Anticipation is building as major asset managers’ predicted approval date for Bitcoin ETF applications approaches 2024. Experts have now issued bold predictions, with Bloomberg exchange-traded fund (ETF) expert James Seyffart pinpointing the potential approval window from January 5th to January 10th.

The significance of this timeframe has sparked excitement within the cryptocurrency community, as the approval could mark a major milestone for the industry. However, experts emphasize that failure to approve during this window could have significant implications for the SEC and potential ETF applicants.

Bitcoin ETF Approval Expected On January 8th

According to James Seyffart, any potential approval orders for the Bitcoin (BTC) ETF are likely to occur on Monday, January 8th, Tuesday, January 9th, or Wednesday, January 10th. Seyffart and expert Eric Balchunas estimate a 10% chance or less that the approval will fall outside this window.

Furthermore, Seyffart believes that failure to approve the ETF during the predicted window could indicate a significant shift in the SEC’s stance on cryptocurrency-related financial products.

This would suggest that either SEC Chairman Gary Gensler and the regulator have taken an aggressive approach or believe the market is not ready for a spot Bitcoin ETF. In the latter scenario, it is possible that ETF applicants such as ARK Invest and 21Shares have voluntarily withdrawn their applications with assurances of future consideration.

Caitlin Long, founder and CEO of Custodia Bank, believes that if the predicted approval window holds true, there will be an intense marketing battle among Bitcoin spot ETF issuers.

Long highlights that the spotlight will be on these issuers as they compete for investors’ attention and navigate the post-approval landscape. This development is expected to generate excitement among mainstream investors, with many expressing curiosity about Bitcoin’s resurgence following previous periods of doubt.

The potential approval timing aligns with the April halving event and the US presidential election, adding further intrigue to the market dynamics.

BTC Hits New Yearly High Amidst High Probability Of Approval

According to insider sources, the SEC has conducted extensive meetings with Bitcoin spot ETF issuers. These discussions have indicated a high probability of approval, with a reported 99% confidence level.

The SEC is said to meticulously review all applications, ensuring that every detail is thoroughly examined and all necessary requirements are met. In the meantime, Grayscale, a prominent cryptocurrency asset management firm, is actively pursuing the possibility of being the first to offer a conversion-based ETF, contingent on a court decision.

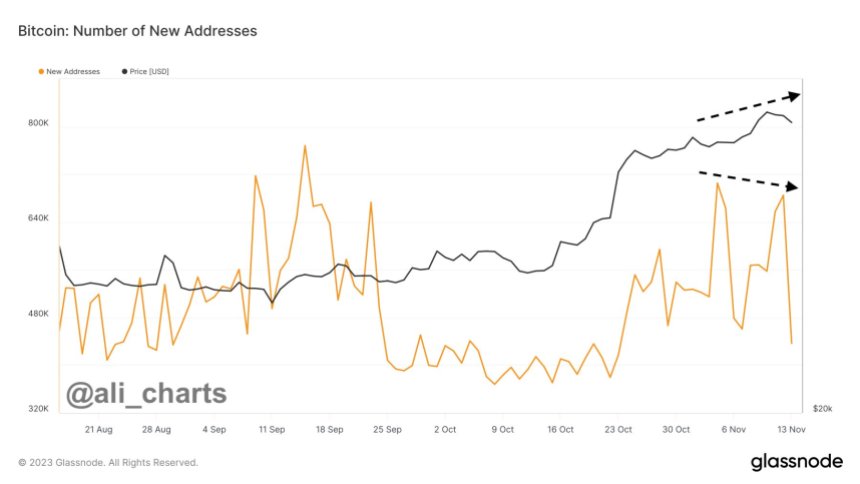

Moreover, Bitcoin has recently achieved a new yearly high, solidifying its position as the leading cryptocurrency in the market. The cryptocurrency has been consistently gaining ground, forming higher lows and demonstrating an upward trend, as evidenced by the 1-day chart below.

Presently, BTC has surpassed the $38,800 mark, surpassing its previous milestone by over $400. The next target in sight is the $40,000 level, which has not been reached since April 2022.

Over the past 24 hours, the bullish momentum has remained strong, with BTC extending its gains by 2.9%, and over the past 7 days, it has seen a 1.7% increase.

As the date of the ETF approvals approaches, it remains to be seen how Bitcoin’s price will respond. Additionally, market participants are eagerly observing how the cryptocurrency will perform during the final stretch of the year.

Featured image from Shutterstock, chart from TradingView.com