An analyst has explained that the outlook for Bitcoin should remain bullish as long as the cryptocurrency’s price remains above this level.

Bitcoin Has Strong On-Chain Support Above $41,800

In a new post on X, analyst Ali talked about the various BTC support and resistance levels from an on-chain perspective. In on-chain analysis, the strength of any support or resistance level depends on the amount of Bitcoin that the investors bought at said level.

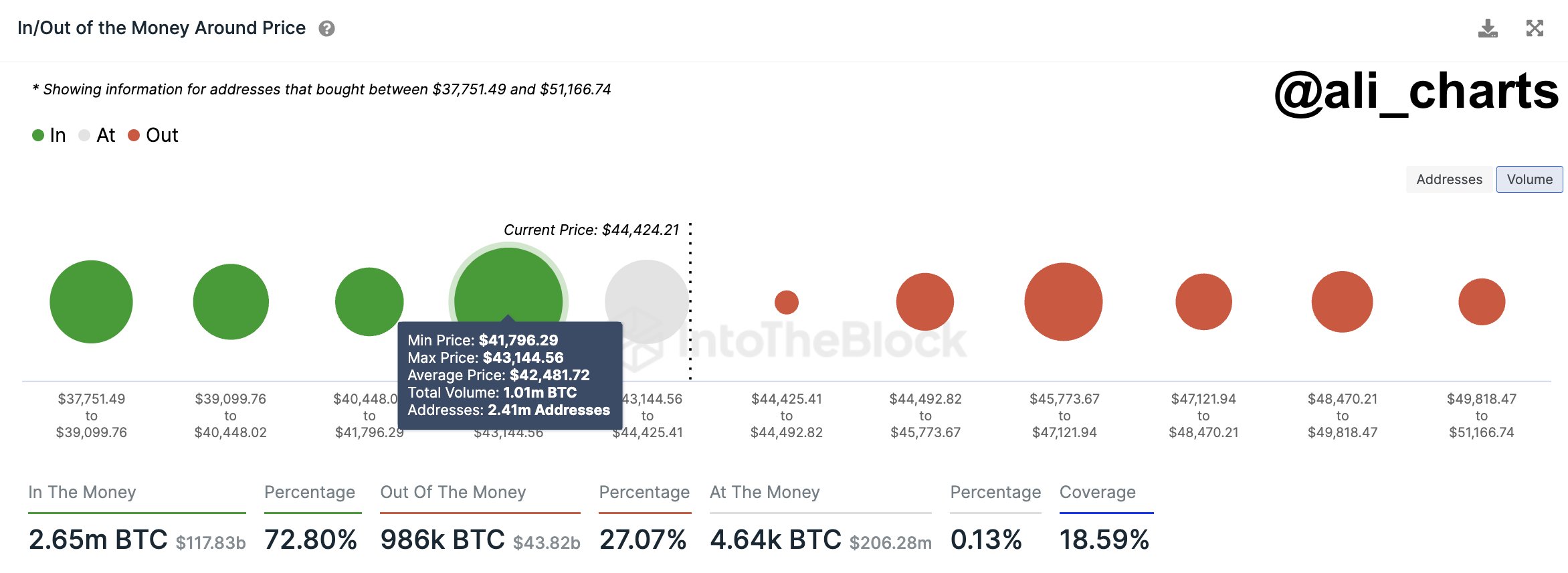

The chart below shows what the distribution of the different BTC price ranges currently looks like based on the concentration of holder cost basis that they carry.

As displayed in the above graph, the $41,800 to $43,100 range hosts the acquisition price of most Bitcoin out of all the price ranges listed. To be more specific, about 2.4 million addresses acquired 1 million BTC within this range.

The cost basis is naturally of immense significance for any investor, as the spot price retesting can flip their profit-loss situation. As such, holders become more likely to show some move when a retest like this happens.

A holder in profit before the retest might tend to buy more when the retest happens, as they might believe this same level that proved profitable earlier would do so again.

On the other hand, loss holders might want to sell at their break-even level since they may fear the cryptocurrency going down again, putting them underwater again.

These buying and selling moves aren’t enough to move the market when just a few investors are making them, but if a large number of investors have their cost basis inside a narrow range, the reaction could become significant.

Since those above $41,800 to $43,100 range is dense with investors, it should be an essential on-chain range. The spot price is floating above the range so that these prices could act as a support barrier for the asset. Based on this, Ali explains, “as long as Bitcoin maintains its position above $41,800, the outlook remains bullish.”

The chart shows that the Bitcoin ranges above the price aren’t carrying the cost basis of that many investors. This could imply that there isn’t much resistance ahead for the coin.

The analyst notes that this lack of major resistance also strengthens the potential for the cryptocurrency to stay at the current levels or push towards the higher ones.

BTC Price

Bitcoin has been gradually making its way back up after the recent crash, with its price climbing towards the $43,800 mark. The below chart shows how the asset has performed during the last few days.