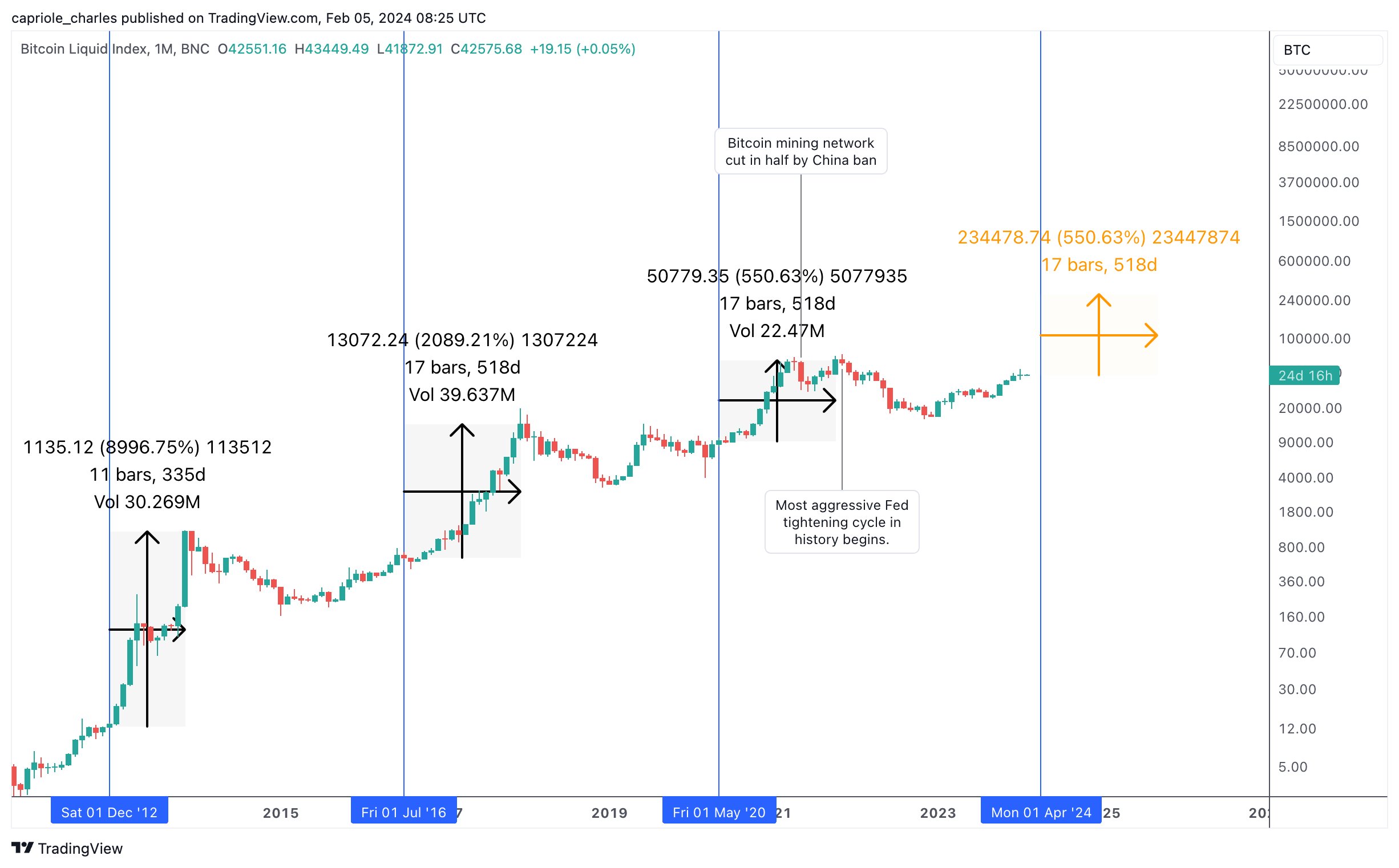

Bitcoin looks to be stuck in a consolidation zone between $50,000 and $52,000, with neither the bulls nor the bears succeeding in completely taking control of the trend. This performance has sparked a number of speculations on whether the BTC price has finally found a local top. One of those who have speculated on the price direction is crypto analyst Alan Santana, who has used the Elliot Wave Theory to predict where the price of the cryptocurrency might be headed next.

Elliot Wave Points To Correction To $31,800

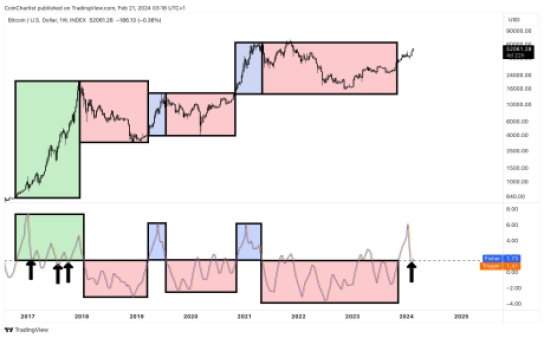

In the analysis shared by Alan Santana on TradingView, the Elliot Wave theory could point out the direction that the Bitcoin price could be headed next. The theory, which consists of five waves, has so far completed three waves, with the fourth wave expected to happen soon.

Given that the third wave is very bullish and the price has risen so fast, the fourth wave is expected to be more bearish. As Santana explains, this fourth wave points toward an upcoming correction. They also reveal that their analysis included Elliot’s Law of Alternation, and applying it to this scenario, the fourth wave is bearish, but would not go as low as the second wave.

Once this fourth wave moves into action, the Bitcoin price is expected to see a sharp correction. At the low end of this correction, though, is the $31,800 level, the analyst believes. So, in this scenario, there will be a return to the $20,000s before Bitcoin resumes its next leg up.

“This wave four of a higher degree cannot enter the territory of wave two, which puts the lowest price possible for the upcoming correction at $31,805 based on Elliot Wave Theory,” Santana said. He further added that: “Just as wave three would lead to a correction (wave four), wave four invariable leads to another impulse; the final and fifth wave of the higher degree.”

Bitcoin Top At $138,000

Not only does the Elliot Wave theory points toward a possible bottom, it also gives an idea for where the Bitcoin top might lie in the fifth wave. The crypto analyst uses one of the two Wave Principle methods to forecast this price, which takes into account the peak of the third wave and then uses that to give the peak of the fifth wave.

So far, the local top of this third wave looks to be $52,985, where Bitcoin peaked earlier this week. Since the Wave Principle says that the peak of Wave 5 would be three times higher than that of Wave 3, the analyst multiples $59,985 by 3, which gives a cycle top of $138,714.

As for when this peak will roll around, Santana explains that the whole thing could play out by 2025, which is when the peak would take place. “So the potential for the final impulse or fifth wave based on the Elliot Wave Theory system, amounts to $138,714. This can happen sometime in 2025,” the analyst stated.