The fluctuations in Bitcoin’s price have marked the tempo of the crypto market and the community’s sentiment. While some feel pessimistic about the rally slowdown, some analysts believe the flagship cryptocurrency is just getting ready to reach higher notes.

Next Stop: Bitcoin’s “Parabolic Upside”

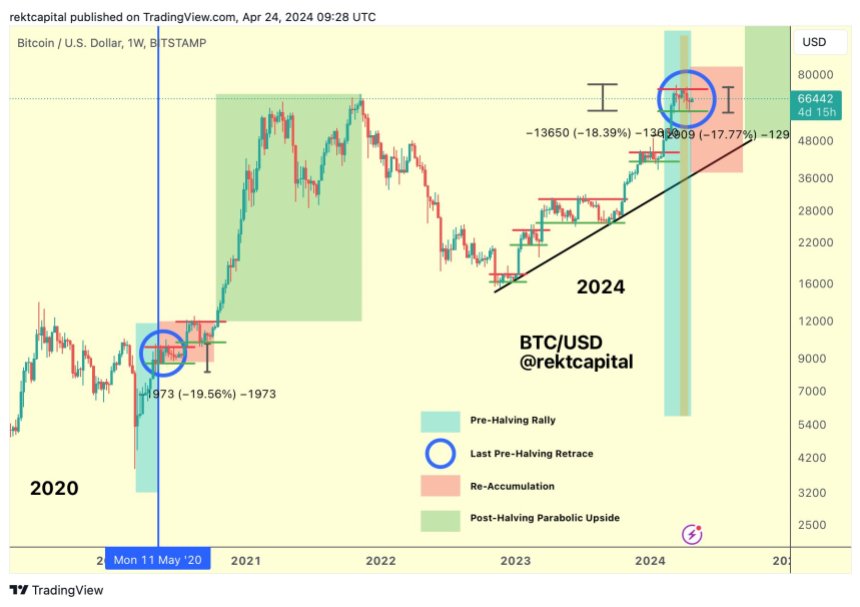

Crypto analyst and trader Rekt Capital considers Bitcoin (BTC) is currently awaiting a period of consolidation. In an X post, the trader highlighted that, during the previous “Halvings,” BTC saw “Re-Accumulation Ranges.”

The analyst shared his chart for Bitcoin phases during the “Halving,” which he has previously used to explain BTC was at the “Last Pre-Halving Retrace” before April 19.

At the time, the analyst pointed out that the re-accumulation phase was next. Bitcoin went through one during the previous “Halving,” as seen in the chart.

The re-accumulation consisted of two consolidation periods followed by the “Post-Halving Parabolic Upside,” which saw BTC reach last cycle’s all-time high (ATH) of $69,000.

Rekt Capital highlighted that, during this cycle, the flagship cryptocurrency has already experienced five re-accumulation ranges. Similarly to the last cycle, the latest re-accumulation phase seems to have started during the “Pre-Halving Rally” phase. Per the analyst, this will be followed by the “Parabolic Upside” if history repeats itself.

Analyst Mikybull seems to share a similar view to Rekt Capital’s, as he highlights that Bitcoin’s “parabolic rally is loading.” The re-accumulation breakout is set to be “explosive,” and “not many are prepared for this,” he added.

The analyst explained that “the RSI on a macro scale is at the same level as it was in 2017, which was followed by a huge rally to cycle top.” Based on this, he believes the current consolidation comes from institutions preparing “for a huge rally to cycle top.”

Analyst Sets Crucial Level For Bitcoin’s Breakout

A day before Bitcoin’s “Halving,” the cryptocurrency faced a correction that shredded 7% of its price in a few hours. BTC went from hovering between the $64,000-$63,000 price range to trading below the $60,000 support zone.

Since then, the largest cryptocurrency by market capitalization appears to have steadily recovered from the drop. Over the weekend, Bitcoin regained the $65,000 support level before testing the $66,000 one, which it reclaimed on Monday.

Over the last few days, BTC has hovered between $66,000 and $67,000. However, it has not been able to successfully test the resistance level set at the $67,000 price range.

According to the crypto analyst Bluntz, Bitcoin’s most recent performance suggests that the price will continue to move sideways between the $66,000 and the $67,000 range.

However, he also considers that BTC is “gagging for a breakout soon,” as the chart displays a bullish pennant pattern forming. Per the analyst, “once we clear 67k,” the whole market will fly above the latest ATH.

As of this writing, Bitcoin is trading at $66,665, a 7.5% increase from a week ago and a 66.22% in the last three months.