Crypto analyst Miles Deutscher has spotlighted several altcoins, with a special focus on artificial intelligence (AI) tokens, that demonstrate strong breakout potential in the current market rebound.

ETH On The Rise

In a recent post on X (formerly Twitter), Deutscher suggests that the upcoming Ethereum (ETH) Dencun upgrade, along with advancements in the AI industry, could drive significant price movements in related tokens.

Deutscher emphasizes the upcoming ETH Dencun upgrade, noting that while much attention has been directed towards Bitcoin (BTC) and exchange-traded fund (ETF) flows, ETH has been steadily rising against BTC.

Interestingly, the analyst expects an “aggressive” upward movement in ETH at some point, particularly with the first set of ETF decision dates approaching in May.

Deutscher also highlights the strong performance of AI tokens, including AGIX, FET, WLD, and RNDR, attributing their recent success to significant advancements within the AI industry. According to the analyst, the upcoming earnings report from NVIDIA (NVDA) on Wednesday could further bolster the bullish sentiment surrounding AI coins.

Highlighted Altcoins And Their Catalysts

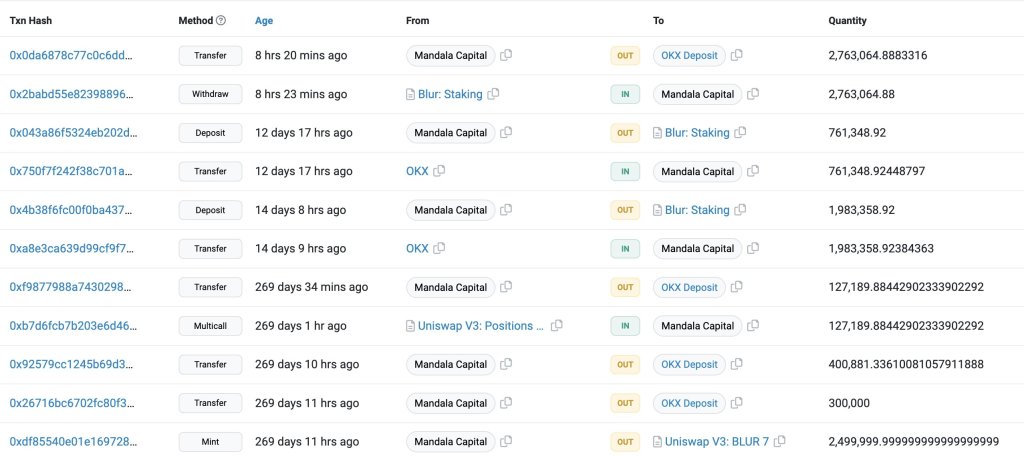

- BLUR: BLUR is nearing a significant announcement, and Deutscher notes the token’s recent strength, suggesting the $1 mark may soon be within reach. The founder’s association with BLAST, another project, adds to the intrigue.

- BEAM: Deutscher points out that BEAM’s treasury holds large MAVIA bags, leading to increased balances. As the market begins to reevaluate the native token’s value, Deutscher is intrigued by the fact that BEAM has not gained widespread attention yet. He also mentions Pantera’s recent investment/partnership, further supporting his interest.

- STRK: Token launch day is Tuesday for STRK, and Deutscher observes that new token launches often present opportunities for investors. He will closely monitor STRK’s performance, as success could lead to airdrop sellers buying back in at higher prices, while continuous selling pressure could result in price declines.

- SEI: SEI is currently near all-time highs, and Deutscher notes positive sentiment surrounding the project, fueled by an “active team” and endorsements from key figures. If overall market sentiment remains positive, Deutscher sees potential for SEI to lead the way.

- MAVIA: Deutscher highlights the buzz surrounding MAVIA, drawing parallels to Axie in its early days. The token’s successful launch and endorsements from influential figures have added to its long-term investment appeal. While acknowledging an initial strong run, Deutscher considers MAVIA a potential dip buying opportunity.

As identified by crypto analyst Miles Deutscher, various altcoins, especially AI tokens, are capturing attention due to their breakout potential. Factors such as the upcoming ETH Dencun upgrade and advancements in the AI industry are expected to influence price movements.

Featured image from Shutterstock, chart from TradingView.com