Amid turbulence surrounding the crypto market, popular founder and Chief Executive Officer (CEO) of Into The Cryptoverse Benjamin Cowen has taken the spotlight to shed his insights on the recent downtrend observed in the Ethereum/Bitcoin (ETH/BTC) pair. Cowen’s views examine the complex relationship between Ethereum and Bitcoin pricing and the potential for further downside risk.

According to Benjamin Cowen, the ETH/BTC pair is currently on the downside, and the last 2 times that the pair declined, ETHUSD witnessed a steep decline of around 70%. Given that the crypto community has been eagerly anticipating an Altcoin season for the past 2.5 years, Cowen thinks it is crucial to warn the community that there is still a possibility of a downward movement.

ETH/BTC Pair Rejected By The Bull Market Band

Cowen has also confirmed that ETH/BTC is presently being rejected by the bull market support band, which he previously predicted days back due to a price pump. “I would expect it (ETH/BTC) to be rejected by the bull market support band, at least when looking at weekly closes ($0.053-$0.054),” he stated. He further noted that the pump appears to be mirroring the last cycle of rate cuts right before summer capitulation.

Following the launch of Bitcoin Spot Exchange-Traded Funds (ETFs), Cowen mentioned that ETH/BTC saw a sharp rally. The analyst affirms that the rally was probably similar to the trend of the previous bull cycle, ushering in new lows.

Furthermore, Cowen stated that there has been an unquestionable macro downtrend since November 2021, particularly following the merger of the ETH/BTC pair. However, it is also evident that the market did not decrease abruptly.

As a result, investors held ETH instead of BTC all the way down from 0.085 to 0.048 because of the multiple lower highs, giving the impression that it was holding up quite well.

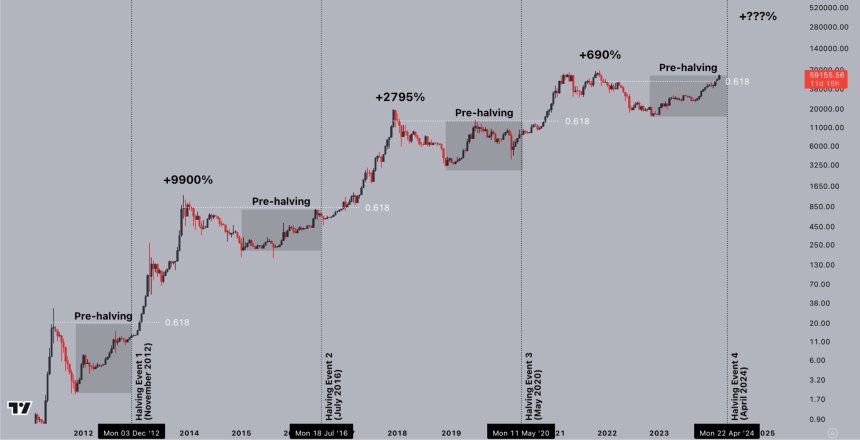

Prior to the Bitcoin Halving, Cowen predicted that the bull market support band would reject ETH/BTC, at least when considering weekly closes ($0.053-$0.054), should there be a rebound after the Halving, similar to that witnessed with BTC spot ETF launch. Regardless of what occurs, the expert is confident that ETH/BTC will reach between $0.03 and $0.04 by this summer.

Heightened Divergence Between Ethereum And Bitcoin

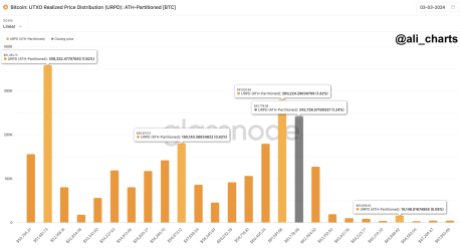

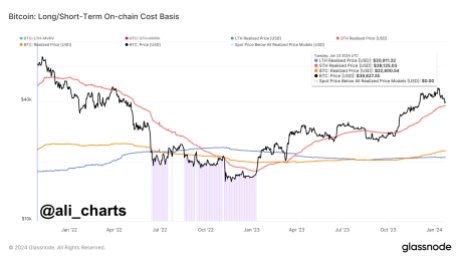

Being the two leading cryptocurrency assets, there is great interest surrounding Ethereum and Bitcoin. However, on-chain analytics firm Glassnode has highlighted a shift in performance between both digital assets.

According to the firm, the performance of Ethereum and Bitcoin has been increasingly diverging so far in the 2023–2024 cycle. This is due to poorer performance in ETH price, which is explained by a generally weaker trend in capital rotation. In addition, this is evident when particularly compared to preceding cycles and all-time highs.