Each Bitcoin halving sees Bitcoin miners rewarded with a smaller block subsidy, but ViaBTC is optimistic that innovative Bitcoin applications will more than cover these needs, as Satoshi Nakamoto envisioned.

Cryptocurrency Financial News

Each Bitcoin halving sees Bitcoin miners rewarded with a smaller block subsidy, but ViaBTC is optimistic that innovative Bitcoin applications will more than cover these needs, as Satoshi Nakamoto envisioned.

Franklin Templeton’s digital assets division has released a note to its investors introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in activity within the Bitcoin ecosystem.

The asset manager attributes this increased momentum to various factors, including the emergence of Bitcoin (BTC) NFTs called Ordinals, the development of new fungible standards like BRC-20 and Runes, the growth of Bitcoin Layer 2 (L2s) solutions, and the expansion of decentralized finance (DeFi) applications built on the Bitcoin network.

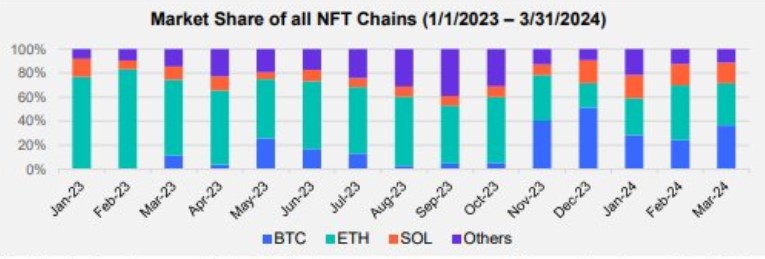

According to the Bitcoin ETF issuer’s report, activity in the Bitcoin NFT space is gaining momentum. In particular, Ordinals have seen a significant increase in trading volume over the past few months.

This growth is evident in Bitcoin’s dominance in terms of trading volume, which surpassed Ethereum (ETH) in December 2023, as shown in the accompanying chart.

In addition, several collections of Bitcoin Ordinals are emerging as dominant players in the NFT market, both in terms of trading volume and market capitalization.

These collections include NodeMonkes, Runestone, and Bitcoin Puppets, which have an aggregate market cap of $353 million, $339 million, and $168 million, respectively. They are the most notable collections.

In terms of trading volume over the past 30 days, the report shows that these three collections recorded trading volumes of $81 million, $85 million, and $38 million, respectively, over the past month.

The asset manager further claimed that what distinguishes BTC Ordinals from NFTs on other blockchains, such as Ethereum or Solana, is that they contain raw data recorded directly on the Bitcoin blockchain. This feature contributes to the attractiveness and growing popularity of Bitcoin Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market, was one of the issuers that launched a spot BTC ETF in the United States earlier this year. Its ETF, which trades under the ticker name “EZBC,” has seen total inflows of 281.8 million since its January 11 launch, according to BitMEX research data as of April 3.

Despite its zero-fee structure, Franklin Templeton’s ETF has seen a significant difference in flows compared to the leading players in the newly approved ETF market, such as Blackrock (IBIT) and Fidelity (FBTC), which have seen flows of over 14 billion and 7.7 billion, respectively.

In a recent blog post, crypto exchange Binance announced it would discontinue support for Bitcoin-based NFTs on its marketplace. Less than a year after their introduction, Binance will no longer facilitate airdrops, benefits, or utilities associated with BTC NFTs, citing a need to streamline its product offerings in the NFT space.

Binance states that users who own Bitcoin NFTs are advised to withdraw them from the Binance NFT marketplace via the Bitcoin network before May 18, 2024.

Effective April 18, 2024, users can no longer purchase, deposit, bid, or list NFTs via the BTC network on the Binance NFT Marketplace. Any existing listing orders affected by this change will be automatically canceled simultaneously.

Currently, BTC is trading at $68,300, up a modest 3% in the last 24 hours. It is approaching the significant milestone of $70,000, a level the cryptocurrency has struggled to maintain several times.

Featured image from Shutterstock, chart from TradingView.com

BRC-20 tokens are a novel standard on the Bitcoin blockchain, BRC-20 tokens were inspired by Ethereum’s ERC-20. Like Ethereum’s ERC-20 strands for Ethereum Request for Comment, BRC-20 also strands for Bitcoin Request for Comment.

BRC-20 tokens allow the creation, minting, trading, and transfer of fungible tokens or assets on the Bitcoin blockchain through the Ordinals protocol. The Bitcoin Ordinals protocol is a numbering system that allows users to attach extra data to satoshis, the smallest unit of Bitcoin.

The process of attaching extra data to satoshis is called inscription, BRC-20 tokens do not need smart contracts to execute transactions as ERC-20 tokens do, their transactions are done through JSON inscriptions on satoshis through Bitcoin Ordinals.

Ethereum’s ERC-20 might have inspired the creation of BRC-20 on the Bitcoin blockchain, but make no mistake, they are not the same, and we are going to explore that in this section of this article.

Operation: One of the key differences between BRC-20 and ERC-20 is that BRC-20 tokens find their home within the Bitcoin blockchain while ERC-20 operates on the Ethereum blockchain.

Implementation: BRC-20 and ERC-20 are both implemented differently; however, BRC-20 is experimental, meaning it has not undergone the BIP process. It only implements changes in the Bitcoin protocol, while ERC-20 has undergone the EIP process, which was approved by the Ethereum community before implementation after being scrutinized.

Security: They are both secure as they are both secure by the top two blockchains in the crypto space, but BRC-20 is secured by the Bitcoin blockchain and ERC-20 is secured by the Ethereum blockchain.

High Gas Fee Or Transaction Fees: They both have high gas fees if you are trading on decentralized exchanges (DEXs).

Wallets: Their wallets are different, you can store your BRC-20 token on wallets that support the Bitcoin Taproot upgrade like Unisat, Xverse, CoinW, and Alex. While ERC-20 tokens are stored on Ethereum-supported wallets like Metamask, Exodus, Trust wallet, Atomic, MyEtherWallet, and all EVM compactable wallets

Smart Contract functionality: BRC-20 tokens do not rely on smart contracts to execute transactions, but ERC-20 tokens do.

Token Value Drive: BRC-20 tokens are token values driven by inscriptions, and ERC-20 token values are driven by utilities and speculations.

Fungibility: BRC-20 tokens are semi-fungible because they are only interchanged in set increments. For example, BRC-20 tokens are being sold in sets, so you can’t buy 1003 xBRC-20 tokens (x being the token) if the only people sell decide to sell in sets of 250, 500, 750, and 1000 depending on how many tokens they want to sell. Meanwhile, ERC-20 tokens are fully fungible because they can be exchanged in any quantity.

Functions: The BRC-20 token standard is majorly to create meme tokens currently, while the ERC-20 token standard is used for a good number of fungible tokens on Ethereum, including stablecoins, governance tokens, wrapped tokens, and utility tokens.

The fact that BRC-20 tokens are built on the most secure blockchain in the crypto space Bitcoin, should help you understand these tokens are going benefit from the security that the Bitcoin Blockchain provides.

The interoperability with the Bitcoin network is one of the major advantages of the BRC-20 tokens, as they enjoy and leverage the widespread acceptance of Bitcoin as the most successful crypto, which has contributed to the BRC-20 token’s overall success. Also, this compatibility with Bitcoin gives the BRC-20 standard access to utilize the existing infrastructure the Bitcoin network already has, including its wallets and exchanges.

BRC-20 standard is still in its early stages, so there is huge potential for growth in the future, and as more people keep adopting and investing in BRC-20 tokens

In the same way, as the BRC-20 token standard enjoys the benefits of the Bitcoin network, they are still going to be affected in the areas where Bitcoin lags behind. This is because Bitcoin is not as scalable as some other blockchains like Ethereum. As BRC-20 tokens keep gaining popularity and awareness there are concerns about congestion, which could lead to potential higher gas or transaction fee issues.

Another consideration is that BRC-20 tokens run on ordinals protocol, a protocol that is still in its early phases of development, which means there is a possibility of it being vulnerable or having glitches as the technology evolves.

The Bitcoin Request for Comment (BRC-20) token standard is still in its early stage of development, so it is safe to say it is still semi-fungible compared to the ERC-20 token standard. It has some limitations, like it being sold and bought in sets, you are limited to what is available in the DEX marketplace, and you can’t buy any amount you want, whether in large or small quantities.

This article is going to cover how to trade Bitcoin Request for Comment (BRC-20) tokens on UniSat, the most used decentralized exchange (DEX) to trade BRC-20 tokens. You can also check out other DEX like Xverse and Alex.

How To Install And Set up UniSat Wallet

To trade on a decentralized exchange (DEX) you need a wallet, go to your Chrome browser and search for the UniSat Wallet extension as shown below, click on “Add to Chrome” to download and add the UniSat Wallet extension to your Chrome browser.

Click the “Create new wallet” button to create your UniSat Wallet.

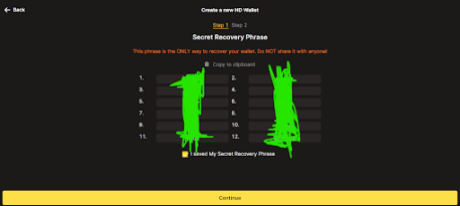

Create your password, use a password you can remember, as you would need your password to make transfers and click on the “Continue” button. The Secret Recover Phrase page will pop up. Write down your secret phrase and keep it in a safe place because anyone who has access to your secret phrase has access to your wallet. Then click on “Continue”.

Expect you are a crypto genius I would advise you to leave the Step 2 page the way it is, just click on “Continue”. The“Compatibility Tips” will pop up check the boxes and click on “Ok”

You have now successfully created your UniSat wallet, where you can receive, send, and buy crypto.

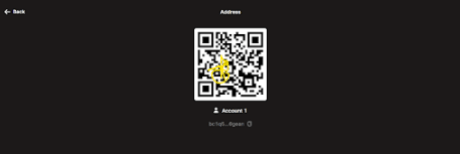

When you click on “Receive” you will be given a QR code that you can scan on your phone and also an option to copy your wallet address manually.

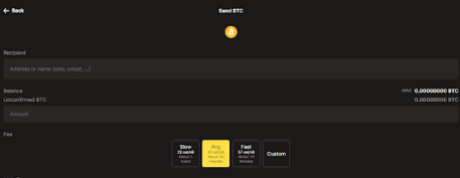

When you click on “Send”, you will see where to fill in the Recipient address you want to send your Bitcoin to, and underneath it is where you will input the amount of Bitcoin you want to send. You can choose the transfer speed you want, but note that the faster the transfer, the higher your gas fee or transaction fee.

I would not recommend that you use the “Buy” feature as it is too expensive, and it is better to buy your Bitcoin on a centralized exchange and send it to your UniSat wallet.

How To Buy, Sell, and Trade on UniSat

To buy, sell, and trade BRC-20 tokens you need Bitcoin in your wallet for gas fees and Bitcoin to buy the BRC-20 token. So go to any centralized exchange of your choice like Binance, OKX, or ByBit to buy your Bitcoin, copy your UniSat wallet, paste it into the recipient address on the centralized exchange, and send the Bitcoin.

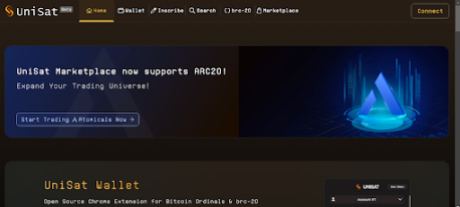

Now that your wallet has been funded it is time to trade, go to the UniSat website, and click on “Connect”.

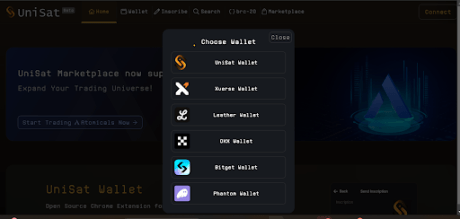

Click on “UniSat Wallet”, and connect your UniSat Wallet.

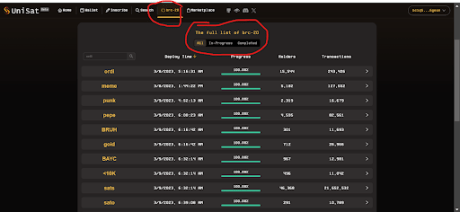

Once your UniSat Wallet is connected, Click on “brc-20”, as shown below, to see the full list of BRC-20 tokens you can trade on UniSat.

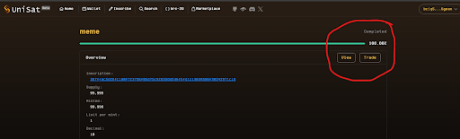

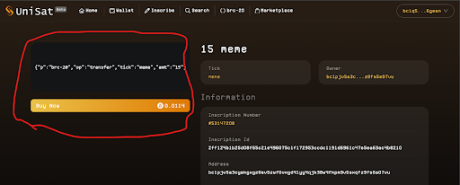

Click on any of the BRC-20 tokens you which to buy, for example, I clicked on the “meme” token below. There are buttons on the top right of the screenshot circled in red “View” and “Trade”.

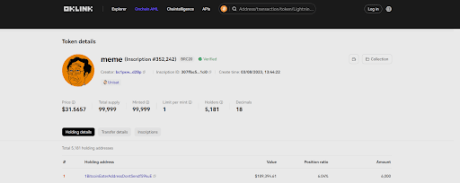

If you click on View, it will take you to OKLINK where you can see the meme BRC-20 inscription with all its details, Total Supply, Limit per mint, Holders, Minted tokens, and Price.

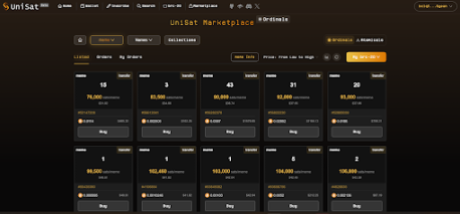

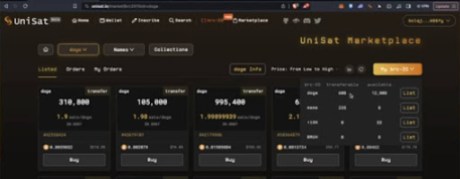

When you click on Trade, it will take you to the UniSat Marketplace, where you will see all the listed meme token inscriptions you can buy.

Click on any of the sellers that have the exact number of meme inscriptions you want to buy or any of the sellers that come close to how many meme inscriptions you want to buy. After selecting a seller, the buy page below with the “Buy Now” button will pop up.

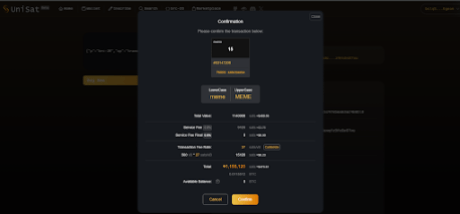

Click on “Buy Now” and the confirmation page to confirm your order will pop up, click on “Confirm” and you have bought the BRC-20 token.

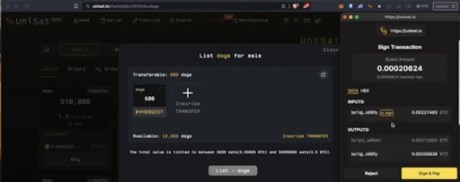

After buying your BRC-20 and you want to sell, go to the marketplace, click on “my brc-20”, click on the inscription you want to sell, and then click on the list.

Click on the plus button, input the exact number you like to sell, and click on “Next”.

Click “Next again”.

“Sign and pay”, and “Done”, your inscriptions will be listed. When your order gets picked up, your inscription will be sold, and the money will be transferred to your wallet.

CoinW is a centralized crypto exchange where you can track your BRC-20 and use the charts to make well-informed decisions on the token you want to buy.

To search for BRC-20 tokens, click on “Market”, click on “Hot”, and then click on “BRC-20”, as shown below.

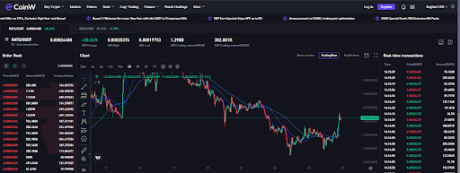

For example, I clicked on ORDI, as you can see in the chart below.

Here is another example with RATS, another BRC-20 token on the list.

Conclusion

In conclusion, BRC-20 tokens provide a novel avenue for tokenization within the Bitcoin blockchain, expanding its utility beyond traditional cryptocurrency transactions. They offer a seamless integration of additional data onto satoshis, enabling a broader range of use cases and applications.

With BRC-20 tokens, the Bitcoin ecosystem gains enhanced functionality and opens up possibilities for innovative decentralized finance (DeFi) solutions. By leveraging the Ordinals protocol, BRC-20 tokens contribute to the growing diversity and maturity of the blockchain industry as a whole.

The short-lived reign of Bitcoin as the leading NFT platform came to an end this month, with Ethereum reclaiming the top spot as NFT sales on the Bitcoin network plummeted over 60% compared to December’s record highs.

Data from NFT analytics platform CryptoSlam reveals a stark reversal in fortunes. After surpassing Ethereum in December with $881 million worth of NFT sales, Bitcoin’s January volume has sunk to $314 million as of two days before month-end. Meanwhile, Ethereum has maintained a steadier pace, registering $328 million in sales over the past 28 days.

This shift can be attributed to the fading fervor surrounding Ordinals, a technology enabling inscriptions and non-fungible tokens directly on the Bitcoin blockchain. The December surge in Bitcoin NFT activity was largely driven by Ordinals-related hype, leading to high fees for inscription minting. For instance, on December 10th, Bitcoin saw a single-day high fee of $10 million due to inscription transactions.

However, with the broader digital asset market facing turbulence, interest in Ordinals has waned significantly. Minting fees have plummeted by 83% since peaking at $5 million on January 14th, now standing at just $848,000 as of January 28th. This decline reflects a drop in demand for blockspace for non-traditional Bitcoin transactions, further suggesting a diminished appetite for Ordinals-based NFTs.

Ethereum, on the other hand, benefits from its established ecosystem and diverse functionalities. Its NFT landscape encompasses a wider range of projects and applications compared to the nascent Ordinals scene on Bitcoin. This, coupled with the relative stability of the Ethereum network, likely contributed to its ability to retain user interest and NFT trading volume throughout December and January.

The rapid change in the NFT landscape highlights the need for adaptability and innovation within the industry. While Ordinals brought a novel use case to Bitcoin, its technical limitations and niche appeal may hamper its long-term sustainability. Conversely, Ethereum’s flexibility and established infrastructure position it well to adapt to evolving market trends and user preferences.

Furthermore, the broader decline in digital asset class interest likely impacted both Bitcoin and Ethereum NFTs. However, Ethereum’s larger and more diverse user base, along with its established NFT ecosystem, suggest it may be better equipped to weather the current market downturn.

The future of the NFT market remains uncertain, but one thing is clear: the landscape is constantly shifting, and players must be able to adapt to stay ahead of the curve.

Featured image from Pixabay, chart from TradingView

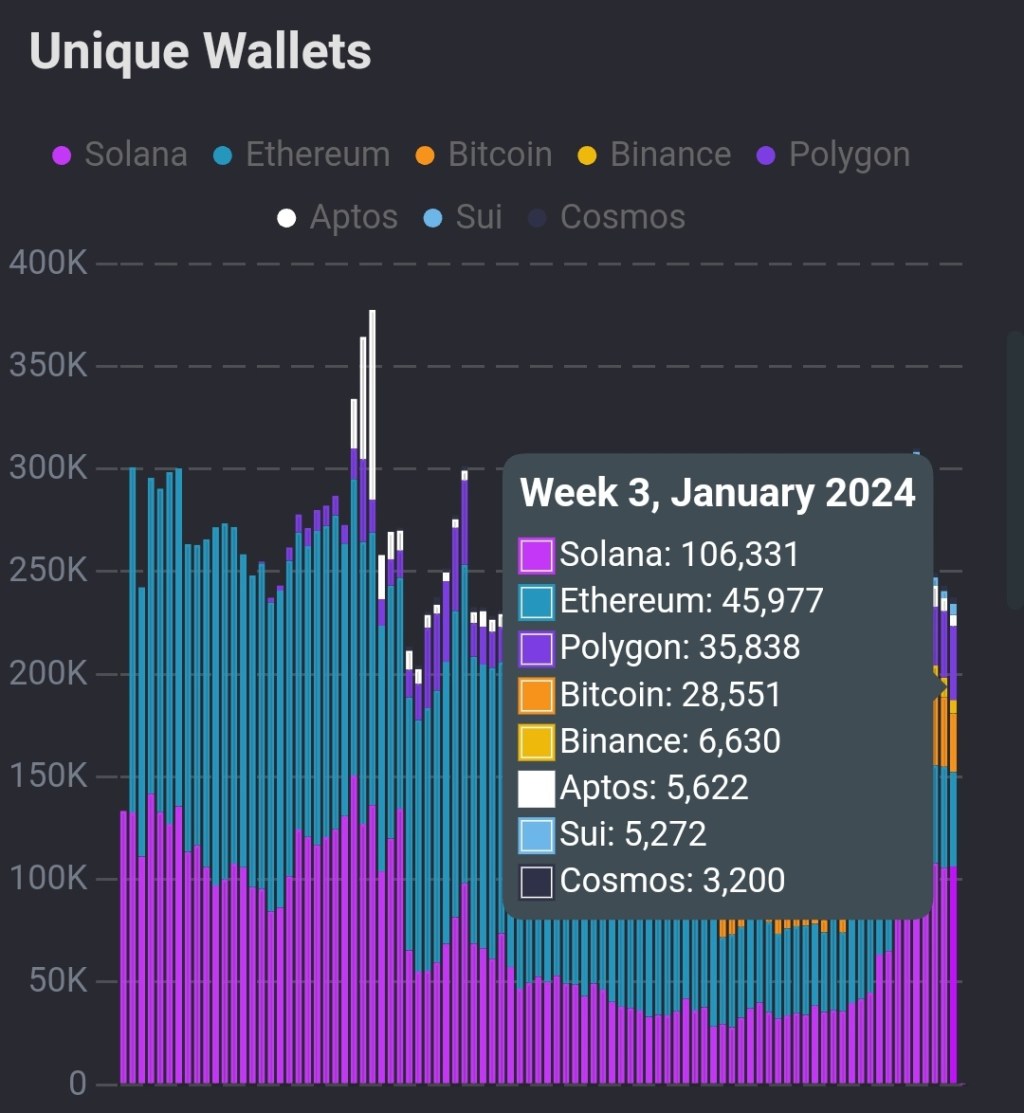

According to on-chain data from SolanaFloor, Solana is dominating other blockchains, including Ethereum and Polygon, across various non-fungible token (NFT) activity metrics in the third week of January.

In a post shared on X on January 23, Solana maintained its NFT dominance among competing blockchains, mainly Ethereum and other high throughput alternatives. Thus far, the blockchain has the highest numbers in unique wallets, transactions, unique buyers, and first-time wallets over the past week.

To illustrate, Solana had over 106,000 unique wallets by the third week of January 2024. This is more than twice those created in Ethereum. Meanwhile, there were over 22,000 first-time wallets on Solana, roughly 3X those in Ethereum and 2X in Bitcoin.

At the same time, more than 2.8 million transactions were posted on Solana. This figure is over 20X those in Ethereum during the same time frame.

Extrapolating from this data suggests that the blockchain is increasingly popular among NFT projects, collectors, and traders. Several factors could be contributing to Solana’s NFT success.

The platform is known for its high throughput and low transaction fees. Considering how minters and active traders are sensitive to trading fees, Solana is emerging as a layer-1 option for projects wishing to enjoy the security of the mainnet while also benefiting from low transaction fees.

Legacy chains, including Ethereum, continue to struggle with on-chain scalability. Minting on the mainnet often translates to high fees, which can decrease profitability, especially for active traders and collectors.

Beyond scalability advantages, Solana’s ecosystem is rapidly expanding. Despite the catastrophic drop of SOL prices at the end of 2022, the spectacular revival in 2023 activated on-chain activity with meme coins blooming and NFT projects opting to launch on Solana.

The ongoing recovery of SOL and the increasing number of projects opting to deploy on the mainnet could further drive on-chain activities, including NFT minting and trading, to new levels in 2024.

As the network draws users, its developers are also working to make the platform more robust and decentralized. In 2024, Solana developers plan to activate Firedancer, a validator client developed by Jump Capital. This client will help further decentralize Solana’s infrastructure, improve performance, and substantially improve reliability, eliminating network hitches that plagued the blockchain in 2022 and early 2023.

SOL is cooling off, trading at around $80 when writing. The coin is down 34% from December 2023 peaks and below the dynamic 20-day moving average, pointing to bears.

Key support remains at around $70. If there is demand at this price point, SOL may recover and retest $125 in the sessions ahead.

Bioniq operates on the Internet Computer Protocol, tapping into native Bitcoin integration to ease the network congestion and high fees associated with Ordinals inscriptions.

Alongside the declining trading volumes, the number of Bitcoin Ordinals transactions dropped by 97% to just 20,571 in mid-August.

Alongside the declining trading volumes, the number of Bitcoin Ordinals transactions dropped by 97% to just 20,571 in mid-August.

Despite hating on crypto for years, and calling NFTs worthless and easy to replicate two years ago, Peter Schiff is set to release an NFT art collection on Bitcoin.

The founder of Digital Bitcoin Art and Assets (DIBA) believes smart contracts on Bitcoin could solve the myriad problems created by Ordinals.

Bitcoin has seen around $167.47 million worth of NFT sales over the past 30 days, while StepN has integrated Apple Pay to remove barriers to entry to the app.

The BRC-20 token standard utilizes Ordinal inscriptions to deploy token contracts, mint tokens, and transfer tokens.

Galaxy’s estimation was based on the rapid uptick of interest in Bitcoin NFTs, currency market infrastructure, and the potential to take some market-share away from Ethereum.

Google Trends data shows interest in NFTs has waned, even as trading volumes are surging, while Korean multinational giant Lotte has partnered with Polygon.

The “Parisland” metaverse experience will launch in time for Valentine’s Day to give budding lovebugs a space to meet, at least virtually.

Users are posting massive files to the Bitcoin network via the Ordinals protocol, taking up block space and paying high fees to do so.