The bullish flow is reminiscent of the 2020-2021 bull market when traders consistently snapped up bitcoin calls at levels well above the going market rate.

Solana Leads Gains in Crypto Majors, Bitcoin Metric Suggests Low Retail Growth

The CoinDesk 20, a liquid index of the top twenty cryptocurrencies, rose 4% in the past 24 hours.

Michael Saylor Believes Demand for Bitcoin Products Is 10x the Supply

MicroStrategy co-founder and executive chairman says his company is re-branding as a bitcoin development company during CNBC interview.

Peter Thiel Made $200M Investment in BTC, ETH Before Bull Run: Reuters

A source said that the investment was split evenly between the two digital assets.

Bitcoin Price Revisits $50K, Why BTC Could Start A Short-Term Correction

Bitcoin price extended its rally above the $48,800 resistance. BTC tested $50,000 and is currently showing signs of a downside correction.

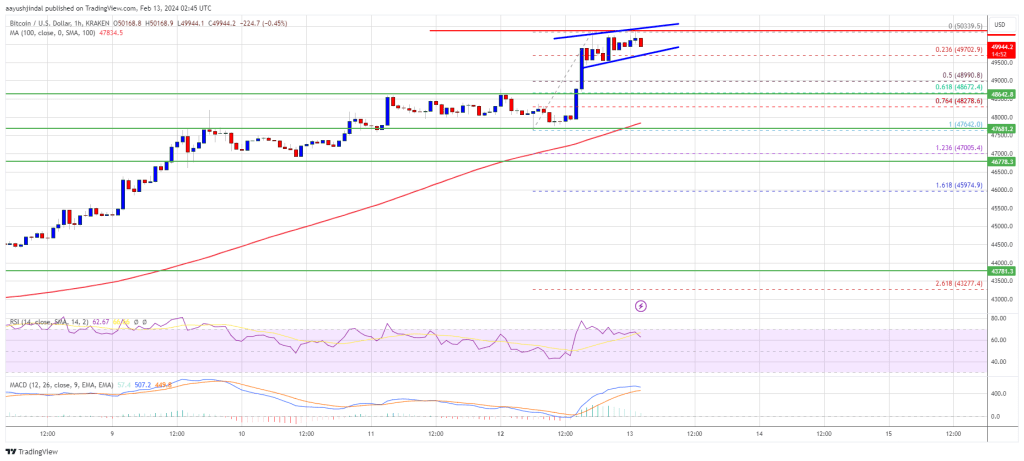

- Bitcoin price climbed higher above the $48,500 and $48,800 resistance levels.

- The price is trading above $48,800 and the 100 hourly Simple moving average.

- There is a short-term rising channel forming with support at $49,750 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a downside correction below the $49,750 and $49,500 levels.

Bitcoin Price Jumps 5%

Bitcoin price remained in a positive zone above the $48,000 resistance zone. BTC extended its rally and climbed above the $48,800 resistance zone. Finally, the price jumped above the $50,000 level.

A new multi-week high was formed near $50,339 and the price is now consolidating gains. There was a minor decline below the $50,000 level. The price is still above the 23.6% Fib retracement level of the recent rally from the $47,642 swing low to the $50,339 high.

Bitcoin price is now trading above $48,800 and the 100 hourly Simple moving average. There is also a short-term rising channel forming with support at $49,750 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

Immediate resistance is near the $50,250 level. The next key resistance could be $50,400, above which the price could start another decent increase. The next stop for the bulls may perhaps be $51,200. A clear move above the $51,200 resistance could send the price toward the $52,000 resistance. The next resistance could be near the $53,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $50,250 resistance zone, it could start a downside correction. Immediate support on the downside is near the $49,750 level or the channel trend line.

The first major support is $49,000 and the 50% Fib retracement level of the recent rally from the $47,642 swing low to the $50,339 high. If there is a close below $49,000, the price could gain bearish momentum. In the stated case, the price could dive toward the $47,650 support.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $49,750, followed by $49,000.

Major Resistance Levels – $50,250, $50,400, and $51,200.

Bitcoin’s Race To $50,000: Analyst Highlights Key Resistance And Market Dynamics

The crypto market is currently abuzz with discussions on Bitcoin (BTC), as it teeters on the brink of reaching the $50,000 threshold. This is fueled by the fast-approaching halving as well as a “bullish divergence” observed over the past week, with Bitcoin breaking past the $48,000 mark.

Analyst Analysis On Bitcoin

Michaël van de Poppe, a prominent figure in the realm of crypto analysis, recently shared insights on the bullish divergence. Van de Poppe pointed out the notable weekly candle that propelled Bitcoin’s value beyond $48,000, signaling a potential challenge at the $50,000 resistance level in the near term.

#Bitcoin looking at the resistance.

Massive weekly candle, through which Bitcoin is back above $48,000.

I’m personally interested what price will do around $50,000 in the upcoming 1-2 weeks. pic.twitter.com/6I927U20pg

— Michaël van de Poppe (@CryptoMichNL) February 12, 2024

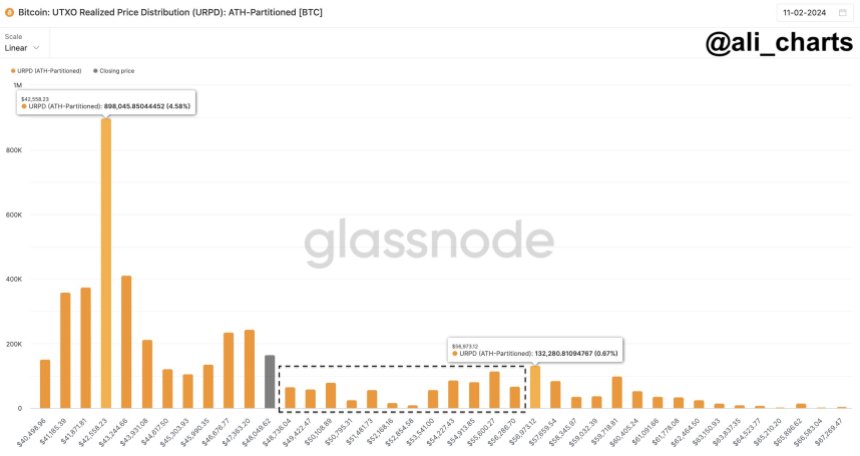

Further echoing this challenge, IntoTheBlock highlighted a key obstacle Bitcoin faces on its path to $50,000 in the latest post. The firm identified a crucial resistance level, noting that over 800,000 addresses have purchased nearly 270,000 BTC at an average price of $48,491.

Currently, at a loss, these holders may exert selling pressure as Bitcoin approaches its break-even point, potentially impacting its ascent to the coveted $50,000 mark.

Bitcoin has set its sights on $50k!

To get there, there is one important resistance level left. Over 800k addresses acquired nearly 270k $BTC at an average price of $48,491. These addresses are currently in the red and might provide sell pressure as they break even on their… pic.twitter.com/nEw4tP8wUc— IntoTheBlock (@intotheblock) February 12, 2024

Over the past week alone, Bitcoin’s value has increased by more than 10%, igniting discussions among crypto enthusiasts and experts regarding its future trajectory. This bullish momentum and the impending halving event reinforce optimistic stances within the crypto sphere about Bitcoin’s value proposition.

Bullish Outlook On BTC And Market Sentiment

Amid this bullish phase, several crypto analysts and market observers have put forward their forecasts regarding Bitcoin’s potential price movement shortly. Crypto Rover, another analyst with a significant following, suggested that surpassing the $48,500 resistance and reaching the 0.618 Fibonacci level could set Bitcoin on a path to the “official trend reversal to a bull market.”

Once #Bitcoin breaks the $48,500 mark, better said, the 0.618 Fibonacci level,

that will mark the official trend reversal to a bull market. I’m keeping a close eye on this level! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

Furthermore, data from IntoTheBlock indicates a positive trend regarding Bitcoin address profitability. Currently, 91% of Bitcoin addresses are profitable, with the total number of addresses in profit at 46.87 million, accounting for 90.53% of all addresses.

This is contrasted with 3.44 million addresses that are still at a loss. IntoTheBlock’s analysis also reveals that most addresses that purchased BTC within the $40,919.92 to $55,413.77 range are now profitable, underscoring a bullish sentiment among Bitcoin holders.

Featured image from Unsplash, Chart from TradingView

CryptoQuant Founder Puts $112,000 Target For Bitcoin This Year

The founder of on-chain analytics firm CryptoQuant has said Bitcoin could reach a target of $112,000 this year driven by the ETF inflows.

Bitcoin May Hit $112,000 Based On Inflows Into The ETFs

In a new post on X, CryptoQuant CEO and founder Ki Young Ju talked about the outlook of the cryptocurrency based on the inflows going towards the spot exchange-traded funds (ETFs).

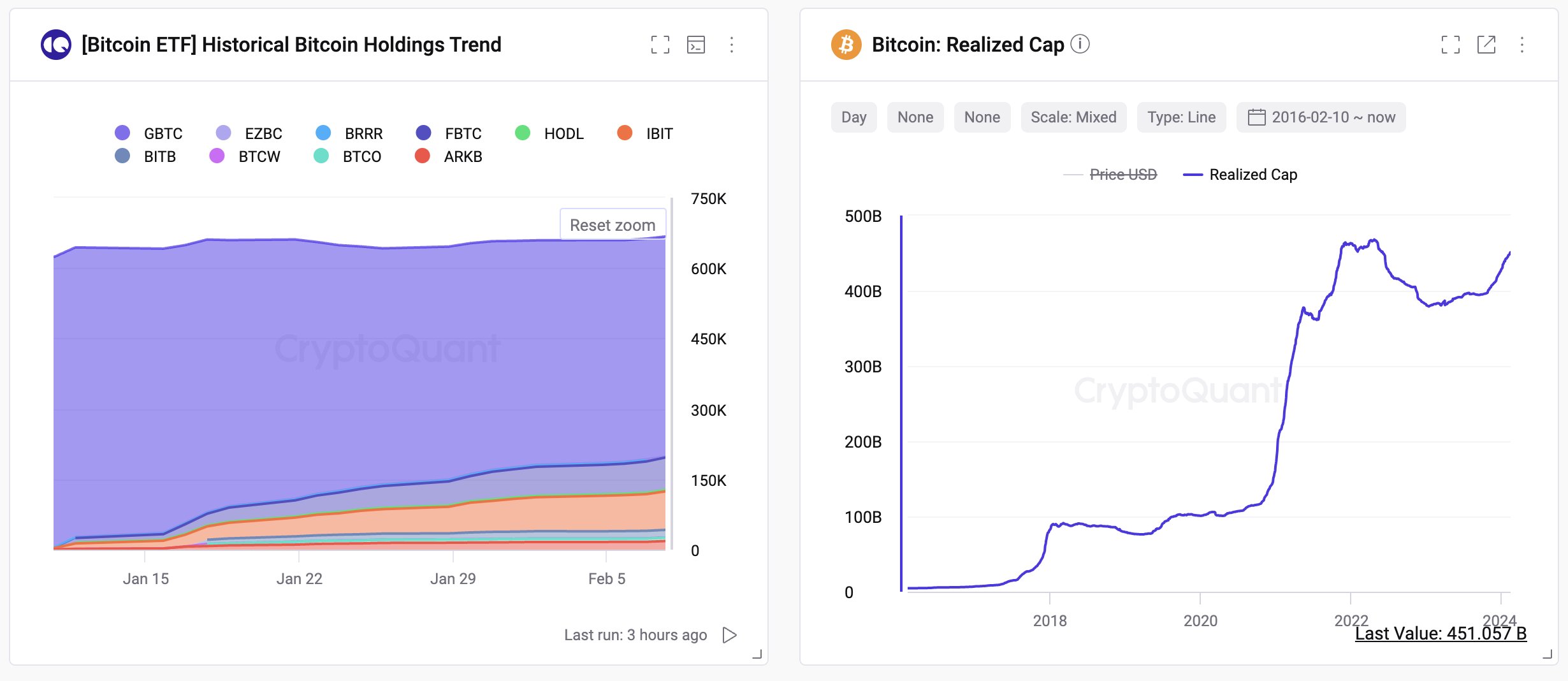

The analyst has used the “Realized Cap” indicator to find price targets for the coin. The Realized Cap refers to a capitalization model for Bitcoin that calculates the total valuation of the asset by assuming that the real value of any coin in circulation is the price at which it was last transacted on the blockchain.

If the previous transaction of any token is assumed to have involved a change of hands for it (that is, buying and selling took place), then the last transfer price would correspond to the cost basis of the coin.

As the Realized Cap essentially adds up the cost basis of all the investors, one way to look at the metric is as a measure of the total amount of investment the holders have put into the coin.

Naturally, the Realized Cap pushes up as trades occur at a higher spot price. Something that could be particularly influential for the Realized Cap this cycle may be the spot ETF inflows.

The spot ETFs, which finally got approval from the US Securities and Exchange Commission (SEC) last month, have been buying up Bitcoin at relatively high prices to add to their holdings, thus elevating the Realized Cap.

The chart below shows the data for the holdings of the spot ETFs and the Bitcoin Realized Cap.

“Bitcoin market has seen $9.5B in spot ETF inflows per month, potentially boosting the realized cap by $114B yearly,” explains Ju. “Even with $GBTC outflows, a $76B rise could elevate the realized cap from $451B to $527-565B.”

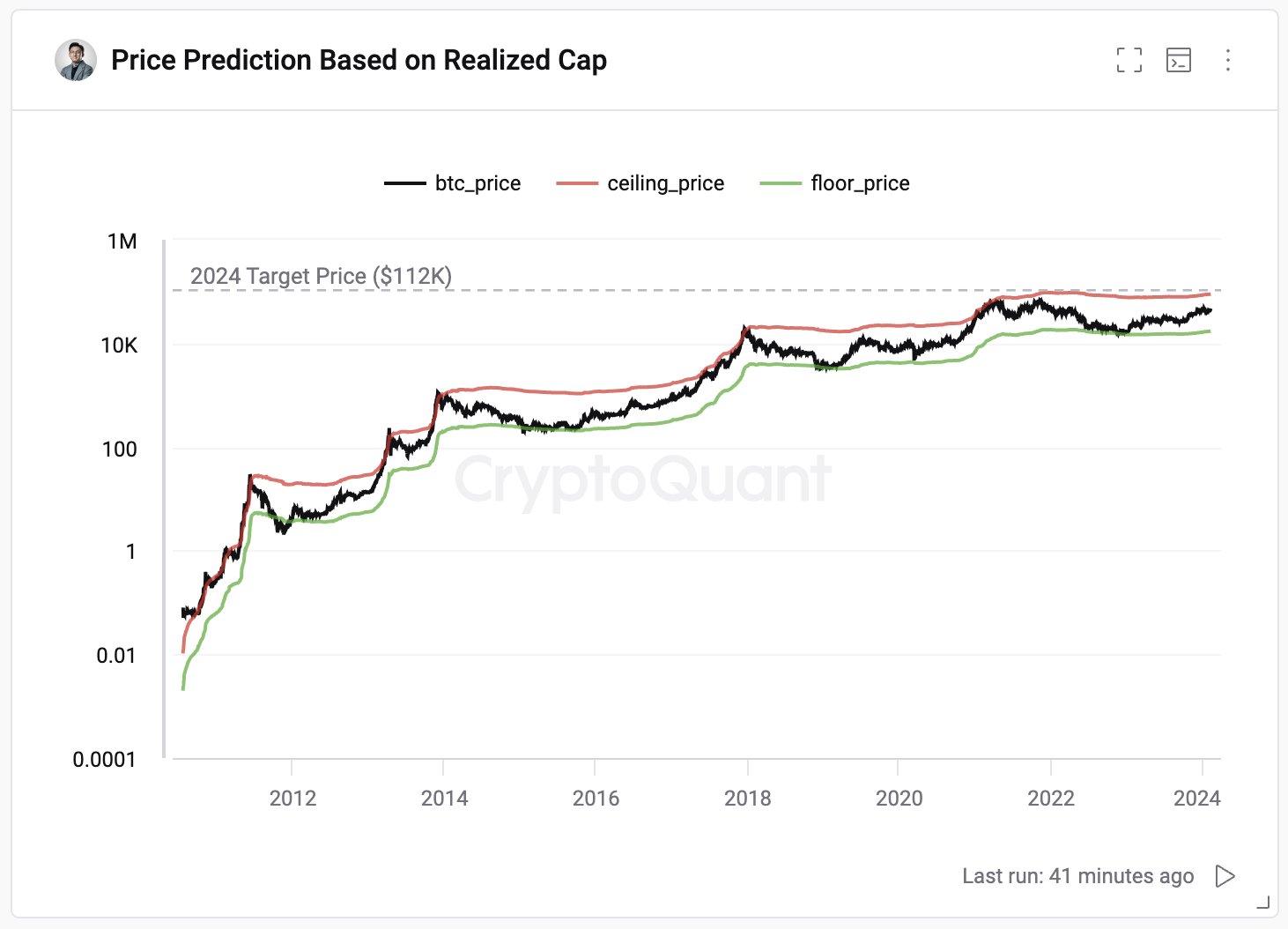

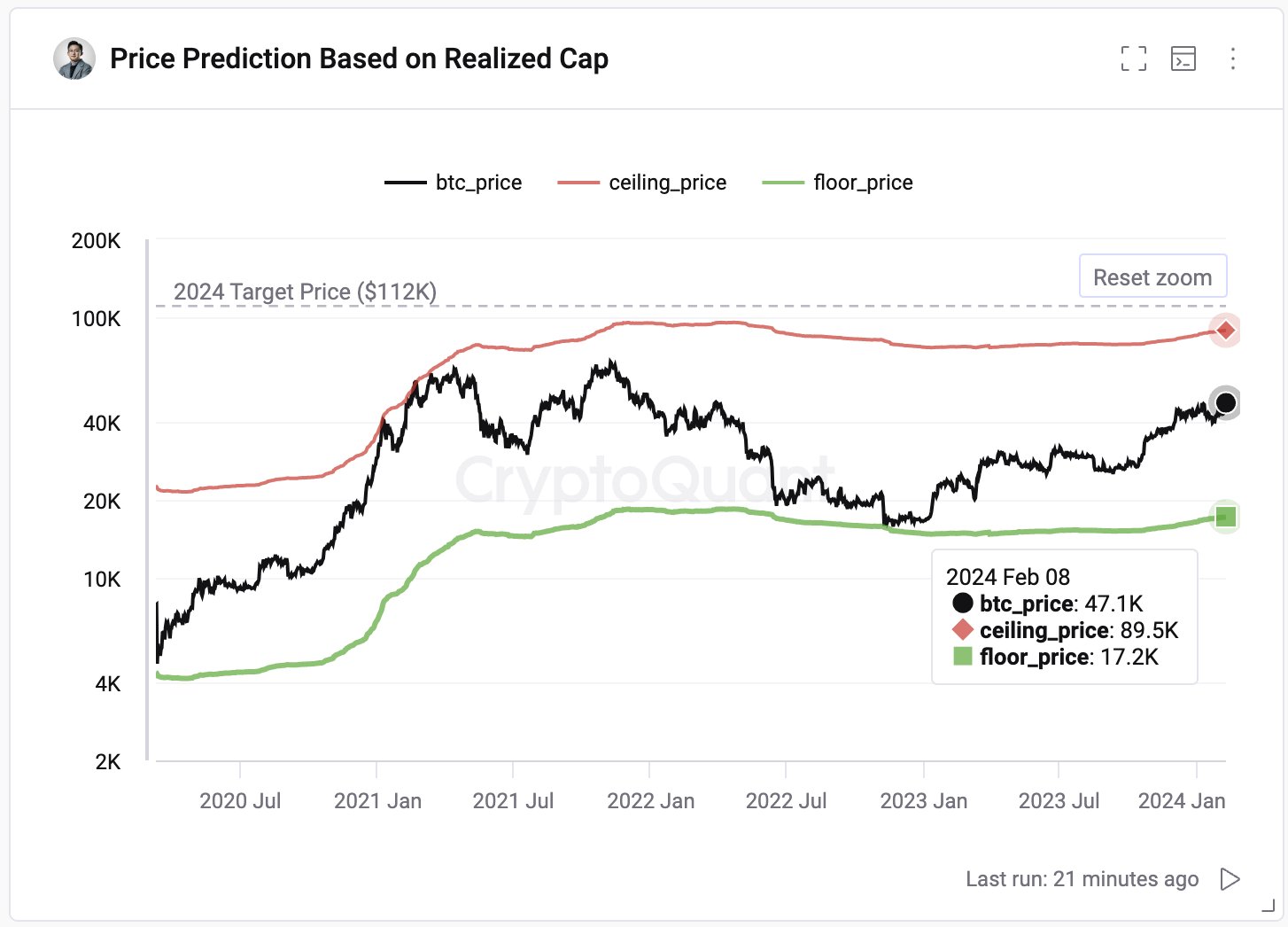

The Market Value to Realized Value (MVRV) ratio may provide some hints regarding how the Realized Cap could be relevant for the spot price. This indicator tracks the BTC Market Cap and the Realized Cap ratio.

“Historically, BTC market bottoms occur at an MVRV of 0.75 and tops at 3.9,” notes the CryptoQuant founder. Based on this fact, the table below shows that ceiling and floor prices can be defined for the asset.

As the spot ETF inflows continue to come in, the Realized Cap will only push further up, and the potential ceiling of the cryptocurrency will also thus increase.

“With current spot ETF inflow trends, the top price could reach $104k-$112k,” says the CryptoQuant CEO. “Without hype, maintaining the current level of 2.07, the price would be $55-59k.”

In the best-case scenario, if Bitcoin had reached the $112,000 target, the cryptocurrency would have jumped more than 126% from the current spot price.

BTC Price

At the time of writing, Bitcoin is trading at around $49,400, up over 15% in the past week.

Grayscale Claims ‘Next Bitcoin Halving Is Different’: What’s Changed?

In Grayscale’s latest report, “2024 Halving: This Time It’s Actually Different,” Michael Zhao, provides an in-depth analysis of the evolving dynamics within the Bitcoin ecosystem as the next halving event approaches in mid-April 2024. The report argues for a significant departure from previous cycles, underlined by the advent of spot Bitcoin ETFs in the United States, evolving investment flows, and innovative use cases emerging within the Bitcoin network.

The Essence Of Bitcoin Halvings

Halvings, designed to halve the reward for mining Bitcoin transactions every four years, are pivotal in maintaining Bitcoin’s scarcity and disinflationary profile. Zhao articulates, “This disinflationary characteristic stands as a fundamental appeal for many Bitcoin holders,” emphasizing the stark contrast with the unpredictable supplies of fiat currencies and precious metals.

Despite historical price surges post-halving, Zhao cautions against assuming such outcomes as guarantees, stating, “Given the highly anticipated nature of these events, if a price surge were a certainty, rational investors would likely buy in advance, driving up the price before the halving occurs.”

Distinguishing Factors Of The 2024 Halving

Macroeconomic Factors

According to Zhao, macroeconomic factors have differed in each cycle, however, always propelling the BTC price to new heights. The researcher describes the European debt crisis in 2012 as a significant catalyst for Bitcoin’s rise from $12 to $1,100, highlighting its potential as an alternative store of value amidst economic turmoil,

“Similarly, the Initial Coin Offering boom in 2016—which funneled over $5.6 billion into altcoins—indirectly benefited Bitcoin as well, pushing its price from $650 to $20k by December 2017. Most notably, during the 2020 COVID-19 pandemic, expansive stimulus measures […] [drove] investors towards Bitcoin as a hedge, which saw its price escalate from $8,600 to $68k by November 2021,” Zhao states.

Thus, Zhao suggests that while the halvings contribute to Bitcoin’s scarcity narrative, the broader economic context is also always critically impacting Bitcoin’s price.

Miners’ Strategic Adjustments

Anticipating the next BTC halving in April, miners have proactively adjusted their strategies to counterbalance the impending reduction in block reward income amidst escalating mining difficulties. Zhao observes a strategic move among miners, noting, “There was a noticeable trend of miners selling their Bitcoin holdings onchain in Q4 2023, presumably building liquidity ahead of the reduction in block rewards.

This foresight suggests miners are not merely reacting but are actively preparing to navigate the challenges ahead, ensuring the network’s resilience. “These measures collectively suggest that Bitcoin miners are well-positioned to navigate the upcoming challenges, at least in the short term,” the Grayscale researcher argues.

The Emergence Of Ordinals And Layer 2 Solutions

The introduction of Ordinal Inscriptions and the exploration of Layer 2 solutions have introduced new dimensions to Bitcoin’s functionality and scalability. Zhao emphasizes the significance of these innovations, stating, “Digital collectibles…have been inscribed, generating more than $200 million in transaction fees for miners.” This development has not only augmented Bitcoin’s utility but also provided miners with new avenues for revenue generation.

Furthermore, Zhao highlights the potential of Layer 2 solutions to address Bitcoin’s scalability challenges, pointing out, “The growing interest in Taproot-enabled wallets…indicates a collective move toward addressing these challenges.” This reflects a concerted effort within the Bitcoin community to enhance the network’s capabilities and accommodate a broader range of applications.

The Role Of ETF Flows

The approval and subsequent introduction of spot Bitcoin ETFs have significantly influenced Bitcoin’s market structure, facilitating wider access for investors and potentially mitigating sell pressure from mining rewards. Zhao articulates the impact of ETF flows, asserting, “Following US spot Bitcoin ETF approvals, the initial net flows…amounted to approximately $1.5 billion in just the first 15 trading days.”

This suggests that ETFs could play a crucial role in balancing the market dynamics post-halving by absorbing a significant portion of the typical sell pressure post-Halving. “In order to maintain current prices, a corresponding buy pressure of $14 billion annually is needed. Post-halving, these requirements will decrease by half: […] that equates to a decrease to $7 billion annually, effectively easing the sell pressure.”

A Promising Outlook for Bitcoin

According to Grayscale’s analysis, the next Bitcoin halving will be different for a number of reasons. Overall, the outlook is highly bullish:

Bitcoin has not only weathered the storm of the bear market but has also emerged stronger, challenging outdated perceptions with its evolution in the past year. While it has long been heralded as digital gold, recent developments suggest that Bitcoin is evolving into something even more significant.

At press time, BTC traded at $49,708.

Did President Biden Just Endorse Bitcoin?

The octogenarian politician is sporting laser eyes on Twitter, seemingly unaware it is a symbol of support for the cryptocurrency.

Craig Wright Told by UK Court to Stop Making ‘Irrelevant Allegations’ as COPA Trial Continues

Wright continued to blame a host of reasons and people for inconsistencies pointed out by opposing counsel on Monday as his cross-examination continued.

Strategic Exploit: Crypto Traders Harvested $3 Billion From ‘Kimchi Premium’?

South Korea’s local media, Newsis, recently reported the case of certain crypto traders who had sent about $3 billion overseas in a bid to profit from the ‘Kimichi Premium.’ Interestingly, the court found 14 out of 16 of these traders not guilty despite their alleged actions.

How This Group Of Crypto Traders Operated

These crypto traders are said to have sent these sums of money through local banks under the guise of these transactions being foreign exchange remittances. However, this was allegedly not the case, as they would then use the funds to purchase virtual currencies abroad and send those crypto assets back to domestic exchanges, where they eventually offload them.

This was done to allegedly profit from the ‘Kimichi Premium.’ This phenomenon occurs when crypto assets are more expensive in South Korea than overseas due to the country’s particular regulations.

This has created an arbitrage opportunity that crypto traders have sought to exploit. Meanwhile, the Korean government has tried to prevent traders from doing so.

That is why the prosecution charged 16 people, including someone referred to as Mr. A in the news report, with violating the Specific Financial Information Act. Mr. A and others were accused of illegally transferring foreign currency worth 4.3 trillion won ($3 billion) overseas between April 2021 and August 2022 to exploit the Kimichi premium allegedly.

The prosecution believes these crypto traders made a market profit of as much as 210 billion won ($158 million). In their defense, the defendants argued against any wrongdoing since they weren’t precisely the ones facilitating the foreign exchange business but the bank.

The traders argued they were platform users, not virtual asset business operators. The bank involved also tried to absolve itself from the case as it claimed it carried out the transaction based on the “false evidence” the defendants submitted.

Court Finds The Defendants Not Guilty

The court agreed with most defendants’ arguments, acquitting 14 (including Mr. A) out of the 16 persons charged. A local Judge who ruled over the case opined that their actions didn’t violate the objective of the Foreign Exchange Transactions Act and, therefore, could not be punished under that law.

The Judge added that there was “nothing to suggest that the defendants operated as virtual asset business operators.” If the reverse was the case, they could have been punished for not registering their business or making certain disclosures as required by the law.

Interestingly, Judge Park further distinguished the current case from a Supreme Court precedent as he noted that the highest court did not “explicitly judge the issues in this case.” The prosecution already submitted an appeal, dissatisfied with the court’s ruling.

Chart from Tradingview

Bitcoin Pushes Through $50K for First Time Since Late 2021

The world’s largest crypto has now roughly tripled in price in 2023, surely signaling the end of the industry’s long bear market.

Bitcoin Runs Into $50K Resistance as Sellers Step In on Binance, Coinbase

Bitcoin approached the $50,000 level Monday for the first time in more than two years, but selling pressure on exchanges stalled the advance.

BREAKING: Bitcoin Price Hits $50,000 – The Big Question: How Much Higher Can BTC Go?

The Bitcoin price has experienced a significant surge, surpassing the $50,000 mark as Wall Street exchange-traded funds (ETFs) gained approval from the US Securities and Exchange Commission (SEC) on January 11.

This bullish momentum, coupled with increased ETF demand, has propelled Bitcoin into a fully-formed bull run just months ahead of the anticipated halving event, which is expected to further amplify the ongoing uptrend.

Wall Street ETFs Drive Bitcoin Demand

In a recent CNBC interview with Anthony Pompliano, it was revealed that Wall Street ETFs are buying approximately 12.5 times more Bitcoin per day than the network can produce.

This surge in demand from institutional investors has contributed to the price appreciation of Bitcoin. Pompliano asserts that Bitcoin has become Wall Street’s preferred asset and predicts that the increased demand through ETFs could lead to a significant rise in its price.

On the other hand, analytics firm Material Indicators has identified $53 million in Bitcoin buy orders stacked at the $50,000 level on the Binance order book. This substantial demand indicates strong investor interest in Bitcoin at this price point.

However, the firm believes that a price retest of support levels may be imminent, although the timing remains uncertain.

Bitcoin Price Rally Faces Potential Correction?

If the Bitcoin price successfully breaks above the $50,000 level, Material Indicators anticipate minimal resistance on the path to $52,000 and $58,000. This scenario raises the possibility of a substantial short squeeze, as investors who have bet against the asset may be forced to cover their positions, further driving up the price.

However, the highly anticipated inflation report scheduled for Tuesday could potentially trigger a correction in the market, as its findings may impact investor sentiment and market dynamics.

Overall, Bitcoin’s price surge above $50,000 is attributed to the approval of Wall Street ETFs and the subsequent increase in institutional demand. The influx of capital from these ETFs has contributed to Bitcoin’s bullish momentum, with expectations of further price appreciation.

As BTC continues to capture Wall Street’s attention, market participants eagerly await further developments and potential Bitcoin price movements to the upside, with potential corrections ahead.

Currently, the Bitcoin price has risen over 3.4% in the past 24 hours, coupled with a seven-day uptrend of 16%.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin Tops $49K as Spot ETF Inflows Accelerate

Bitcoin price approaches $49,000 Monday after strong spot bitcoin ETF inflows last week.

First Mover Americas: Bitcoin Hovers Below $48K; Immutable X Soars

The latest price moves in bitcoin [BTC] and crypto markets in context for Feb. 12, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Bitcoin Bears Brewing: Analyst Predicts A Pullback Before Halving

Rekt Capital, a well-known cryptocurrency analyst and enthusiast, has offered insights on Bitcoin’s price action ahead of the upcoming BTC Halving event.

One Final Retracement For Bitcoin Before Halving?

The crypto expert took to the social media platform X to share his perception with his nearly 400,000 followers. Rekt believes Bitcoin is poised for a significant retracement before the impending BTC halving.

According to the analyst, the retracement will be Bitcoin’s “last correction before the halving event.” He further highlighted that, due to historical patterns, the pullback is anticipated to occur in late March or April 2024.

In response, a pseudonymous user curiously asked the expert if he could address the pre-halving rally phase in his next newsletter. He added, “Of course, we are unable to have both play out, as we are currently above the 8 resistance line.”

He further noted that a new pattern might be formed if Bitcoin ends the month above the diagonal. “Monthly Close above the diagonal would be the first in history in a pre-halving period,” he stated.

So far, the cryptocurrency community is excited about the upcoming Bitcoin Halving event. This is because Bitcoin Halvings are seen as a bullish occurrence that drives up the price of BTC significantly.

Notably, the event occurs approximately every four years. It aims to maintain BTC’s scarcity and value while controlling inflation by decreasing the rate at which miners in the network create new BTC units.

The miners‘ block reward will drop from 6.25 BTC to 3.125 BTC during the next halving. Additionally, the event is anticipated to occur in April 2024 after the number of blocks reaches 840,000.

Bullish Overview Of The Digital Asset

Despite the potential pullback pre-halving, several crypto enthusiasts are still bullish about the leading cryptocurrency asset on low timeframes. Ali Martinez, a cryptocurrency expert, recently shared an optimistic prediction for BTC to tackle skepticism around the token.

Ali Martinez highlighted that BTC boasts robust support levels that could surpass resistance. Due to this, he has predicted a possible rise in BTC’s price to the $57,000 price mark. However, he believes that Bitcoin will undergo a correction before reaching the aforementioned price mark.

Currently, Bitcoin is sitting at $47,886, recording an increase of over 11% in the past 7 days. CoinMarketCap shows that the token’s trading volume is up by 4%, while its market cap is down by 0.53%.

Bitcoin Optimism: Analysts Signal Potential New All-Time High For BTC In 2024

After a tumultuous 2022, Bitcoin (BTC) is poised for a remarkable resurgence in 2024, according to a consensus of industry experts. This comprehensive analysis delves into the key factors driving this positive sentiment, including the highly anticipated Bitcoin halving event, surging institutional adoption, and the introduction of spot Bitcoin exchange-traded funds (ETFs).

The Halving Event: A Catalyst For Scarcity, Price Appreciation

The Bitcoin halving event, scheduled for April 2024, stands as a pivotal moment in the cryptocurrency’s history. This event, occurring every four years, reduces the block reward for miners by half, effectively diminishing the supply of new BTC. This scarcity, coupled with steady or increasing demand, has historically triggered substantial price increases.

A retrospective analysis of previous halving events reveals the transformative impact on Bitcoin’s value. In the year following the 2012 halving, BTC’s price skyrocketed by an astounding 10,000%, while the 2016 halving was followed by a remarkable 2,000% surge. These historical precedents provide a compelling basis for optimism regarding the upcoming halving event’s potential to ignite a new bull run.

Institutional Adoption: A Surge Of Confidence And Liquidity

The growing institutional adoption of Bitcoin represents another key driver of its bullish outlook. Institutional investors, recognizing the cryptocurrency’s potential as a hedge against inflation and currency devaluation, are increasingly allocating funds to this emerging asset class.

This influx of institutional capital, coupled with the recent launch of spot Bitcoin ETFs in the United States and Hong Kong, has significantly enhanced the accessibility and legitimacy of Bitcoin as an investment vehicle.

Spot Bitcoin ETFs, unlike their futures counterparts, allow institutional investors to directly buy and sell the actual cryptocurrency, eliminating the need for intermediaries. This added flexibility, combined with the increasing regulatory clarity surrounding cryptocurrencies, is expected to attract even more institutional money into the market, further fueling demand and price appreciation.

Bitcoin Price Predictions: Experts Weigh In

Prominent crypto analysts and market experts have offered their predictions for Bitcoin’s price trajectory in 2024. Crypto Rover, a renowned market analyst, believes that Bitcoin could embark on a bullish trend if it surpasses the $48,500 resistance level and reaches the 0.618 Fibonacci level.

I think #Bitcoin will hit a new ATH in 2024.

— Crypto Rover (@rovercrc) February 10, 2024

At the time of writing, Bitcoin was trading at $48,234 up 0.2% and 13.7% in the daily and weekly timeframes, data by Coingecko shows.

Once #Bitcoin breaks the $48,500 mark, better said, the 0.618 Fibonacci level,

that will mark the official trend reversal to a bull market. I’m keeping a close eye on this level! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

The CEO of analytics platform CryptoQuant, Ki Young Ju, predicts that by the end of the year, the price of a bitcoin might soar to an astounding $112,000 per unit.

#Bitcoin could reach $112K this year driven by ETF inflows, worst-case $55K.https://t.co/HrkV3TU8Ul pic.twitter.com/jBn6HWpt9b

— Ki Young Ju (@ki_young_ju) February 11, 2024

A Year Of Transformation And Growth

In light of the impending Bitcoin halving event, the surge in institutional adoption, and the introduction of spot Bitcoin ETFs, 2024 emerges as a pivotal year for the cryptocurrency. While price predictions may vary, the overwhelming consensus among experts points to significant potential for growth and appreciation.

Featured image from Adobe Stock, chart from TradingView

Bitcoin ‘Stronger’ Ahead of Halving: Grayscale

A slew of newer features means bitcoin is “evolving into something even more” than merely digital gold, a core investment thesis.

Bitcoin Logs Biggest Weekly Gain Since October as S&P 500 Tops 5K

The S&P 500 look expensive relative to bonds, but that does not imply risk aversion or outflow of money from stocks and crypto and into Treasury notes.