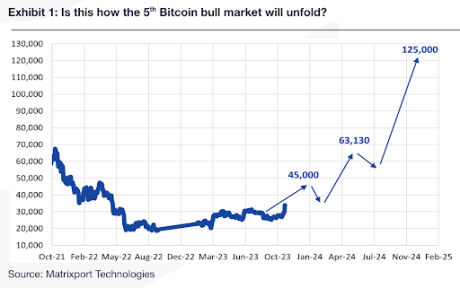

The Bitcoin price crash over the past day has taken crypto investors by surprise, leading to a full bleed day for the industry. However, while this may have come as a shock to many, some were able to call it out ahead of time. One of those is Rent Capital, which said the decline was in line with Bitcoin’s established halving trend.

An Expected Crash

The analysis posted by Rest Capital outlines the trends that Bitcoin has followed leading up to its halving months. In 2020, the halving fell on the month of May and in the month leading up to the rally, the Bitcoin price saw an approximately 20% decline.

Over the years, Bitcoin has followed similar patterns to usher in the anticipated halving and while there has been some deviation this time around, the digital asset looks to be maintain some trends. One of these trends is the price crash before the halving.

As Rekt Capital’s analysis shows, Bitcoin is right in region of where this crash is expected to happen. The previous trends have seen the price fall between 20% and 38% in the month before the halving. So taking this into account, the BTC price could crash around 25% on average if it sticks to this trend.

The crypto analyst also revealed their target for if Bitcoin follows this trend. The crash is expected to push the BTC price below the $40,000. However, if the average plays out, then the price could bottom out above $40,000 before rebounding.

Why This Crash Is Important For Bitcoin

The crash is a confirmation that the Bitcoin price is following the established pre-halving trend and also confirms the incoming bull market. Going by the previous trends, the halving takes place after the crash, following which there is some upside the is seen with the cryptocurrency.

Then, in the months following the halving, there is massive accumulation that serves as a precursor to the bull market. In this case, this accumulation is expected to begin sometime in April 2024 and then continue on for a few months.

The crash, as Rekt Capital points out, also serves as the last opportunity for cryptocurrency investors to get into position at the lowest prices. This is because once the halving is complete and the bull market begins, low prices become a thing of the past.

At the time of writing, the BTC price is seeing minor recovery from its crash below $63,000. It I trading at $63,500, but with a 5.91% decline on the daily chart and a 12.19% decline on the weekly chart, according to CoinMarketCap.

(@DocumentingBTC)

(@DocumentingBTC)

1st cycle, price reached it 4 months before halving.

1st cycle, price reached it 4 months before halving. Nov 2022 $15.5k was the bottom

Nov 2022 $15.5k was the bottom 2024 halving will be >$32k ($32k-$66k IMO)

2024 halving will be >$32k ($32k-$66k IMO)