On-chain data shows the Bitcoin futures market has remained heated recently as leverage taken on by investors has been quite high.

Bitcoin Estimated Leverage Ratio Declines A Bit, But Still Remains Very High

Following the rise in derivative activities, the leverage in the market hit a new all-tine high recently, as noted by an analyst in a CryptoQuant post.

The “all exchanges estimated leverage ratio” is an indicator that’s defined as the ratio between the open interest and the derivative exchange reserve.

When the value of this metric is high, it means the average investor is currently using a large amount of leverage on exchanges. Such a trend suggests holders are willing to take high risk currently.

On the other hand, low values of the indicator imply holders are going for a low-risk approach at the moment as they aren’t using much leverage.

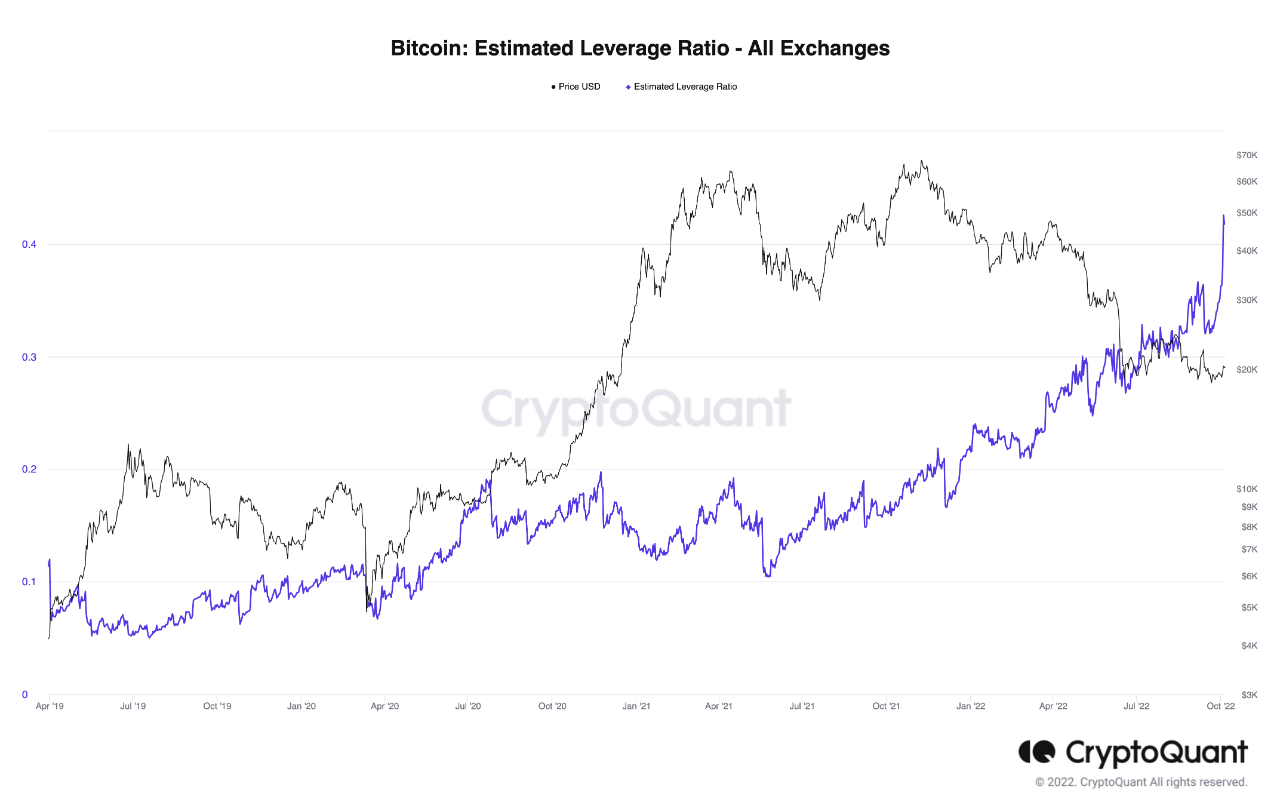

Now, here is a chart that shows the trend in the Bitcoin all exchanges estimated leverage ratio over the last couple of years:

The value of the metric seems to have rapidly risen during the last few weeks | Source: CryptoQuant

As you can see in the above graph, the Bitcoin estimated leverage ratio had been rising in recent weeks and hit a new all-time just a while ago.

However, since then the indicator’s value has come down a bit. This decrease was instigated by the recent temporary rush of volatility in the market due to the CPI release, which flushed out a large amount of leverage.

Nonetheless, the indicator’s value has remained pretty high despite the decline, meaning there is still plenty of leverage to go around in the market.

Historically, overleveraged markets have usually ended in very sharp price moves as liquidations tend to occur quite easily in such environments.

Such liquidations amplify the price move that caused them, leading to even more liquidations. This event where liquidations cascade together is called a squeeze.

Since leverage is so high in the Bitcoin futures market right now, a squeeze could likely take place and break BTC’s price out of the range.

As for which direction the squeeze might go in, the quant comments: “With retail traders overly bullish compared to institutional traders, the risk-reward does not look good for the bulls.”

BTC Price

At the time of writing, Bitcoin’s price floats around $19.1k, down 2% in the last seven days.

Looks like the value of the crypto has once again gone stagnant after the CPI volatility | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com