The BitMEX co-founder says the current phase of price consolidation is ideal for accumulating crypto before macroeconomic factors trigger the next leg up in the bull market.

Cryptocurrency Financial News

The BitMEX co-founder says the current phase of price consolidation is ideal for accumulating crypto before macroeconomic factors trigger the next leg up in the bull market.

The launch of Bitcoin Runes played an important role in the spike in the total number of transactions over the Bitcoin network.

Bitcoin miners are reaping the benefits of Runes after the halving, with skyrocketing transaction fees lessening the impact of reduced block rewards.

Franklin Templeton’s digital assets division has released a note to its investors introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in activity within the Bitcoin ecosystem.

The asset manager attributes this increased momentum to various factors, including the emergence of Bitcoin (BTC) NFTs called Ordinals, the development of new fungible standards like BRC-20 and Runes, the growth of Bitcoin Layer 2 (L2s) solutions, and the expansion of decentralized finance (DeFi) applications built on the Bitcoin network.

According to the Bitcoin ETF issuer’s report, activity in the Bitcoin NFT space is gaining momentum. In particular, Ordinals have seen a significant increase in trading volume over the past few months.

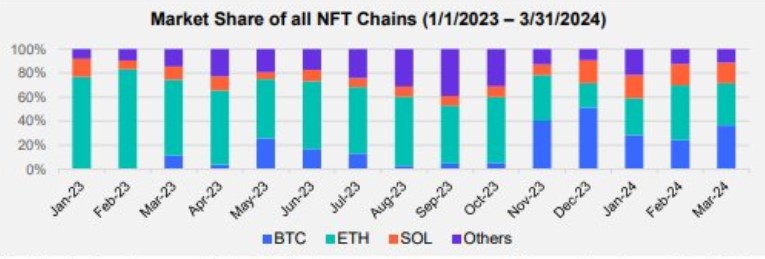

This growth is evident in Bitcoin’s dominance in terms of trading volume, which surpassed Ethereum (ETH) in December 2023, as shown in the accompanying chart.

In addition, several collections of Bitcoin Ordinals are emerging as dominant players in the NFT market, both in terms of trading volume and market capitalization.

These collections include NodeMonkes, Runestone, and Bitcoin Puppets, which have an aggregate market cap of $353 million, $339 million, and $168 million, respectively. They are the most notable collections.

In terms of trading volume over the past 30 days, the report shows that these three collections recorded trading volumes of $81 million, $85 million, and $38 million, respectively, over the past month.

The asset manager further claimed that what distinguishes BTC Ordinals from NFTs on other blockchains, such as Ethereum or Solana, is that they contain raw data recorded directly on the Bitcoin blockchain. This feature contributes to the attractiveness and growing popularity of Bitcoin Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market, was one of the issuers that launched a spot BTC ETF in the United States earlier this year. Its ETF, which trades under the ticker name “EZBC,” has seen total inflows of 281.8 million since its January 11 launch, according to BitMEX research data as of April 3.

Despite its zero-fee structure, Franklin Templeton’s ETF has seen a significant difference in flows compared to the leading players in the newly approved ETF market, such as Blackrock (IBIT) and Fidelity (FBTC), which have seen flows of over 14 billion and 7.7 billion, respectively.

In a recent blog post, crypto exchange Binance announced it would discontinue support for Bitcoin-based NFTs on its marketplace. Less than a year after their introduction, Binance will no longer facilitate airdrops, benefits, or utilities associated with BTC NFTs, citing a need to streamline its product offerings in the NFT space.

Binance states that users who own Bitcoin NFTs are advised to withdraw them from the Binance NFT marketplace via the Bitcoin network before May 18, 2024.

Effective April 18, 2024, users can no longer purchase, deposit, bid, or list NFTs via the BTC network on the Binance NFT Marketplace. Any existing listing orders affected by this change will be automatically canceled simultaneously.

Currently, BTC is trading at $68,300, up a modest 3% in the last 24 hours. It is approaching the significant milestone of $70,000, a level the cryptocurrency has struggled to maintain several times.

Featured image from Shutterstock, chart from TradingView.com

Multiple Ethereum NFT funds were also among the backers, marking their first investment in a Bitcoin-focused company.

Bitcoin core developer Luke Dashjr said he played no part in flagging Bitcoin inscriptions as a cybersecurity threat with the NVD, as the listing received a “5.3 Medium” severity score.

Last week, a Bitcoin developer Luke Dashjr raised alarm about a possible vulnerability in the network in relation to the Bitcoin Ordinals that could lead to a code exploit. After posting his findings to social media, Dashjr’s warnings were not taken seriously as community members believed it was a non-issue. However, the US government seems to be taking the vulnerability seriously, adding it to its vulnerability database.

Dashjr had first raised alarm about the bug in the Bitcoin network on December 6 through an X (formerly Twitter) post. As the developer explains, this bug was related to the BTC Inscriptions which have gained popularity in the last year. This capability has helped developers to create what could be referred to as Bitcoin’s version of non-fungible tokens (NFTs).

Elaborating on the mechanism of Ordinals, Dashjr explained that the Inscriptions were actually taking advantage of a vulnerability in the Bitcoin Core. Developers are able to hide their data as program code, thereby being able to bypass the preset limit on the size of extra data that can be included in BTC transactions.

Dashjr explained that he was working to fix this issue. However, the vulnerability remains as developers are still able to create inscriptions on the network. Even after being fixed in the “Bitcoin Knots v25.1,” the developer explains that the vulnerability still remains “in the upcoming v26 release.” As for when the vulnerability might be completely fixed, Dashjr said he hopes this will happen sometime in 2024.

As Bitcoinist reported, not everyone in the community agreed that this was actually a vulnerability. Some worried that if the ‘vulnerability’ is eventually fixed, Ordinals and BRC-20 tokens would disappear, to which Dashjr responded in the affirmative.

Despite the Bitcoin community not taking the warning of the vulnerability seriously, the United States government has chosen a more proactive approach. The National Vulnerability Database which is under the government agency, the National Institute of Standards and Technology (NIST), has moved forward to add the vulnerability to its Vulnerability List under ‘Common Vulnerabilities and Exposures.’

The agency has assigned the vulnerability with the code CVE-2023-50428 after identifying that it could be a potential risk for the network, especially when it comes to security or integrity. This means the agency believes this could lead to an exploit in the Bitcoin network.

The very existence of Ordinals and BRC-20 tokens is already identified as one of the ways that this vulnerability is already being exploited. Naturally, the agency is looking to prevent other ways in which the vulnerability could be further exploited in a way that could cause harm to its users.

The United States National Vulnerability Database (NVD) flagged Bitcoin’s inscriptions as a cybersecurity risk on Dec. 9.

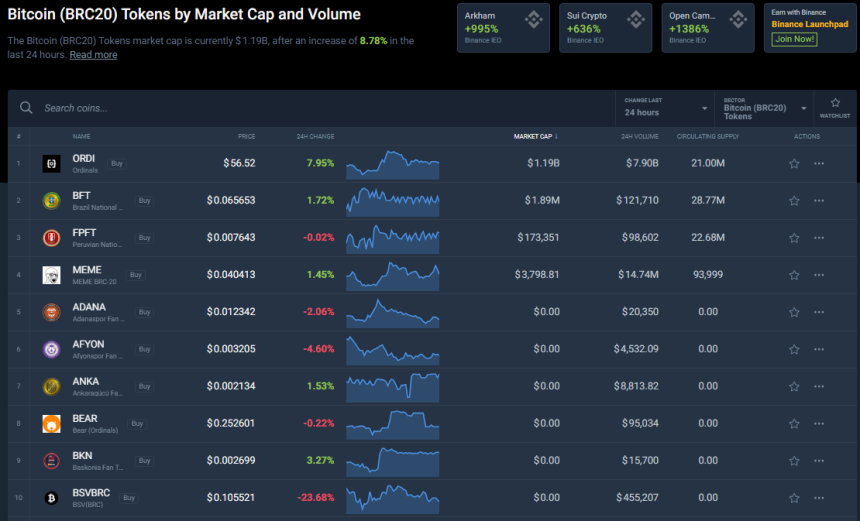

The BRC-20 token ORDI, which is based on Bitcoin, surged by 181% today amid a wider cryptocurrency upswing and a recent rise in activity surrounding the Ordinals protocol.

According to the most recent data, the token’s trade volume has increased by more than 900% during the last 30 days.

The ORDI coin has experienced a downward trend since its entry onto the market. It began trading at around $10 in June of this year and gradually dropped back to slightly less than $3 by mid-September.

The token’s decline marked the bottom and the beginning of the subsequent bull market, which drove the price up to its all-time high of $66 on November 5.

The previous few days have seen a phenomenal increase in the price of ORDI, and since Bitcoin has recently performed well and crossed $44,000, ORDI is also rising quickly.

The ORDI token, which is based on Bitcoin Ordinals, has achieved triple-digit monthly and weekly percentage growth, making it the first BRC-20 token to surpass a $1 billion market valuation.

Tokens based on Bitcoin are comparatively new in the digital currency space. These tokens leverage the Bitcoin network to produce a variety of digital assets, in contrast to Bitcoin, which is mostly used as electronic money. This change broadens the use of blockchain applications beyond the initial intent of Bitcoin.

Casey Rodarmor introduced the initial version of Bitcoin Ordinals in January. The protocol made it possible to add content to the blockchain of Bitcoin.

An important factor in the development of the two different types of tokens—fungible and non-fungible—was the introduction of the Ordinals mechanism.

In particular, this creative process has played a significant role in the development of BRC-20 tokens, which are a class of fungible token with characteristics similar to those of Ethereum’s ERC-20 standard.

Like BRC-20s, fungible tokens are interchangeable and frequently linked to simpler use cases, such as enabling different decentralized applications and transaction processing.

Trading in Ordinals decreased significantly in October after reaching a peak in the preceding month, but it increased again once Binance declared it will list ORDI.

The Ordinals Inscription Service, which Binance Pool introduced in August, makes it simpler for users to engrave extra data on the Bitcoin blockchain.

Meanwhile, in the event that investors perceive the saturation and sell in order to book profits, the price of ORDI is expected to find some support at $60.

Since the meme coin is now tracking the price movement of Bitcoin, eventually the rise in BTC will halt, which would prompt additional selling by investors seeking to validate their gains.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

As unconfirmed transactions on the Bitcoin blockchain rise, Luke Dashjr, a prominent developer pledges that Ordinal Inscriptions are a ‘bug’ that will be fixed.

Following an outsized rally, ORDI became the first BRC-20 token to breach a $1 billion market capitalization.

Bioniq operates on the Internet Computer Protocol, tapping into native Bitcoin integration to ease the network congestion and high fees associated with Ordinals inscriptions.

Bitcoin transaction fees have soared above Ethereum’s amid a renewed appetite for Ordinals-inscribed assets.

Gas fees on the Polygon network reached as high as $0.10 during a mad rush to mint an Ordinals-inspired token called POLS.

Taproot Wizards, which describes itself as “magic internet JPEGs”, offers a collection of Microsoft Paint images of wizards harking back to a 2013 bitcoin meme: “magic internet money.”

In this week’s edition of The Protocol newsletter, we share a few trends stand out to close 2023: the proliferation of Ethereum layer-2 networks, the ascendancy of zero-knowledge cryptography and the appearance of tokens, smart contracts and now file hosting on the Bitcoin blockchain.

From “AI x blockchain” and zero-knowledge proofs to Bitcoin ordinal projects, there are plenty of bright spots in the Web3 ecosystem.

Before it was taken down, Ordswap users said the compromised website directed users to a phishing link.

Casey Rodarmor, the creator of Bitcoin Ordinals, clarified that the inscription numbers would only be changed, not scrapped entirely.

Trump NFT prices spiked after the former U.S. president’s mugshot in police custody was released.