Here’s what the Bitcoin network fundamentals have to say regarding whether the cryptocurrency could see a bull run soon or not.

Monthly Average Bitcoin New Addresses Have Shot Up Recently

In a new post on X, analyst Ali discussed the possibility of a bull run starting soon for the cryptocurrency. According to the analyst, “a bull run is often characterized by increased on-chain activity.”

To measure the activity, Ali has used the “new addresses” metric, which keeps track of the total number of new addresses coming online on the Bitcoin blockchain every day.

When the value of this metric is high, it means that many users have joined the network during the past day. This could suggest that the cryptocurrency is observing high adoption right now.

On the other hand, low values imply not many newcomers are currently attracted to the blockchain, potentially a sign of a lack of interest in the market around the coin.

Now, here is a chart that shows the trend in the Bitcoin new addresses, as well as the 30-day and 365-day simple moving averages (SMAs) of the indicator over the past few years:

The increased activity, which may be associated with a bull run, can be “spotted when the monthly average of new wallets (red) surpasses the yearly average (blue), which indicates strengthened network fundamentals and increased use,” as explained by the analyst.

The graph shows that the 30-day SMA of the Bitcoin new addresses had been under the 365-day SMA during the bear market, but with the rally this year, the former had managed to break above the latter.

The reverse cross had happened during the slowdown in May-June, but as the subsequent rebound in the price had occurred, the monthly average new addresses had broken back above the yearly average, and it has since stayed there.

Recently, despite the struggle in the price, the 30-day SMA of the metric has only continued to rise sharply. This could naturally be a constructive sign for the asset, and going by historical precedence, it may even mean a return toward bullish momentum.

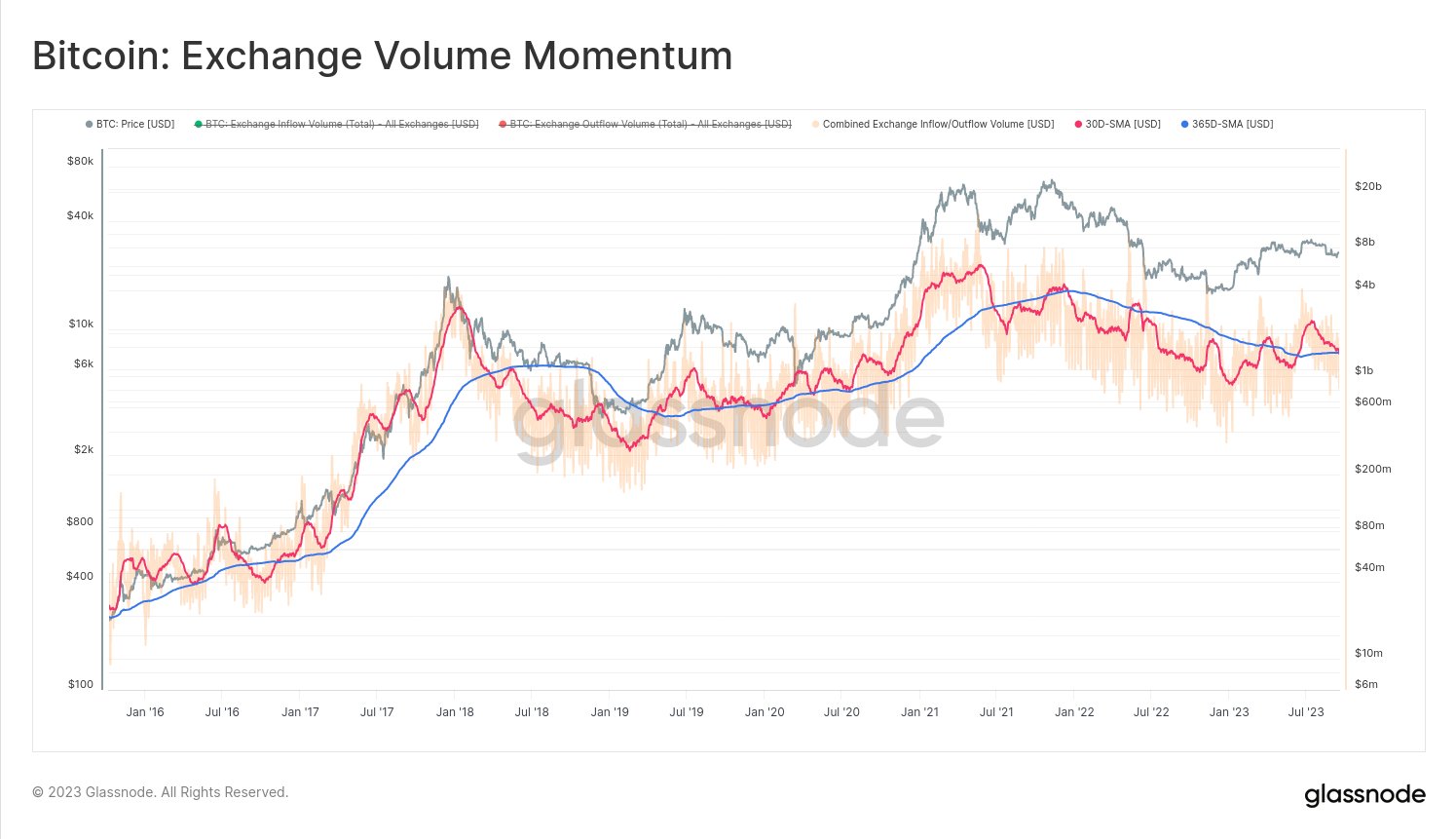

The lead on-chain analyst at Glassnode, @_Checkmatey_, however, has replied to Ali’s post, saying, “with the advent of ordinals, it is always a great idea to pair ‘addresses,’ and ‘transactions’ metrics with ‘volume’ metrics.”

“Ordinals” here refer to inscribing data directly into the Bitcoin blockchain. They are utilized in various applications, including making non-fungible tokens (NFTs) on the network.

Such chain applications can skew the address-related metrics, as new ones may be created solely for using the blockchain in this way and not for actually trading the coin itself.

The Glassnode lead explains that they assign a slightly higher weight towards the volume metrics because the Ordinals-related transactions don’t involve much volume.

Unlike the new addresses metric, the bullish pattern isn’t yet forming for the exchange volume (which includes both inflows and outflows). This would suggest that the activity on the network may not be at a bull run stage right now.

BTC Price

At the time of writing, Bitcoin is trading at around $27,000, up 3% over the past week.

#Bitcoin's daily active addresses hit 1.02m on Thursday, the third day in a row with 1m+ $BTC addresses interacting on the network. The last time this threshold was consistently above 1m for 3 straight days was December 1-3, when prices were $56k-$57k. https://t.co/49eVEHz9QN pic.twitter.com/wHvgMtDKzq

#Bitcoin's daily active addresses hit 1.02m on Thursday, the third day in a row with 1m+ $BTC addresses interacting on the network. The last time this threshold was consistently above 1m for 3 straight days was December 1-3, when prices were $56k-$57k. https://t.co/49eVEHz9QN pic.twitter.com/wHvgMtDKzq