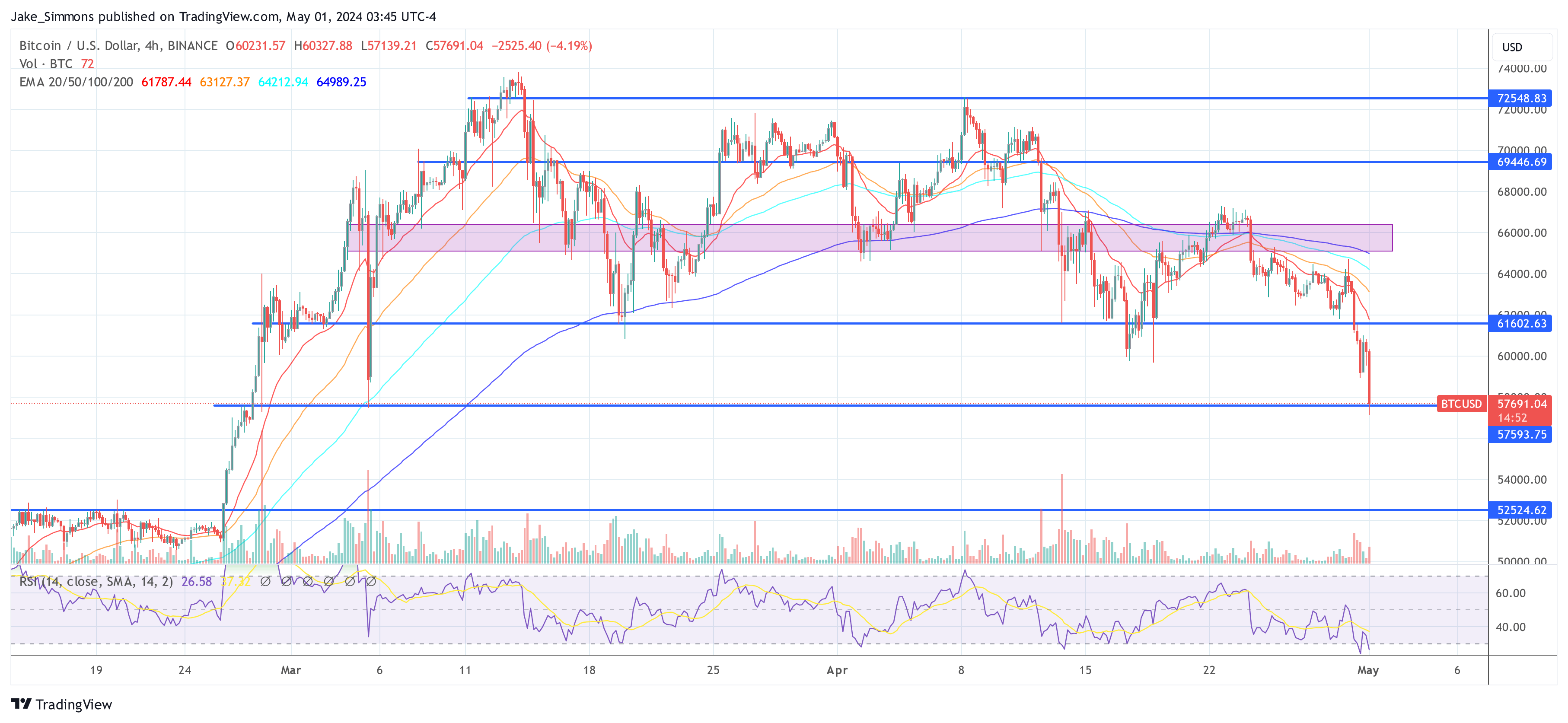

In the last week, Bitcoin has shown much resilience bouncing back above the $60,000 zone after a significant decline to below the $57,000 price zone. As Bitcoin bulls gather momentum to possibly initiate the crypto bull run, top analyst and market expert Peter Brandt has backed BTC to attain a particular six-figure digit value by 2025.

No Other Market Like Bitcoin, Brandt Says

In a blog post on May 3, Peter Brandt shared some insights on Bitcoin in celebration of his 50th anniversary in future markets trading. The veteran analyst described his experience with the maiden cryptocurrency as a “once-in-a-lifetime trade, never to be equaled”.

Bitcoin — the trade of a lifetime

There has never been and never again will be another asset like Bitcoin $BTC

Here is the perspective from my 50-year career as a professional traderhttps://t.co/fyHrGRRHLo pic.twitter.com/dwrBwtknqP— Peter Brandt (@PeterLBrandt) May 3, 2024

Brandt states that Bitcoin is a unique asset in comparison to commodities such as gold, cattle, iron ore, copper, and even other cryptocurrencies such as altcoins and meme coins. He claims that BTC owes this uniqueness to its operational nature as well as its price behavior.

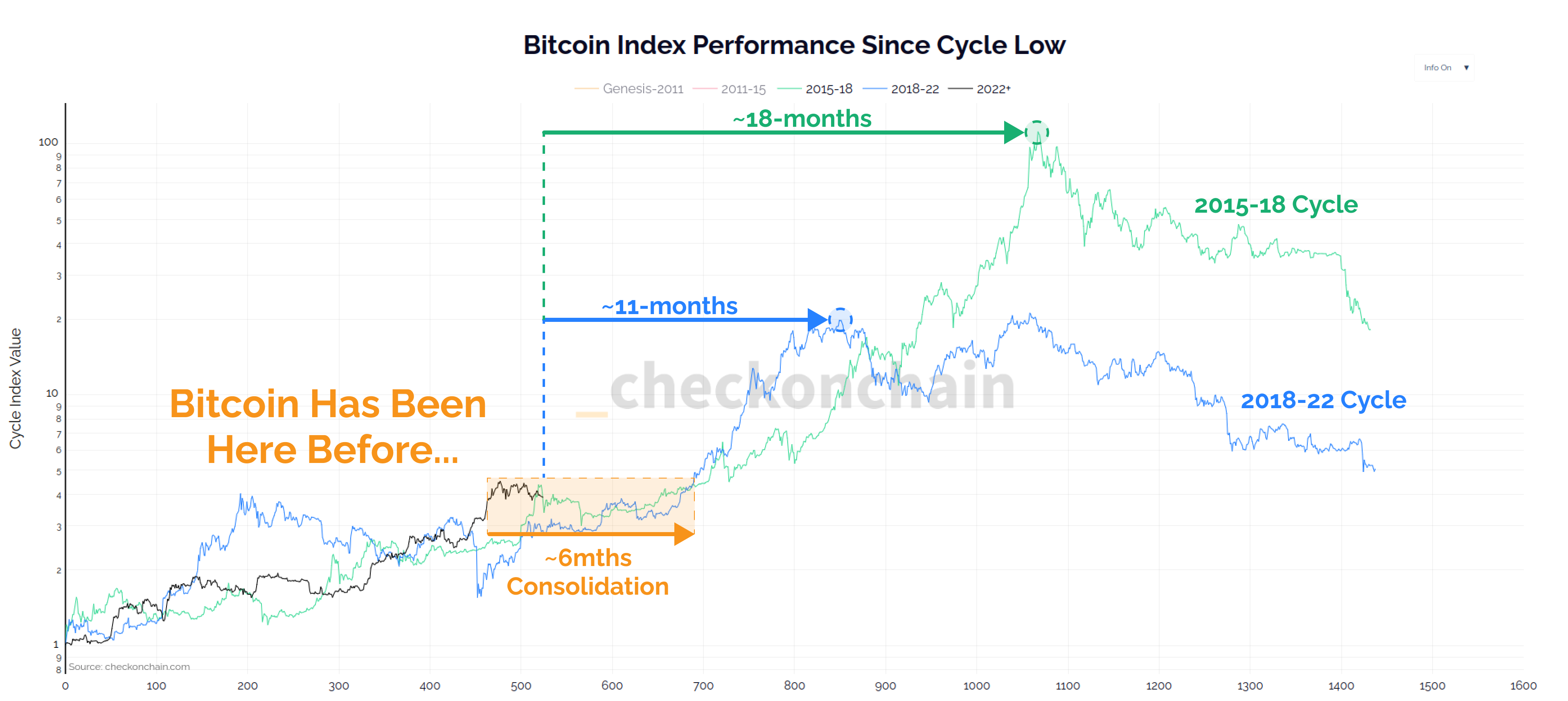

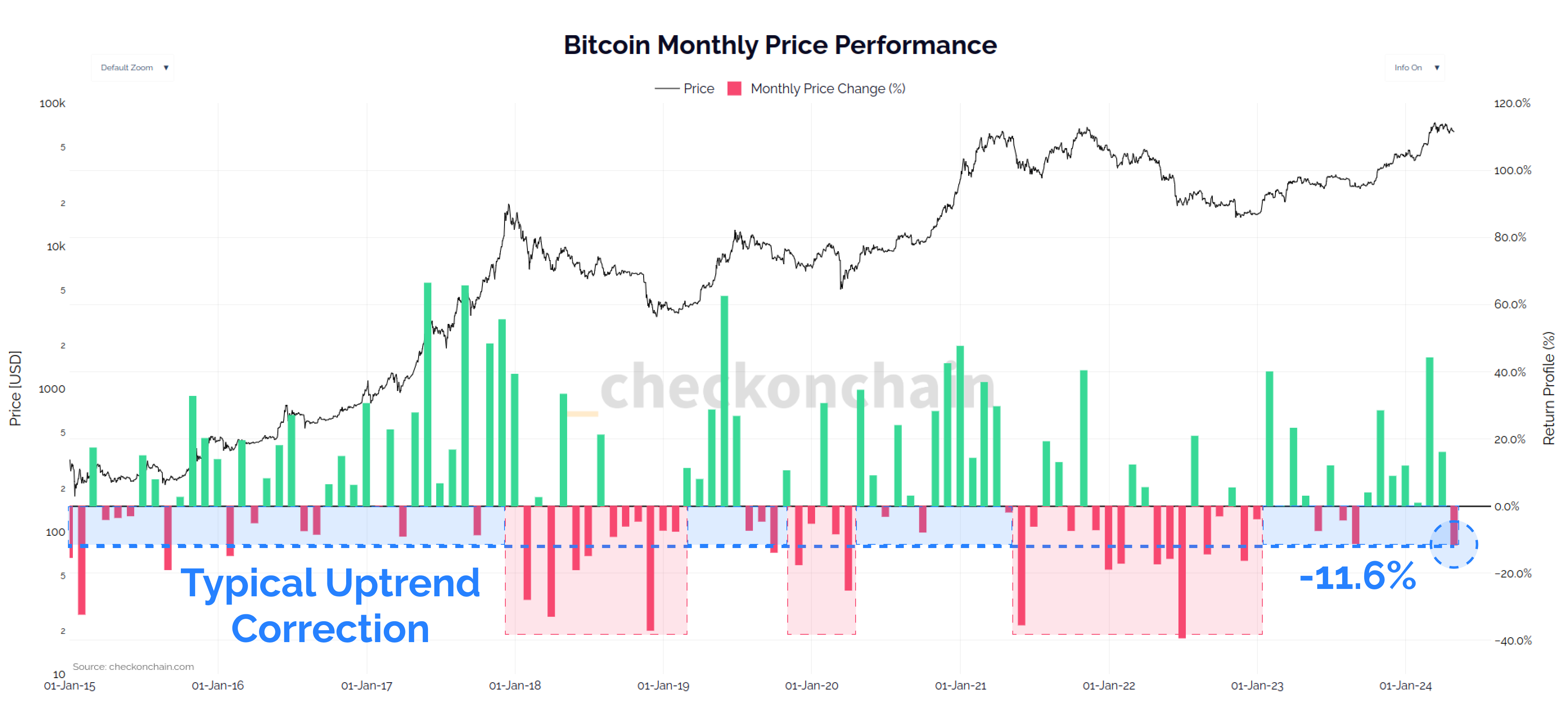

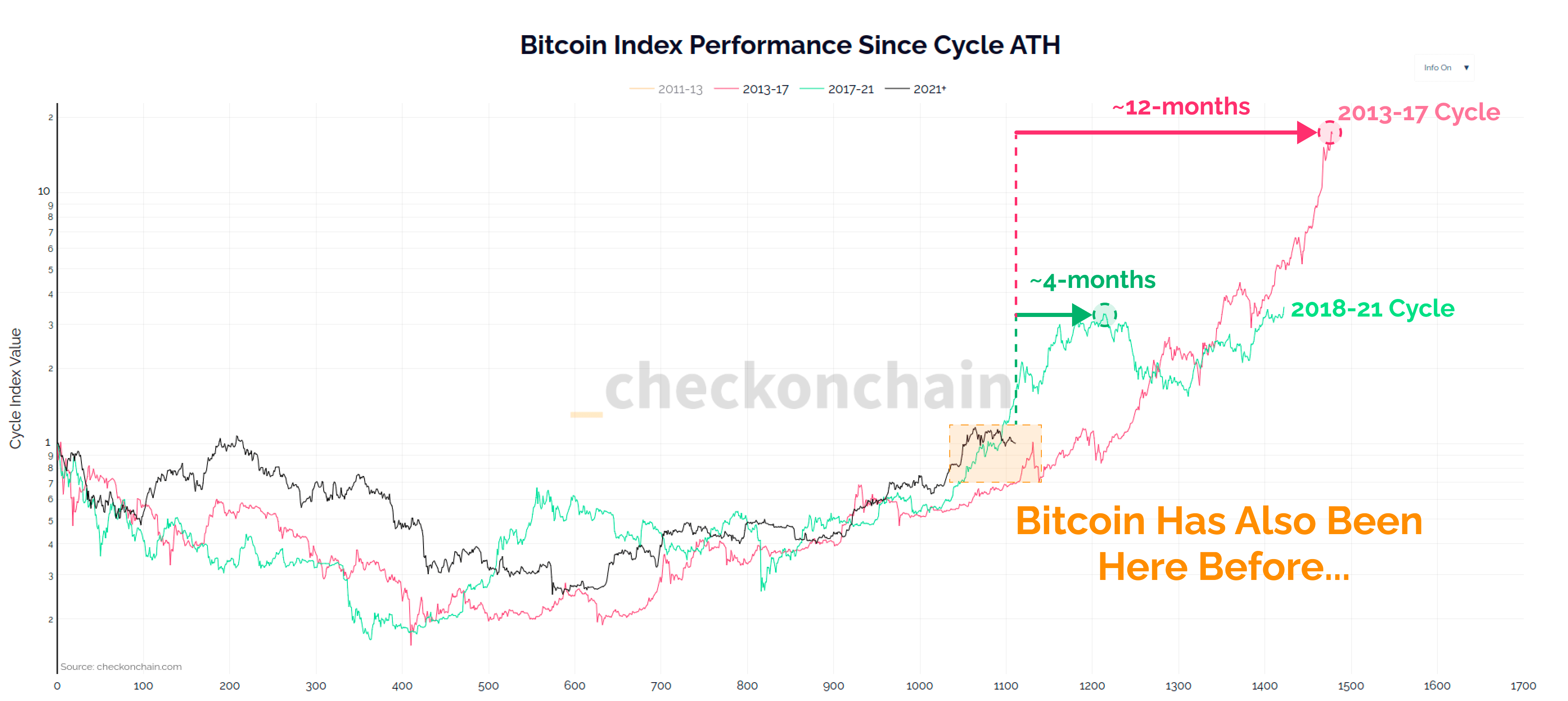

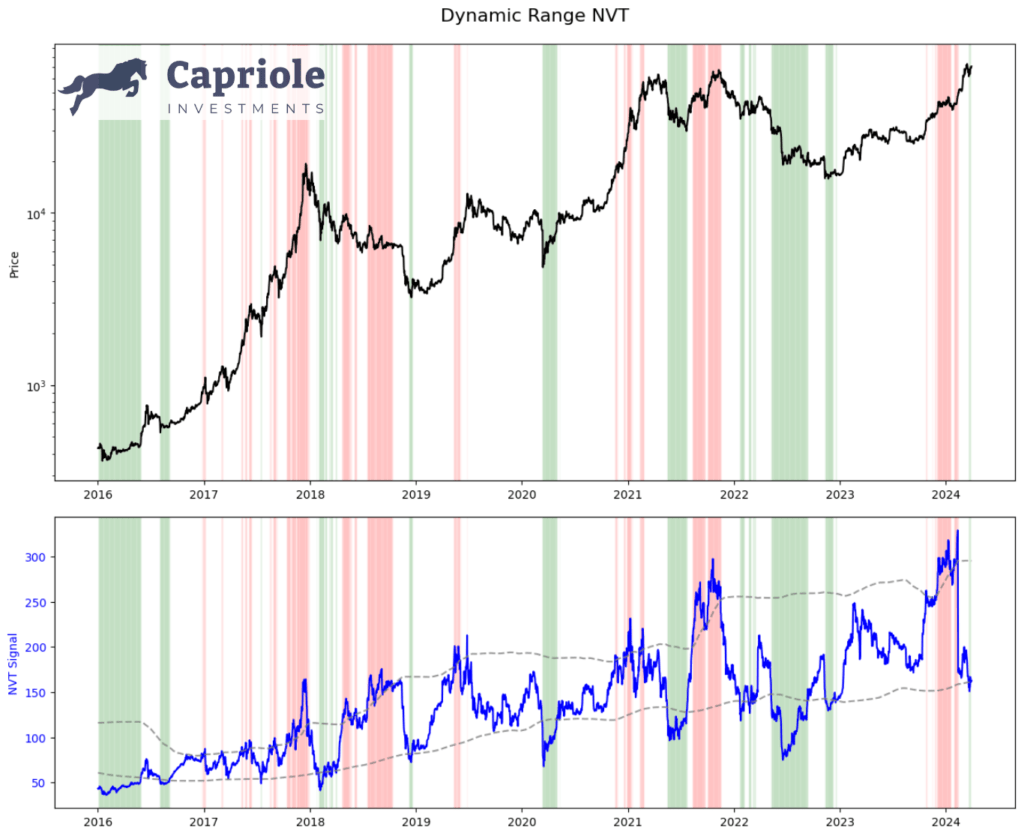

Analyzing BTC price history, Brandt notes that the coin has repeatedly produced exponential gains in the past not seen with any other trading asset. And while these gains are followed by significant corrections, the overall price performance sets BTC apart from other assets.

Another aspect of Bitcoin’s uniqueness as highlighted by Brandt is that the asset’s volatility is also evident in its downturns resulting in a decline of more than 50% and even 75%. Therefore, Bitcoin exerts a special ability to generate substantial profits while also causing significant losses.

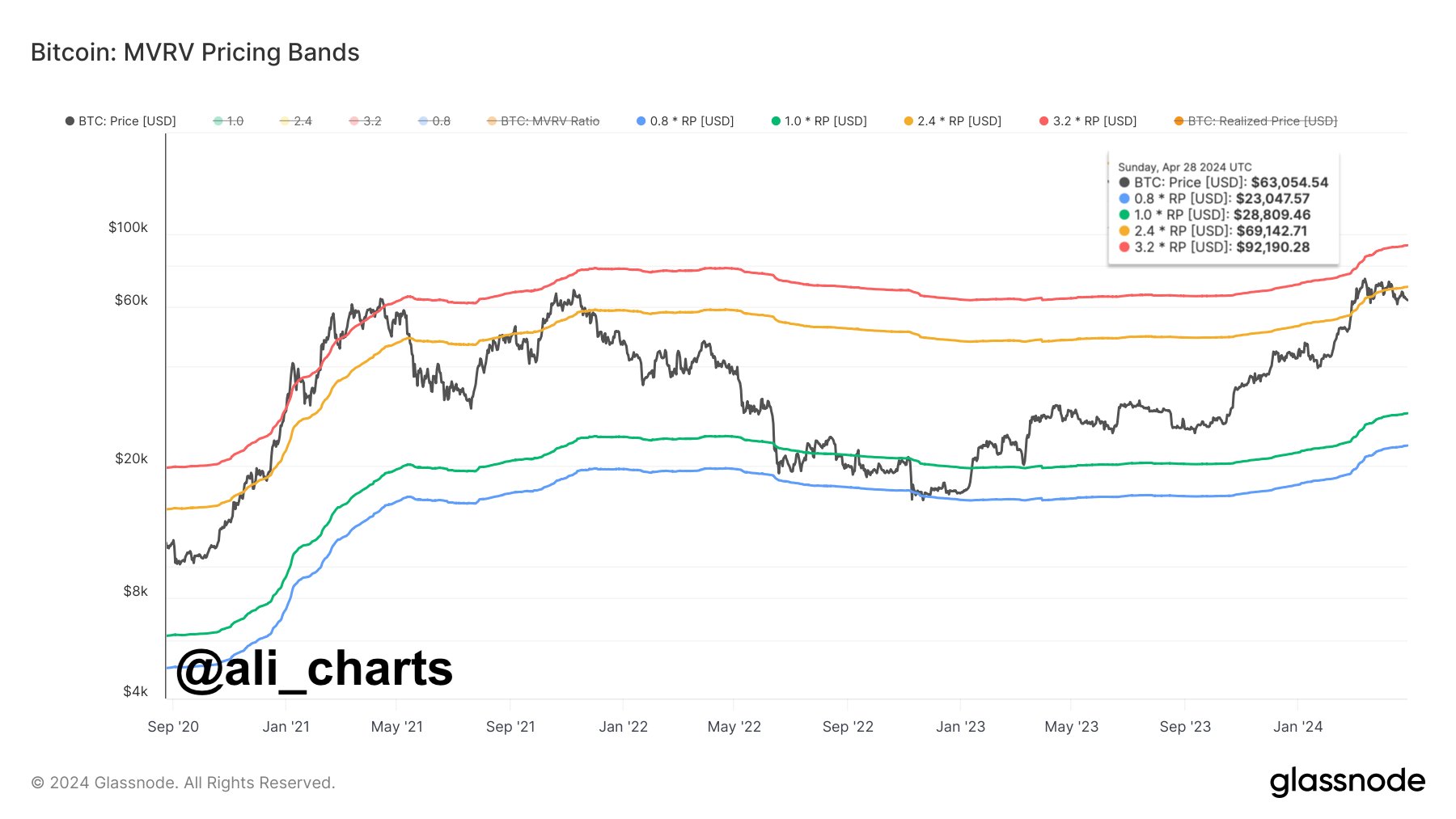

Now, following BTC’s parabolic price nature, Brandt predicts the asset is on course to reach $150,000 by 2025. Interestingly, if the bulls maintain market control, the analyst believes Bitcoin could rise as high as $300,000 beyond 2026.

BTC Price Overview

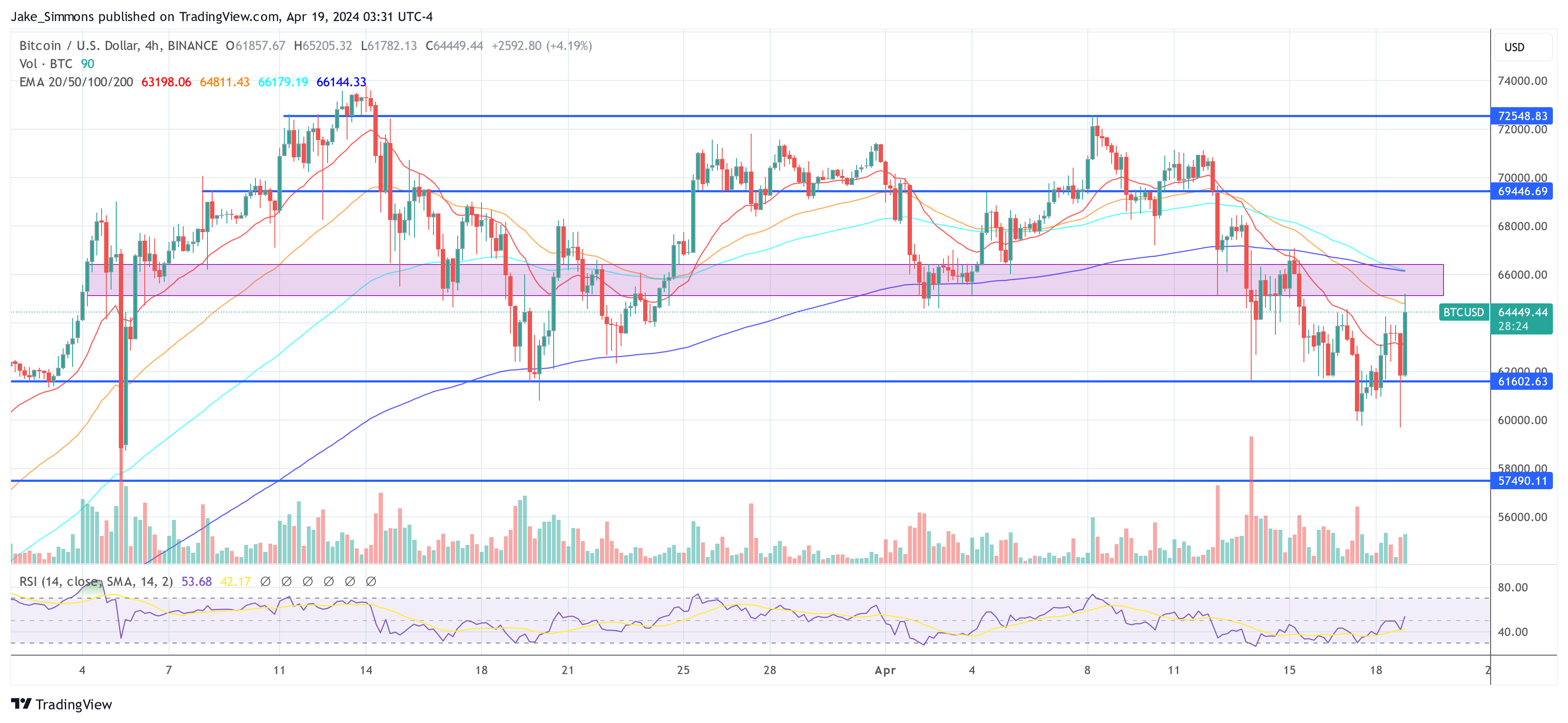

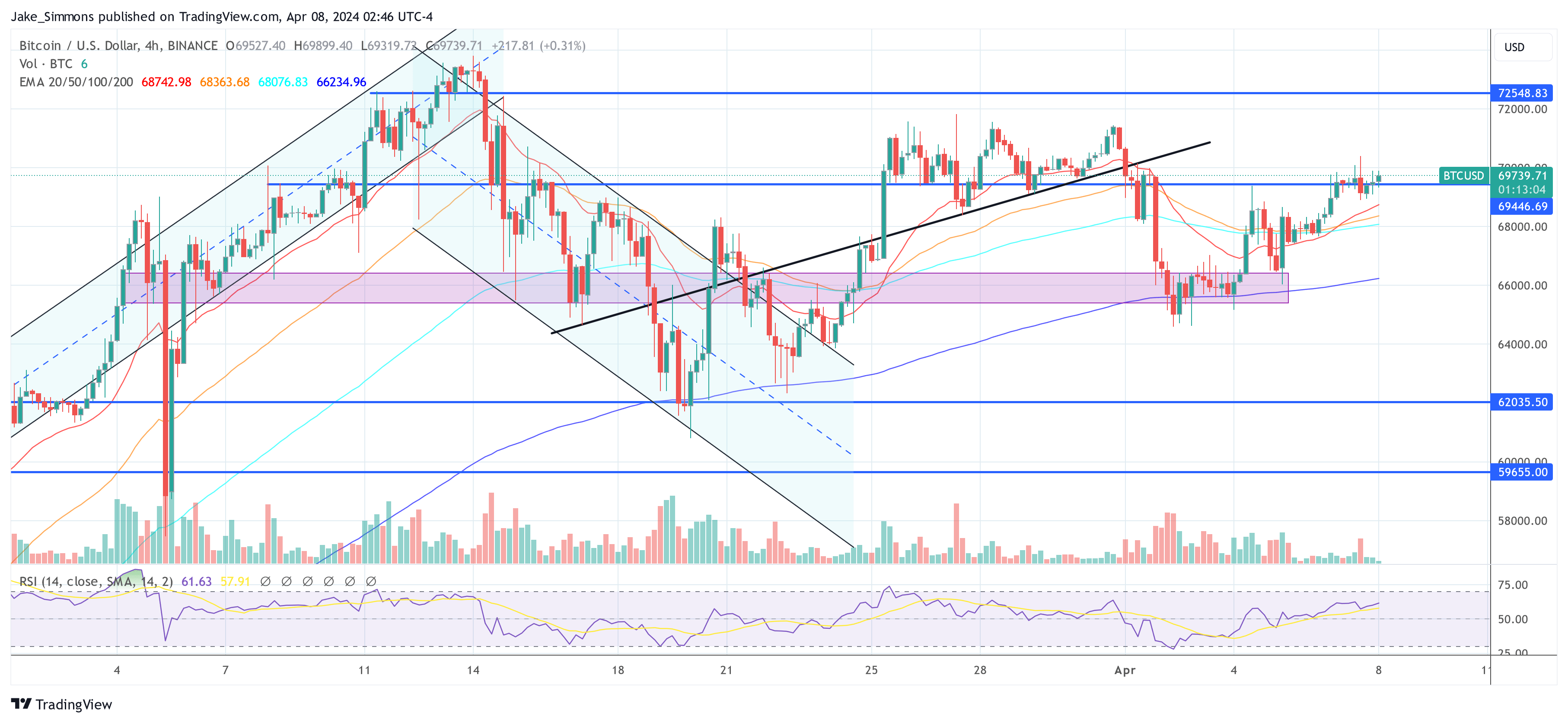

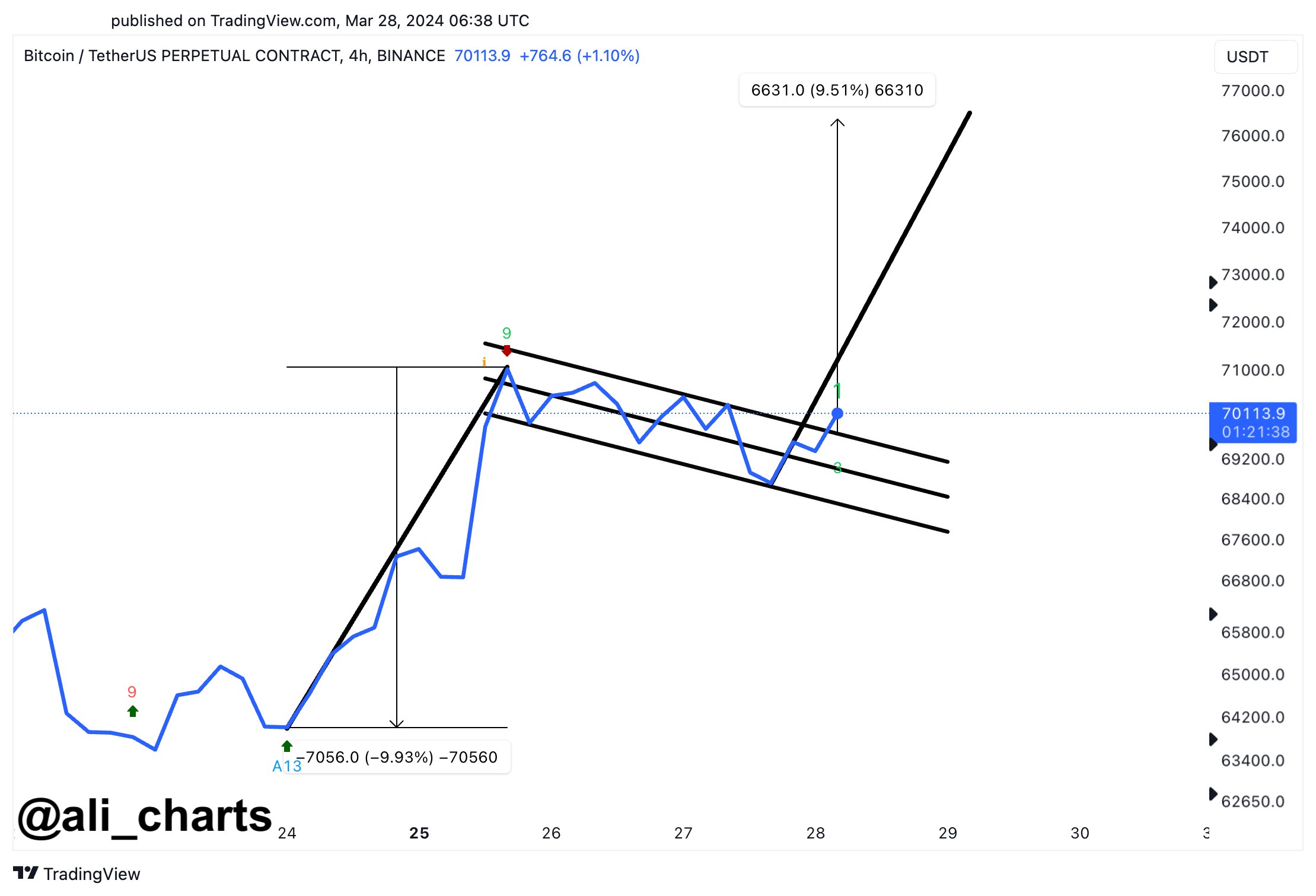

At the time of writing, Bitcoin trades at $63,303 having encountered serious resistance in the $64,000 price zone. The maiden cryptocurrency currently looks to be in consolidation and could be preparing for another possible breakout.

If Bitcoin embarks on a bull run, investors would be hoping for a return to its all-time high value of $73,750. However, in the advent of more selling pressure in the future, BTC could drop below $60,000 again. Nevertheless, Bitcoin remains the diamond of the crypto bull season with several analysts hyping the digital asset to trade above $100,000 within the next 12 to 15 months.

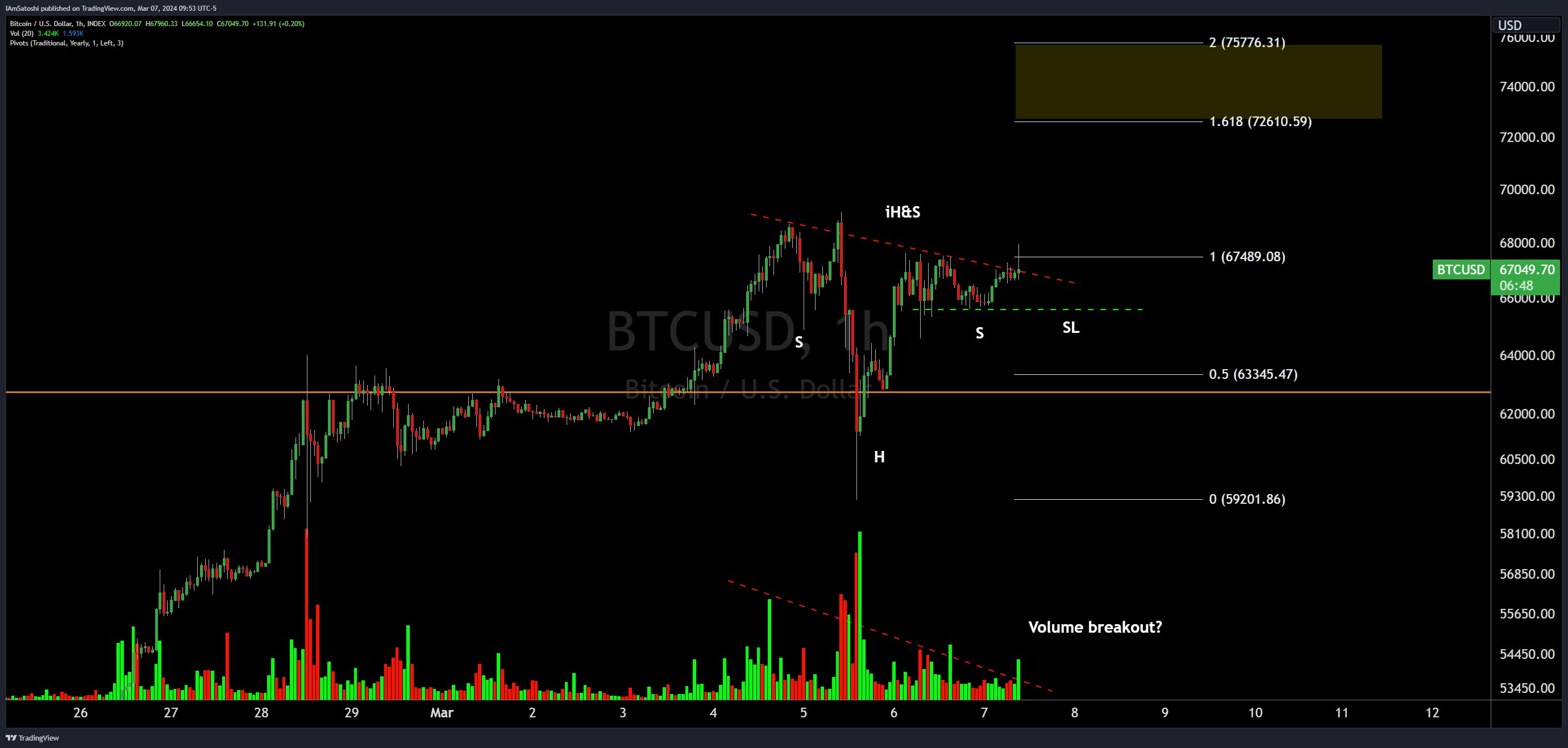

BTC trading at $63,405 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from iStockphotos, chart from Tradingview