An analyst has explained why the recent high in Bitcoin has experienced different market conditions than those observed during the 2021 bull run peak.

Bitcoin Liquidations Have Been Short-Dominated In Recent Market High

In a new post on X, on-chain analyst Checkmate pointed out how the latest 2024 high achieved following the spot exchange-traded fund (ETF) inflows has a major difference when compared to the 2021 peak.

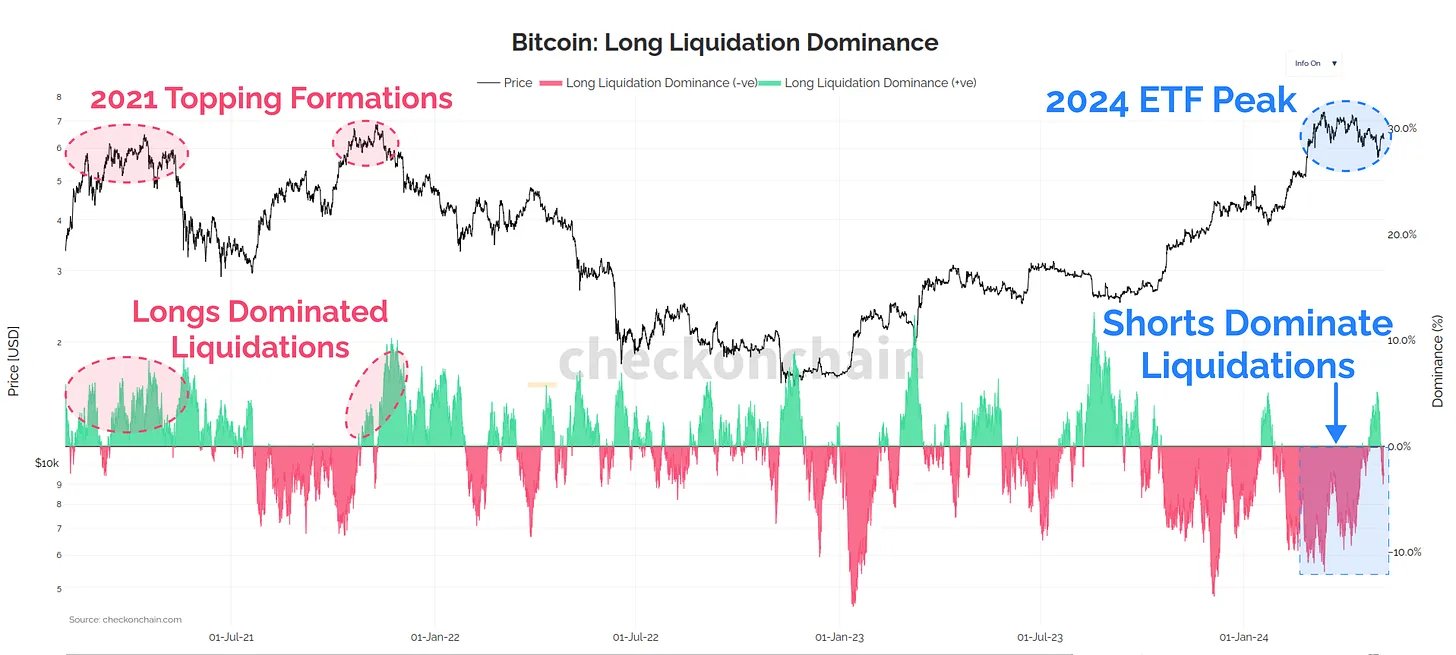

The difference lies in the trend registered on derivatives markets. Below is the chart shared by the analyst that shows the trend in the dominance of long liquidations in the sector over the last few years.

“Liquidation” here naturally refers to the act of forceful closure that any derivatives market contract undergoes on an exchange when it accumulates losses of a certain degree.

The risk of a contract getting liquidated becomes higher, and the more volatile the asset price gets. During sharp rallies and crashes, huge amounts of liquidation can pile up in the market.

From the chart, it’s visible that as the rally in the cryptocurrency had occurred this year, the short holders had been taking a beating. This was only natural as surges pile up losses for these investors betting on a decline, so price growth as rapid as the one witnessed would have pushed many of these contracts toward liquidation.

Interestingly, the scale of the short dominance maintained throughout the run, implying that the investors didn’t quite believe the run would continue any further at every point of the rally, so they bet against it.

This has also remained true in the recent stagnation following the top, as short liquidations have outweighed the long ones even though the price has decreased.

As is apparent in the graph, the 2021 peaks saw a different trend. Longs were getting liquidated as Bitcoin topped out during both the first half of the 2021 peak and the second half.

In those periods, the investors had become too greedy and were only betting on the rise to continue even when the asset had slowed down. This greed appears to haven’t overtaken the market in the bull run.

While the current Bitcoin rally differs from the last one in this metric, analyst Maartunn has pointed out in an X post another indicator where the trend appears to be similar to that observed in previous peaks.

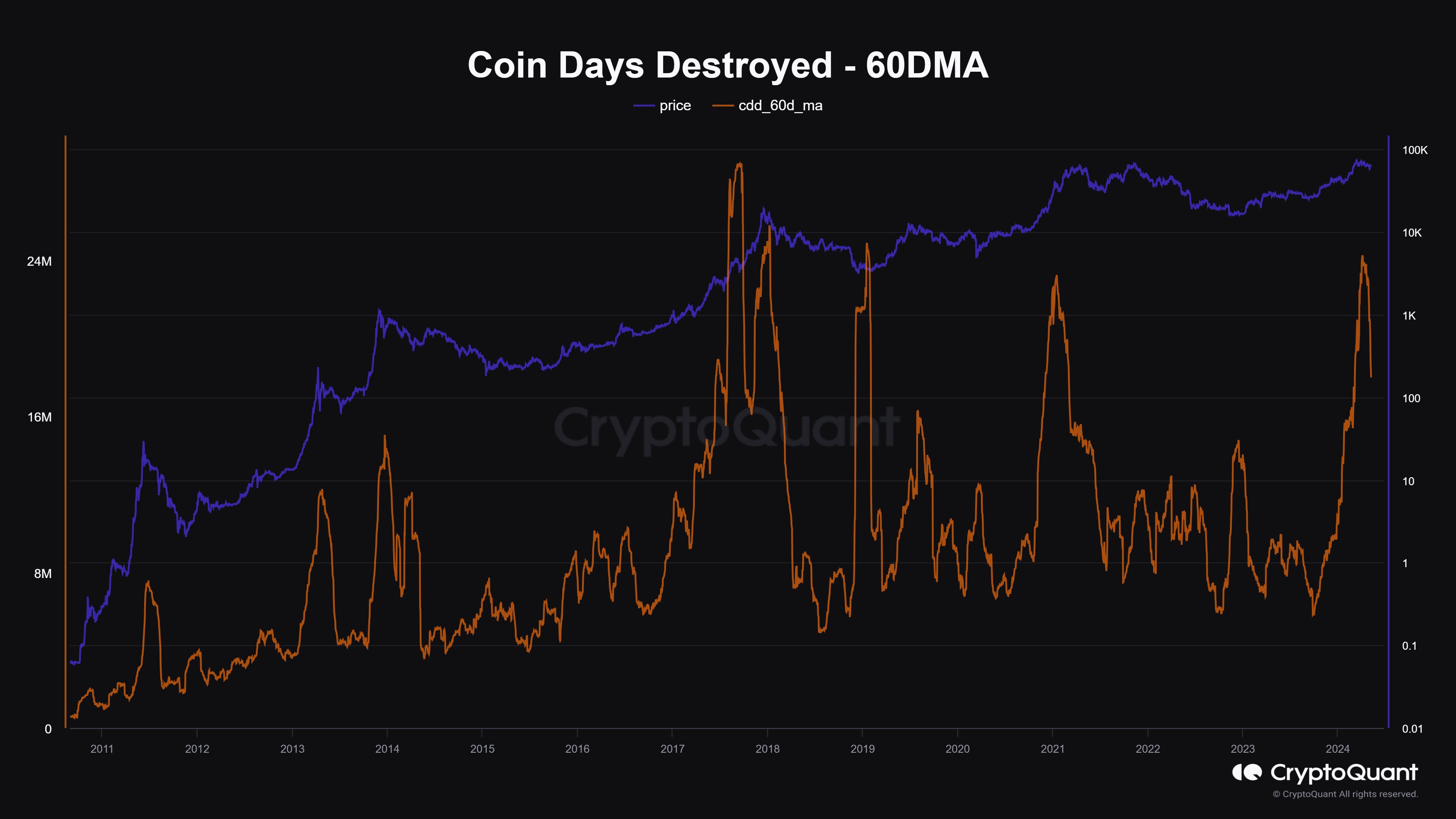

This indicator is the Coin Days Destroyed (CDD), which basically tells us about the scale of dormant coin movement that’s happening in the market right now. It would appear that this metric had attained very high levels recently.

“Coin Days Destroyed has probably peaked,” says Maartunn. “Bitcoin’s price typically reaches its peak around the same time.” It should be noted that although this has been true for some of the tops, the 2021 peak took months to form after the metric peaked.

BTC Price

At the time of writing, Bitcoin is floating around $62,200, up more than 5% over the past week.