This week, The Market Report discusses Bitcoin’s recent price action and the upcoming FOMC meeting, where some speculate interest rates might be paused.

Cryptocurrency Financial News

This week, The Market Report discusses Bitcoin’s recent price action and the upcoming FOMC meeting, where some speculate interest rates might be paused.

“It is more than likely that BAM still doesn’t understand what Ceffu is,” the SEC stated after trying to untangle the web of relationships between entities.

As legal challenges against Binance mount, the average spot BTC trading volume on the platform has decreased 57% since Sep. 1

Binance.US previously told a DC court it used custody software offered by Binance’s international arm that was later rebranded Ceffu.

Binance’s staked ether token (BETH) experienced $573 million in deposits across two single days in September, more than quadrupling total value locked to $731 million, DefiLlama data show.

A U.S. judge declined to order Binance.US to make its executives more available for depositions, or for the U.S. Securities and Exchange Commission (SEC) to back down in its demands for more documents during a hearing Monday.

The legal struggle between the SEC and Binance.US continues, with the company hitting new lows in trading volume.

As regulators prepare to square off with one of the world’s biggest crypto exchanges in court, Ceffu has denied any ties to Binance or U.S. operations. The reality is murkier.

Bitcoin and select altcoins are attempting to make a comeback as traders expect the Fed to hold rates steady during its meeting this week.

The securities regulator claims that “Ceffu” is a Binance entity and not merely a digital asset wallet provider.

The regulator asked a U.S. court to reject Binance’s “half-hearted” objections to its motion seeking depositions, an inspection and communication from the exchange.

On Sep. 16, exchange volume stood at $5.09 million on Binance.US amidst executive departures and ongoing regulatory scrutiny.

Despite Brian Shroder resigning as CEO of the exchange’s US wing amid SEC and CFTC lawsuits, Binance CEO Changpeng Zhao claimed that the departure was normal.

Binance crypto exchange announced in late August that it is moving to end support for its beloved BUSD stablecoin. This move comes amid the stablecoin’s run-in with regulators, leading to a halt in its production. And now, the exchange has started moving to begin the end of support for the stablecoin.

Binance took to its official X (formerly Twitter) account on Thursday, September 14, to announce that it would begin burning a number of Binance-pegged tokens. Among the five tokens listed to be burned, four were BUSD tokens across different blockchains.

According to the announcement, the Binance-pegged tokens would be burned on the listed blockchains, and then the exchange would release the equivalent amount of tokens that were initially used as collateral on their native networks.

Later today, #Binance will burn a number of idle Binance-pegged tokens.

The equivalent amount of tokens on their native networks, which were used as collateral, will then be released.

Tokens:

TUSDOLD (BSC)

BUSD (MATIC)

BUSD (BSC)

BUSD (BNB)

BUSD (TRX)

— Binance (@binance) September 14, 2023

The BUSD tokens listed across four networks include BUSD on the Polygon (MATIC) network, BUSD on the Tron (TRX) network, BUSD on BSC, and BUSD (BNB). In addition to these, the exchange also revealed that the TUSDOLD on BSC would be burned as well, making it the only token on this list that is not BUSD.

The collateral in this case will be the equivalent of the Binance-pegged tokens that are burned. So if 1,000 BUSD on the MATIC network is burned, then the equivalent on the native blockchain will be released by the exchange.

The BUSD stablecoin first came under fire in early 2023 when the United States Securities and Exchange Commission (SEC) issued a Wells Notice to issuer Paxos alleging that the stablecoin was an unregistered security. The regulator, through this, made its intention to pursue legal action known.

Following the move by the SEC, the New York State Department of Financial Services (NYDFS) asked the issuer to stop printing new tokens. The NYDFS’s concern mainly bordered on Paxos’ relationship with Binance, and eventually, the BUSD issuer decided to cut ties with the crypto exchange.

Since the initial move by regulators, the stablecoin has suffered in terms of usage and market cap. The stablecoin which was once a top 10 crypto by market cap has since seen its market cap decline to $2.5 billion, making it the 26-largest cryptocurrency as of the time of this writing.

Binance has also announced plans to stop offering support for the stablecoin completely by 2024. Paxos also revealed that it will cease all BUSD redemptions in February 2024, and Binance’s complete withdrawal is expected to come shortly after this.

Nevertheless, the stablecoin continues to maintain its dollar peg quite well. It is still trading at a 1:1 parity with the United States dollar and has rarely dipped below $1 amid the regulatory storm.

The documents filed Aug. 28 may be seen by the public in a week. They are not all the sealed documents in the case, however.

Network, futures and user data all point toward Ether potentially charting a new course.

SEC said in a court filing that Binance.US has produced only 220 documents during the discovery process many of which were “unintelligible screenshots and documents without dates or signatures.”

Securities regulators have complained the exchange is unregistered, and worry about assets being shifted overseas.

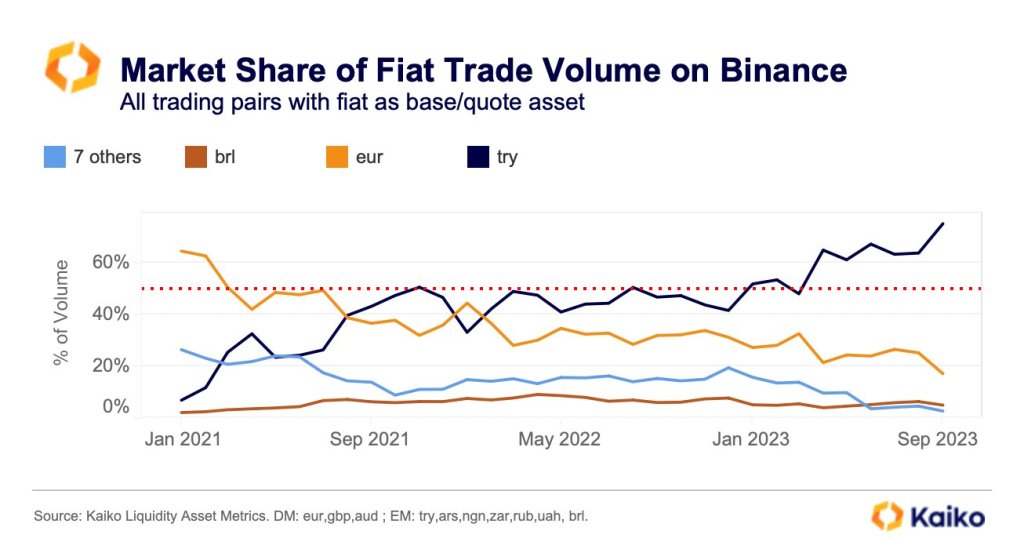

75% of all fiat volume in Binance, the largest cryptocurrency exchange by client count, is dominated by the Turkish Lira (TRY). At this rate, Kaiko, a blockchain analytics firm, confirms that the Turkish Lira is the most preferred currency, pointing to a shift in the global dynamics, especially regarding crypto adoption.

As of September 14, 75% of all fiat volume was in Turkish Lira, ahead of the Euro and Brazilian Real (BRL). In the past three years, an unidentified cryptocurrency has gained popularity over traditional fiat currencies.

From 2021, TRY’s use was among the lowest, with the Euro and BRL being popular. However, the trend changed in 2022 as adoption spiked, pushing the currency to the top in 2023.

When writing on September 14, Binance remains the most popular cryptocurrency exchange, supporting over 380 coins. At the same time, the crypto exchange supports over ten fiat currencies, of which other coins, besides those mentioned above, include the Nigerian Naira, GBP, and the Australian Dollar (AUD).

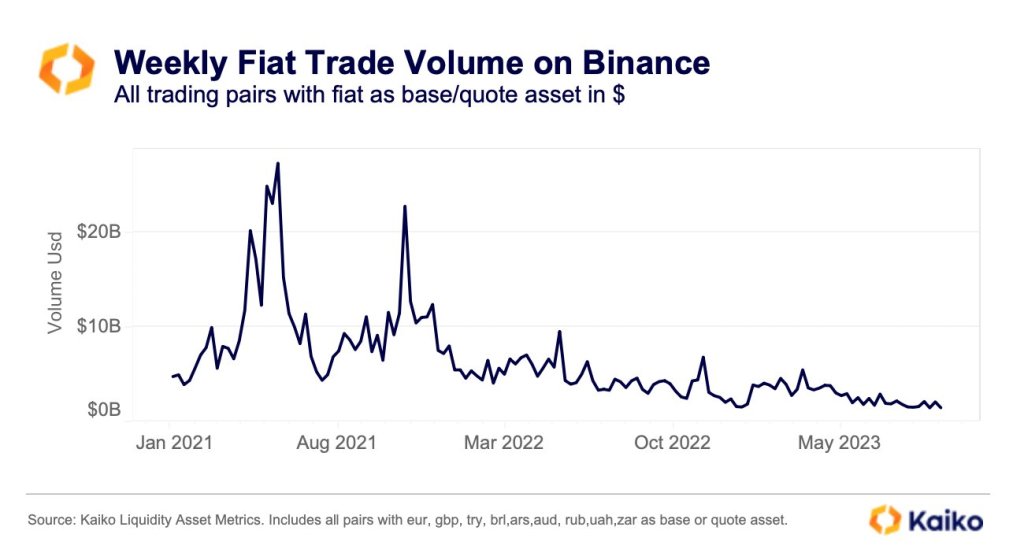

Looking at statistics, USDT, TUSD, and FUSD pairs are among the most liquid. This observation has been confirmed by Kaiko data, which shows that fiat trading on Binance had contracted by over 95% from 2021 when prices of top crypto assets peaked. By November 2021, Bitcoin prices had soared to nearly $70,000, lifting trading volumes in fiat and stablecoin pairs.

CoinMarketCap data reveals that the BTC/USDT pair is the most liquid, with the average daily trading volume exceeding $986 million when writing. On the other hand, the BTC/TUSD attracts over $486 million in trading volume.

This development highlights the level of liquidity of stablecoins and how they are entrenched in crypto trading. For example, the processing of fiat deposits or withdrawals on Binance can range from hours to days, depending on the method used.

Unlike fiat currencies, stablecoins are more fluid and can be transferred within seconds. For instance, USDT, the world’s largest stablecoin by market cap, is available in over five blockchains, with Ethereum and Tron emerging as the most popular minting platforms.

Following the delisting of USDC, BUSD volumes spiked. However, the New York Department of Financial Services (NYDFS) directive, barring Paxos–the then issuer–from minting new tokens, saw activity shrink as USDT cemented its position. TUSD and FUSD activity on Binance remains high, as data shows.

A recent survey by KuCoin, a crypto exchange, reveals that over 50% of people in Turkey own crypto. The Turkish government has also been experimenting with a central bank digital currency (CBC), the Digital Lira.

The Binance.US head of legal and chief risk officer have reportedly left the exchange while it faces an SEC suit.