Overall crypto market capitalization crossed the $1.7 trillion mark on Wednesday for the first time since May 2022.

Bitcoin Could Retract to $36K Before Uptrend Resumes, QCP Capital Says

In a recent note, the Singapore-based investment fund said expects topside resistance for bitcoin in the $45k-$48.5K region.

Bitcoin Price Outperforms – Key Reasons Why Bulls Still Aim $48K

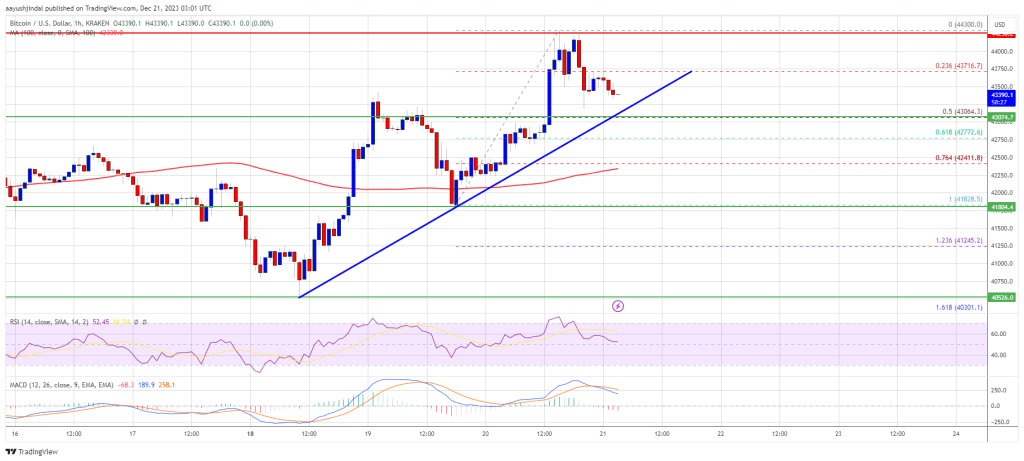

Bitcoin price is moving higher and recently broke the $43,500 resistance. BTC is still in a strong uptrend and might gain pace for a move above $45,000.

- Bitcoin extended its increase and climbed above the $43,500 resistance zone.

- The price is trading above $43,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support near $43,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move up if there is a close above $44,500 and $45,000.

Bitcoin Price Regains Strength

Bitcoin price remained stable above the $42,000 resistance zone. BTC gained bullish momentum and climbed above the $43,000 resistance zone. It even cleared the key $43,500 barrier.

Finally, the price tested the $44,300 level. A high is formed near $44,300 and the price is now correcting gains. There was a minor decline below the $44,000 level. The price dipped below the 23.6% Fib retracement level of the recent increase from the $41,828 swing low to the $44,300 high.

Bitcoin is now trading above $43,000 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support near $43,100 on the hourly chart of the BTC/USD pair.

The current price action and the recent breakout calls for more gains. On the upside, immediate resistance is near the $44,000 level. The first major resistance is forming near $44,300 and $44,500. A close above the $44,500 resistance could set the pace for a move above $45,000.

Source: BTCUSD on TradingView.com

The next key resistance could be near $46,500, above which BTC could rise toward the $47,200 level. The next major target for the bulls could be $48,000.

Another Decline In BTC?

If Bitcoin fails to rise above the $44,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $43,200 level.

The next major support is near $43,000 or the 50% Fib retracement level of the recent increase from the $41,828 swing low to the $44,300 high. If there is a move below $43,000, there is a risk of more losses. In the stated case, the price could drop toward the $42,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $43,100, followed by $43,000.

Major Resistance Levels – $44,300, $44,500, and $45,000.

Protocol Village: Bitfinex Securities Announces First Tokenized Bond on Liquid Network

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Dec 21-Jan. 3. (EDITOR’S NOTE: We will be taking much-needed time off around the end of the year, so updates will be less frequent. Happy holidays!)

Blockchain Tech Predictions for 2024, From Experts at Ripple, Coinbase, a16z, Starknet

We assembled 10 new year’s predictions for blockchain tech trends and developments, from the experts. They might be right.

Stacks’ STX Soars 27% on Positive Comments From Tim Draper

Stacks [STX], the native token of Stacks Network, rose by 25% on Wednesday on the back of praise from legendary investor Tim Draper.

First Mover Americas: BlackRock, SEC Discuss ETF Listing Rules

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 20, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Institutional Investors Increase Bitcoin Appetite Ahead Of Spot ETF, Report Shows

A report by K33 research analysts has provided insight into how much institutional investors’ appetite for Bitcoin has increased ahead of a potential approval of a Spot BTC ETF. The research firm emphasized a particular indicator to drive home their point and provided further insight into what the future holds if these ETFs get approved.

The Derivatives Market: An Indicator Of Institutional Interest In Bitcoin

In the report written by K33’s Senior Analyst Vetle Lunde and Head of Research Anders Helseth, they noted that the derivatives market was important as it can be used to gauge institutional traders’ interest in Bitcoin. In line with this, they touched on how there has been a significant increase in open interest in the Chicago Mercantile Exchange (CME) derivatives market.

The K33 report specifically noted that the CME’s open interest has grown by over 3,4000 BTC over the past week. Meanwhile, CME’s open interest remains near all-time highs of 110,000 BTC. The increased activity on the CME has resulted from these traders’ desire to gain exposure to Bitcoin ahead of the “imminent ETF verdict.”

With a potential approval on the horizon, it is believed that many traders are looking to make as much profit as they can from this bullish event. Meanwhile, others have genuinely become bullish on the flagship cryptocurrency and want to gain exposure to it in any way they can. The CME is arguably the most accessible means to gain exposure to Bitcoin for this class of investors.

Notably, the K33 analysts highlighted how the open interest in the CME exchange had picked up the pace back in October. Coincidentally or not, this happened to be when Bitcoin and the broader crypto market picked up steam, as many believed that the Spot Bitcoin ETF rumors were the reason for the rally.

CME To Lose Market Share Once ETFs Get Approved

NewsBTC had in November reported how CME had overtaken Binance in Bitcoin futures. Data from Coinglass also shows that the CME is still well ahead in terms of Bitcoin futures open interest. However, that could change soon enough as the K33 report touched on the possibility of open interest in CME collapsing once these Spot Bitcoin ETFs get approved.

An approval can cause selling pressure on CME as these institutional investors might look to take profit while others will be looking to transfer their capital to the Spot ETFs. K33 elaborated on the latter. The report noted that futures-based ETFs currently account for 46% of the CME’s open interest.

Considering that futures and Spot ETFs will be in direct competition, they expect the latter to become the more favorable option. As such, these K33 analysts foresee a decline in the open interest, which these futures ETFs account for. They project that many institutional investors will look to rotate a substantial portion of their capital to the Spot ETFs.

At the time of writing, Bitcoin is trading at around $42,800, down in the last 24 hours, according to data from CoinMarketCap.

Nansen’s Crypto Crystal Ball: AI Integration And A Potential Plot Twist In 2024?

As 2024 approaches, crypto analytics firm Nansen offers insightful predictions for the crypto sector, anticipating significant developments and shifts. Despite cautious optimism, they acknowledge a 10-20% chance of inflation resurgence after the US Federal Reserve (Fed) pivot, potentially impacting crypto prices.

Related Reading: Ethereum Price Close Below $2,120 Could Spark Larger Degree Decline

As of this writing, the total crypto market capitalization is $1.5 trillion on the daily chart and seems poised for further upside in the long run.

AI As Primary Use Case: The New Hot Thing In 2024?

According to the firm, a key high-conviction bet for 2024 is the emergence of Artificial Intelligence (AI) agents as primary blockchain users. Integrating AI and blockchain is expected to “advance rapidly, enhancing blockchain performance and broadening use cases.”

This development signifies a crucial step in the blockchain world, potentially transforming how transactions and interactions are processed on the network.

Another focus area is the intent-centric applications that address user experience (UX) challenges in the crypto space. These applications are designed to simplify user interactions with networks, removing complexities and making the technology more accessible to a broader audience.

As seen in the chart below, the integration between AI and crypto is already paying off for early investors. Despite the persistent downside pressure recorded across the board, the AI tokens sector has been among the best-performing in the nascent industry.

2024 is also projected to be a pivotal year for decentralized exchanges (DEXs). Nansen forecasts that DEXs will gain significant market share from centralized exchanges (CEXs), driven by monetary incentives and innovative features.

This shift could mark a fundamental change in the crypto trading landscape, emphasizing the growing importance of decentralized financial systems. Since 2020 and 2021, DEX has been gaining ground over CEX, and the trend might favor the former in 2024.

Finally, Nansen believes that the largest and most trusted cryptocurrency, Bitcoin, is expected to secure a broader range of use cases beyond simple transactions. This expansion could open new avenues for Bitcoin and highlight its versatility and robustness as a digital asset.

Use cases such as non-fungible tokens (NFTs) already gained popularity in 2023, and this trend might continue. However, some Bitcoin community members are fighting the change, which could hinder its adoption and implementation.

Nansen: Market Scenario Analysis For 2024

The potential scenarios for the crypto market in 2024 depend a lot on the macroeconomic situation. In a “soft landing” situation, where inflation slows without drastically increasing unemployment, crypto prices are expected to grow steadily.

However, there’s also the possibility of a re-acceleration of inflation or a recession, which would pose challenges for crypto prices and change the bullish narrative. Nansen’s analysis also acknowledges structural drivers likely to influence the crypto market, such as the statistical boost around Bitcoin’s halving.

These structural drivers also include the adoption of blockchain by major traditional players and regulatory clarity, particularly around a BTC spot Exchange Traded Fund (ETF) in the US. However, unknowns like geopolitical events and macroeconomic shifts could significantly impact the market.

In conclusion, Nansen’s research presents a nuanced view of the crypto market in 2024, highlighting potential growth areas like AI integration and DEXs while remaining aware of the challenges ahead. The year promises to be crucial for the crypto sector, with significant developments expected in technology integration, market structures, and regulatory landscapes.

Cover image from Unsplash, chart from Tradingview

Bitcoin Could Reach $160K in 2024 on the Back of Halving, Spot ETF Hype: Analysts

Bitcoin has historically rallied after its halving event – which automatically decreases the supply of new coins in the open market – and traders are likely pricing in the event that’s next scheduled for April 2024.

Woo-ing Buyers: Woo Network Token 75% Rally Sparks Investor Interest

The market is still on the lookout for distinct signs of a long-term recovery. Given this, it is critical to pay strategic attention to tokens such as Woo Network (WOO), which present chances for short- and long-term trading in the dynamic crypto environment.

The cryptocurrency market is in a positive mood as the new week begins, following a time of increased volatility in the first half of December. The two most popular cryptocurrencies, Ethereum and Bitcoin, have shown signs of stability during the last 48 hours.

Woo Network Explodes 75% In The Last Week

The WOO token, which is part of the Woo Network liquidity protocol, has been rising recently after fluctuating earlier. According to data from Coingecko, WOO was trading at $0.45 at the time of writing, up over 2% in the previous day and maintaining a strong 75.0% increase over the previous seven days.

A contributing element to the cryptocurrency’s recent price increase was the WooFi exchange, which attracted attention from possible investors after announcing a partnership with Arbitrum.

The cryptocurrency exchange WOO X, which runs on the WOO token, announced this week that it will be partnering with Wintermute to increase liquidity.

With a combined trading volume of about $3.6 trillion, Wintermute is an algorithmic trading company and liquidity provider. Thanks to its partnership with WOO X, it now serves as the primary liquidity provider for the exchange.

Another market maker, Selini Capital, joined WOO X in order to extend its designated market maker (DMM) program and gain access to over 135 perpetual markets.

When WOO debuted on the open market in late 2020, its value was approximately $0.03. Woo Network surged ahead of the market in early 2021, breaking through the dollar in April and hitting a one-time high of $1.34 on May 9.

The price of WOO token has recovered after suffering a significant drop over the weekend. Over the weekend, it dropped to a low of $0.35, but it rose to a high of $0.42 following that. WOO continues to be higher above the 50-period moving average.

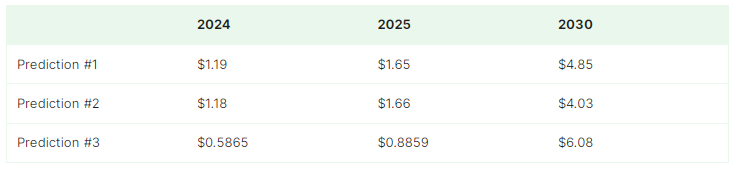

Woo Network Price Prediction

Additionally, it appears to be creating a double-top pattern, with the upper side located at $0.4578. The Relative Strength Index (RSI) is heading toward the 70 overbought level after making an upward trend.

As a result, investors are aiming for the double-top point at $0.4578, which is around 15% above the current price, which indicates a bullish view for the cryptocurrency.

The Woo Network short-term price projection for 2023 by CoinCodex shows that the token will fall to $0.411 by December 24 and rise to $0.4881 by January 18. The technical analysis on the website was bullish, with 24 indications indicating a bullish trend and only four indicating a bearish trend.

According to DigitalCoinPrice, Woo Network will trade at $1.19 at some time in the upcoming year. PricePrediction.net and Bitnation, on the other hand, were more conservative and predicted that WOO would be worth $0.58 and $1.18 in 2024, respectively.

Featured image from Binance Academy

Bitcoin Price Rejects $43.5K, Why BTC Could Tumble In Short-Term

Bitcoin price attempted a fresh upside break above the $43,500 resistance. BTC failed and corrected lower to test the $41,800 support zone.

- Bitcoin is correcting gains from the $43,500 resistance zone.

- The price is trading above $42,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance near $42,600 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move down if there is a move below the $41,650 support.

Bitcoin Price Drops Again

Bitcoin price gained pace above the $42,000 resistance zone. BTC even climbed above the $43,000 level, but it faced a strong rejection near $43,500. It seems like the price failed again to clear the $43,500 zone.

A high was formed near $43,464 and the price started a fresh decline. There was a move below the $42,800 and $42,500 support levels. The price even spiked below the 50% Fib retracement level of the upward wave from the $40,514 swing low to the $43,464 high.

Bitcoin found support near the $41,800 level. It is now trading above $42,000 and the 100 hourly Simple moving average. The price is also stable above the 61.8% Fib retracement level of the upward wave from the $40,514 swing low to the $43,464 high.

On the upside, immediate resistance is near the $42,600 level. There is also a connecting bearish trend line forming with resistance near $42,600 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

The first major resistance is forming near $43,000. The main resistance is still near the $43,500 zone. A close above the $43,500 resistance might start a steady increase. The next key resistance could be near $44,500, above which BTC could rise toward the $45,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $42,650 resistance zone, it could continue to move down. Immediate support on the downside is near the $42,000 level.

The next major support is near $41,650. If there is a move below $41,650, there is a risk of more losses. In the stated case, the price could drop toward the $40,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $42,000, followed by $41,650.

Major Resistance Levels – $42,650, $43,000, and $43,500.

Matrixport Says 95% Chance Of Bitcoin Spot ETF In January, Sets BTC Price Target

The anticipation around a potential approval of a Spot Bitcoin ETF is still high among crypto investors. This anticipation has been one of the main drivers of the price rally that has been witnessed over the last two months.

Despite the United States Securities and Exchange Commission (SEC) postponing its decision on multiple spot ETF filings, industry experts remain very positive that the regulator is on the verge of approving the first Spot Bitcoin ETF.

Bitcoin Spot ETF Coming In January 2024

Many experts have revised their expectations for if and when the SEC would approve a Spot Bitcoin ETF. At first, expectations were low. But as time has gone on, the expectations have risen quickly and analysts at Matrixport are part of the camp that believes a Spot Bitcoin ETF is on its way.

In a report released on Monday, December 18, Matrixport Head of Research Markus Thielen reveals a 95% chance that a Spot BTC ETF will be approved in January 2024. January carries the deadline dates for most of the 13 filings so far, and Thielen expects that the SEC will approve a spot ETF on January 10.

The report points to the fact that BlackRock, the largest asset manager in the world, reviewed its S-1 filing with the SEC. Here, the regulator had given the asset manager instructions which included monitoring unusual price movements, storing all private keys in cold storage, and having procedures in the event there are Bitcoin forks.

Additionally, the SEC also responded to Franklin-Templeton’s filing in November despite having until January to do so. This move, the analyst says, “gave the impression that the SEC is lining all issuers up to get approval by January 10, 2024.”

Thielen explains the importance of the meeting the regulator had with BlackRock, saying, “The SEC has never actively engaged with potential ETF issues and appears to have given all ETF issuers with whom it had discussions the same instructions.”

BTC Price Expectations After Approvals

Given that Matrixport expects approvals to come in January, the analyst also gave their expectation for price when this happens. Thielen expects that Bitcoin will go on another rally once this happens and the price could rise as high as $50,000 in the first quarter of the year 2024 as a result.

“We expect this correction to switch back into another leg higher in Bitcoin prices after Christmas as investors take advantage of the recent correction and position themselves for the likely Bitcoin Spot ETF approval period – January 8 to January 10, 2024,” the analyst said, alluding to the decline in price that Bitcoin has recorded over the last week.

As for Grayscale, the analyst doesn’t believe that the SEC would allow for a conversion of the Bitcoin trust into a Spot ETF on January 10. However, they do expect 20% of precious metal demand to switch to Spot Bitcoin ETFs following the approvals.

Eyes On $50,000: Bitcoin Poised For Major Rally Amid Spot ETF Optimism – Analyst

Crypto analyst Michael van de Poppe has recently shared his latest Bitcoin price prediction on X. Van de Poppe has now set his sights on new heights for the flagship cryptocurrency.

In a recent post, the analyst expressed confidence that Bitcoin has concluded its corrective phase and is primed to test the $47,000-$50,000 range soon.

Van de Poppe’s optimism stems from a critical market development: the potential approval of spot BTC exchange-traded fund (ETF) by major financial entities like BlackRock, Fidelity, and Ark Investment. This anticipated move, widely supported by industry experts, could catalyze BTC’s leap.

The SEC’s expected nod in early January could unlock unprecedented market dynamics, propelling Bitcoin to new highs.

#Bitcoin did test the lows, didn’t take the liquidity beneath the lows.

Anyway, correction seems over and pre-ETF we’re likely to test $47-50K.

Buy the dips. pic.twitter.com/Ar4mqvYRjJ

— Michaël van de Poppe (@CryptoMichNL) December 19, 2023

Meanwhile: Recovery Found In Key Supply Zone

Amid the waves of predictions, Michael van de Poppe isn’t alone in his bullish outlook. Ali, another market analyst, has raised concerns over Bitcoin’s recent slip below a crucial supply zone, ranging from $41,200 to $42,400.

Leveraging on-chain data from IntoTheBlock, Ali pointed out that this zone is a stronghold for 1.87 million addresses, cumulatively holding around 730,000 BTC. He warns that a breach below this level could trigger a sell-off, potentially pushing Bitcoin down to the next demand zone between $37,500 and $38,700.

#Bitcoin has slipped below a key supply zone, ranging from $41,200 to $42,400. In this area, 1.87 million addresses had accumulated 730,000 $BTC.

This downturn might trigger these holders to sell, aiming to cut losses.

If selling pressure increases, watch for a possible decline… pic.twitter.com/aTX1RWarkb

— Ali (@ali_charts) December 18, 2023

However, in a positive twist, Bitcoin has shown signs of recovery, surpassing the $42,400 mark. In the past 24 hours, Bitcoin has witnessed a near 3% rise, trading around $42,548 at the time of writing. This resurgence is a strong indicator that Bitcoin has re-entered and solidified its position in the critical supply zone identified by Ali.

Bitcoin Path To $200,000 By 2024

Beyond these immediate forecasts, Dan Tapiero, Managing Partner at 10T Holdings, envisions a broader transformation for Bitcoin and the crypto market. Tapiero, echoing insights from Real Vision’s CEO Raoul Paul, predicts that BTC could surge to over $200,000 by May 2024.

This bullish trajectory is not just mere speculation. Still, it is backed by the anticipation of a significant liquidity influx into the BTC market, especially with the potential SEC approval of spot Bitcoin ETFs.

Introducing these spot ETFs, especially from traditional finance stalwarts like BlackRock, is poised to be a game-changer. It offers institutional investors a regulated avenue to dive into BTC, thereby enhancing the coin’s liquidity and, consequently, its market value.

As more institutions embrace Bitcoin, its liquidity is expected to spike, setting the stage for substantial price increases.

The world is not ready for this chart.@RaoulGMI continues his excellent work with monthly GMI report.

A 200k #Bitcoin in 2024 suggests a true and imminent change in the world.

Zero exposure will pose career risk for traditional money managers.

Money and value get redefined. pic.twitter.com/VlKD7DF5tb

— Dan Tapiero (@DTAPCAP) December 17, 2023

Featured image from Unsplash, Chart from TradingView

Bitcoin Spot ETF Biggest Development on Wall Street in Last 30 Years, Says Michael Saylor

A large increase in demand coupled with lower supply should set the stage for higher prices in 2024, he told Bloomberg.

First Mover Americas: Altcoins Rally as Bitcoin Climbs Back to $43K

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 19, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Elastos Looks to Capture BTC Staking Demand With Bitcoin Layer 2 Offering

The platform is developing Bitcoin tools as the applications built on the network catch favor with investors.

MicroStrategy’s Michael Saylor Calls Bitcoin An Institutional-Grade Asset Destined For $1 Million

Microstrategy’s Executive Chairman and Co-founder, Michael Saylor, is one who always uses every opportunity to heap praises on the flagship cryptocurrency Bitcoin. Once again, he didn’t disappoint, as BTC was the center of discussion in his latest media appearance.

Bitcoin Going To $1 Million

In an interview with CNBC, Michael Saylor stated that Bitcoin is going to $1 million if it isn’t going to “zero.” He noted that the “big question” in relation to BTC’s potential was whether or not the digital asset was legitimate. According to him, if Bitcoin is a “legitimate institutional asset,” then everybody is “under-allocated” to it.

His comment about Bitcoin possibly hitting $1 million seems to stem from his belief that Bitcoin as an asset is still untapped, as he expects many institutional players to get in on the crypto token. He noted how 99.9% of the world’s capital is currently tied to other global assets like bonds, real estate, stocks, and precious metals. However, expects that to change soon enough.

That change, he believes, will stem from education about digital assets. From that, Saylor says more and more people will realize that they ought to be allocating more and more of their capital to digital assets. Interestingly, he labeled BTC as a “digital transformation of capital,” alluding to its disruptive nature.

These institutional players could well be allocating more of their capital to BTC as early as 2024. The new rule by the Financial Accounting Standards Board (FASB) recently opened the door for firms to include cryptocurrencies like Bitcoin on their balance sheet. As such, we could see other tech firms adopt Microstrategy’s “Bitcoin Strategy.”

BTC Is Going Foward In 2024

Saylor also discussed several macro factors that he considers bullish for Bitcoin going into the new year. These factors include the potential approval of a Spot Bitcoin ETF, the loosening of monetary policies, and wider BTC adoption in countries suffering from inflation.

He also alluded to the BTC Halving event, which he believes is also bullish for the Bitcoin ecosystem. All these factors form a “confluence of very bullish milestones,” which Saylor projects are going to happen over the next six months.

Saylor will undoubtedly be fulfilled when his company’s Bitcoin strategy has panned out as Microstarategy is currently in profit with its Bitcoin acquisitions. The company’s stocks are also flying high as it recently hit a 2-year high, thanks in part to its BTC exposure.

At the time of writing, BTC is currently trading at around $43,000, up over 4% in the last 24 hours according to data from CoinMarketCap.

Solana, Avalanche Meme Coin Fever Continues as Bitcoin Nears $43K

Traders have increasingly favored these networks over Ethereum for their lower transaction fees and faster speeds.

BTC price bounces 5% as investor says Bitcoin ETF ‘99.9% done deal’

New updates to BlackRock’s spot Bitcoin ETF filing come as BTC price strength narrowly retains $40,000 as support.