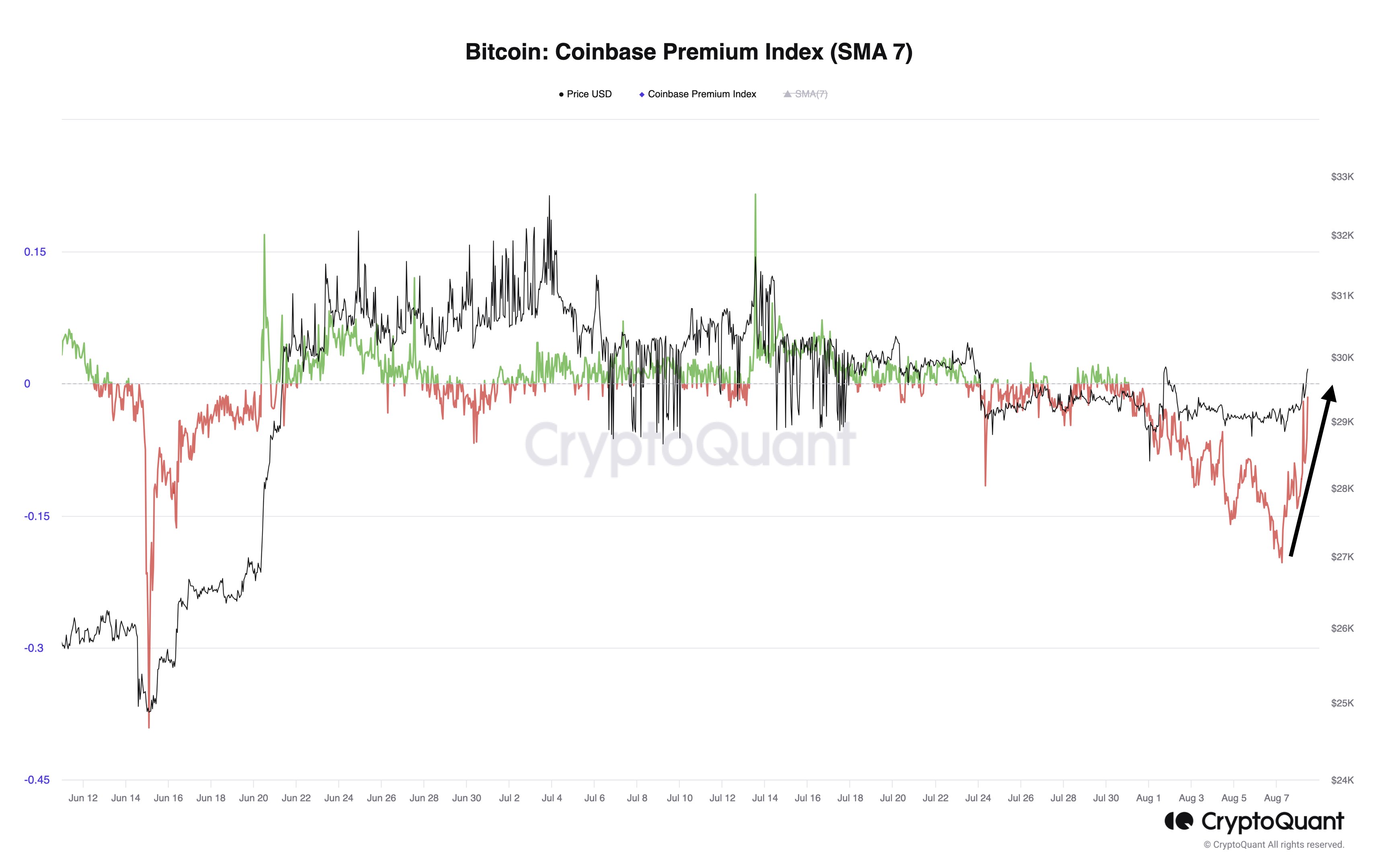

Data shows the Bitcoin Coinbase Premium Gap is currently negative. Here’s what this could mean for the asset’s recent attempt at recovery.

Bitcoin Coinbase Premium Gap Has Been Deep Red Recently

An analyst in a CryptoQuant Quicktake post pointed out that the Coinbase Premium Gap has been negative recently. The “Coinbase Premium Gap” here refers to an indicator that tracks the difference between the Bitcoin prices listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the value of this metric is positive, it means that the price listed on Coinbase is greater than that on Binance right now. Such a trend implies that the former platform is currently witnessing a higher buying pressure or a lower selling pressure than the latter.

On the other hand, the negative indicator suggests Coinbase is witnessing relatively high selling pressure as the price listed here is lower than on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the last few years:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has plunged into negative values recently, implying that the selling pressure on Coinbase has risen.

Earlier, the metric had a notable positive streak, and this run coincided with a rally in the cryptocurrency’s price. The asset fell as the indicator flipped towards red, suggesting increased selling pressure may have contributed.

US-based institutional investors commonly use Coinbase, while Binance has a more global audience. As such, the Premium Gap can provide hints about American whales’ buying or selling behavior.

It would appear that these institutional players were buying during the recent rally, but as soon as they switched towards selling, the price suffered for it. The last bull market also saw significant buying pressure from these investors, while the bear market saw the indicator restricted to negative or neutral levels.

Bitcoin has been trying to recover from its recent drawdown, but from the chart, it’s apparent that the Coinbase Premium Gap is still at deep red values.

Thus, the fact that large American investors are falling behind in buying pressure may not bode well for this recovery attempt if the recent pattern followed by the metric is anything to go by.

BTC Price

Since the visit below the $39,000 level, Bitcoin has seen a notable rebound below the $43,000 mark. The chart below shows how the coin has performed over the past month.

This recovery has stood so far, but given the negative Coinbase Premium Gap, the cryptocurrency may encounter some resistance soon.