On-chain data suggests demand for Bitcoin remains significant as newcomer whales in the sector have been scooping up 200,000 BTC every week.

Short-Term Holder Bitcoin Whales Have Continued To Accumulate Recently

As explained by CryptoQuant author Axel Adler Jr in a post on X, the demand among the short-term holder whales has decreased since the all-time high, although it still continues to remain strong.

The “short-term holders” (STHs) refer to the Bitcoin investors who have been holding onto their coins since less than 155 days ago. This cohort includes the new investors in the market, as well as the fickle-minded traders who make moves often and don’t tend to HODL.

The investors who make it past the 155-day threshold are put inside the “long-term holders” (LTHs), which is a group that’s generally considered to reflect the resolute side of the sector.

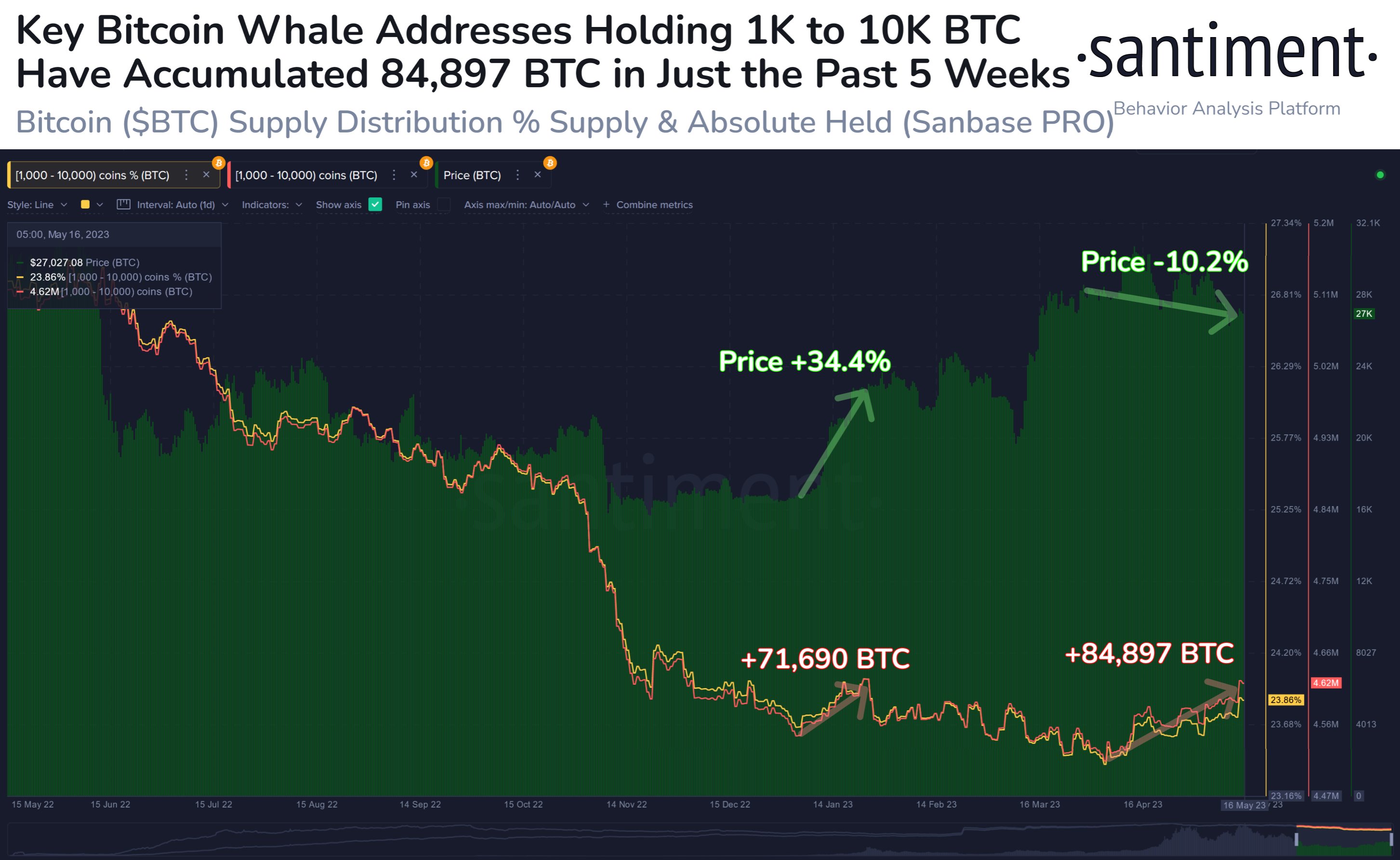

In the context of the current discussion, the investors of interest aren’t the ordinary STHs, but rather the humongous entities called whales. Formally, these investors are defined as those holding more than 1,000 BTC in their wallets.

At the current exchange rate, this lower limit is worth $61.5 million, which is massive indeed. Whales can be influential beings on the network because of these large holdings, so their behavior can be something worth keeping an eye on.

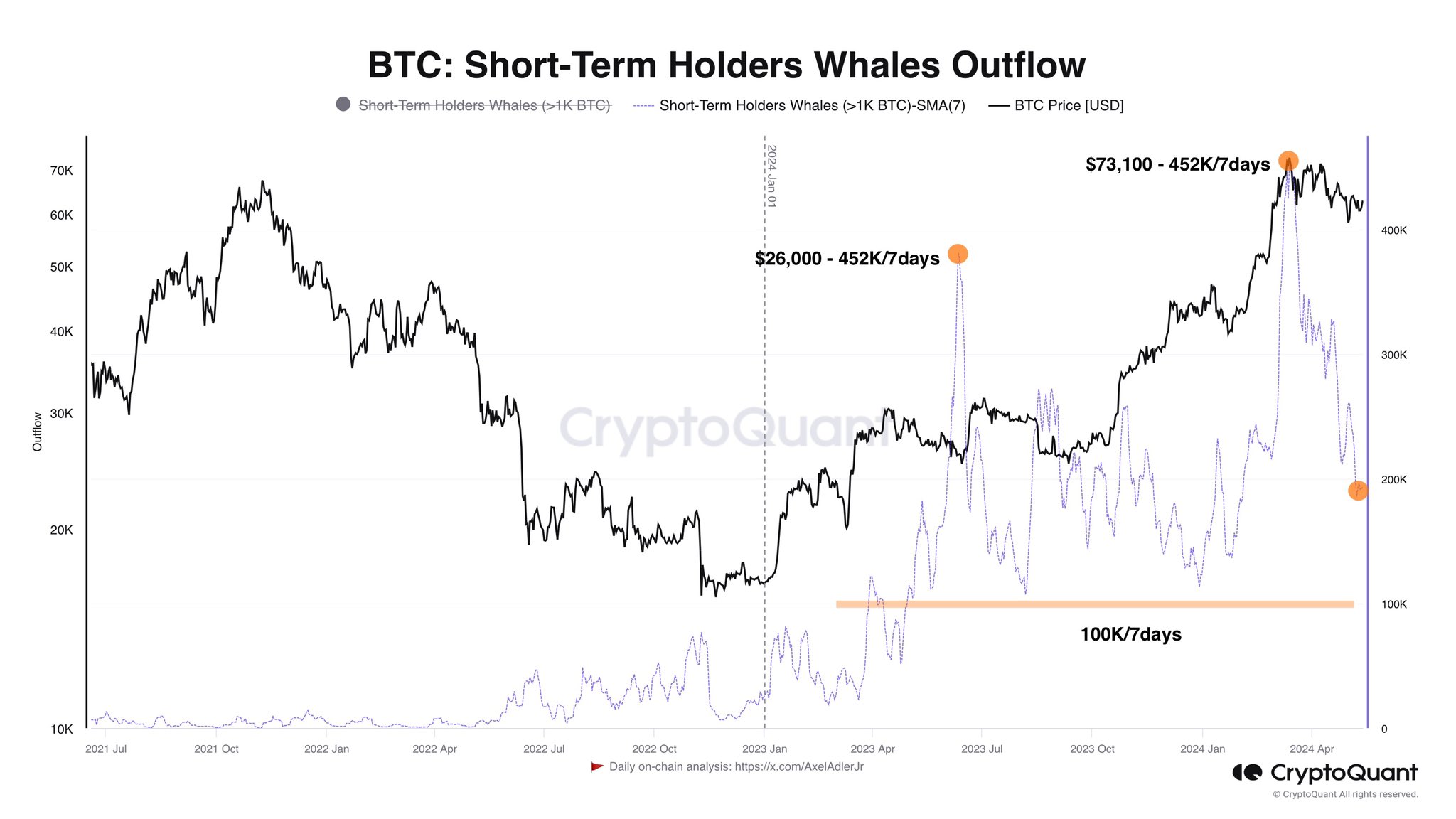

The STH whales would naturally correspond to the large holders who only bought within the past five months. Here is a chart that shows the trend in the exchange outflows being made by these new whales in the Bitcoin market over the last few years:

As displayed in the above graph, the 7-day simple moving average (SMA) of the Bitcoin STH whale exchange outflows had spiked to pretty high levels earlier in the year, when the rally towards the new all-time high (ATH) price had taken place.

Naturally, this spike would suggest demand for buying the cryptocurrency was high from new whale investors entering the space. At the peak, the indicator implied accumulation was occurring at the rate of a whopping 452,000 BTC per week.

A part of this buying would correspond to the demand coming in from the spot exchange-traded funds (ETFs) – new investment vehicles for Bitcoin only approved at the start of this year that provide for an indirect way to invest into the asset in a format that may be preferrable for the more traditional investors.

From the chart, it’s visible that the demand from the new whales has seen a clear decline in the period since the ATH, but accumulation nonetheless remains substantial as the STH whales are still potentially buying at a rate of around 200,000 BTC per week.

BTC Price

Bitcoin has continued to be stagnant recently as its price is trading around $61,600 right now, still very much inside the range.

The number of #Bitcoin addresses has been increasing since the #RussianUkrainianWar began. Since then, there are 1,629 shark and whale addresses holding between 10 to 100k that are either new or have returned to this millionaire (or above) status.

The number of #Bitcoin addresses has been increasing since the #RussianUkrainianWar began. Since then, there are 1,629 shark and whale addresses holding between 10 to 100k that are either new or have returned to this millionaire (or above) status.  https://t.co/08ytC3aMhW pic.twitter.com/9Ts70gdfHJ

https://t.co/08ytC3aMhW pic.twitter.com/9Ts70gdfHJ