This represents a 15x increase compared to the S&P 500’s year-to-date returns.

Cryptocurrency Financial News

This represents a 15x increase compared to the S&P 500’s year-to-date returns.

The Solana memecoin frenzy has made many investors score a home run or be out of the game this cycle. Traders are looking for new projects that could be the next hit while the market enters a new re-accumulation phase.

Memecoins have been the narrative of this bull cycle. As a result, those who wanted to make big profits mainly invested in newly launched projects. While some have made millions by trading the week’s top gainers, others have lost significant amounts trying to climb the ladder.

Solana-based memecoins have been the most popular, with some, like dogwifhat (WIF) and cat in a dog’s world (MEW), leading the way. However, not all projects have achieved recognition and support for these tokens.

A considerable number of the Solana memecoins launched in the last two months have left investors empty-handed. The latest culprit is the recently launched Bonk Killer (BONKKILLER), which became the hottest topic on Monday for the wrong reasons.

The token surpassed the $100 trillion market capitalization only a few hours after launching. Nonetheless, the reason behind what could have been the most impressive feat in crypto history is no other than a honeypot scam.

As reported by SolanaFloor, the memecoin is a scam token that attracts investors with high-profit potential but prevents them from selling their holdings. Many realized they couldn’t move their tokens only after the project’s creator activated the “freeze authority.”

This action allowed the creator to avoid selling the token, which skyrocketed the market capitalization metric to $328 trillion. According to analytics platform Birdeye, the Solana-based memecoin registers a $318 trillion market cap at the time of writing.

It’s worth noting that the token isn’t backed by the amount reflected in the metric. As one X user pointed out, the token is worthless if you cannot sell it.

When you buy but can't sell. #bonkkiller pic.twitter.com/AjJokgptmw

— Bull.BnB (@bull_bnb) April 30, 2024

Unfortunately for investors, the creator didn’t use the freezing authority to boost the token’s market cap. The scammer took advantage of the function and stole nearly half a million dollars in BONKKILLER and SOL tokens.

The creator, who holds around 90.8% of the total supply, removed 30,500 BONKILLER and 1,561 SOL, worth around $420,000. According to Birdeye data, the token is valued at $32.81 as of This writing.

UPDATE: @solana memecoin BONKKILLER, a scam and honeypot token, has withdrawn liquidity worth over 3,000 $SOL after freezing token sales for users. pic.twitter.com/JO3E3RuXMW

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 30, 2024

Even after the community’s warning, some investors continued to buy the project. In the last 12 hours, investors have spent nearly $40,000 on the token. As some X users pointed out, the false market cap might be misleading inexperienced investors into buying the memecoin.

Although it’s not the first scam of this type, the increasing rate of new launches turning fraudulent seems alarming. As reported by NewsBTC, $27 million vanished over the last month after 12 projects were abandoned by their creators.

Ultimately, this incident highlights the importance of thoughtfully researching a project’s background and carefully deciding whether the possibility of massive gains outweighs the risks.

Crypto users have continued to send funds to the apparent honeypot scam, even with many warnings they won’t be able to transfer any of it.

Bitcoin’s range-bound price action could lead traders to focus on NEAR, AR, CORE and BONK.

Memecoins are once making waves in the crypto market. In the last 24 hours, 4 of the 10 best-performing cryptocurrencies in the top 100 are meme coins. The biggest gainers include BONK (+10.2%), PEPE (+4.8%), WIF (+4.7%) and FLOKI (+4.1%). With meme coins slowly regaining, crypto traders are seemingly focusing on lesser-known coins.

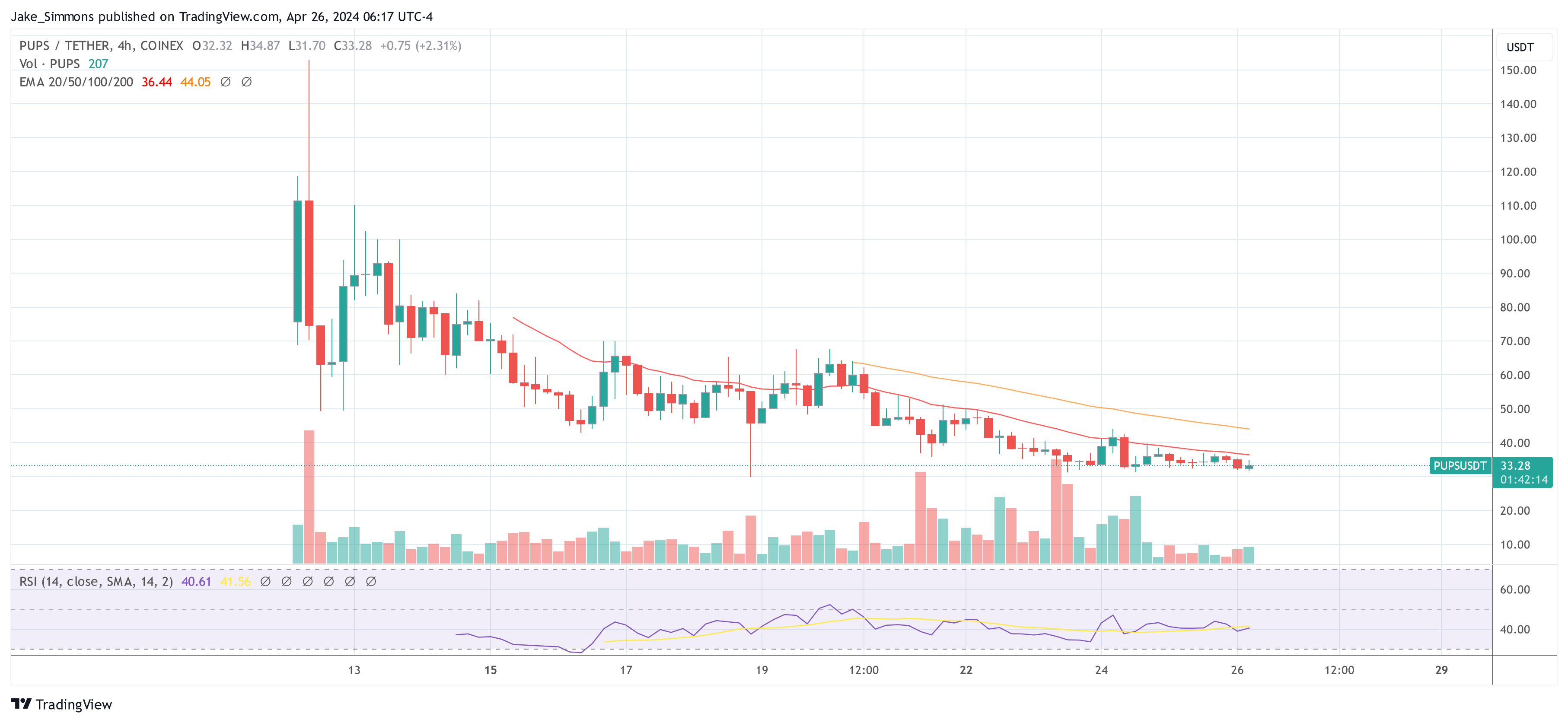

According to data from on-chain analysis service Lookonchain, the renowned crypto trader known as “paulo.sol” has been making significant moves into new memecoin territories. Paulo.sol, who has previously amassed substantial profits from meme coins like BONK, WIF, and BODEN, is now shifting his focus to acquiring significant stakes in PUPS and POPCAT.

What a legend!

paulo.sol has realized profits of $9.51M on $WIF, $7.04M on $boden and $6.28M on $BONK.

1/ Let's dig into his trades to see what he's buying.

pic.twitter.com/2axUwHb3el

— Lookonchain (@lookonchain) April 26, 2024

Lookonchain’s recent posts on X (formerly Twitter) provide a deep dive into paulo.sol’s past and present investment patterns. “What a legend! Paulo.sol has realized profits of $9.51M on WIF, $7.04M on BODEN, and $6.28M on BONK,” Lookonchain tweeted. In total, the crypto trader has made $22 million in realized profits.

The posts further reveal that paulo.sol bought into BONK early in November 2023, capturing substantial gains as its value surged. “As early as Nov 11, 2023, paulo.sol noticed the rising of BONK and bought BONK. He made ~$6.28M by buying BONK at low prices and selling at high,” the data provider stated.

The crypto trader continued his strategy by investing in WIF and BODEN in December 2023 and March 2024, respectively, following their sharp price increases. Notably, “paulo.sol did not buy WIF and BODEN when they first went online, but paid attention to and bought heavily when they first rose sharply,” Lookonchain observes.

As of now, paulo.sol continues to hold 12.87 million BODEN tokens valued at approximately $7.6 million and 1.87 million WIF tokens worth around $5.7 million. However, his most recent activities show a pivot towards new meme coins, PUPS and POPCAT, sparking interest among investors and analysts alike.

Lookonchain noted, “We noticed that paulo.sol is buying PUPS and POPCAT recently. He spent $1.77M to buy 4.3M POPCAT at $0.42 today. And he has spent $5.97M to buy 101,712 PUPS at $59 since Apr 11, becoming the largest holder of PUPS on Solana.”

The impact of paulo.sol’s investment has been palpable in the market dynamics of the newly favored meme coins. Despite a general downturn in the memecoin sector, POPCAT’s price surged by 52% today, trading at approximately $0.51 with a trading volume increase of 51% to $166 million. Over the past nine days, POPCAT has risen a whopping 410%.

On the other hand, PUPS is seeing a price drop of 4.2% today, trading at $36.96, with a 27% fall in trading volume to $2.82 million. Since reaching an all-time high above $152 on April 14 (on Coinex), the PUPS price is down more than 78%.

Two Solana-based memecoins, Bonk (BONK) and Dogwifhat (WIF), have registered substantial gains over the past 24 hours. BONK recorded a 35% increase, while WIF climbed by 19%, positioning them among the top three gainers in the top 100 cryptocurrencies by market cap today. Only Hedera Hashgraph (HBAR) surpassed them, with a notable 44% rise during the same period.

The significant uptick in these Solana memecoins is closely linked to the recent improvements in the Solana network’s performance. A tweet from SolanaFloor earlier today indicated, “BREAKING: Solana’s congestion issues have been completely resolved, with block production back to normal. Transactions confirming in under 2 seconds.” This announcement marks a pivotal moment for the network which had been plagued by congestion issues.

Source A: https://t.co/2TVnbaPNlHSource B: https://t.co/GfHxy8dC1B

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 24, 2024

On April 15, Solana developers rolled out crucial updates designed to alleviate these problems, urging validators to adopt version v1.17.31. This version introduces changes in the treatment of validators based on their stakes. Further enhancements are anticipated with the release of version v1.18 next month, which will include a new scheduler, albeit disabled by default.

Andrew Kang, founder of Mechanism Capital, remarked a few days before the fix, “Let’s also not forget that the Solana congestion issues have weighed down SOL and Solana-based memecoins significantly. It’s not a question of if but when the network is significantly improved. That’s your springboard.” Kang’s comments now seem prophetic as the resolution of network issues has indeed acted as a springboard for memecoin valuations.

Specifics On Rally Of Dogwifhat (WIF) And BONK

The price of WIF soared to a 24-hour high of $3.43 on April 24, buoyed by an impressive 96% increase in trading volume. This influx was fueled by notable acquisitions from whales like Ansem, who capitalized on the positive market sentiments.

The breakout above the resistance level at $3.18, after a week of sideways trading between $1.97 and $3.18, was a significant trigger. WIF formed a two-week-long ascending triangle, a bullish chart pattern that indicated a continuation of the previous upward trend. The breakout was widely discussed in the crypto community, with trader Bluntz Capital confirming the pattern’s resolution and sparking further bullish sentiment.

2 week long ascending triangle forming here on $WIF, i think the breakout is imminent pic.twitter.com/S0OZWBsq6u

— Bluntz (@Bluntz_Capital) April 24, 2024

BONK is registering a dramatic 35% rise, with a remarkable 304% increase in trading volume. The price action successfully breached the 0.236 Fibonacci retracement level at $0.000020727, and continued its upward trajectory to the 0.5 Fibonacci level, signaling strong buying interest and bullish momentum.

This rally probably gained additional support from the recent listing of BONK by the global neobank Revolut, which was announced on April 22. This inclusion in Revolut’s trading platform, which features over 150 digital currencies, provided significant exposure and legitimacy, further enhancing investor interest and market activity around BONK.

FLOKI and BONK had remarkable growth over the weekend after recovering from the Bitcoin dip at the end of last week. These tokens have been some of the hottest topics during this bull run, with FLOKI and BONK increasing by over 500% and 87%, respectively.

Recently, both memecoins were listed on the European neo bank and retail platform Revolut, but the news didn’t appear to have a massive impact on the tokens. However, the projects’ most recent announcements have seemingly made them soar in the past hour.

The projects announced their listing on Revolut on Monday. The new listing expands the reach of FLOKI and BONK to a broader audience, as the platform is available to 40 million users in over 150 countries.

#FLOKI just got listed on Revolut, the biggest neobank and retail trading app in Europe!

This listing will make $FLOKI accessible to @RevolutApp's 40 million+ users in 150+ countries who will be able to buy FLOKI with 25+ fiat currencies including GBP, EUR, USD and more.

Users… pic.twitter.com/Hy62VJw2w4

— FLOKI (@RealFlokiInu) April 22, 2024

Moreover, the listing will allow users to buy the tokens with 25 fiat currencies, including EUR, GBP, and USD, directly from the Revolut app. Per the BONK X post, users in Europe and eligible countries will also have access to a Learn and Earn program starting on April 29.

Crypto trader Altcoin Gordon weighed in on the matter, telling his 458,000 followers that the listing was “pretty BIG.” According to Gordon, it will allow the tokens to compete with Dogecoin (DOGE), Dogwifhat (WIF), PEPE, and Shiba Inu (SHIB).

Despite the announcement, the tokens performed modestly after the news. FLOKI’s price increased 2% in the following hour, trading at $0.0001778. Nonetheless, the token dropped 5.3% hours later to trade at $0.0001693.

Meanwhile, Bonk’s price increased by 3.7%, trading at $0.0002069 before facing a 3.4% dip to the $0.0001990 level.

Similarly, both tokens have seen a decrease in daily activity in the past 24 hours. FLOKI’s daily trading volume fell a staggering 31.6%, while BONK’s trading volume dropped over 51%.

On Tuesday morning, FLOKI was trading at $0.0001727, representing a modest 0.4% gain from the token’s price 24 hours prior. On the other hand, BONK traded for $0.00002019, a 2.6% price decrease from the day before.

However, the project’s most recent announcements have positively impacted the tokens’ prices. FLOKI announced that the decentralized platform Alltoscan locked $18 million worth of $ATS for 15 months using the project’s crypto locker protocol, FlokiFi Locker.

Alltoscan has just secured over $18,000,000 worth of $ATS tokens for a 15-month period using #Floki's advanced crypto locker protocol, #FlokiFi Locker!@alltoscan is developing an open-source block explorer compatible with all rollups, enabling users to inspect their L2… https://t.co/RBc0nGnrJr

— FLOKI (@RealFlokiInu) April 23, 2024

The news appears to have been well-received by the community. Seemingly fueled by the positive sentiment, the token rose 5.5% in the last hour. Similarly, FLOKI now surged 11.2% from 24 hours ago.

Meanwhile, BONK announced renowned artist JT Liss as “The Dog’s Director for BONK Art Masters.” JT is set to lead Bonk’s BAM residency program and the Creator Grants program “to help provide more opportunities for artists in the Solana ecosystem.”

Following this news, the token increased by 4.3% in an hour and over 5.6% from its price 24 hours ago. At the time of writing, BONK is trading at $0.00002164.

Bucking the trend within the highly volatile memecoin sector, Bonk (BONK), a Solana-native meme token, has exhibited a bearish bias despite prevailing bullish sentiment across the broader memecoin market.

Recent data from CoinMarketCap reveals a staggering 25% price decline for Bonk over the past month, a stark contrast to the general upward trajectory witnessed across the meme coin landscape during the same period.

At the time of writing, BONK was trading at $0.00002166, down 1.93% and 1.40% in the daily and weekly timeframes, data from CMC shows.

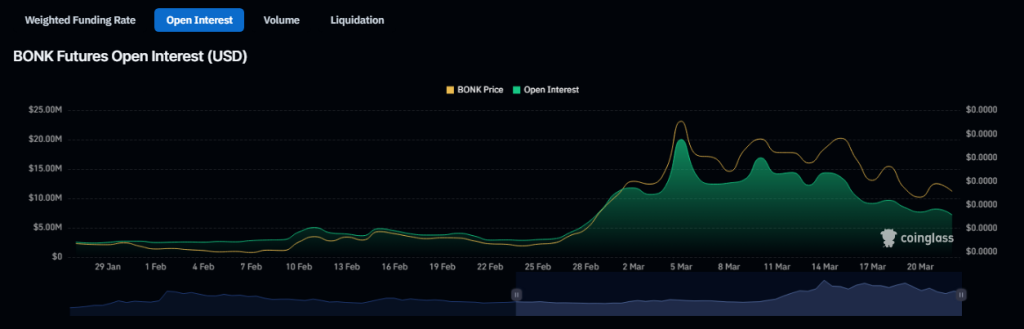

In the derivatives market, where traders speculate on the future price movements of assets, Bonk’s futures open interest has witnessed a dramatic decline, plummeting by a staggering 60% since early March, as reported by data from Coinglass.

This sharp downturn in open interest reflects a significant reduction in the number of contracts or positions held by traders, indicative of diminishing interest and confidence in Bonk’s prospects among derivative traders.

Despite the pronounced downturn in futures open interest, the funding rate across various cryptocurrency exchanges has managed to maintain a positive stance.

This funding rate, which reflects the cost of holding long positions relative to short positions, suggests that some traders are still maintaining optimism and are unwilling to entirely abandon the possibility of an impending uptrend in Bonk’s price.

However, the conflicting signals between technical indicators and market sentiment leave traders grappling with uncertainty, unsure whether to hold onto their positions or cut their losses.

The 30-day period under review has seen a significant fall in Bonk’s daily trading volume, with Santiment’s data indicating a 75% decrease.

This decline in trading activity adds further weight to the bearish sentiment surrounding the coin, signaling waning investor interest and confidence in its potential.

Further exacerbating Bonk’s woes are its momentum indicators, which reveal a troubling discrepancy between distribution and accumulation.

The Money Flow Index (MFI) points to increased selling activity, outweighing any attempts at buying and adding further downward pressure on the coin’s value.

As the market grapples with these conflicting signals, the spotlight remains firmly fixed on Bonk and its ability to weather the storm.

With its MACD line sinking below the signal and zero lines, signaling a weakening short-term trend compared to its longer-term outlook, traders are faced with a critical decision point.

A Glimmer Of Hope Amidst The Storm

As traders continue to monitor the situation closely, there is potential for a shift in sentiment that could breathe new life into Bonk’s ailing price.

For now, the road ahead for Bonk remains uncertain, with technical indicators pointing towards further declines while traders cling to hopes of a reversal.

Featured image from Pixabay, chart from TradingView

The memecoin BONK has faced a significant setback as its prices plummeted by 30% in the last week, sparking discussions about the need to reassess predictions for this meme token. This decline in value has been accompanied by a drop in BONK’s open interest to its lowest level in the past month, signaling potential challenges ahead for the token.

The recent slump in BONK’s prices has raised concerns among investors and traders, with key technical indicators hinting at the possibility of further declines in its value. At present, BONK is trading at $0.000023, making it one of the cryptocurrencies with the most losses over the past week. The altcoin’s future trajectory remains uncertain as market dynamics continue to evolve.

Following a rejection at $0.00004, the price of BONK lost momentum and had a 35% value adjustment. After then, there was a period of sideways trading for the memecoin. The bulls lost steam as the volatility increased and broke through the support level; the market has been trading sideways ever since.

The recent analysis of BONK’s price performance reveals a shift in sentiment towards bearish outlooks, with weighted sentiment turning negative and key technical indicators confirming the presence of bearish sentiments. This negative sentiment among market participants could potentially lead to further declines in BONK’s value unless there is a significant shift in market dynamics.

Futures open interest in the cryptocurrency fell to its lowest level in one month, which led to a decrease in its price. The open interest in BONK began to fall on March 5th and has since fallen by 60%, according to statistics from Coinglass.

Traders’ interest or involvement in the derivative market for an asset declines as its open interest diminishes. This usually happens when there is a change in investor mood, leading to more people trying to cut losses or take profits.

Impact On Investor Sentiment And Market Dynamics

The recent price slump in BONK has had a notable impact on investor sentiment, with many adopting a cautious approach towards the token’s future prospects. This shift in sentiment has also influenced trading volumes and market activity, as investors reassess their positions and strategies in light of BONK’s price movements.

Expert Price Predictions And Analysis

As market observers examine BONK’s price predictions, varying outlooks emerge regarding its future performance. While some forecasts suggest a bearish scenario with a price of $0.000018 in 2024, others paint a more optimistic picture, projecting an average price of $0.000067 by April 17, 2024. These contrasting predictions highlight the volatility and unpredictability inherent in the cryptocurrency market.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView

The meme coins market cap is currently hovering above $54 billion up by nearly 20% ion the past day. This surge is evident as roughly seven meme coins now rank among the top 100 crypto by market capitalization, marking a significant shift in investor interest towards these once ‘speculative assets.’

A recent market report from QCP Capital has shed light on this phenomenon, disclosing what drives this meme coins surge.

According to QCP Capital, the price appreciation in meme coins can be attributed to a “speculative buying frenzy” during the Asia trading session. Particularly, the firm report suggests that the rallying meme coins is driven by retail FOMO (Fear of Missing Out), indicating a significant shift in the dynamics of market participation.

The analysts from QCP Capital also observed an increase in leveraged buying activity, hinting at the “robust” momentum that could potentially pause should Bitcoin surpass its all-time high in dollar terms. The market report read:

Altcoins, especially memecoins, are rallying hard as retail FOMO really kicks in now. Leveraged buyers will likely not relent until we break all-time highs, which could be any time now.

So far, major meme coins such as Dogecoin, Shiba Inu, PEPE, and BONK have registered. massive gains, with increases of 27%, 57%, 46%, and 68% respectively over the last 24 hours. These gains reflect the growing investor interest in meme coins and underscore the broader trend of retail investment driving the crypto market.

Dogecoin and Shiba Inu, in particular, have solidified their positions within the top 15 global crypto market cap rankings, demonstrating the significant traction meme coins have gained among investors.

The surge in memecoins is part of a larger trend of increased retail participation in the cryptocurrency market. Analysts from JPMorgan have echoed the observations made by QCP Capital, noting that retail traders have played a crucial role in the cryptocurrency market rally observed throughout February.

The study carried out by the research group at JPMorgan, under the guidance of Managing Director Nikolaos Panigirtzoglou, highlighted the significant role of “small-scale investors,” commonly known as ‘mom-and-pop’ traders, in driving prominent cryptocurrencies like Bitcoin to a two-year high last month.

The researchers noted:

We find that the retail impulse into crypto rebounded in February, thus likely responsible for this month’s strong crypto market rally.

Meanwhile, over the past 24 hours, Bitcoin has reached new heights, trading above $66,000, marking a nearly 30% increase over the past week. This upward trajectory is also evident in the asset’s market cap, which currently exceeds $1.2 trillion.

Featured image from Unsplash, Chart from TradingView

In comments likely to resonate with crypto fans, Hayden Adams, the founder of Uniswap, a leading decentralized exchange (DEX), predicts that network fees will eventually become a background expense for users, much like server costs are today for top centralized applications running on Amazon Web Service and other platforms.

Taking to X, Adams envisioned a future where decentralized applications (dapps) seamlessly cover network fees on behalf of users. This approach, the inventor adds, aligns with how server costs are currently handled in the current setup, especially among operators of common applications like X or Facebook.

Server costs are often considered a hidden expense in the overall business model. However, this can cost millions of dollars monthly, depending on the app’s popularity.

Presently, the dream of low-fee transactions remains out of reach for some blockchains, particularly Ethereum, the dominant platform for smart contracts. Ethereum is a legacy blockchain that recently shifted from a proof-of-work to proof-of-stake consensus.

However, while this was a major shift, the network still struggles with scaling challenges. At optimum, Ethereum can only process 15 transactions every second. Comparing this with current demand only means “gas fees” must be high to incentivize the validator to include transactions in the next block.

This high “gas fee” continues to be a major pain point, leading some projects to migrate to alternative networks with faster transaction speeds and lower fees. Solana, a high-throughput blockchain, and layer-2 scaling solutions like Arbitrum have emerged as popular destinations for these migrating projects. This trend is particularly evident with the recent surge of meme coins like BONK and WIF, which have seen significant growth on Solana.

Unlike Ethereum, Solana and layer-2 platforms relying on Ethereum for security boast higher throughput and negligible gas fees. Accordingly, more meme coin projects are launching on these networks. Here, users can transact without considering the implication of gas fees. In recent weeks, top meme coins, besides PepeCoin (PEPE) or Dogecoin (DOGE), have been launching on Solana.

Ethereum will implement the Dencun Upgrade in mid-March to combat its scaling woes. The update aims to reduce costs for users interacting with layer-2 solutions significantly. However, this upgrade is just one of the many Ethereum developers plan to implement over time.

Eventually, the proof-of-stake network aims to scale processing speeds, allowing it to execute millions of transactions every second through innovations like Sharding.

Uniswap continues to lead in popularity, looking at assets under management. So far, Uniswap developers have deployed its solution across other blockchains and layer-2 options, including Arbitrum and the BNB Chain.

On-chain data shows Shiba Inu (SHIB) and other memecoins in the sector have observed a sharp boost in their volumes alongside their rallies.

According to data from the on-chain analytics firm Santiment, the trading volume of the memecoins has shot up recently. The “trading volume” here refers to the total amount of a given cryptocurrency involved in trading activities on the various spot exchanges in the sector.

When the value of this metric is high, it means that the asset in question is observing a large amount of trades right now. Such a trend implies that the interest around the coin is high among the investors.

On the other hand, the low indicator suggests that investors may not pay too much attention to the cryptocurrency as they are not making trades.

Now, here is a chart that shows the trend in the trading volume for four different memecoins: Shiba Inu, Pepe (PEPE), FLOKI (FLOKI), and Bonk (BONK).

As displayed in the above graph, the Bitcoin trading volume for all four of these memecoins has surged to high levels recently as their prices have gone through a rally.

Santiment notes that, on average, the trading volume across Shiba Inu, FLOKI, Pepe, and Bonk has increased by more than 3,000% over the past week. This would imply that crowd interest in these assets has witnessed a significant uplift.

Generally, it’s not surprising to see the volume jump alongside price surges, as such sharp price action is attractive to investors, so they tend to make more moves in such periods.

For any rally to be sustainable, it must keep attracting fresh volume. This is because moves like these require a large amount of fuel to keep going, which they can only get if more and more interest comes into the asset.

Sometimes rallies start sharp, but fail to amass any appreciable volume, so, predictably die off before too long. As the volume of Shiba Inu and others has rocketed up recently, at least their current rallies shouldn’t face an issue like this.

Now, while the trading volume can be something that can help rallies stretch longer, a high volume itself doesn’t imply a bullish prediction. This is because the volume can also spike during a selloff, as the indicator merely keeps track of the activity and not whether said activity is buying or selling dominated.

As such, all that can be said about the implications of the current high trading volume on the prices of Shiba Inu and the company is that they should likely continue to see high volatility in either direction in the coming days.

Shiba Inu has enjoyed an extraordinary run of more than 180% in the past week, which has taken its price to the $0.00002746 mark.

Solana (SOL) has reached a new 22-month high, demonstrating a remarkable 28% uptrend over the past month. However, the Solana-based meme coin, Bonk Inu (BONK), has captured investors’ attention with its explosive performance last month.

According to CoinGecko data, BONK has achieved a staggering 102% price uptrend in the last 7 days and an impressive 103% increase in the past month, reaching a trading price of $0.00002510 and attaining a 3-month high.

In addition, the meme coin has experienced significant growth in market capitalization, reaching $1.6 billion and surpassing renowned tokens such as Pepe Coin (PEPE) to secure the 66th position among all cryptocurrencies, highlighting the growing interest in BONK as the cryptocurrency market experiences a resurgence of bullish sentiment fueled by Bitcoin’s (BTC) price uptrend.

Accumulating data from blockchain company Lookonchain shows the growing interest in Bonk Inu. In addition to the 50% increase in a single day, one wallet reportedly accumulated 98 billion BONK ($1.54 million) from the centralized crypto exchange (CEX) Binance just before the price increase.

According to Lookonchain, the SmartMoney wallet currently holds 319.44 billion BONK tokens worth approximately $7 million, enjoying a profit of $2.9 million, which could have further contributed to the price surge in the past 24 hours.

As of the latest update, the trading volume of Bonk Inu stands at $794,842,219 in the last 24 hours, demonstrating a substantial 74.30% increase compared to the previous day. This surge in trading volume indicates a recent rise in market activity surrounding the meme coin, reflecting growing investor participation and attention.

As the token enjoys one of its best trading months since its launch, crypto analyst Altcoin Sherpa expressed positive sentiment towards Bonk Inu, highlighting its potential for further growth.

Altcoin Sherpa stated that Bonk Inu looks promising due to its relative underperformance compared to other meme coins, coupled with a notable uptrend pattern. The analyst wouldn’t be surprised to see Bonk Inu target previous highs and make further gains, although he suggested that a potential pullback may occur.

As the analyst suggests, the $0.00001940 price level may serve as a crucial support level for the BONK token in the event of a potential pullback or price correction. This level is significant as it would help maintain the current uptrend pattern observed on its daily chart.

However, suppose this support level fails to hold. In that case, it’s possible that BONK could see a further price decline towards the $0.00001500 level, which acts as the ultimate support before a potential drop to the $0.00001350 mark, key for the token’s prospects as it represents the last line of defense to prevent a fully formed downtrend in the cryptocurrency’s performance.

On the other hand, when analyzing the BONK/USD 1-W chart, it is important to note that there are no prominent resistance levels. The chart above shows thin lines known as “wicks” above the candlesticks of the token since its launch on December 15th.

This suggests that no significant obstacles prevent the token from reaching its all-time high of $0.0005487. The ability to maintain its current uptrend or potentially experience renewed bullish sentiment after a pullback will determine whether BONK can surpass this previous high.

Featured image from Shutterstock, chart from TradingView.com

With altcoins finally catching up to Bitcoin, meme coins such as Dogecoin, BONK, and PEPE have been in the spotlight. This outperformance from these meme coins has pushed their standing in the crypto market further, putting them ahead of large competitors.

While Dogecoin did start out the week on a slow note, it picked up the pace on Wednesday after Bitcoin’s price rose to $64,000. This rally saw the DOGE price go from $0.09 to over $0.1 in a matter of hours, before the wipeout that sent Bitcoin below $60,000.

Once the market recovered, Dogecoin began to move up once again, and by Thursday, its price touched above $0.13. This is the highest that the price has been since 2022 and it gave its market cap enough boost to not only re-enter the top 10 cryptocurrencies by market cap. But also to reclaim the 9th spot from Avalanche.

Dogecoin’s price has risen 50% in the last week and pushed its market cap above $18.1 billion. Avalanche had been occupying the 9th spot on this list after rising from $10 to $40 in the last few months. However, its market cap of $16.64 billion falls behind DOGE, putting it in 10th place on the list.

It is interesting to note that a week ago, Dogecoin had completely fallen out of the top 10 cryptocurrencies after Tron’s TRX saw its market cap rise. This will end up being short-lived as TRX has fallen out of the top 10 and now sits at 11th position with a market cap of $12.6 billion.

In addition to Dogecoin, BONK, another meme coin, has also seen impressive growth during the time. According to data from Coinmarketcap, the BONK price has risen 30% in the last day to cross the $0.00002 threshold.

This outperformance comes in light of a notable surge in the daily trading volume of the meme coin. Its volume saw a 135% increase in the last day to reach $955 million. This rapid rise in volume suggests a rapid increase in investor interest in the coin, leading to its gains.

BONK’s market rose to $1.81 billion as a result of this, which put it ahead of PEPE with a $1.22 billion market cap. BONK now holds the spot for the third-largest meme coin in the space behind Dogecoin and Shiba Inu.

However, on the weekly chart, PEPE is outperforming BONK with 148% gains compared to BONK’s 74% gains. Following behind PEPE is dogwifhat (WIF) which rose 142.6% in the last week to reach an $820 million market cap.

The recent market rally has shown positive signals for many cryptocurrencies and has filled investors with optimistic expectations for the near future.

Ignited by the ongoing Bitcoin Exchange-traded Fund (ETF) frenzy, whale accumulation, and meaningful updates from different projects, the market has shown significant growth during the first two months of 2024.

In the last week, Bitcoin and Ether, the two largest cryptocurrencies by market capitalization, have met important milestones that have set the tone for the general market.

BTC surpassed the $50,000 resistance zone 9 days ago and has shown strong support above this level ever since. Similarly, this Tuesday, Ether momentarily surpassed the $3,000 support zone for the first time in almost two years. Both milestones have fueled investor’s excitement for the crypto market.

Nonetheless, the market showed signals of a momentary slowdown this Wednesday after many cryptocurrencies started seeing a red light decelerating their numbers.

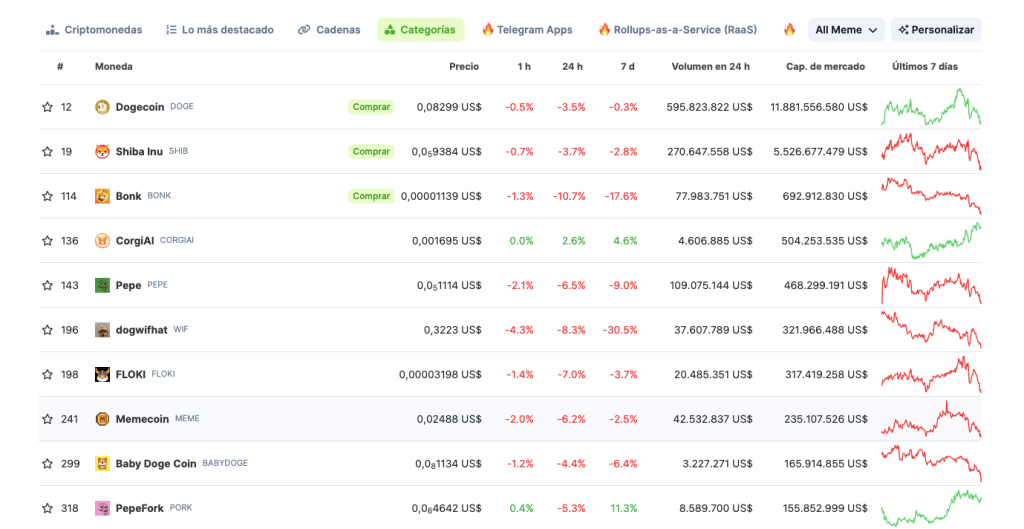

According to CoinGecko data, meme coins are not an exception. The sector’s market capitalization has declined 7.0% in the last 24 hours, currently at $21.9 billion and a total daily trading volume of $1.35 billion.

As the chart above illustrates, eight of the top ten memecoins face a price downtrend in the 1-hour, one-day, and seven-day timeframes. Pepe (PEPE), dogwifhat (WIF), and FLOKI were among the biggest losers since yesterday. However, CorgiAI (CORGIAI) and PepeFork (PORK) prices show green numbers simultaneously.

The top 3 memecoins by market capitalization follow the same trend as the memecoin market. At the time of writing, the prices of Dogecoin (DOGE), Shiba Inu (SHIB), and Bonk (BONK) are displaying negative numbers.

Bonk

BONK is leading the red path as the biggest loser in the memecoin top 10. Recently, the cryptocurrency saw a revival by its meteoric 25% on-day rally that propelled it back to the top 100 cryptocurrencies.

The memecoin sits at the 114th spot of all cryptocurrencies, with a market capitalization of $692.3 million, representing a 5.8% decrease in the last 24 hours.

BONK is trading at $0,00001148, indicating a 9.3% and 17.6% price drop in the last 24-hour and seven-day timeframes, respectively. However, the token’s daily trading volume shows a 10,9% increase compared to yesterday, signaling a recent rise in market activity.

Dogecoin

As previously reported, DOGE has shown signs of embarking on a bullish recovery after whale activity fueled the rise in trading volume. The ecosystem’s activity increased in the last month, with more than 1 million transactions being processed daily since January 30.

DOGE’s trading activity on the last day revealed a 39.3% decline in market activity for the token, with $597.9 million worth of trading volume.

According to CoinGecko, its market capitalization sits at $11.88 billion. This indicates a 25% one-day decrease in performance that leaves the token out of the top 10 cryptocurrencies by this metric. Likewise, DOGE’s price shows a 3.5% pullback during the last day, currently trading at $0.083.

Shiba Inu

SHIB, like DOGE and BONK, has seen a considerable price reduction since yesterday and is currently trading at $0,09399, a 3.8% decrease in this time frame. While its market capitalization has also reduced in the last day (a 2.71% decrease), the daily trading volume for the 19th largest cryptocurrency has increased 15% in the previous 24 hours, at $300.8 million.

Despite the recent data signaling a momentary loss of momentum for the memecoin market, it’s worth noting that the top 3 memecoins by market capitalization saw positive performance in the 14-day time frame. In the last two weeks, BONK has seen a 12.7% price upsurge, while DOGE and SHIB have increased a notable 5.6% and 5.9%, respectively.

A technical indicator shift has sparked predictions of an imminent altcoin surge, with one analyst on X forecasting gains as sharp as those posted in 2017 and 2021.

Taking to X, the analyst said this optimism follows a change in the Gaussian Channel, a technical indicator used to assess market momentum. On X, the trader notes that the Gaussian Channel has, after weeks, flipped from red to green.

Reading from historical performance and indicator changes suggests that there could be a bullish shift for leading altcoins like Ethereum, Solana, and even Dogecoin in the days ahead.

However, from a technical standpoint, this upswing would be better confirmed once there is a comprehensive breakout above the immediate resistance. If this happens, the altcoin market could have a “parabolic” rally.

The broader crypto market is bullish, sparked by the encouraging Bitcoin rally. The world’s most valuable coin trades above $50,000, trending at December 2021 levels. Supporters are optimistic that not only will Bitcoin register more gains in the days ahead but will likely float to break November 2021 highs.

This uptick in demand follows institutions and investors leveraging spot Bitcoin exchange-traded funds (ETFs) to hold Bitcoin.

Surging Bitcoin prices have immensely benefited coins like Solana and Ethereum and meme coins like BONK, which continue to trend. To illustrate, SOL is now trading above $100 despite a recent network outage that questioned the platform’s reliability. In January, SOL peaked at over $125.

On the other hand, Ethereum continues to rally but remains below $3,000. Rising decentralized finance (DeFi) activity and optimism of the United States Securities and Exchange Commission (SEC) approving a spot Ethereum exchange-traded funds (ETF) continue to fuel demand. Recently, Franklin Templeton applied with the regulator for a spot in Ethereum ETF, joining BlackRock and Fidelity.

It is unclear how strongly altcoins will rally should buyers take over. Gauging from how leading altcoins like Solana and Cardano have performed in Q1 2024, it is likely that prices will explode to register new 2024 highs, breaking above 2023 resistance levels.

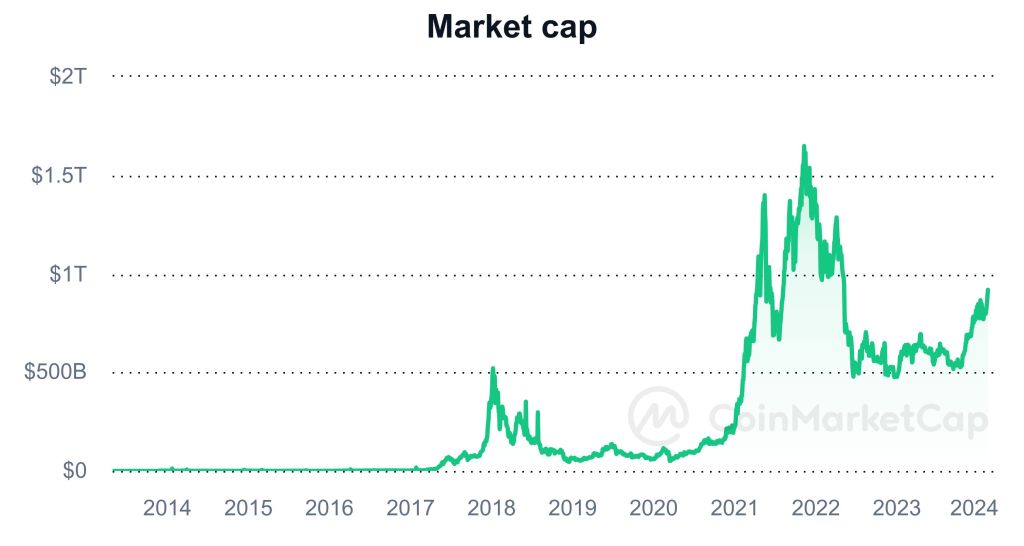

Based on CoinMarketCap data, the altcoin market cap has nearly doubled. It is up from around $475 billion in late 2022 to over $910 billion when writing in mid-February. When altcoins peaked in November 2021, their cumulative market cap exceeded $1.6 trillion.

The crypto world is always buzzing, and this week, it’s the Shiba Inu-inspired BONK, built on the Solana blockchain, making the headlines. Its price has experienced a remarkable jump, exceeding 30% in just the past week, fueled by whispers of potential listings on two major platforms: Revolut and Robinhood.

Rumors emerged suggesting BONK could soon become available to Revolut’s staggering 38 million user base. The speculation didn’t stop there, with talk of a “Learn and Earn” campaign potentially adding another half a million to the BONK community.

Robinhood, synonymous with the meme stock frenzy of 2021, is known for its ability to bring lesser-known assets to the forefront. The mere possibility of BONK finding a home on its platform sent the price hurtling upwards.

Barking At The Moon Or Running With The Pack

Before you grab your leash and join the BONK bonanza, remember this: these are just rumors. Neither Revolut nor Robinhood has confirmed anything, and diving headfirst into unconfirmed news is never a sound investment strategy.

Additionally, memecoins are notorious for their wild price swings. BONK itself experienced a meteoric rise of 4,424% in 2023, followed by a sharp correction. While the potential upside is tempting, be prepared for some serious volatility.

Digging Deeper Into BONK’s Territory

It’s crucial to remember that BONK isn’t just a meme coin riding a rumor wave. It has carved its own niche within the Solana ecosystem. Major exchanges like Binance and Coinbase already offer BONK trading, and it even played a role as an incentive within the Solana Saga smartphone project. This suggests that BONK isn’t simply a flash in the pan, but a project with some established groundwork.

Investment Considerations: Weighing The Risks And Rewards

The potential impact of major platform listings is undeniable. Increased accessibility could significantly boost BONK’s adoption and potentially positively impact the broader Solana ecosystem. However, the lack of confirmation surrounding the rumors and the inherent volatility of meme coins necessitate a cautious approach. Before investing, thorough research and a clear understanding of the risks involved are paramount.

BONK’s recent price surge serves as a reminder of the fast-paced and ever-evolving nature of the crypto world. While the unconfirmed rumors offer a glimpse of potential opportunities, investors need to proceed with caution, remembering that the path to crypto riches is seldom straightforward. Whether BONK will truly “bark its way” to mainstream adoption or retreat to the shadows remains to be seen.

Featured image from Adobe Stock, chart from TradingView

Solana’s biggest meme coin BONK will list on Revolut, which plans to run a $1.2 million “learn” campaign for users.

In a surprising turn of events, BONK, the self-proclaimed third biggest Doge-inspired meme coin, has roared back to life, notching an impressive 25% surge in the past 24 hours.

This dramatic price jump catapulted BONK back into the coveted top 100 cryptocurrency rankings, reigniting hope among its investors and sparking curiosity within the wider crypto community.

But what fueled this sudden rally, and can BONK sustain its newfound momentum? Let’s dissect the factors behind this comeback and explore the challenges that lie ahead.

Just days ago, BONK’s future seemed bleak. The meme coin had been on a downward spiral, losing over 20% of its value in the last month and teetering on the edge of falling out of the top 100 list.

However, the winds of fortune shifted dramatically in the last few days, with BONK experiencing a meteoric rise that propelled it back into the cryptocurrency limelight.

Similar to its previous rally, BONK’s resurgence can be partially attributed to a broader market upswing. Bitcoin and Ethereum, the leading cryptocurrencies, saw significant gains, with Bitcoin rising by 4.6% and Ethereum by 3%. This positive sentiment undoubtedly played a role in boosting investor confidence in BONK.

However, internal developments within the BONK ecosystem also contributed to the rally. Recent updates to the BONK protocol, including increased utility for token holders and the launch of new community initiatives, seem to have revitalized interest in the project.

Additionally, BONK’s close association with the Solana blockchain, which itself experienced a 7.4% price increase, might have provided further support.

From a technical standpoint, BONK’s current position appears promising. The token’s Relative Strength Index (RSI) sits comfortably at around 58, indicating healthy buying pressure. Moreover, trading above its 30-day moving average suggests potential for continued near-term growth.

Nevertheless, seasoned investors know that the world of memecoins is riddled with volatility. BONK’s all-time high of $0.00003416, reached in December 2023, stands a stark reminder of the potential for sharp declines.

Also, the token’s market cap of $641 million pales in comparison to its meme-coin rivals like Dogecoin and Shiba Inu, highlighting the need for wider adoption and sustained community engagement.

The Verdict: A Cautiously Optimistic Outlook

BONK’s recent 25% surge serves as a testament to the meme coin’s resilience and the power of community support. While riding the market wave and internal developments have provided a much-needed boost, the road ahead remains challenging.

Overcoming volatility, establishing itself within the meme-coin landscape, and attracting wider adoption are crucial hurdles that BONK needs to overcome to secure its place in the top 100 – and beyond.

Featured image from Adobe Stock, chart from TradingView

BONK DAO is writing a $500,000 check for the venture fund of Colosseum, Solana’s new hackathon organizer.