Willy Woo, an on-chain analyst, believes the Bitcoin upswing is far from over. Citing the development in the Bitcoin Macro Oscillator and the possibility of traditional finance jumping on the bandwagon (FOMO), the odds of BTC rallying in at least two strong legs up in the coming session could not be discounted.

On-Chain Data Signals More Upside For Bitcoin

In a post on X, Woo remains confident about what lies ahead for the world’s most valuable cryptocurrency. Based on on-chain development, there are indicators that the coin may firmly push higher, breaking above the current lull.

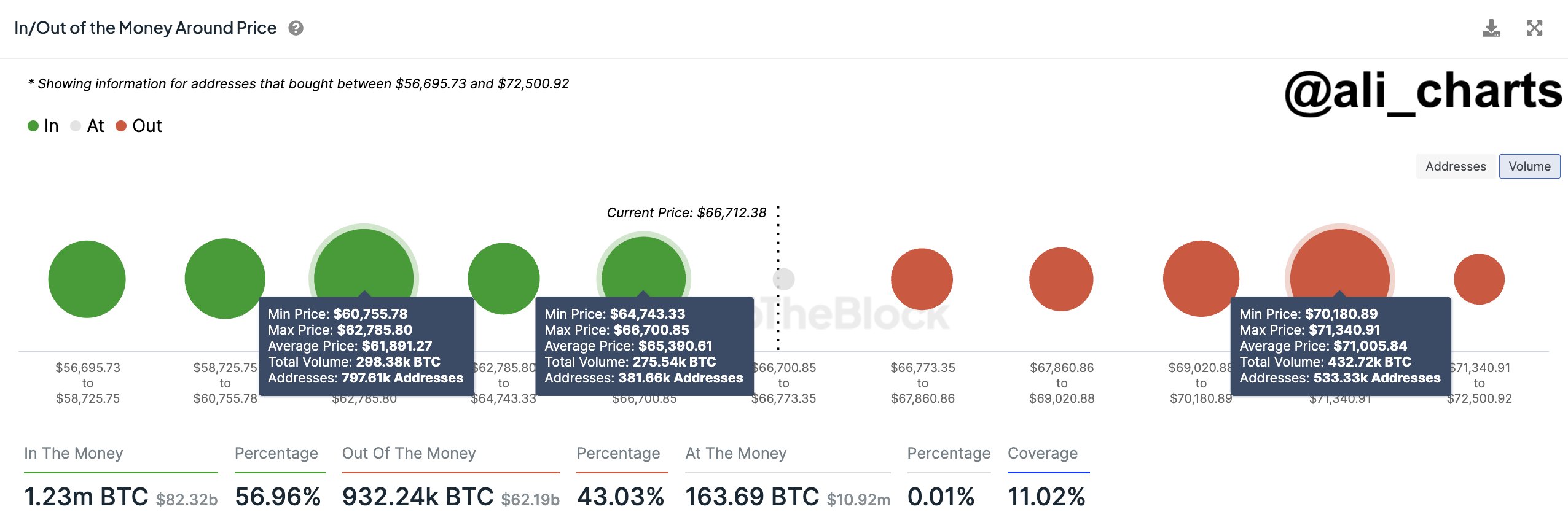

Bitcoin remains mostly range-bound when writing, trading within a tight zone capped by $73,800 on the upper end and $69,000 as immediate support. Even with analysts being confident of what lies ahead, the coin has failed to overcome strong selling momentum from sellers to breach all-time highs in a buy-trend continuation.

From how the coin is set up, the current sideways movement may be accumulation or distribution, depending on the breakout direction. For instance, any upswing above $72,400 might spur demand, lifting the coin towards $73,800. Conversely, losses below $69,000 and the middle BB might see BTC slump to March 5 lows or even lower.

Will TradFi FOMO And Short Squeeze Lift BTC?

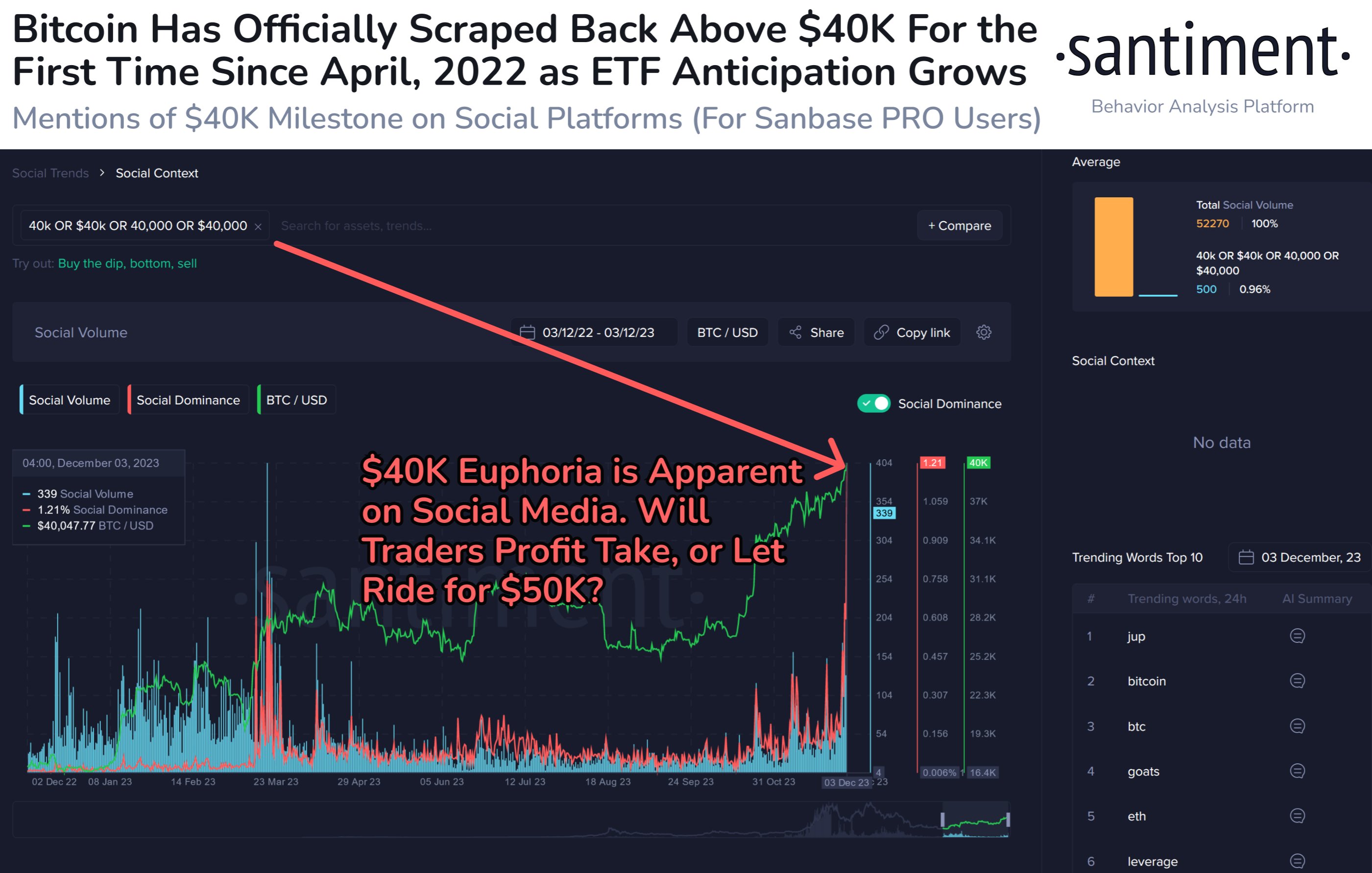

Even with the slowdown in upside momentum, Woo says there is strong potential for “another solid leg up.” The analyst also added that there could be two surges if TradFi investors “FOMO” into Bitcoin. In the 2017 bull run, the rally to $20,000 was primarily due to retailers jumping in and FOMOing on the coin.

With spot Bitcoin exchange-traded funds (ETFs) available in the United States, speculation is that more institutions and high-net-worth individuals are buying the coin. If BTC rips higher, breaking $74,000, more inflow will likely be into the multiple spot Bitcoin ETFs, fueling demand.

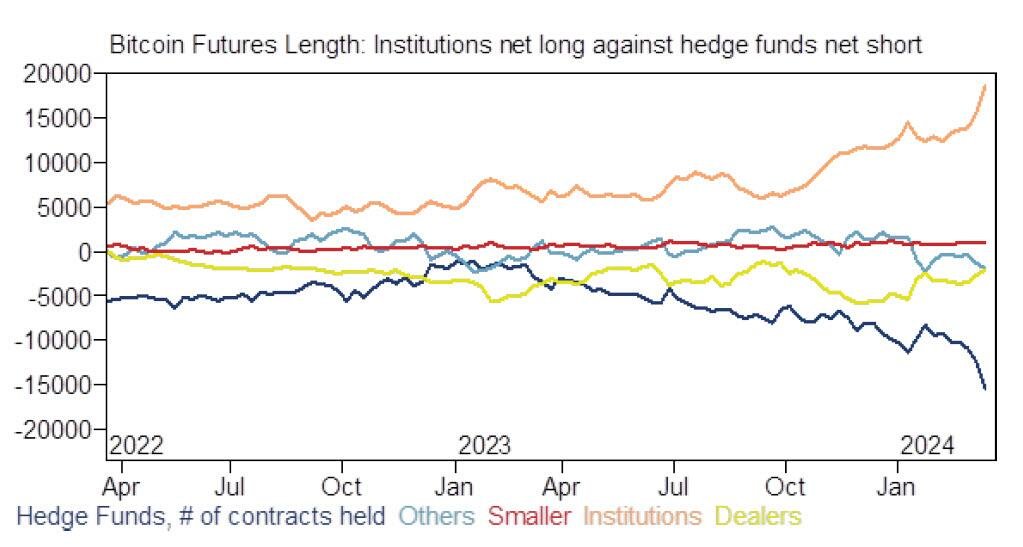

This bullish outlook comes when other analysts expect Bitcoin to surge in the sessions ahead. In a post on X, one analyst says the incoming short squeeze will likely propel the coin above March highs. Whenever a short squeeze happens, prices rise, forcing sellers to buy back at higher prices, accelerating the uptrend.

The assessment is behind a record-breaking gap between institutional investors betting on price increases and hedge funds selling the coin.