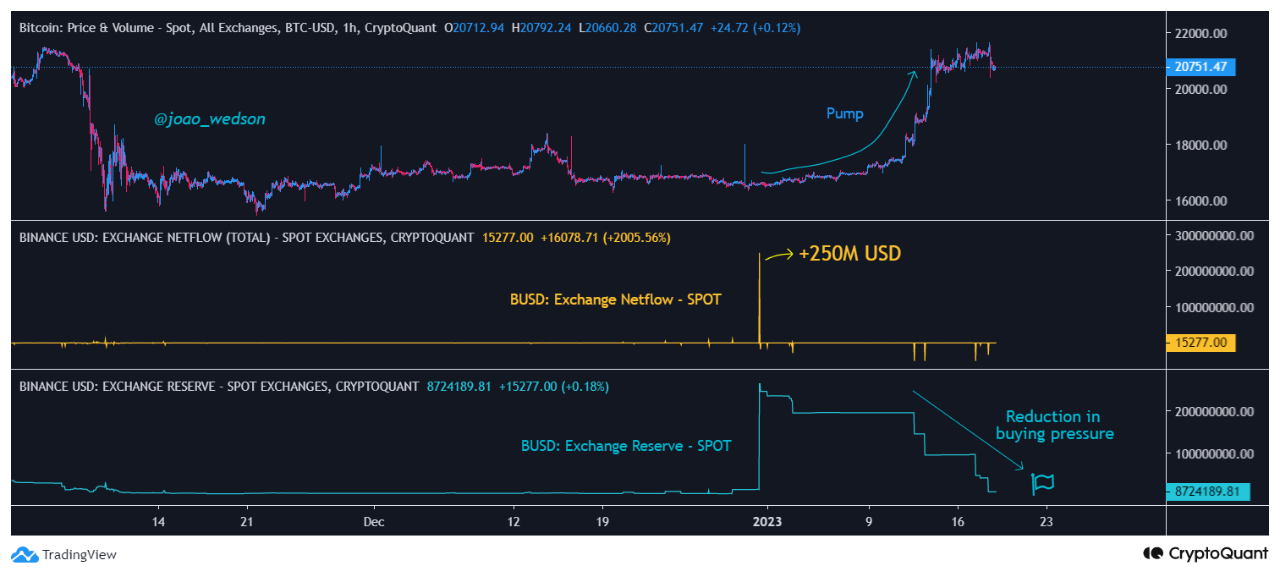

On-chain data shows the Binance USD (BUSD) exchange reserves have declined recently, a factor that may be behind Bitcoin’s slowdown.

As pointed out by an analyst in a CryptoQuant post, there was a very large inflow of $250 million BUSD just a while ago. The “exchange reserve” is an indicator that measures the total amount of a cryptocurrency (which, in the present case, is Binance USD) currently being stored on wallets of centralized exchanges.

Generally, investors swap their coins for stablecoins like BUSD when they want to avoid the volatility associated with other cryptocurrencies like Bitcoin. When these holders feel that prices are right to reenter the volatile markets, they shift their stables back into their desired coins. This can act as buying pressure for the specific crypto that they are swapping into.

Investors usually make use of exchanges to swap these coins, which means that whenever the exchange reserve of a stablecoin like BUSD rises, it presents the possibility that holders want to buy back into volatile cryptocurrencies. A large enough increase in the stablecoin reserve can result in a high amount of buying pressure for other coins, and can therefore have a bullish effect on their prices.

Now, here is a chart that shows the trend in the Binance USD exchange reserve (specifically for spot exchanges) over the past couple of months:

As you can see in the above graph, the Binance USD exchange reserve observed a rapid increase a while back. Since then, however, the metric has been steadily declining and has hit significantly lower values now.

But from the chart, it’s apparent that while the BUSD reserve was coming down from high values, Bitcoin had been rallying instead. This means that holders might have been actively swapping the stablecoin for BTC, thus providing a boost to its price.

The graph also displays data for a metric called the “exchange netflow,” which tells us the net number of coins entering or exiting exchange wallets. When this metric has a positive value, it means investors are depositing a net amount of the asset to exchanges currently, while negative values suggest net withdrawals are taking place.

A while ago, there was a huge positive spike in the Binance USD exchange netflow of around $250 million (which is what caused the reserve to blow up). This inflow may have been what helped the recent BTC rally.

However, since then, there have only been outflows, which have taken the reserve back to the same level as before this $250 million spike. This suggests that buying pressure from this inflow has now dried up, which could be one of the factors responsible for the latest slowdown in Bitcoin’s rally.

At the time of writing, Bitcoin is trading around $20,700, up 14% in the last week.

An estimated $148.7 billion worth of stablecoins are still in circulation.

On CoinMarketCap, XRP has risen to sixth place as of today, July 20, with a market value of $17.63 billion. Being able to exceed not just Binance USD but also Cardano and Solana is a noteworthy accomplishment for Ripple’s native currency.

Ripple’s native token, XRP, provides a means of payment settlement between banks and digital assets exchanges. It decreases the number of extra steps needed when transferring money internationally, which leads to lower fees.

Related Reading | Solana And Avalanche Poised For Gains As Crypto Market Enjoys New Tailwinds

However, by breaking through significant resistance, XRP overtakes Binance USD’s market cap and gains the upper hand by 8%. The primary factor contributing to XRP’s placement in sixth place is the coin’s weekly price increase of more than 21%.

There is much more to be done for the battle between Binance USD and Ripple. However, both are still trying very hard to make headway which, under the right conditions, could lead to them taking fifth or fourth place- or even third and second place- in addition to keeping their original standings of sixth and seventh.

Following news updates on the SEC v. Ripple lawsuit, the more optimistic investor attitude led to an increase in the coin’s price. Fans and developers of Ripple are now closely following the U.S. SEC’s continuing lawsuit against the business, which appears to be interesting, according to the most recent news.

XRP is currently trading at $0.36 on the daily chart | Source: XRPUSDT from Tradingview.com

Analysis Of Ripple (XRP) Struggles to Regain its Value

In terms of the lifespan of cryptocurrency, Ripple is one of the longest. When it was first introduced in 2012, it frequently traded for less than $0.10. However, when the crypto market experienced a boom in late 2017 and early 2018. XRP was one of them which gained much from this boom and recorded its all-time high on January 4, 2018, at $3.84.

The coin soon started to decline, and by the end of 2018, it was only worth $0.50. By then, XRP’s value continued to decline. The coin was in the early stages of a bull run that ended on April 14, 2021, when it touched an average high of $1.96.

Since the beginning of September 2021, the sixth-largest coin has struggled, dropping more than half of its value, while dozens of other cryptocurrencies have collapsed in this period.

The situation worsened in January 2022 when a sluggish cryptocurrency market caused XRP to end the month at $0.6191. Following that, it fell even further, reaching $0.345 on May 12 due to the market turbulence caused by the de-pegging of the TerraUSD stablecoin and the demise of LUNA.

Related Reading | Why Bitcoin Must Beat $25,500 To Establish A Bull Rally

It was valued at about $0.40 on June 10. Following that, the cancellation of withdrawals by the cryptocurrency lending firm Celsius confirmed that the cryptocurrency market is in a bear market, and on June 18, it dropped to $0.2906.

However, it has already bounced back from its June low and is presently trading at $0.366650, up 12.6% in 14 days. In addition, the Finder’s panel forecasts that the price of Ripple (XRP) will increase by almost 260 % in 2022 and reach $2.55 this year at the end of December.

Featured image from Flickr, chart from Tradingview.com

While Tether’s dominance has fallen to 56%, USDC and BUSD have surged to 23.9% and 10.4% respectively.

Ethereum’s transaction counts have surged by 72% since mid-February

Binance USD, a U.S. dollar-backed stablecoin, has surpassed $100 million in market capitalization, chipping away at a market still dominated by Tether’s TUSD.