A crypto analyst has forecasted Bitcoin’s price to surge to unprecedented highs ahead of the 2024 Bitcoin halving event scheduled for April. The cryptocurrency has already been experiencing significant gains, surpassing its previous all-time high to trade above $70,000.

Bitcoin’s Path To $200,000

In a recent X (formerly Twitter) post, crypto analyst, Gert van Lagen provided a compelling narrative supporting Bitcoin’s bullish trajectory leading up to the halving event in April 2024.

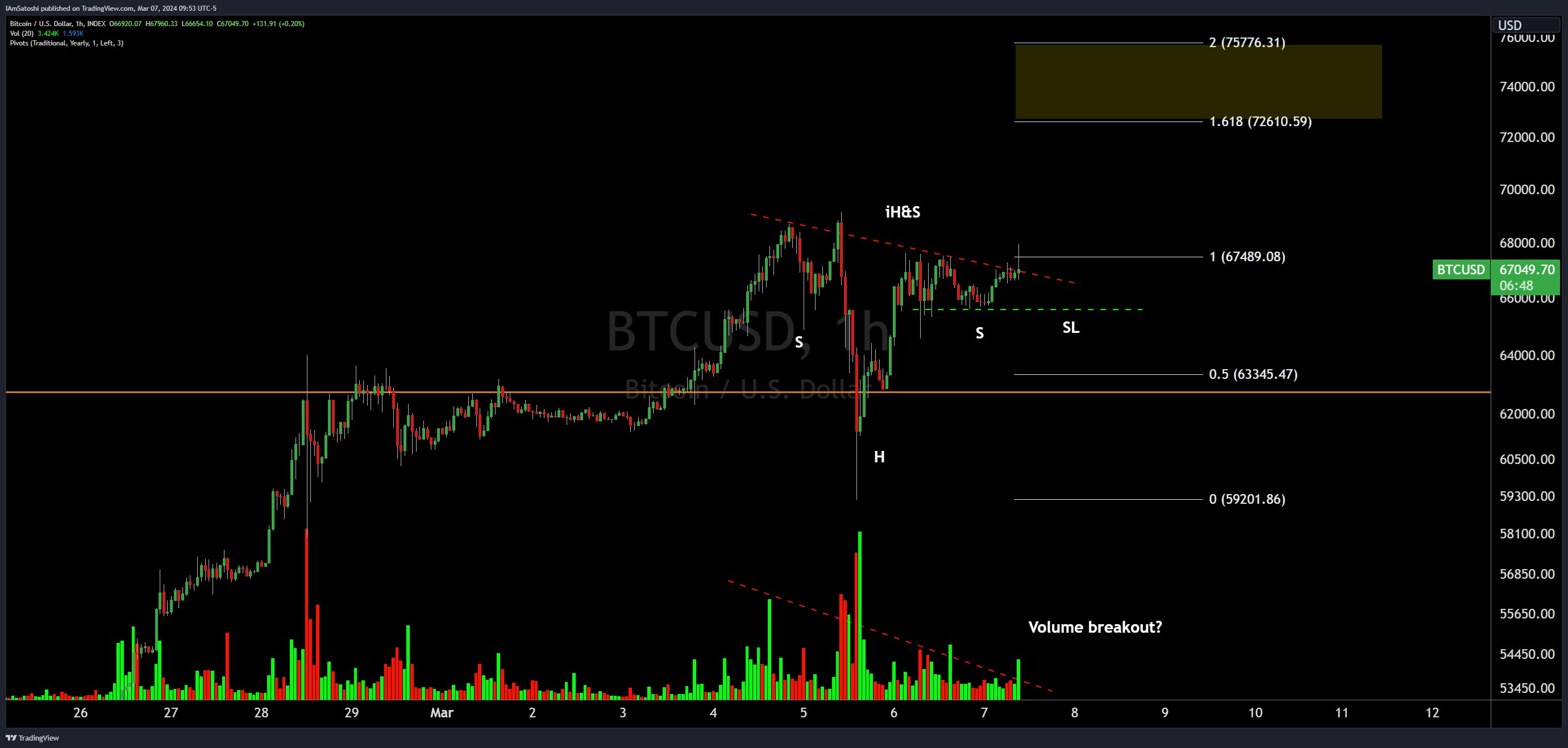

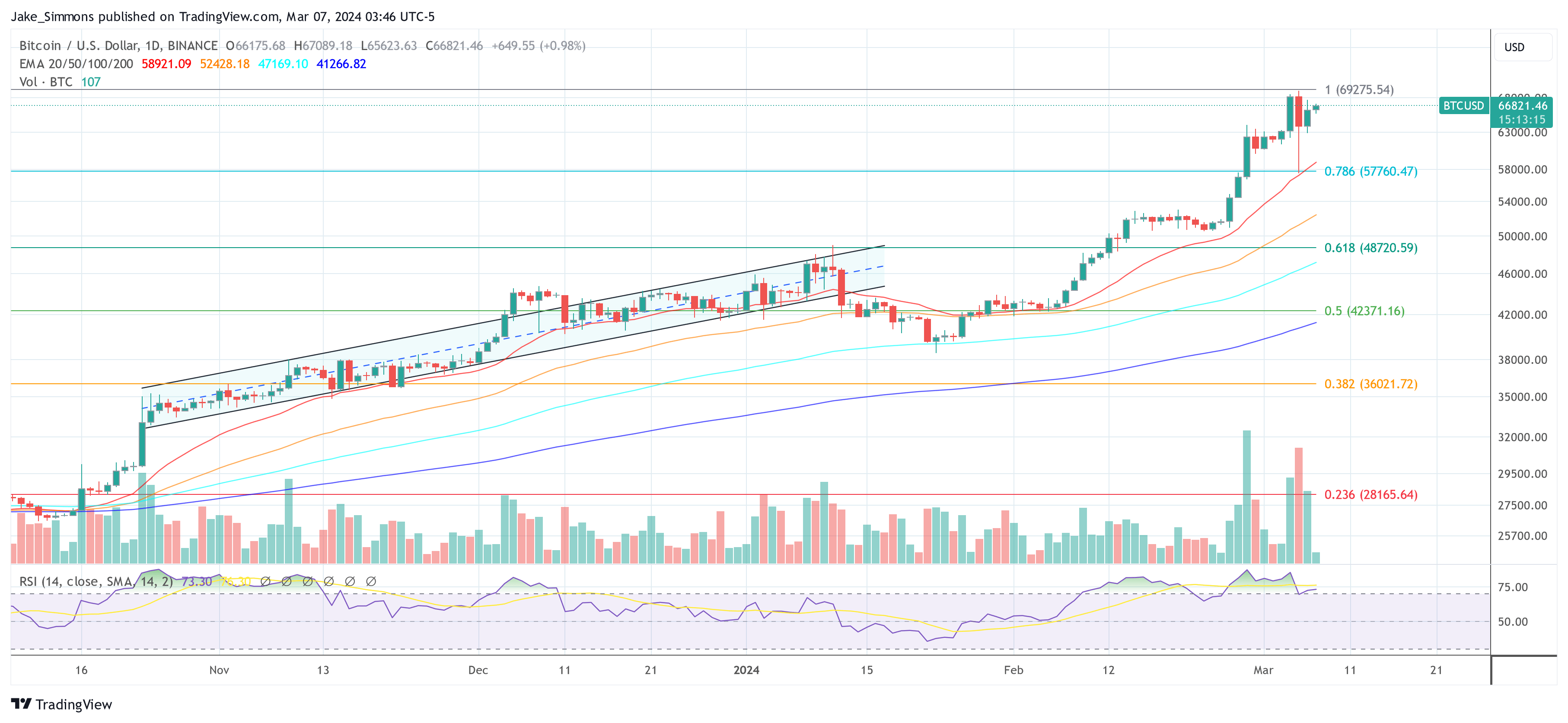

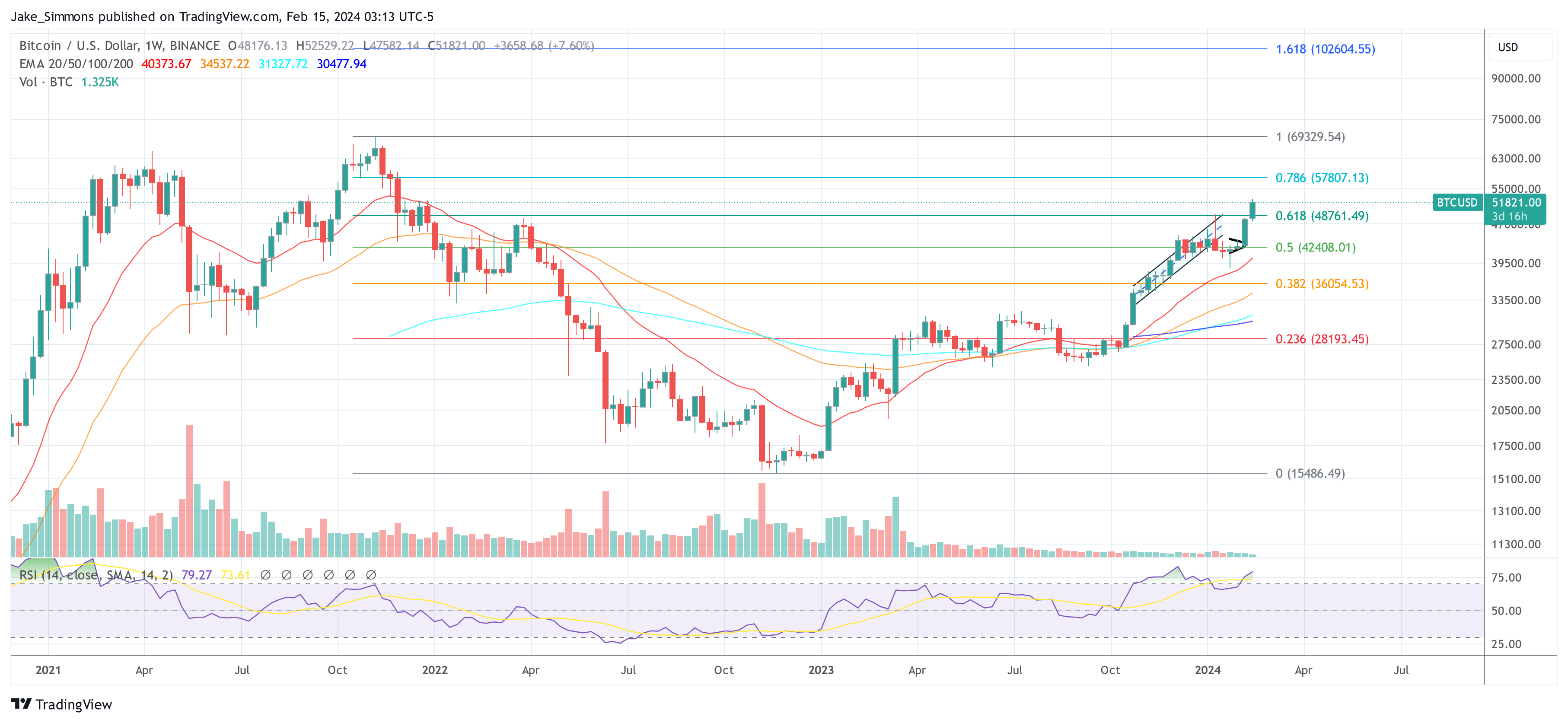

Sharing a price chart illustrating Bitcoin’s recent bullish movements, Lagen revealed that the cryptocurrency doubled in value within 10, 18 and 84 days following its surge to new all-time highs. As a result of this massive rallying trend, the analyst confidently expressed his belief that a move to $200,000 before the halving cycle in April is becoming more plausible.

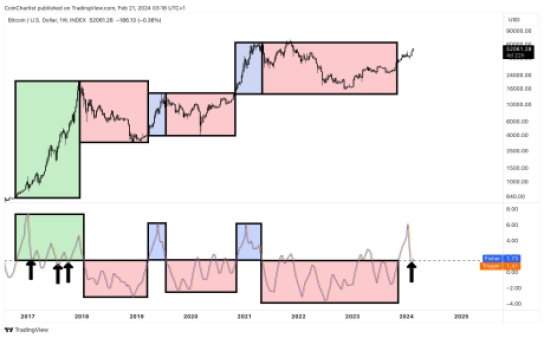

Traditionally, the Bitcoin halving marks an event where the rewards for mining new blocks are cut by half, leading to a subsequent reduction in the cryptocurrency’s supply and contributing to a sustainable increase in its value. The highly regarded four-year event is usually accompanied by a significant bull run for Bitcoin and other cryptocurrencies within the market.

Contrary to historical patterns indicating that the Bitcoin bull run typically aligns with the halving event, the cryptocurrency has been experiencing unprecedented gains in anticipation of the halving, leading analysts to consider the possibility of an even larger price jump during the event.

The cryptocurrency’s achievement of a new all-time high before the halving stands as an extraordinary occurrence, underscoring the immense demand and growing popularity of Bitcoin in the crypto space.

Including Lagen, other analysts have predicted bullish outcomes for Bitcoin ahead of the halving event. According to crypto analyst, “The Bitcoin Therapist,” on X, Bitcoin is expected to rise to $100,000 by April. Additionally, a steady rise to new all-time highs at $75,000 is expected to occur before the halving, as stated by another crypto analyst.

Bitcoin Smashes Through $70,000 Barrier

Following its previous surge to $70,000 on Friday, March 8, 2024, Bitcoin encountered a minor setback, retracting to a level just above $69,000. However, in the last 24 hours, the cryptocurrency has recorded an unprecedented surge, amassing approximately 2.68% and currently trading above the $71,000 price mark, according to CoinMarketCap.

This price increase marks a historic milestone for the cryptocurrency as it reaches an all-time high above $71,000 for the first time. As of this moment, Bitcoin is trading around $71,312, experiencing significant price fluctuations that have contributed to its recent gains. The cryptocurrency’s 24-hour trading volume is also up by 82.80%, underscoring the increasing demand and interest in the pioneering digital currency.