BRC-20 tokens open doors for developers to build their own decentralized applications (dApps) with unique economies on the Bitcoin network. This fosters community engagement through internal currencies, and attracting investment through innovative token sale structures.

BRC-20 tokens are fungible tokens built on the Bitcoin network using the Ordinals protocol. It also utilizes inscriptions containing JSON (JavaScript Object Notation) data to facilitate the deployment of token contracts, minting tokens, and transferring tokens. Presently, the BRC-20 token standard offers the ability to create a BRC-20 token using the deploy function, mint a specified quantity of BRC-20 tokens using the mint function, and transfer a designated amount of BRC-20 tokens through the transfer function.

BRC-20 and ERC-20 share some similar characteristics and functional concepts, but they are not identical due to their different underlying blockchains and implementation details. One of the differences is that BRC-20 tokens operate on the Bitcoin blockchain, while ERC-20 tokens reside on the Ethereum blockchain. This leads to differences in technical implementations and transaction fees.

Related Reading: How To Buy And Trade BRC-20 Tokens On The Bitcoin Network

Similar to ERC-20 tokens, BRC-20 tokens are fungible, meaning they can be exchanged on a one-to-one basis with equal value. They can be created, transferred, and traded on the Bitcoin network using decentralized marketplaces like Magic Eden with compatible wallets and decentralized exchanges that support the BRC-20 standard.

BRC-20 tokens breathe vitality into the Bitcoin network, acting as programmable extensions that expand the scope beyond basic transfers. They empower the Bitcoin network by enabling the development of DApps, fostering communities, and facilitating ownership of real-world assets. This dynamic frontier presents exciting opportunities for engagement, incentives, and innovation.

However, it is essential to navigate the technical intricacies and embrace the evolving infrastructure. BRC-20 tokens, still a work in progress, possess tremendous potential to reshape the future of Bitcoin, unveiling a multitude of tokenized possibilities along the way.

Now, let’s dive into the exciting world of building your own BRC-20 tokens! As we discussed, platforms like Magic Eden offer a gateway to creating and trading these digital assets.

Creating BRC-20 Tokens On The Bitcoin Network

Creating BRC-20 tokens involves defining the token’s parameters, such as its name, symbol, and total supply, as well as any additional functionality you want to incorporate, such as token burning or minting restrictions. Once the smart contract is written, it needs to be compiled into bytecode and deployed onto the Bitcoin blockchain using the platform’s provided tools. This deployment process usually involves paying gas fees to execute the necessary transactions. Platforms like Magic Eden enable users to create their own BRC-20 Tokens.

First, visit the Magic Eden homepage, and click on “Connect Wallet” at the top right corner, as shown in the image below:

For the best wallets to use for BRC-20 tokens on the Bitcoin network, check here.

To initiate the creation of your BRC-20 token, it is essential to deploy it first. Adhere to the following instructions to proceed:

Next, click on the “Inscribe” button. (The Inscribe button pops up after you click on the “Mint” icon situated towards the top left of the screen).

Next, Click on the “BRC-20 ” tab at the top of the screen.

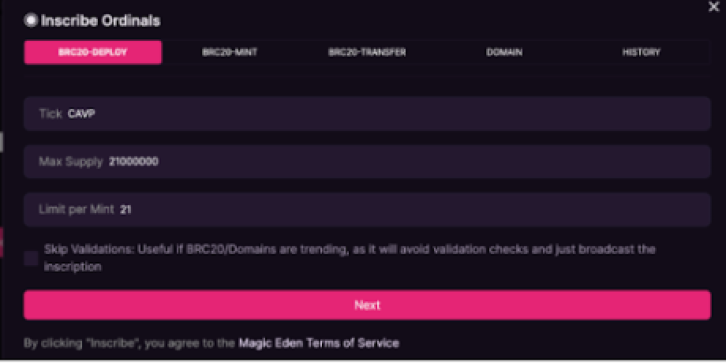

Then, follow these instructions:

Ticker: Select a four-letter phrase to serve as the unique identifier for your token. For instance, widely recognized BRC-20 tokens have utilized tickers like ORDI or OXBT. Establish the maximum quantity of tokens that will be available for minting. Specify the highest number of tokens that can be minted in a single transaction. Select the desired parameters and click on “Next”.

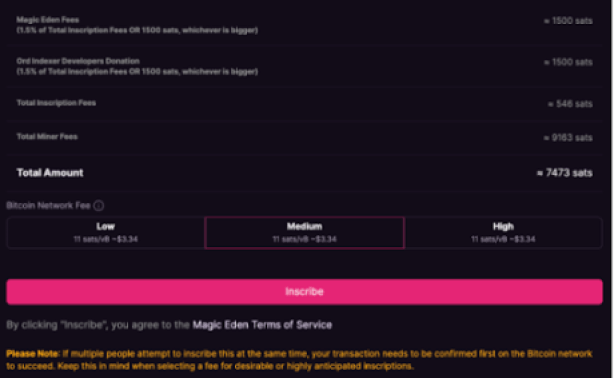

Choose the desired Bitcoin Network Fee from the options available, such as Low, Medium, or High. After making your selection, proceed by clicking the “Inscribe” button. (Ensure that the chosen ticker is not already deployed to avoid transaction failure. Magic Eden will automatically check this unless instructed otherwise).

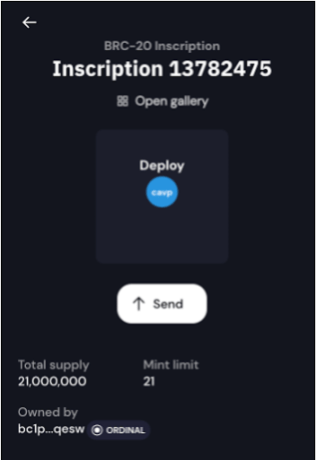

Now, wait for the transaction to be confirmed by the Bitcoin network. Confirmation times may vary.After the confirmation, check your wallet. Upon successful confirmation, you will receive a “Deploy” inscription, signifying that you can proceed to mint your tokens. The provided example illustrates a “Deploy” inscription within the Xverse wallet.

Minting Your BRC-20 Token

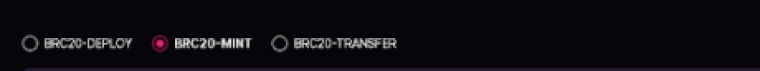

Having successfully deployed your BRC20 token, follow these instructions to mint it. Navigate back to the ‘Inscribe Ordinals’ modal located on the Magic Eden homepage. Within the modal, click on the “BRC-20 Mint” tab to proceed.

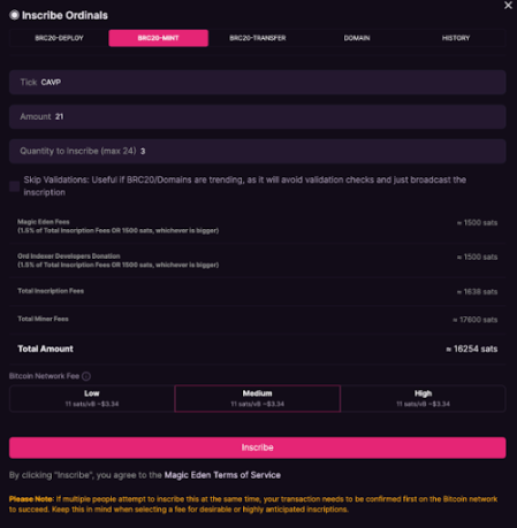

Enter the four-letter phrase that you deployed earlier, indicate the desired quantity of tokens you intend to mint, and specify the number of mint inscriptions you wish to generate.

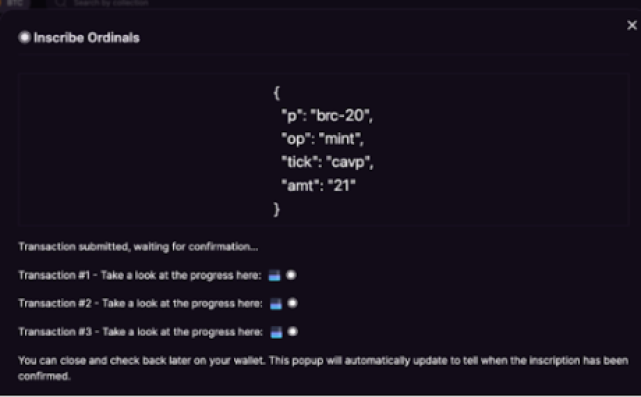

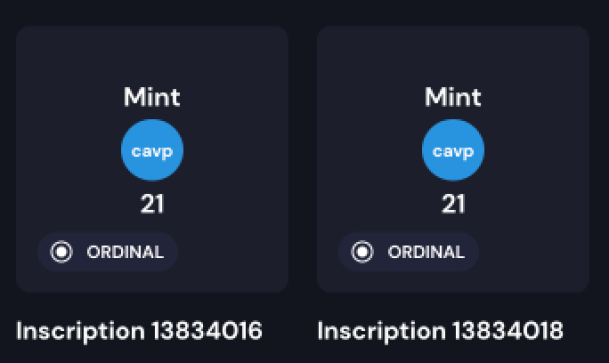

Note: The maximum number you can mint per transaction has to be the same with the value set in the “Limit per mint” during the deploy process. Now, click on the “Next” button and select the network fee. After selecting the desired fee rate, click the “Inscribe” button. In the following example, 63 BRC-20 tokens are being minted in three batches of 21 each.

A set of mint transaction links will be provided. Please note that confirming the mint transactions once again may take some time.

After confirmation, you will receive the mint inscriptions in your connected wallet.

Congratulations, you have successfully created your first BRC-20 Token!

Conclusion

BRC-20 tokens offer fungible tokenization capabilities within the Bitcoin network, enabling a range of applications and use cases. As the blockchain industry progresses, both NFTs and BRC-20 tokens assume crucial roles in shaping the trajectory of digital ownership and decentralized finance (DeFi).

BRC-20 tokens introduce fungible tokenization capabilities within the Bitcoin network, providing the ability to create and exchange interchangeable tokens. This opens up a wide array of possibilities for various applications and use cases within the blockchain industry. As the blockchain ecosystem continues to advance, both NFTs and BRC-20 tokens play pivotal roles in shaping the direction of digital ownership and decentralized finance, driving innovation, and paving the way for a more inclusive and decentralized financial landscape.