There may finally be light at the end of the tunnel for the Bitcoin price as selling has begun to subside for the cryptocurrency. So far, it seems that the large holders have been the main driving force behind the price decline, which could explain why the rally has been suppressed for so long. However, as these large investors start to scale back their selling, the Bitcoin price could be looking at another recovery.

Bitcoin Whales Stop Selling Old BTC

According to a report posted by Santiment, the reason for the suppressed Bitcoin price over the last week could be traced back to large Bitcoin holders. These holders who have a massive stash of old coins, which means coins that have not moved in a long time, had begun to move their coins after the price of BTC found its legs due to anticipation around the Spot ETF approvals.

Once these whales began to move these coins, there was a definite drop in the asset’s price that can be linked back to this move. As these whales moved these coins out of their wallets, the age of their BTC holdings went down, suggesting that they were selling these older coins.

On average, the age of their holdings went from around 640 days to around 624 days in the days following the Spot ETF approvals by the SEC. The on-chain tracker suggests that this was a sign that the market was back in the bull market.

However, after around a week of doing this, these whales seem to have come to a point where they are no longer moving coins. “There are mild signs that this continued movement of older coins is finally done for the time being,” Santiment said.

Now, while Santiment interprets this as a sign that the bull cycle may be over, there is also the possibility that these whales have stopped moving their coins in a bid to wait for the price to recover. In this case, selling pressure will recede, allowing Bitcoin the space to regain its footing once more.

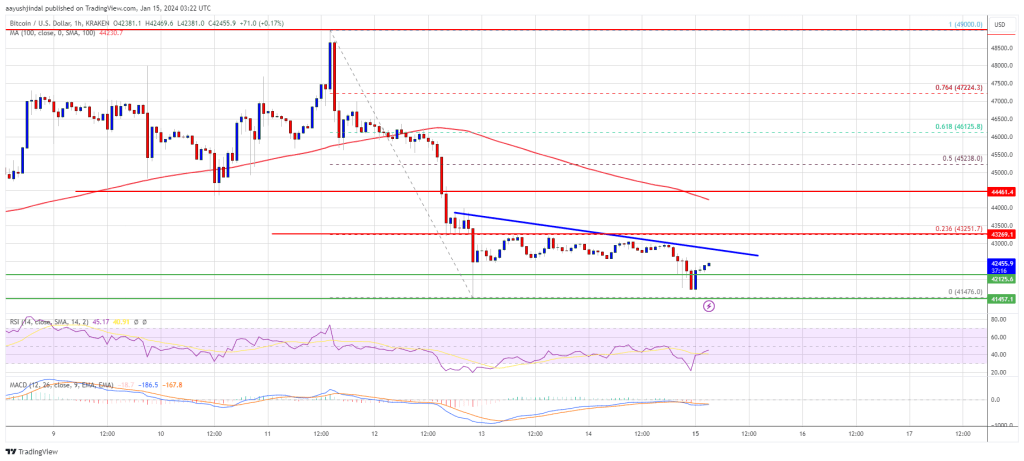

BTC Struggles With $43,000 Resistance

The Bitcoin price is currently struggling with the resistance mounting at $43,000. Since the crash last week, bulls have continued to lag behind as bears have chosen this level to pitch their tents. The sell pressure also seems to be localized at this point, so it has become the next important level to beat.

If Bitcoin is able to surmount the $43,000 resistance, it could signal a return of the rally. At this point, $45,000 becomes the next major resistance as investors flock back in. However, failure to turn $43,000 into support could result in a further decline in the price.