On-chain data shows the next major Bitcoin demand zone is around $56,000, a level BTC might end up revisiting if the decline continues.

Bitcoin Has Next Major On-Chain Support Around $56,000

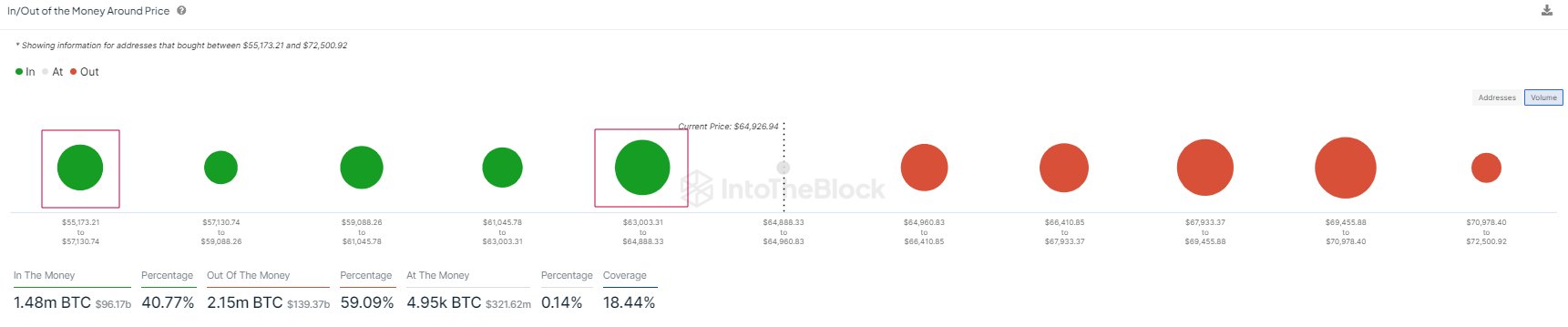

According to data from the market intelligence platform IntoTheBlock, BTC’s recent drawdown has meant that it may end up having to rely on the price range around $56,000 for support.

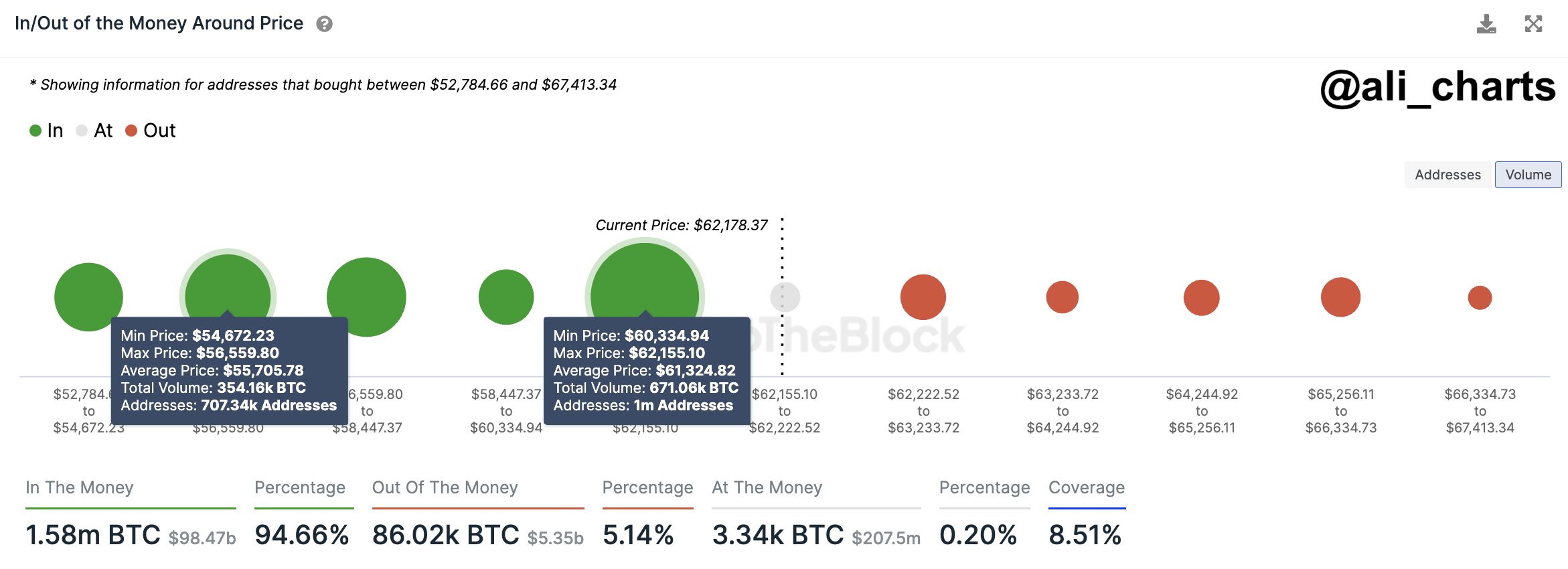

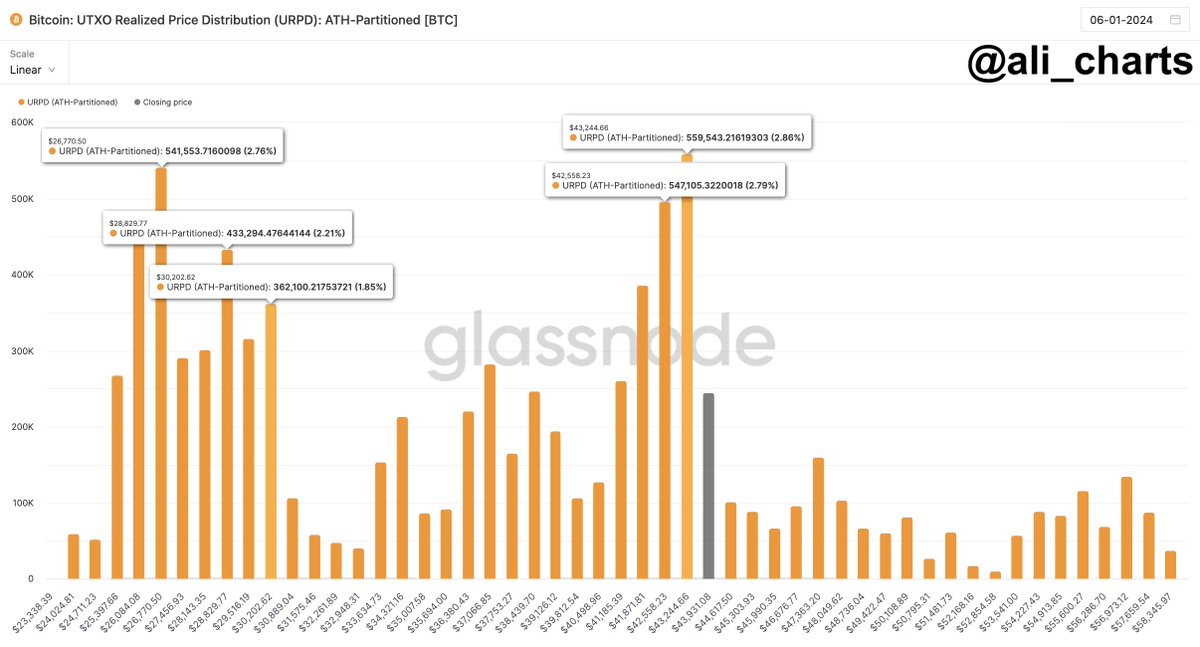

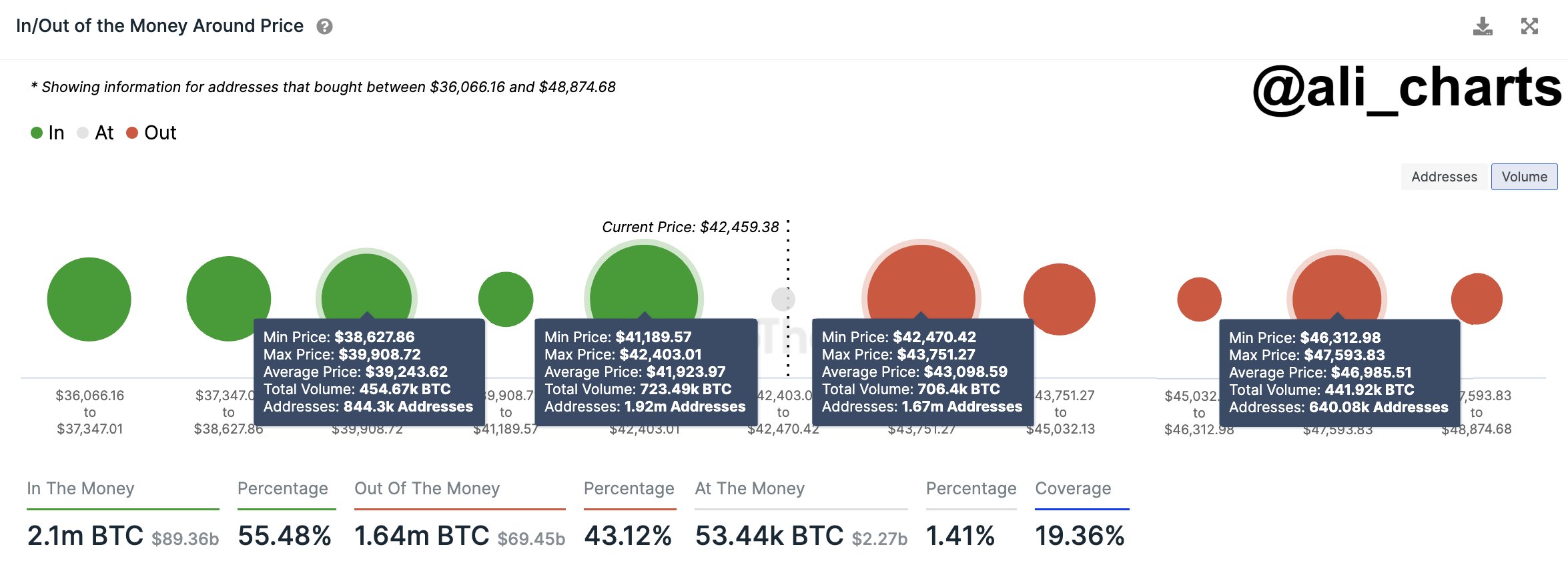

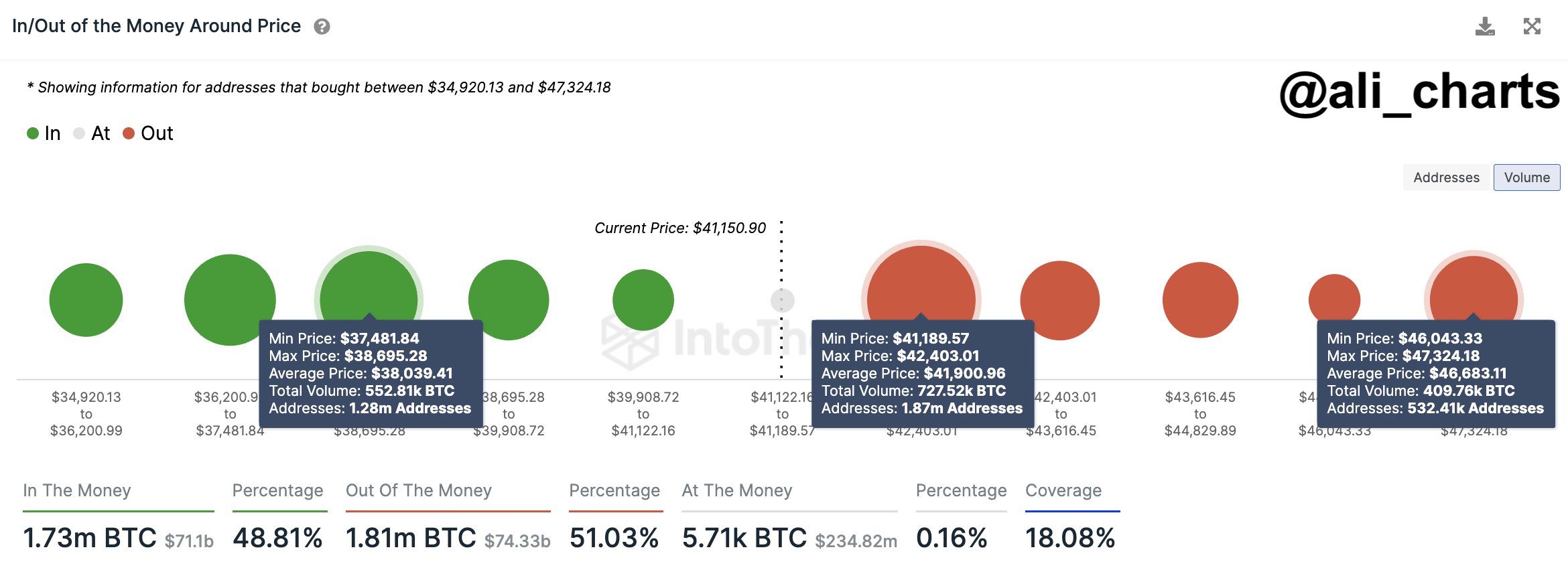

In on-chain analysis, a level’s potential as support or resistance is based on the total number of coins that the investors last acquired there. Below is a chart that shows what the various price ranges around the current spot price of the cryptocurrency look like in terms of this cost-basis distribution.

In the graph, the size of the dot represents the amount of Bitcoin that was purchased inside the corresponding price range. It would appear that the $63,000 to $64,890 level is currently thick with investors. To be more particular, 1 million investors acquired 530,000 BTC inside this range.

Generally, whenever the asset retests the cost basis of any investor, they may become more likely to make some kind of move, due to the importance the level holds for them.

Investors who were in profits just prior to the retest may be willing to make further bets, believing that if this level was profitable in the past it might be so again in the future.

Naturally, this buying effect would only be relevant for the market if a large amount of investors acquired coins inside a tight price range. The $63,000 to $64,890 range qualifies for this.

The range should have acted as a support point for the coin, but BTC has recently slipped under it, possibly suggesting that this support level may have broken down.

As IntoTheBlock has highlighted in the chart, the next major range of potential support is the $55,200 to $57,100 range. Thus, should the current drawdown continue, this may be the next relevant range.

“While this doesn’t mean that Bitcoin has to go this low, it is good to keep this range in mind while price is exploring recent lows,” notes the analytics firm. A decline to the average price of this range ($56,000) would mean a drawdown of almost 10% from the current spot value of the coin.

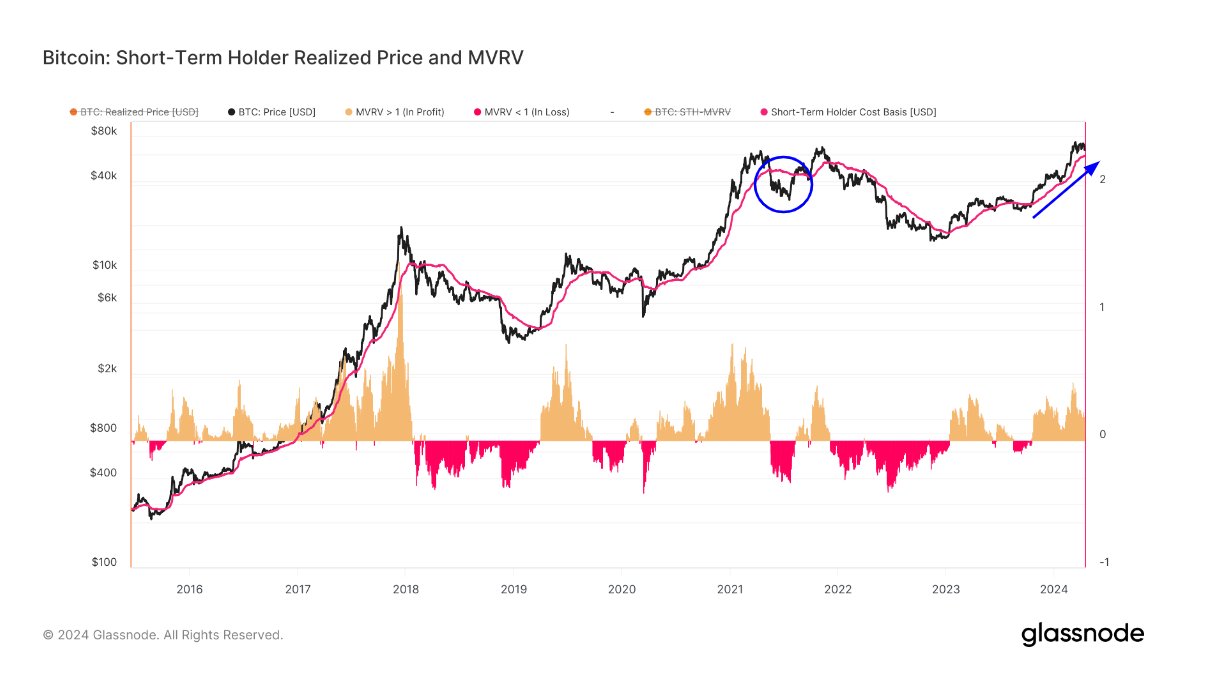

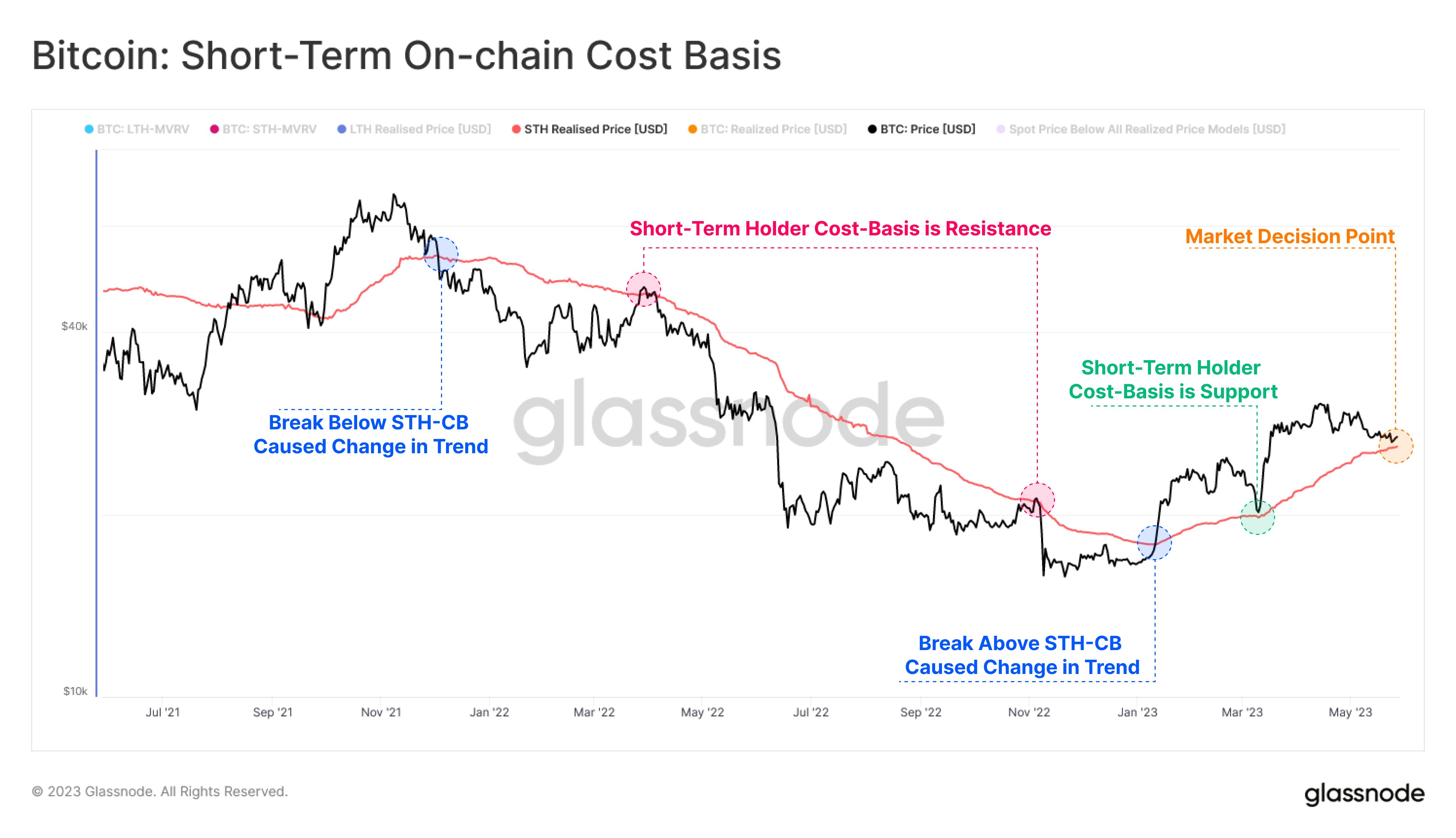

Before this level, though, there is another interesting on-chain level that BTC could end up revisiting. As analyst James Van Straten has pointed out in an X post, the Realized Price (the average cost basis) of the short-term holders is around $58,800 right now.

The short-term holders (STHs) here refer to the investors who bought within the past 155 days. This group’s Realized Price has been at an important level historically during bull runs, as the asset has often found support at it.

Breaks under it have, in fact, usually led to bearish transitions in the past. “If we drop below this, I will concede to a bear market similar to May 2021,” says Straten.

BTC Price

Bitcoin has registered a decline of almost 7% over the past 24 hours and in the process, has lost any recovery it had made earlier. Now, BTC is trading around $62,100.