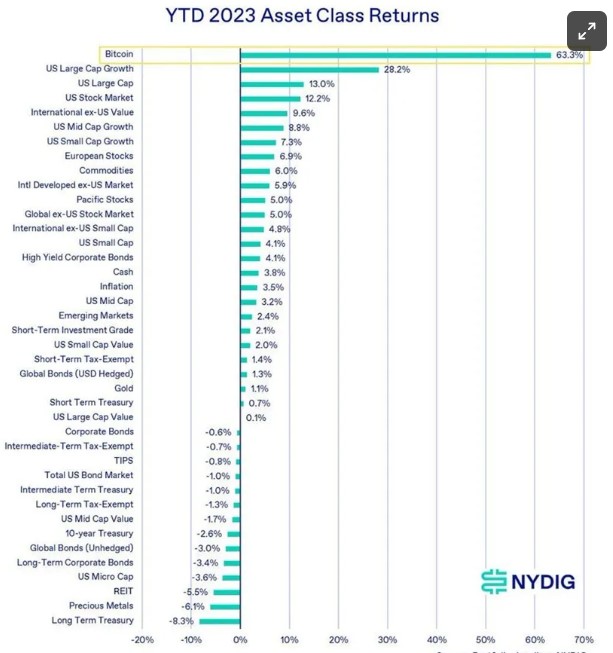

According to a recent Bloomberg report, the crypto market is experiencing a significant rally, with speculative demand expanding beyond the revival of Bitcoin (BTC).

In November, gauges tracking the performance of the bottom half and mid-tier tokens in MarketVector’s index of the largest 100 digital assets surged by 16% and 14%, respectively. This surpasses the broader market’s 4% gain and Bitcoin’s modest 1% rise.

As a result, BTC’s dominance in the $1.38 trillion crypto market has decreased to around 49%, down from its peak of 51.5% in October, as per CoinGecko data. This decline is often perceived as a sign of growing risk appetite among digital asset investors.

Optimism Spreads Beyond Bitcoin

Richard Galvin, co-founder at Digital Asset Capital Management, noted that this rally is “more extensive and sustained” than any price action seen since January. Galvin mentioned to Bloomberg that in an environment still “relatively thin” in terms of liquidity, substantial upward movements are being witnessed.

Bitcoin experienced a notable 28% surge last month, the largest since January, driven by expectations of the first US Bitcoin spot exchange-traded funds (ETFs) securing approval for direct investment in the token.

Per the report, the general sense of optimism has extended beyond Bitcoin, fueled by speculations that the Federal Reserve (Fed) has concluded its interest-rate hikes. Furthermore, according to Bloomberg, the crypto rally is spreading to other areas, such as decentralized finance (DeFi), encompassing blockchain projects facilitating peer-to-peer transactions.

Interest rates to borrow stablecoins on major DeFi lender Aave have exceeded 10%, indicating investors’ willingness to pay higher costs to fund trading positions.

XRP Strength Shines Amid Ripple’s Legal Battle

Among “smaller tokens,” XRP demonstrated strength in November by recording a 14% increase. This surge can be attributed to Ripple’s recent partial legal victory over the Securities and Exchange Commission (SEC). The lawsuit raised questions regarding whether XRP should be classified as a security falling under the regulatory purview of the SEC.

As a result, XRP is currently trading at $0.6699, experiencing a notable decline of over 5% in the past 24 hours after failing to consolidate above current levels. Nonetheless, the token has generated significant profits, evidenced by its 11.4% surge over the past seven days.

Moreover, speculation regarding a potential settlement of the SEC lawsuit has been fueled by an upcoming November 9 deadline for a briefing schedule on remedies for pending issues in the case.

While Bitcoin has experienced a significant rebound this year, with a 111% increase following the crypto rout in 2022, it is currently trading at 34,800, consolidating above this key level with sideways price action and a slight surge in the past seven days of 1%.

Overall, the crypto market is experiencing a broader rally beyond Bitcoin, with its peers gaining momentum and decentralized finance gaining traction.

Positive developments for Ripple have contributed to the surge in XRP, while Bitcoin’s rebound and growing investor sentiment indicate a potential shift in the overall market dynamics.

Featured image from Shutterstock, chart from TradingView.com