The BNB Chain core development team said the move aims to streamline the network and improve efficiency.

Cryptocurrency Financial News

The BNB Chain core development team said the move aims to streamline the network and improve efficiency.

In a significant development for the Binance Smart Chain (BSC) ecosystem, Aave (AAVE), one of the largest decentralized finance (DeFi) market protocols, has announced its integration with BNB Smart Chain. Aave joins prominent projects such as Uniswap, Ambit Finance, PancakeSwap, and Lista DAO.

According to the announcement, this latest development opens up new opportunities for BNB Chain users, giving them access to what the protocol calls “top-tier lending platforms” and enhanced liquidity.

With the launch of First Digital USD (FDUSD), users can now leverage “robust” liquidity, allowing them to explore different applications and opportunities in the Binance ecosystem.

On the other hand, Aave users can now benefit from BNB Chain’s fees and the ability to integrate with one of the largest DeFi ecosystems, fostering increased collaboration between the two communities. The announcement also noted the following about the Aave integration:

This not only complements but strategically aligns with BNB Chain’s 2024 outlook. Focused on mass adoption, high-frequency DeFi applications, and network efficiency improvements, the ecosystem is set for an exciting evolution.

Looking ahead, BNB Chain has set numerous goals for 2024. The introduction of opBNB – the Layer 2 (L2) scaling solution for the BNB Smart Chain – aims to achieve a transaction processing capacity of 10,000 transactions per second (TPS) by doubling the gas limit to 200 M/s.

Enhanced security measures accompany this increase in capacity through multi-proof mechanisms. In addition, implementing Ethereum’s EIP4844 and Greenfield’s data availability upgrades will reduce gas fees by 5-10 times, providing users with a more cost-effective experience.

In a move called “BNB Chain Fusion,” the BNB Beacon Chain will be merged with the BSC, further enhancing the efficiency and security of the network. The expansion of the number of validators, which will increase from 40 to 100 by 2024, is also expected to contribute to the stability of the network.

Market Cap And Token Holders On The Rise

According to Token Terminal data, the BNB chain has experienced significant growth, evidenced by several key metrics.

One notable metric is the fully diluted market cap, which stands at $75.71 billion, representing a significant increase of 23.9% over the past 30 days, highlighting the confidence in the protocol.

The circulating market cap, another crucial indicator, currently sits at $54.73 billion, showing a solid 11.6% growth over the same 30-day period.

On the other hand, the number of BNB token holders has shown a positive trend, reaching 113.51 million, with a significant increase of 3.5% in the last 30 days, demonstrating interest in the ecosystem.

Featured image from Shutterstock, chart from TradingView.com

BNB holders transferred over $400 million worth of BNB tokens in 24 hours to benefit from cross-chain gaming project Portal’s upcoming airdrop, Arkham Intelligence noted.

In a recent announcement by Binance, the BNB Foundation declared the successful completion of the 26th quarterly Binance Coin token burn through the BNB Chain. The burn, which included Auto-Burn and the Pioneer Burn Program, eliminated a significant amount of the exchange’s native token from circulation.

During this latest burn event, the Auto-Burn process removed 2,141,487.27 BNB from circulation, equivalent to approximately $636 million in USD.

It is worth noting that the Auto-Burn mechanism operates independently of Binance’s centralized exchange (CEX), providing an auditable and objective process, according to the exchange’s statement.

Additionally, the Pioneer Burn Program contributed by removing 1542.15 tokens from circulation. This program permanently eliminates an amount of BNB equal to the provable lost funds of eligible users.

Since the introduction of BEP95, an estimated 210,000 tokens have been permanently burned under this mechanism. As announced, the Pioneer Burn Program helps maintain the integrity of the ecosystem and ensures that lost funds do not influence the circulating supply.

Furthermore, BNB Chain’s Real-Time-Burn mechanism continuously reduces the token supply. This mechanism enables burning a portion of BNB Chain’s gas fees in real-time, further contributing to the ongoing supply reduction efforts.

Completing the 26th quarterly BNB token burn marks another significant milestone for the BNB ecosystem. The independent Auto-Burn mechanism, combined with the Pioneer Burn Program and Real-Time-Burn mechanism, showcases BNB Chain’s approach to reducing token supply and fostering long-term value.

In addition to its quarterly token burn, BNB has recently displayed notable strength and progress, as revealed by Token Terminal’s on-chain data.

With a circulating market cap of $47.86 billion, BNB Chain has experienced a 30.45% increase in market capitalization. This surge in value reflects the growing confidence and demand for the token among investors.

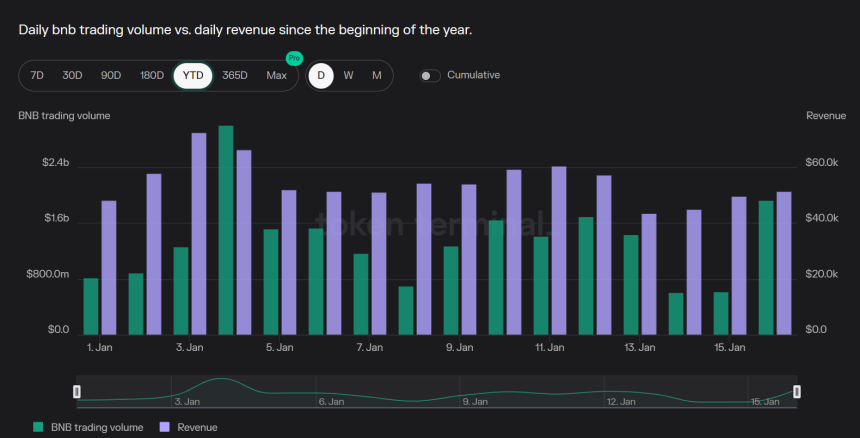

BNB Chain’s financial metrics are equally impressive. The platform has witnessed a revenue growth of 30.47% over the past 30 days, generating $1.72 million in revenue during this period, as seen in the chart below.

Extrapolating this data to an annualized basis, the chain’s revenue is noteworthy at $20.96 million, reflecting solid financial stability and sustainable growth.

The data from Token Terminal also highlights BNB Chain’s increasing user adoption and developer activity. The platform has seen a surge in active daily users, with a 30-day average of 1.42 million, representing a robust 48.6% growth.

The Binance Coin price performance has been steady, with a 2.14% decrease over the past 24 hours, while showing a positive trend over more extended periods.

The token recorded a 4.38% increase in the past seven days, and over the past 30 days, it achieved an impressive growth of 30.51%. Furthermore, BNB’s performance over the past 180 days has been significant, with a growth rate of 29.92%.

Featured image from Shutterstock, chart from TradingView.com

Binance Coin (BNB), despite experiencing a significant decline earlier this year due to market volatility and the SEC lawsuit against Binance and its founder Changpeng Zhao (CZ), has shown remarkable recovery and promising prospects.

Recent data indicates a resurgence in the BNB price, driven by the growing usage of decentralized applications (DApps) on the Binance Smart Chain (BSC).

Additionally, BNB’s fundamentals, including impressive market cap figures and increased revenue, further contribute to the positive momentum.

After witnessing a sharp decline from its yearly high of $350, BNB experienced a drop to the $203 level following the SEC lawsuit against Binance and CZ. However, recent price movements show signs of recovery and bullish sentiment.

Over the past 24 hours, BNB has gained 4.5%, and its performance in the seven, fourteen, and thirty-day time frames demonstrates an upward trend, with gains of 20%, 24%, and 38%, respectively.

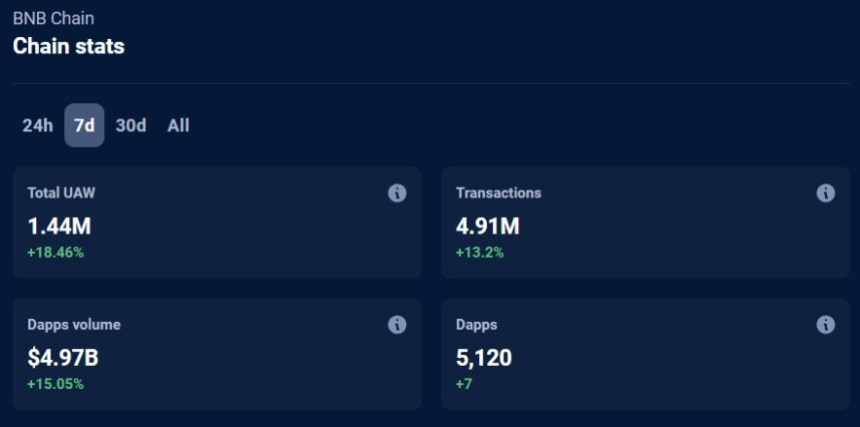

One of the driving factors behind BNB’s price rally is the increasing use of DApps on the Binance Smart Chain. Data from DappRadar reveals a surge in DApp volume, currently at $4.83 billion, representing a 12% increase.

The BNB chain boasts an ecosystem of 5,120 DApps and has recorded 4.89 million transactions, reflecting a 12.73% surge in the past seven days. These figures indicate a growing demand for BNB as it serves as the primary token within the BSC ecosystem.

Comparing BNB to Ethereum (ETH), DappRadar data highlights BNB’s superior performance in various indicators such as contracts, total unique active wallets (UAW), decentralized finance (DeFi) total value locked (TVL), and non-fungible token (NFT) volume.

The BNB chain has held the top position over the past 24 hours, showcasing its usage and adoption. This outperformance contributes to the positive market sentiment surrounding BNB and bolsters its price.

Further boosting the Binance Coin prospects, Token Terminal data reveals impressive market cap figures for BNB, with a circulating market cap of $48.02 billion, marking a 14.18% increase.

Additionally, BNB’s fully diluted market cap stands at the same value, reflecting a 28.32% growth. The revenue generated by BNB in the past 30 days has increased by 28.51%, reaching $1.47 million.

Furthermore, BNB has recorded significant fee growth, with a 27.98% fee increase over the past 30 days and an annualized revenue of $187.56 million. These fundamentals contribute to the positive sentiment surrounding BNB.

Overall, Binance Coin has staged a strong recovery, demonstrating a notable price rally driven by the increasing usage of DApps on the Binance Smart Chain. However, there is a bold prediction by a crypto analyst that could further boost the sentiment and excitement surrounding the token.

Binance Coin To Reach New Yearly High?

According to Captain Faibik, a prominent crypto analyst on X (formerly Twitter), Binance Coin is poised to achieve a new yearly high in the first half of 2024.

This prediction is based on an analysis of BNB’s 1-week chart, revealing a breakout from a descending triangle pattern, signaling the end of the macro downtrend and initiating a new uptrend phase for BNB.

Looking at the chart below, Faibik suggests that BNB’s price could potentially experience an impressive uptrend of 171% in the initial weeks of 2024. This surge would propel the token’s price above the current all-time high (ATH) of $686.

However, several resistance levels must be overcome for this projection to materialize. Notably, at the current trading price of $307, BNB faces a significant seven-month resistance barrier, which currently hinders its ascent to the $314 level, the next resistance level in the near term.

Analyzing the 1-day chart, it becomes evident that reaching the all-time high level would require surpassing additional macro resistance levels, including $329, $402, $450, $563, $607, $639, and $653.

While the theory proposed by Faibik holds promise, the actual realization of Binance Coin’s new yearly high in the early months of 2024, along with a sustained uptrend, remains to be observed.

Featured image from Shutterstock, chart from TradingView.com

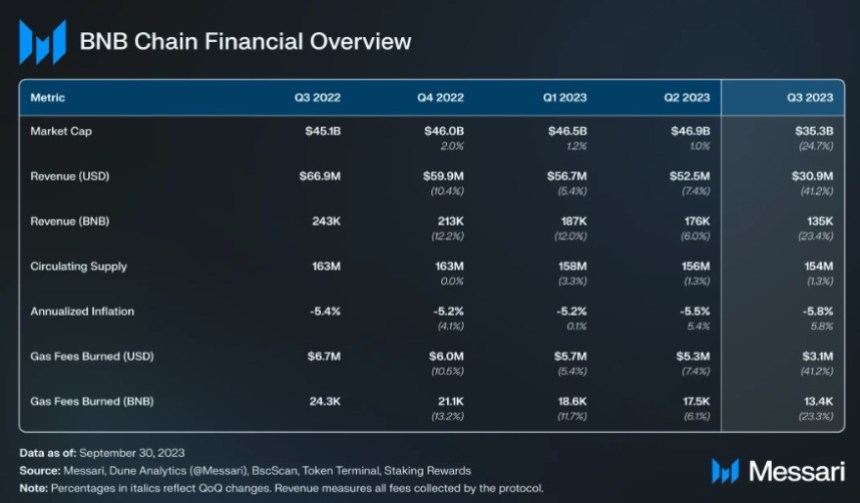

In a recent report by Messari, the analysis sheds light on the developments and challenges faced by Binance Chain (BNB), the blockchain created by Binance, the world’s largest cryptocurrency exchange regarding trading volume.

The report highlights the separation of BNB Chain from Binance and various events and allegations that have impacted Binance and its associated entities throughout the third quarter of 2023.

The Messari report emphasizes that BNB Chain has distinguished itself as an independent entity separate from Binance despite its origins as a product of the largest centralized cryptocurrency exchange. However, the market has not fully recognized this separation, leading to a lack of distinction between BNB Chain and Binance.

During the third quarter, Binance encountered numerous challenges, including losing partnerships, shutting down lines of business, conducting layoffs, and facing accusations of violating sanctions.

These events coincided with a downward pressure on the value of BNB, which experienced a 25% decline compared to the previous quarter. In contrast, the cryptocurrency market dropped by 9% during the same period.

The Messari report mentions that Binance, including its subsidiary Binance.US, was accused by the Securities and Exchange Commission (SEC) of engaging in unregistered offers and sales of “crypto securities”, including BNB.

These allegations further added to the challenges faced by Binance and its associated entities during the third quarter.

Despite the challenges, BNB maintained its position as the fourth-largest cryptocurrency by market capitalization, with a market cap of $35.3 billion. The circulating supply of BNB decreased by 1.3% in the third quarter due to the token-burning mechanism employed by BNB Chain.

The report also highlights the impact of adverse events on BNB Chain’s on-chain activity. BNB Smart Chain’s revenue, measured in BNB, fell in line with the decline in BNB’s market cap, indicating a decrease in activity on the Binance Smart Chain (BSC). Daily transactions (-14%) and average fees (-12) in BNB also experienced declines during this period.

BNB Chain offers staking opportunities for cryptocurrencies such as Ethereum (ETH), BNB, Cardano (ADA), and others. The report notes that the total stake and eligible supply declined by 3% and 2%, respectively, while the average annualized staking yield decreased from 2.6% to 2.1% during the third quarter.

The DeFi sector on the BNB Chain demonstrated strength compared to other sectors. The NFT space experienced increased secondary sales volume, unique buyers, and sellers.

However, stablecoin transfers and GameFi experienced declines in volume. The report suggests that newer applications on BSC may have influenced the growth of unique buyers and sellers in the NFT sector.

Ultimately, the Messari report provides insights into the separation of BNB Chain from Binance and the challenges faced by Binance and its associated entities during the third quarter of 2023.

Despite these challenges, BNB Chain maintained its market capitalization and continued to launch new products and implement technical upgrades. The report highlights the need for market recognition of the separation between BNB Chain and Binance and the impact of adverse events on BNB Chain’s on-chain activity.

On the other hand, BNB has experienced a prolonged downtrend since reaching its annual peak of $350 in April. Subsequently, the token plummeted to $202 on October 9.

However, recent developments have resulted in a positive trend, with BNB recording a profit of 5.2% in the past 14 days and 1.8% in the last 30 days. As a result, the current trading price of BNB stands at $223.

Featured image from Shutterstock, chart from TradingView.com

The deployer account for LSC drained over $1 million in tokens from the project, then swapped them to BUSD using PancakeSwap.

Binance, the world’s largest cryptocurrency exchange, is currently grappling with challenges that have raised concerns about its credibility and market performance.

Recent reports by Forbes shed light on Binance’s initial coin offering (ICO) and the subsequent distribution of its native cryptocurrency, Binance Coin (BNB).

The investigation reveals allegations of undisclosed token retention, discrepancies in the ICO process, and the accumulation of a significant token reserve by Binance.

Per the report, in June 2017, Binance initiated its ICO, aiming to raise $15 million by selling 100 million BNB tokens. However, the Forbes investigation, conducted with the assistance of crypto forensic firms, suggests that only around 10.78 million BNB tokens were transferred to investors during the ICO.

An additional 20 million tokens were “quietly” allocated to angel investors, doubling their initial allocation to 40 million tokens. Consequently, according to Forbes, Binance likely raised less than $5 million during the ICO, contrary to the $15 million claimed by founder Changpeng Zhao.

The Forbes report indicates that Binance’s white paper did not disclose the company’s plans for unsold tokens in the event of an undersold ICO. While it is not illegal for issuers to retain unsold tokens, transparency is crucial in such cases, Forbes alleges.

Binance founders and insiders reportedly ended up with 145 million BNB tokens instead of the originally planned 80 million. These tokens, initially valued at less than $10 million, are now estimated to be worth approximately $14 billion.

Furthermore, Binance implemented a token buyback and burn program to reduce the total supply of BNB tokens over time.

According to Binance’s website, approximately 48 million tokens have been burned as of August 31, 2023. However, Forbes suggests that Binance controls nearly 117 million tokens, accounting for 76% of the total outstanding supply.

The analysis combines disclosed tokens issued to the founding team with a proprietary probabilistic analysis that identifies previously undisclosed wallets holding customer funds and serving other corporate purposes.

Forbes concludes discrepancies and lack of transparency surrounding Binance’s ICO and token distribution raise questions about the integrity of reported trading volumes and the adequacy of consumer protections.

Changpeng Zhao (CZ), the Chief Executive Officer of Binance, has remained silent in the face of recent allegations and ongoing investigations brought forth by Forbes.

The prolonged exchange of statements between the cryptocurrency firm and the renowned news outlet has endured for a significant period. Binance had taken legal action against Forbes in 2020, filing a defamation lawsuit in the US District Court in New Jersey.

The lawsuit stemmed from Forbes’ publication of “false statements” that Binance allegedly used deceptive practices to deceive regulators and participated in money laundering activities.

Forbes published a series of articles that made damaging claims about Binance’s corporate structure, asserting that it was deliberately designed to deceive regulators and engaged in activities characteristic of money laundering. Binance vehemently denied these allegations, deeming them false and highly defamatory.

Binance’s attorney, Charles J. Harder, has emphasized the harm caused to Binance’s reputation by Forbes’ misleading story. Binance had requested a retraction or correction from Forbes, which was refused, leading to the necessity of the defamation lawsuit.

Overall, Binance and Forbes have been embroiled in contentious claims and disputes, with both parties accusing each other of disseminating inaccurate information.

As the situation unfolds, it remains uncertain how the cryptocurrency exchange will respond to the latest allegations put forth by Forbes.

Featured image from Shutterstock, chart from TradingView.com

Yuga Labs – creators of the popular Bored Ape Yacht Club (BAYC) NFT collection – has unveiled its plans to cut ties with NFT marketplace OpenSea. This comes as a response to the platform’s proposed shift to an optional royalty system.

On Thursday, August 17, OpenSea announced that it is changing its creator fees framework, making royalties optional for new collections after August 31, 2023. The NFT marketplace also disclosed that it would disable the Operator Filter, a feature that enforces creator royalties.

According to the announcement, NFT collections that utilized the Operator Filter up until August 31 will have their creator royalties enforced till February 29, 2024, when the fees will become optional.

In the blog post, OpenSea explained the rationale behind its decision, saying the Operator Filter was designed to empower creators with greater control. However, the marketplace claims that it has not received the much-needed acceptance in the web3 ecosystem.

On Friday, August 18, Yuga Labs published an open letter on X (formerly Twitter), subtly criticizing OpenSea’s decision to make creator fees optional on all secondary sales for all collections by February 2024. The BAYC creator also disclosed its plans to wind down support for OpenSea’s SeaPort, a marketplace protocol that enables the buying and selling of NFTs.

Daniel Alegre, CEO of Yuga Lab, said in the response:

Yuga Labs will begin the process of sunsetting support for OpenSea’s SeaPort for all upgradable contracts and any new collections, with the aim of this being complete in February 2024 in tandem with OpenSea’s approach.

Alegre noted that while the purpose of NFTs has been to revolutionize true ownership of digital assets, it has also been about empowering artists and creators. “Yuga believes in protecting creator royalties so creators are properly compensated for their work,” he added.

Yuga Labs’ stance will likely be a significant blow to OpenSea, but perhaps not one the marketplace wouldn’t have foreseen. In January, the BAYC creators blacklisted about four marketplaces – with an optional royalty model – from its Sewer Pass collection.

OpenSea also recently announced its decision to disable the minting and listing of NFTs on the BNB smart chain. According to the post on X, this move was informed by the marketplace’s “need to align resources with the most promising efforts”.

The NFT platform wrote in the announcement:

Starting today (August 18, 2023), you will no longer be able to create new listings for or make new offers on BSC NFTs. However, you will still be able to view, discover, and transfer BSC NFTs on our site.

This latest development brings OpenSea’s total supported chains down to 10, including Arbitrum, Avalanche, Ethereum, Optimism, Polygon, Solana, and the recently-added Base and Zora.

While Ethereum-based protocols have been hit with the majority of the exploit activity, BNB Smart Chain has also seen similar “copycat” exploits, according to BlockSec.

The reported attacker is a known exploiter, labeled ‘Fake_Phishing750’ by BscScan.

GMX, the perpetual trading decentralized exchange (DEX) allowing up to 50X leverage, now generates more trading fees than the BNB Smart Chain (BSC) and Bitcoin.

According to statistics, GMX’s 1-day fee on January 19 was around $589,000, while BSC and Bitcoin on-chain fees, over the same period, stood at $524,232 and $328,935, respectively.

Ethereum and Uniswap are the only two major protocols more active than the perpetual trading decentralized exchange, per the above data. During this time, the total Gas fees accrued in Ethereum exceeded $5 million. In Uniswap, it was over $2.1 million, roughly 4x GMX’s and BSC’s daily fees.

GMX supports trading various coins, including BTC, ETH, and AVAX. As of writing, GMX had $96,802,651,673 in total trading volume with open interest, that is, the number of opened positions, long and short, of $207,102,720. Meanwhile, over 208,000 active traders were using the platform to trade on Arbitrum and Avalanche. GMX launched on Arbitrum and Avalanche, considering their scalability and low fees versus Ethereum.

Arbitrum is Ethereum’s layer-2 platform permitting scalable and low-fee trading fees. On the other hand, Avalanche is scalable and boasts the fastest settlement time in crypto. By launching on these two platforms, GMX says it allows users to save on costs by entering and exiting positions with minimal spread and zero price impact.

Traders take the profits of selling positions in USDC and the quote token when they go long. GMX prices are based on Chainlink’s decentralized oracles to prevent price manipulations.

Trading fees generated by a dApp or on a blockchain are a crucial activity indicator. Despite the tendency of users to opt for protocols offering near-zero fees, the decentralized nature of blockchains means validators or entities securing core infrastructures must be compensated.

In decentralized finance dApps like Uniswap and GMX, trading fees generated from swapping activities are distributed to liquidity providers (LPs). There are also governance tokens that are distributed. Anyone can be an LP.

In September 2020, Uniswap distributed UNI to users who had, in one way or another, used the protocol to swap tokens before the airdrop distributing date. Currently, UNI trades at $6.1.

Interestingly for GMX, the 1-day trading fee of $589,000 posted on January 19 exceeds the total average amount accrued over the past trading week of $565,682. The same trend can be observed in the top-5 most active platforms. Making extensions on this could point to renewed interest from users and traders using the protocol in one way or another.

In GMX, it could mean more traders are posting traders, aiming to clip the market and turn in a profit. Coincidentally, the upswing in trading fees is recorded when the cryptocurrency market appears to be bottoming up after losses. At least, this was the trend in 2022.