The year 2024 marks the dawn of a new era, not just for technology but for finance, as a major victory was achieved for Bitcoin Spot ETFs (Exchang-Traded Funds). It’s now the era where the past will be appreciated for its foresight and doggedness.

When the pioneer cryptocurrency and digital currency, Bitcoin launched in January 2009, it was nothing like a real-world asset or of an ‘agreed’ digital value, but an almost neglected bag of gold as it faced enough rejection from all phases. Even with Satoshi’s Whitepaper, Bitcoin wasn’t given a cordial welcome in the world of finance.

However, for all its promise, BTC remained shrouded in an air of mystery and skepticism. It took several years for Bitcoin to cement its value in the world of technology, finance, and the digital economy, assuming a giant role amidst many other cryptocurrencies.

However, On January 10, 2024, the SEC, in its official filing, approves all 11 Bitcoin Spot ETFs. This long-awaited green light from the US SEC marked a watershed moment, not just for Bitcoin, but for the entire cryptocurrency industry.

The 14-year journey to this point was arduous and paved with skepticism; regulatory hurdles loomed large, with the SEC citing concerns about market manipulation and investor protection as justification for repeated rejections. Attempts like Bitcoin futures ETFs offered limited exposure, failing to capture the true essence of a spot ETF’s direct price tracking.

Bitcoin Spot ETF Explained

The recent approval of Bitcoin spot ETFs has stirred excitement across the financial landscape. But what exactly are these instruments, and what impact will they have on the future of BTC and, more broadly, on the investment landscape?

Bitcoin “Spot” ETFs (exchange-traded funds), unlike their futures-based counterparts, don’t track the price of Bitcoin futures contracts. Instead, they take a more direct approach, holding the underlying asset – Bitcoin itself – in secure digital custodians.

This eliminates the potential for “basis risk,” a phenomenon where futures prices deviate from the actual cash price of Bitcoin. Simply put, Spot ETFs offer a more straightforward and transparent way to gain exposure to BTC’s price movements, akin to traditional gold-backed ETFs.

Bitcoin Spot ETFs function similarly to their traditional counterparts, such as those tracking stock market indices. They pool investor capital, purchasing Bitcoin and holding it securely. Each share of the ETF represents a fractional ownership of the pooled Bitcoin, allowing investors to participate in the market without directly holding or managing the cryptocurrency themselves. This eliminates technical complexities and potential security risks, particularly for those with limited crypto experience, potentially broadening the base of Bitcoin investors.

The Genesis Of Bitcoin ETFs (Early Days and Conceptualization – 2013-2017)

The earliest sparks of a Bitcoin ETF concept date back to 2013, when the Winklevoss twins first proposed their Gemini ETF. Winklevoss twins, Cameron and Tyler, both tech entrepreneurs with a vision in 2013, submitted the first application for a Bitcoin ETF, the Gemini ETF, sparking the decade-long journey to regulatory approval.

This audacious proposal was outrightly rejected by the SEC during the tenure of its former chairman, Jay Clayton, who later resigned in 2020 and became a supporter of cryptocurrency. Interestingly, Clayton is now actively involved in crypto regulations when he joined the advisory board of Fireblocks, a crypto custody platform.

The following years were a crucible of innovation and uncertainty. While Bitcoin’s market capitalization surged, attracting both fervent supporters and cautious observers, the SEC remained hesitant. The regulator’s concerns about market manipulation, price volatility, and the nascent state of blockchain technology were cited as justifications for repeated rejections of subsequent ETF proposals, including Grayscale’s attempt to convert its Bitcoin Investment Trust into a spot ETF.

Yet, amidst the rejections, there were flickers of progress. Technological advancements improved blockchain security and custody solutions, addressing initial concerns about vulnerability and potential wash trading. The global adoption of Bitcoin, particularly in Canada with its approval of Spot ETFs in 2021, served as a compelling case study for increased accessibility and market stability.

This period also saw the SEC’s stance slowly evolve. The appointment of Gary Gensler as SEC Chair in 2021 brought a newfound openness to dialogue and exploration of potential regulatory frameworks for cryptocurrencies. The approval of the first US-listed futures-based bitcoin ETF in October 2021, despite its limitations, offered a glimpse of what could be.

The Turning Point: A Decade Of Persistence Pays Off (2018-2023)

While the 2017-2018 crypto boom and subsequent crash sent shockwaves through the industry, it also served as a crucible, forging resilience and fueling a renewed focus on compliance and innovation. Industry figures like Grayscale, undeterred by previous rejections, continued to refine their proposals, incorporating crucial safeguards and addressing regulatory concerns.

This relentless pursuit of approval finally yielded results in 2023. In May, Cathie Wood’s ARK Investments filed for a spot bitcoin ETF, setting a definitive deadline for the SEC’s decision.

Then, in June, BlackRock’s entry into the arena with its own Spot Bitcoin ETF application sent ripples of excitement through the financial world. This move by a traditional financial giant signalled a crucial shift in sentiment, demonstrating growing institutional confidence in BTC’s potential.

The months that followed were a whirlwind of activity. A flurry of applications from firms like Fidelity and Invesco poured in, fueled by the momentum of BlackRock’s move and the prospect of imminent approval. In August, a pivotal legal victory for Grayscale in the D.C. Circuit Court further strengthened the case for spot ETFs, forcing the SEC to re-examine its previous rejections.

Finally, the SEC, in a historic decision, greenlighted 11 spot bitcoin ETF proposals, including those from BlackRock, Fidelity, and VanEck. This moment marked the culmination of a decade-long struggle, signifying the mainstream acceptance of investor participation in the cryptocurrency space.

Ripples Across The Crypto Landscape: Implications Of Bitcoin Spot ETFs (2024)

The arrival of spot ETFs has cast a wide net, sending ripples across various spheres of the financial world. There are a lot of potentials and challenges presented by spot ETFs, vital impact on market stability, institutional adoption, and regulatory oversight. There are positive predictions that the Bitcoin market cap could rise above $1 Trillion after the launch of Bitcoin Spot ETFs.

Let’s contemplate the broader significance of this pivotal moment, what it means for the future of finance, and its relationship between technology and traditional financial systems here.

Investor Crossroads

For retail investors, Spot ETFs offer a convenient and familiar way to participate in the Bitcoin market without directly holding the cryptocurrency. This opens the door to broader adoption and increased liquidity, potentially leading to smoother price discovery and reduced volatility. The influential American magazine, Forbes predicted the BTC price will trade as high as $80,000 as a result of Bitcoin Spot ETFs’ approval.

The year 2024 is also shaping up to be a good one, if not one of the best seasons for cryptocurrency, especially Bitcoin, as it’s the season for Bitcoin halving, which will have another mega impact on the crypto industry.

However, the inherent risks of Bitcoin, including price fluctuations and potential exposure to fraud, must not be underplayed. Investors should approach spot ETFs with cautious optimism, ensuring a proper understanding of the technology, market dynamics, and associated risks before venturing in.

Institutional Embrace Bitcoin

The arrival of spot ETFs marks a significant step towards institutional acceptance of Bitcoin. The involvement of established financial institutions like BlackRock and Fidelity lends credibility to the cryptocurrency and paves the way for further integration with traditional financial products and services.

Concerns remain about the impact of institutional involvement on market manipulation and potential conflicts of interest. However, regulatory oversight and robust compliance frameworks will be crucial in ensuring a fair and transparent market for all participants.

Market Redefined

Spot ETFs could potentially lead to greater market stability by introducing institutional investors and their risk management expertise. This could mitigate some of the inherent volatility of the cryptocurrency market, attracting a wider range of investors and fostering sustainable growth.

The SEC’s approval represents a cautious acceptance, not a blank check. Further regulatory clarity and potential adaptation of existing frameworks might be required to effectively address the unique challenges posed by the integration of cryptocurrencies into mainstream financial systems.

Beyond Bitcoin

Spot ETFs could act as a gateway for investors to explore the broader crypto landscape. Their familiarity and ease of access might encourage exploration of other promising blockchain-based projects, accelerating the overall growth and development of the cryptocurrency ecosystem.

The success of spot ETFs will hinge on the continued evolution of blockchain technology and associated infrastructure. Scalability, security, and user experience will remain key areas of focus for ensuring the smooth functioning and widespread adoption of crypto-based financial products.

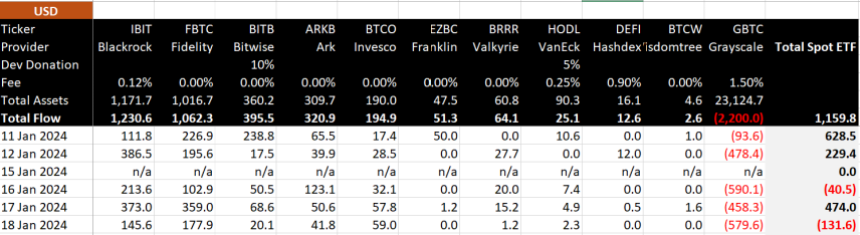

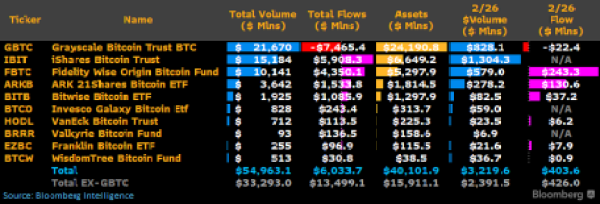

The 11 Spot Bitcoin ETFs products (with their ticker symbols) approved on January 10, 2024, are:

- Blackrock’s iShares Bitcoin Trust (IBIT)

- ARK 21Shares Bitcoin ETF (ARKB)

- WisdomTree Bitcoin Fund (BTCW)

- Invesco Galaxy Bitcoin ETF (BTCO)

- Bitwise Bitcoin ETF (BITB)

- VanEck Bitcoin Trust (HODL)

- Franklin Bitcoin ETF (EZBC)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Valkyrie Bitcoin Fund (BRRR)

- Grayscale Bitcoin Trust (GBTC)

- Hashdex Bitcoin ETF (DEFI)

Conclusion

The approval of Bitcoin spot ETFs is a watershed moment, not just for the cryptocurrency itself, but for the entire financial landscape. It marks a new chapter in the saga of Bitcoin, one where its disruptive potential can be harnessed within the framework of established financial systems.

Also, this path forward is paved with both opportunities and challenges. Navigating regulations and addressing investor risk concerns are important to ensure seamless integration with traditional financial systems and regulatory bodies, which will be crucial in determining the ultimate success of this technological leap.

Final Thoughts

The approval of Bitcoin spot ETFs is not merely a regulatory green light; it’s a resounding declaration of Bitcoin’s arrival on the main stage of finance.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

However, the journey is far from over. This approval is a milestone, not a destination. As we stand at this turning point, it’s important to remember the spirit of defiance that birthed BTC. It was born from a desire for autonomy, for freedom from centralised control, and for a more equitable financial system.

While ETFs offer a bridge between this decentralized world and the established financial order, it’s crucial not to lose sight of these core principles.

BTC trades at $63,023 on the daily chart | Source: BTCUSD chart on Tradingview.com

(@brian_armstrong)

(@brian_armstrong)