The Binance Smart Chain (BNB Chain), developed by the world’s largest cryptocurrency exchange by trading volume, Binance, experienced significant growth and performance in the first quarter (Q1) of 2024.

As highlighted in a recent report by Messari, Binance Smart Chain has surged in market cap, revenue, average daily active addresses, decentralized finance (DeFi), total value locked (TVL), and average daily decentralized exchange (DEX) volume.

BNB Outperforms Bitcoin In Q1 2024

During Q1 2024, BNB Smart Chain demonstrated notable market cap growth, soaring by 89% quarter-over-quarter (QoQ). It reached a market cap of $92.5 billion, securing the third position among all tokens, excluding stablecoins. Only Ethereum (ETH) and Bitcoin (BTC) surpassed BNB in market cap.

Interestingly, the report notes that BNB’s performance surpassed that of Bitcoin, which saw a 65% increase in outstanding market capitalization over the same period.

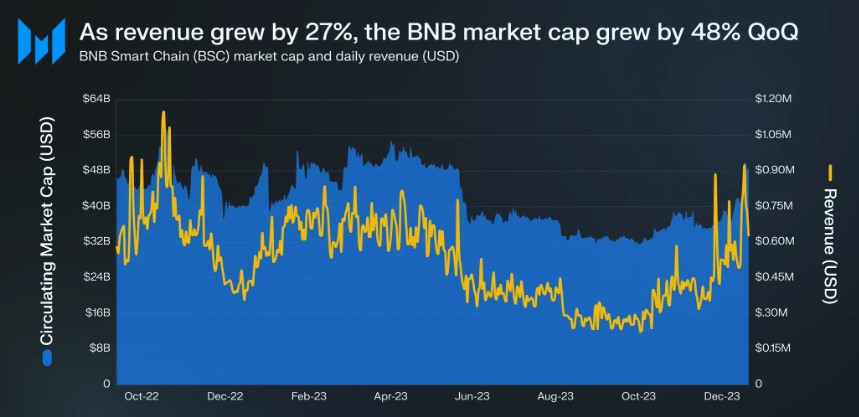

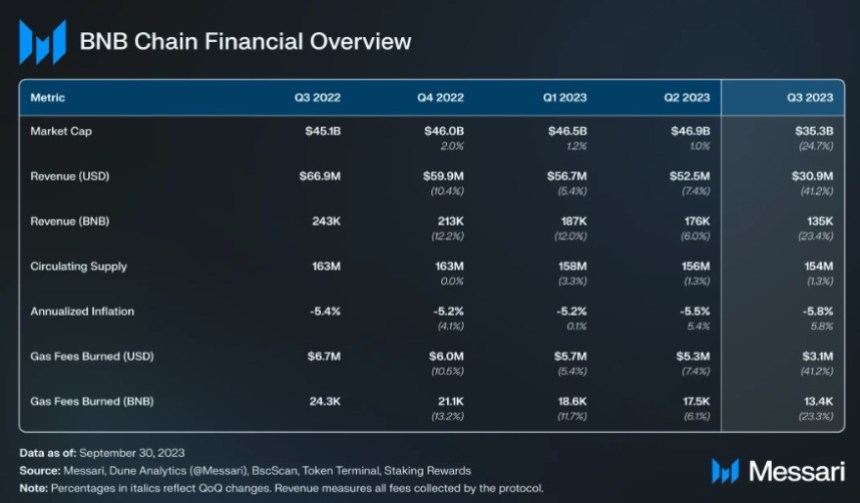

Revenue generated by the Binance Smart Chain experienced a substantial boost in Q1. The network collected $66.8 million in revenue, marking a 70% QoQ increase.

According to Messari, this surge in revenue was primarily driven by the appreciation of BNB’s price. Notably, Q1’s revenue exceeded that of any quarter in 2023. DeFi transactions, particularly gas fees, were significant in revenue contributions, accounting for 46% of the total.

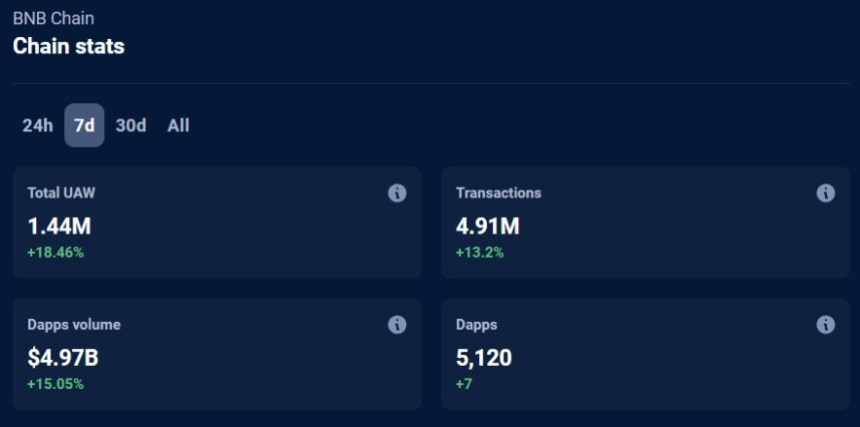

Despite a slight decrease in average daily transactions, BNB Smart Chain experienced a 27% year-over-year (YoY) increase, demonstrating sustained growth in network activity.

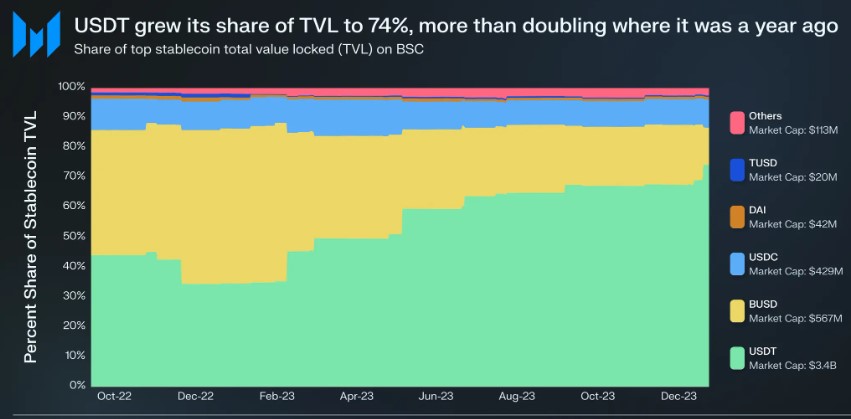

Average daily active addresses surged by 26% QoQ, reaching 1.3 million. Several protocols on the BNB Smart Chain witnessed increased transaction volumes and active addresses, with Tether’s USDT and decentralized exchange (DEX) PancakeSwap leading the way.

DEX Trading Volume Explodes

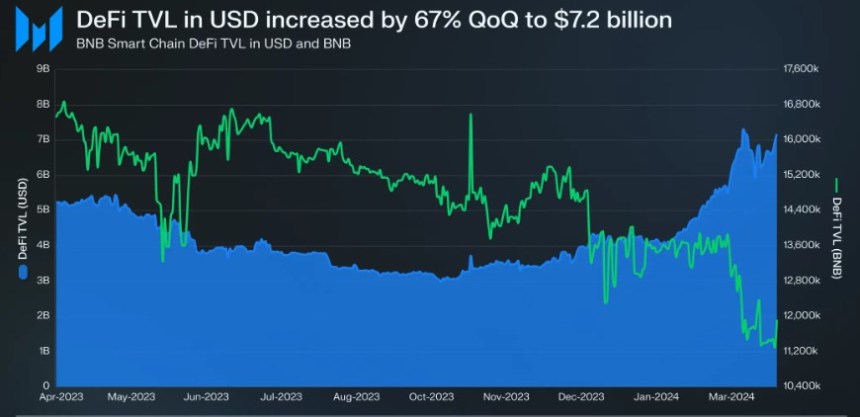

BNB Smart Chain’s DeFi TVL, denominated in USD, experienced a 67% QoQ surge, reaching $7.2 billion. This growth positioned the Binance Smart Chain as the third-highest chain regarding DeFi TVL, denominated in USD.

However, when denominated in BNB, TVL decreased slightly by 12%. This indicates that the surge in USD value was primarily driven by BNB price appreciation and capital inflows.

Decentralized exchanges on the Binance Smart Chain witnessed a staggering 193% QoQ increase in average daily trading volume. The total DEX volume for Q1 reached $1.1 billion, with PancakeSwap emerging as the dominant DEX on the platform.

PancakeSwap’s average daily DEX volume surged by 140% QoQ, surpassing other competitors and solidifying its position as the preferred DEX on the BNB Smart Chain.

Overall, Binance Smart Chain’s performance in the first quarter of 2024 showed significant growth across various parameters, reinforcing its position as an important blockchain platform.

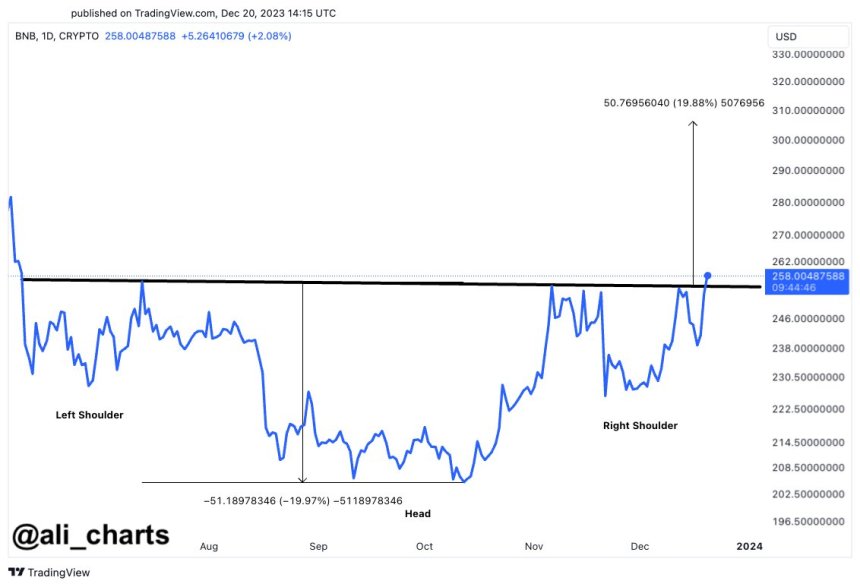

The exchange’s native token, Binance Coin, is currently trading at $607, reflecting a 2% price increase over the past 24 hours and a 10% increase over the past 7 days.

These positive price movements bring the token closer to its all-time high of $686, reached in May 2021.

Featured image from Shutterstock, chart from TradingView.com

Binance (@cz_binance)

Binance (@cz_binance)