The bitcoin cash-Korean won (BCH/KRW) pair listed on Upbit has registered a trading volume of $557.63 million in the past 24 hours. That’s nearly 3.5 times

Bitcoin Cash Sees Largest Bets in 2 Years as BCH Doubles in a Week

Technical improvements and a listing on EDX Markets have likely fueled trading interest in bitcoin cash tokens.

Bitcoin Cash Price Jumps to One-Year High Fueled by Spiking Social Interest, Exchange Support

With today’s 17% gain, the BCH has now more than doubled in the week since it was listed on EDX Markets, a new crypto exchange backed by financial heavyweights.

Bitcoin Cash Prices Spikes to Four-Month High; Open Interest Rises to 77%

Bitcoin Cash (BCH) has surged by 36.5% in the past three-days after EDX, the exchange backed by Fidelity, Schwab and Citadel, listed it alongside bitcoin (BTC), ether (ETH) and litecoin (LTC).

Bitcoin Cash Prices Bump Ahead of ‘CashTokens’ Upgrade

The upgrade is set to go live on mainnet at noon UTC on Monday.

Bitcoin Cash Rises 11% but Gains Could Be Short-Lived

The token was up 11% on the day, but analysts think the cryptocurrency will not be able to sustain its gains.

PayPal’s crypto holdings increased by 56% in Q1 2023 to nearly $1B

The lion’s share of the fintech’s held cryptocurrency assets lies in BTC and ETH with $499 million and $362 million, respectively — up more than 56% since Q4 2022.

Bitcoin vs Ethereum: Community split between capped supply and deflationary model

Bitcoin proponents argued that Ether’s monetary policy has changed at least seven times while BTC has seen zero changes.

Bitcoin Cash Closes 2022 With A Year-Low – Will 2023 Be Better?

It is no surprise for Bitcoin Cash to perform this poorly when the entire crypto market fell deeper in the bear market due to various negative factors, including the much-publicized collapse of crypto exchange FTX.

According to CoinGecko, the token is down a further 1.4% in the past 24 hours. This doesn’t bode well as major cryptocurrencies like Bitcoin and Ethereum have started 2023 very weakly as well.

Bitcoin Cash And Bitcoin Connections

Since Bitcoin Cash is a fork of Bitcoin, BCH will have a strong correlation to BTC most of the time. To have a glimpse of where BCH will go, a look at what crypto analysts think of Bitcoin will provide strong insights on what the future for BCH will look like.

CryptoQuant analyst Dan Lim recently released his take on the current state of affairs in Bitcoin. He noticed that the top crypto is being dictated by a small number of whales. However, his analysis is contradicted by recent news that BTC is actually being accumulated by whales.

This might mean that Dan Lim’s analysis points to retail investor activity or a mix of both retail and whale activity.

What if this is the beginning of 3 bullish years for #BTC?$BTC #Crypto #Bitcoin pic.twitter.com/OtuOFLUftE

— Rekt Capital (@rektcapital) January 1, 2023

2023: Year Of Reversals?

With institutional investors slowly edging their way to the market, an uptick in Bitcoin will translate to gains in BCH as the two are closely correlated. However, some major financial institutions have been lost on the idea of cryptocurrency as a portfolio diversifier due to the many controversies that plagued the crypto market.

If Rekt Capital’s hypothesis, which essentially says that 2023 will be the accumulation period before the potential 2024 crypto bull market, is true, gains will be up for the entire crypto market, especially Bitcoin Cash.

However, with the broader financial market having its worst year since the 2008 crisis, we can set 2023 to be a slow but steady phase of loss and gradual gain in the next few months.

In the short term, potential BCH investors and traders could hope that the current support at $96.18 will hold. But with potential downturns caused by further interest rate increases, we might see BCH bears test the $89.17 in the coming weeks.

With the start of another fiscal year, BCH investors and traders should watch out for macroeconomic developments as it also holds sway on the crypto market. Caution should still be exercised as the future is still uncertain for Bitcoin Cash and crypto as a whole.

-Featured image: Binance Academy

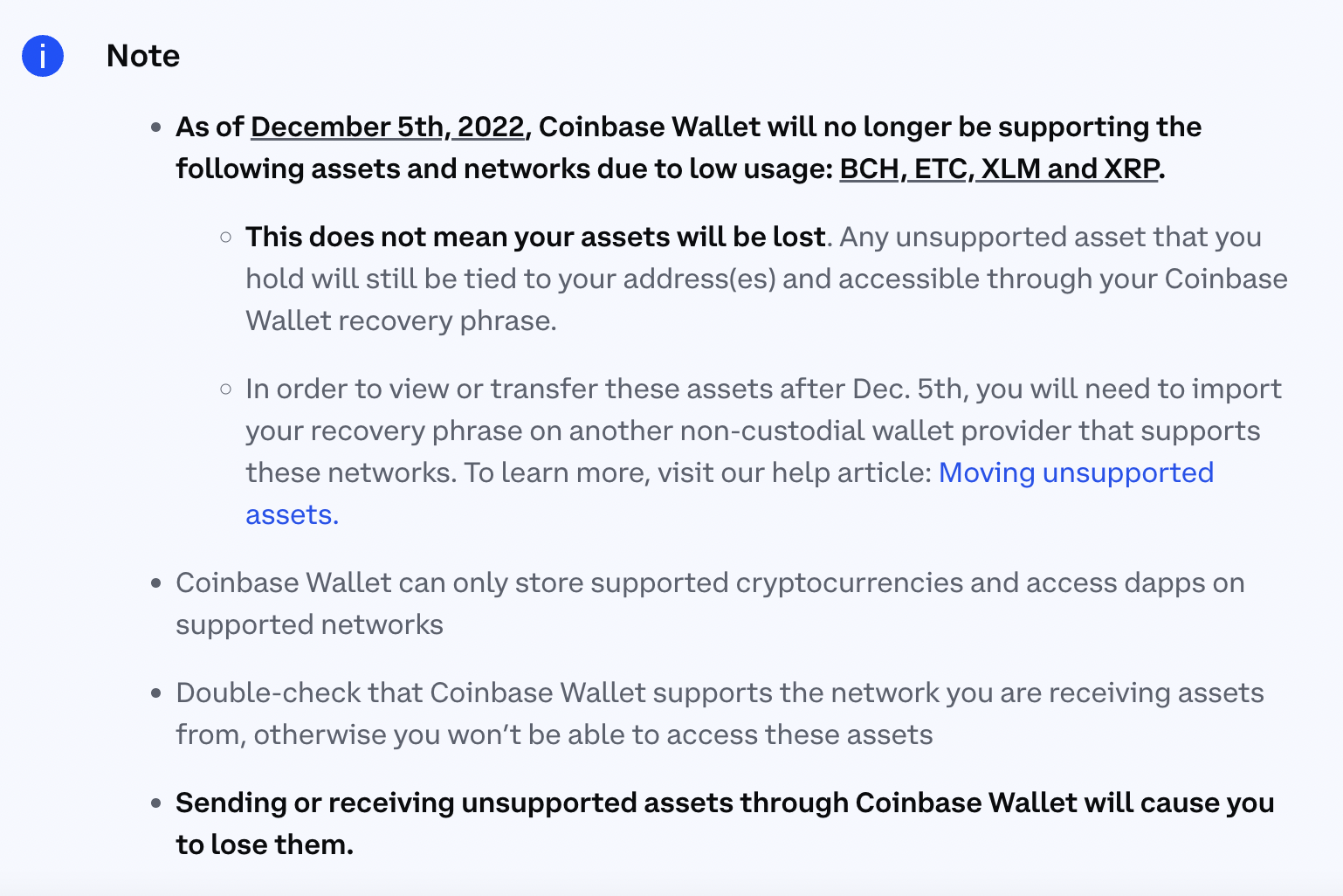

Coinbase Wallet will stop supporting BCH, ETC, XLM and XRP, citing ‘low usage’

The crypto wallet plans to stop support for the four tokens on Dec. 5, but added any remaining funds would still be tied to users’ existing addresses.

BCH Price: Investors May Not Want To Go Long Yet On BCH – Here’s Why

BCH (Bitcoin Cash) saw its chance to recover as the crypto market’s capitalization still hasn’t made that much recovery. After stalling for a few candles at or near its pre-FTX collapse price level, the Bitcoin hard fork continued its descent.

CoinGecko reports that Bitcoin Cash has greens on the weekly and biweekly timelines, but reds on the daily and monthly charts.

Here’s a quick glance at BCH movement:

- When dealing with BCH, caution is advised

- There are conflicting signs coming from bitcoin cash

- Bulls must keep an eye on the 50 Fib retracement line

This may indicate that trading BCH in the long term is not a good idea. At least, not yet.

The Bitcoin Correlation

As was said, the correlation between Bitcoin and Bitcoin Cash was exceptionally high during the aforementioned market correction. Its pullback showed considerable significance as it fluctuated in the 0.90s.

It’s possible that BCH will experience more losses in the near and medium term as it breaches the rising triangle pattern.

When this was written, the coin’s value was trading at around the 50 percent Fibonacci retracement level. There are additional breaks in the lower part of the regression channel. It suggests the downward trend could be more pronounced than initially thought.

Chart: TradingView

Volatility is reflected in the Bollinger band’s expansion, but it’s also providing dynamic resistance. As the band widens, the orange middle band, currently at $112.7, acts as a downward pressure on the price.

First, bulls must keep an eye on the 50 Fib retracement line, as this will be the bears’ immediate objective.

Currently, the bears lack sufficient momentum to advance. This might change, though, if the RSI moves into oversold area, so boosting BCH’s downward momentum. This is within the 4-hour window.

Price Movement Suggests Reversal

On a daily time scale, the MFI clearly contradicts the price movement and indicates a reversal. Currently, a reversal could target the 38.20 Fib level to recoup lost ground.

On shorter timelines, the reversal is currently taking shape. If BCH can close the daily candle with a green candle, it will have a greater possibility of experiencing a well-supported relief rally.

Even when a reversal is in the process of forming, one cannot reject the other technical indicators that paint a different image.

As the RSI continues to decline, the price would follow suit. The regression channel is positive on a daily basis, suggesting the probability of a rally.

If the bullishness persists, BCH may hit the 23.60 Fibonacci barrier in an attempt to recoup pre-FTX levels. However, if bears outnumber bulls, BCH may breach the 61.80 Fib level.

BCH total market cap at $2 billion on the daily chart | Featured image from Coin Edition, Chart: TradingView.com

Bitcoin Cash On Downward Motion Since Breaching $105 Level – Here’s Why

There has been significant sideways fluctuation in the price of bitcoin recently, and it is currently trading in the $16,541 area. However, Bitcoin Cash, a spinoff of BTC, has seen its value drop after passing through the $105 threshold.

BCH may need BTC for a rally, as there is a strong market correlation between the two.

At the time of writing, the token was trading at $102.21, which is far lower than the $126 price range that swiftly rejected any potential bull run. The current market environment is further adding to the unfavorable mood towards BCH.

Image: TradingView

What Bitcoin Cash Metrics Show

BCH’s price has been steadily decreasing since it was rejected at $165 earlier this year. However, as was previously mentioned, BCH is highly correlated with BTC, which is experiencing strong sideways motion at the present time.

The BCH price may be affected by factors other than correlation. According to CoinGlass, long traders are still active despite the current bearish market sentiment.

As long as investors continue to cling onto Bitcoin Cash, the currency will continue to go sideways.

In addition, position liquidation is rather minimal, coming in at $242,400. In spite of this, the data shows that the vast majority of liquidations are long positions, suggesting that long traders are selling their BCH at a loss.

However, the presence of long traders indicates that the market sentiment is negative but relatively optimistic in the long run. Nonetheless, if the price falls below $99.47, the number of short traders will surely exceed the number of long traders.

BCH: Bearish Market Prognosis

A negative breach of the $99.47 price range might ignite a BCH market sell-off, pushing the price down $88.22.

However, investors and traders should examine BCH’s association with Bitcoin, as the correlation coefficient sits at 0.94 as of this writing.

Current market dynamics indicate a gloomy future for BCH. The last time the present trading range was observed was in 2018. This revisiting of the aforementioned trading range will surely enhance the market’s existing bearish momentum.

With the cryptospace in risk with the FTX’s demise, a bull run in the coming weeks or months is unlikely. As market sentiment remains adverse, this crypto winter would push investors to keep or sell.

Investors and traders could take advantage of BCH’s link with BTC, but if the market scenario deteriorates, they could anticipate further losses in the days to come.

BCH total market cap at $2.03 billion on the daily chart | Featured image from FXLeaders, Chart: TradingView.com

Caribbean nation St. Kitts & Nevis may adopt Bitcoin Cash as legal tender by March 2023

The country’s prime minister says it is consulting on the introduction of Bitcoin Cash on a legal basis, in spite of being within the territory of pioneering CBDC DCash.

Programmer spends 69 nights in ‘Bitcoin Cash City’ using only BCH: Here’s how it went

Silverblood says using Bitcoin Cash as payment method “makes sense” because it’s part of his income and “it’s less effort than some of the other forms of payment I use.”

Bitcoin Cash Price: Investors Must Avoid These Levels To Prevent Losses

Investors, who are keeping a close eye on Bitcoin Cash and want to avoid losses, should steer clear of these crucial price points.

As of this writing, Bitcoin is still showing a little bit of bullishness, despite losing a few digits from its price. BTC retreated below the $20K mark, and now trades at $19,998, according to data from Coingecko.

Short-term support for the bears came from rejection wicks at the $20.5k level. Even Bitcoin Cash, the fork of BTC, isn’t immune to this issue.

BCH is in such a jam, despite Bitcoin losing the $20k psychological support.

There have been recent reports regarding a number of developments with potentially profound implications for BCH. This report indicates that Bitcoin Cash’s transaction volume has been below the average of 27,734 daily transactions.

Lower transaction volumes are a negative indicator to both potential and existing investors for BCH, thus this could be an issue.

Bitcoin Cash: Formidable Wall For The Bulls

Bitcoin Cash’s value fell 35.50% between the July 29 rally and the September 19 low, before rebounding 17.40%. After that time, however, Bitcoin Cash’s price remains stable.

These days, you can buy Bitcoin Cash for as little as $96.559 and as much as $166.025. Furthermore, BCH has a support level at $112.246 and a resistance level at $125,912.

Although CCI and Stoch RSI readings are optimistic, the stated resistance level remains a formidable obstacle for BCH bulls to overcome.

Even though the Chaikin money flow index is optimistic, it is establishing a downward trajectory, indicating that the velocity of selling is increasing.

The CMF index’s gloomy prognosis, on the other hand, is more pronounced on the 4-hour time range.

The 4-hour CMF is -0.05, indicating that sellers are gaining control of the BCH market. Currently, the question is whether BCH can still recover.

Possible Recuperation? Or Further Decline?

The BCH support line stays unchanged. However, there are two levels of resistance that investors and traders should target: $125.912 and $138.835.

Source: TradingView

The former level was breached twice on August 23 and September 9, but the bulls were unable to sustain the break, resulting in a price decline to $112.246.

A breach of the $125.912 resistance can be interpreted as a psychological buy signal for investors. Since the fall on September 13, a modest uptrend is building on the 4-hour time period.

A strong closing in today’s trade could aid the bulls in maintaining momentum and finally surpassing the indicated resistance levels.

BCH market cap at $2.28 billion | Featured image from CriptoFacil, Chart: TradingView.com

Ethereum chain split is possible after the Merge, survey finds — but will ETC price keep climbing?

Ethereum Classic is a relatively smaller PoW chain compared to Ethereum in terms of usage and hash rate.

The Inside Story Of The Roger Ver Vs. CoinFLEX Conflict

The infamous Roger Ver is back in the headlines for all the wrong reasons. Like many players in the industry, the derivatives exchange CoinFLEX recently ran into financial trouble. Surprisingly, they blamed it all on Roger Ver and the circus started. Luckily for us, Chinese journalist Colin Wu covered “the entire insider details through a source close to the situation” in his newsletter. However, as you can see, it’s an anonymous source. So, take the story we’re about to analyze with a grain of salt.

The summary of the situation according to Wu:

“On June 24, 2022, the exchange CoinFLEX announced that it made the decision to halt user withdraws, and the price of the platform Token FLEX subsequently plummeted, from $4.30 to less than $1.50 in four hours. At the same time, FlexUSD, the platform’s stablecoin, also began to de-peg, with prices dropping as low as $0.23.”

The funny thing is that both entities were clearly in business together. On May 14th, Roger Ver tweeted, “Interest paying FlexUSD by CoinFLEX is on its way to being the default stable coin for the whole SmartBCH ecosystem if USDT & USDC don’t move quickly.” How did everything deteriorate so fast? That’s what this article’s about.

Interest paying #FlexUSD by @CoinFLEXdotcom is on its way to being the default stable coin for the whole @SmartBCH ecosystem if #USDT & #USDC don’t move quickly.https://t.co/HG14Ik6U0o

— Roger Ver (@rogerkver) May 14, 2022

Roger Ver Vs. CoinFLEX, The Play By Play

The story starts with CoinFLEX announcing to their partners that they “opened a special account for Roger Ver.” The account’s characteristics guaranteed that Roger Ver “would not be liquidated immediately if it fell below the maintenance margin, but rather that he would be given sufficient time to make a margin call.” Nothing special here, the man is a high-net-worth individual, deals like this are a dime a dozen in high finance.

As a guarantee, Roger Ver offered “a margin of BCH,” valued “at around $400.” Then, the Terra collapse happened and the whole crypto market crashed. By the time CoinFLEX ”faced a liquidity crisis,” Bitcoin Cash was worth around $120. It’s still at that price range at the time of writing. This is where things get insane. The biggest revelation of Wu’s story is at the end of this paragraph.

“If that were all, CoinFLEX would have been able to cover its shortfall. However, prior to this, CoinFLEX had issued its own stablecoin, FlexUSD, like other exchanges. At this point, CoinFLEX used FlexUSD to buy a large amount of FLEX from the secondary market and opened short position to hedge the spot price. However, the counterparty to this short position was also Roger Ver!”

As we’ve seen happen again and again, “when the withdrawal restriction announcement was made, CoinFLEX’s total funds began to fall in a cyclical fashion.” And all hell broke loose.

BCH price chart on Coinbase | Source: BCH/USD on TradingView.com

An All-Out Twitter War

On June 27th, the company’s CEO Mark Lamb tweeted, “CoinFLEX made the decision to halt user withdrawals on June 23, shortly after a long-time customer of CoinFLEX went into negative equity. ” Immediately after, the rumor that Roger Ver was that “long-time customer” began circulating.

Recently some rumors have been

spreading that I have defaulted on a

debt to a counter-party. These rumors

are false. Not only do I not have a debt

to this counter-party, but this counter-

party owes me a substantial sum of

money, and I am currently seeking the

return of my funds.— Roger Ver (@rogerkver) June 28, 2022

The Bitcoin Cash leader went on the offensive and tweeted a statement obviously written by a lawyer. “Recently some rumors have been spreading that I have defaulted on a debt to a counter-party. These rumors are false. Not only do I not have a debt to this counter-party, but this counter-party owes me a substantial sum of money, and I am currently seeking the return of my funds.” How could those two statements be true? Remember that “the counterparty to this short position was also Roger Ver!”

He had a long track record of previously topping up margin and meeting margin requirements in accordance with this agreement. We have been speaking to him on calls frequently about this situation with the aim of resolving it. We still would like to resolve it.

— Mark Lamb

(@MarkDavidLamb) June 28, 2022

However, Mark Lamb was not having it. Even though both parties were negotiating, Lamb took to Twitter and stated, “CoinFLEX also categorically denies that we have any debts owing to him.” Plus, “Roger Ver owes CoinFLEX $47 Million USDC. We have a written contract with him obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regularly.”

Even if CoinFLEX is right in this instance, did they have to air their dirty laundry in public?

Roger Ver Vs. CoinFLEX, The Aftermath

Back to Colin Wu’s newsletter:

“In the end, Roger Ver’s position was completely worn out and turned into negative equity, while CoinFLEX was left with a lot of delisting FLEX. It was revealed that CoinFLEX had a real loss of $120 million, including losses from the de-peg of the stablecoin FlexUSD and the loss of withdrawals (less than $10 million) due to the collapse of the SmartBCH cross-chain bridge, which was built by CoinFLEX.”

And the fact of the matter is that, even if Roger Ver’s debt caused this, CoinFLEX’s risk management team has a few questions to answer. “Roger Ver became almost the only counterparty to the exchange, and this only counterparty had the privilege of not replenishing the margin in time,” Wu concludes. It was an unfortunate sequence of events, but both parties signed those deals and both parties took to Twitter to resolve what should’ve been a private matter.

Shame all around.

Featured Image by Gerd Altmann from Pixabay | Charts by TradingView

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

If Bitcoin clears its overhead resistance level, ETH, BCH, AXS and EOS could resume their uptrend with surprising strength.

No flexing for Bitcoin Cash users as BCH loses 98% against Bitcoin

Amid controversy surrounding major supporter Roger Ver, the Bitcoin hard fork plumbs new depths in BTC terms.

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

The rumor surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity.